Main Points

- Veteran-owned businesses can get special government contracts through VOSB and SDVOSB certifications.

- Before expanding, assess your business performance and market demand.

- By diversifying your products and services, you can create new revenue streams.

- Using federal programs can greatly help in growing your business.

- Effective financial management is key to successful expansion.

Guide to Expanding Your Veteran-Owned Business & Entering New Markets

Expanding a veteran-owned business can be an exhilarating, yet daunting, journey. It demands careful planning, strategic decision-making, and taking advantage of the resources available to you. In this guide, I’ll take you through the key tips and strategies to help you successfully navigate this journey.

Obstacles and Prospects for Businesses Owned by Veterans

Businesses owned by veterans encounter specific obstacles, like securing funding and discovering the ideal market niche. Nonetheless, these businesses also possess exclusive prospects, like exclusive rights to government contracts and specialized assistance programs.

“Veteran-owned businesses can access exclusive government contracts through VOSB and SDVOSB certifications.”

Leveraging Federal Programs for Growth

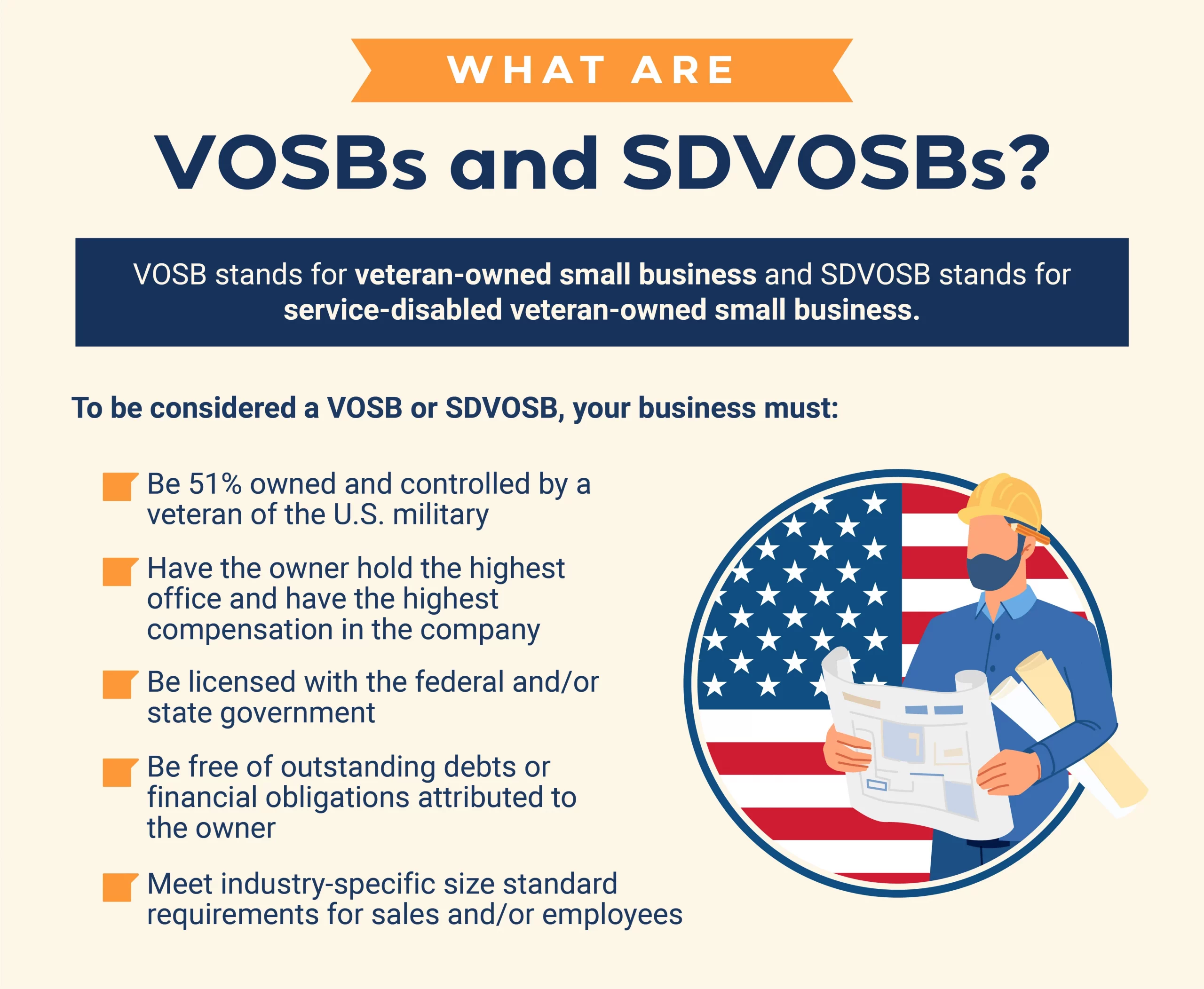

Federal programs are a goldmine for veteran entrepreneurs. The Small Business Administration (SBA) offers certification programs for Veteran-Owned Small Businesses (VOSB) and Service-Disabled Veteran-Owned Small Businesses (SDVOSB). These certifications can unlock doors to government contracts reserved specifically for veteran-owned businesses.

In addition, the SBA offers mentoring, advice, and training through groups such as SCORE and the Veterans Business Outreach Center (VBOC) Program. These resources are crucial for growing your business and breaking into new markets.

Knowing When to Expand

Timing is everything when it comes to expanding your business. If you expand too early or too late, it can cause serious problems. Let’s take a closer look at how you can determine the best time for your business to expand. For more insights, check out this guide on veteran-owned business growth.

Assessing Your Current Business Status

Begin by taking a look at your current business status. Are you regularly meeting or surpassing your financial objectives? Do you have a loyal clientele? These answers can give you a better understanding of whether your business is prepared to expand.

- Regularly check your financial statements.

- Keep an eye on customer satisfaction and retention.

- Examine your sales trends over a period of time.

Evaluating Market Demand

Afterwards, assess the market demand for your products or services. Is there an increasing demand in your current market? Are there markets that haven’t been tapped into that could use what you offer? Doing extensive market research can help you find the answers to these questions.

Monetary Preparedness

Finally, it’s critical to verify that your business is financially prepared for growth. This means having enough money to cover expansion-related expenses, such as advertising, recruiting additional personnel, and boosting stock. It’s also a good idea to have a financial safety net in case things don’t go according to plan.

Discovering Additional Sources of Income

Expanding your business often involves finding additional sources of income. By broadening the range of products or services you offer, you can attract a wider customer base and boost your total income.

- Expanding Product and Service Offerings

- Increasing Customer Base

- Breaking Into Global Markets

Expanding Product and Service Offerings

Expanding your product and service offerings involves introducing new products or services that align with what you’re currently offering. For instance, if you own a gym, you could start offering nutritional advice or selling fitness equipment. This could draw in new customers and give more value to your current customers. For more insights on business growth, check out Fueling Veteran-Owned Business Growth in 2024.

Increasing Customer Base

Another strategy for business expansion is to increase your customer base. This could involve opening new locations, forming partnerships with other businesses, or leveraging online platforms to reach a wider audience. The aim is to make your products or services available to a larger number of people.

Breaking Into Foreign Markets

Going global can be a game-changer. But, it requires careful planning and research. You’ll need to understand the cultural, legal, and economic differences in the new market. Plus, think about the logistics of shipping products and providing customer support across borders.

Exploring New Market Niches

Expanding into new market niches can be a fantastic method to expand your business. Nevertheless, it necessitates a tactical strategy to guarantee success.

Spotting Potential Market Segments

First and foremost, spot potential market segments that match your business. This could be based on demographics, geographic locations, or specific needs and preferences of different customer groups. Grasping these segments can help you customize your offerings to meet their needs.

Understanding the Competition

- Find out who your biggest competitors are in the new market.

- Study their strong and weak points.

- Figure out what sets your business apart from theirs.

Knowing your competition can help your business stand out and draw in customers. For more insights, check out these conflict resolution strategies for small business owners.

Customizing Your Marketing Approach

After you’ve pinpointed who your audience is and scoped out the competition, it’s time to customize your marketing approach. This might mean launching an ad campaign aimed at your target audience, crafting marketing messages that speak directly to them, or using social media to connect with your audience more effectively.

Utilizing Government Contracts and Certifications

Government contracts can be a substantial income source for veteran-owned businesses. But, to secure these contracts, you must acquire the required certifications and understand the application process.

Advantages of Getting VOSB and SDVOSB Certifications

There are several advantages to getting VOSB and SDVOSB certifications, such as:

These certifications can significantly enhance your business’s growth strategy. For more effective plans and tips, check out this minority-owned business growth strategy guide.

- Eligibility for special government contracts.

- Enhanced reputation and trustworthiness among prospective customers.

- Opportunities to connect with other businesses owned by veterans.

These qualifications can greatly boost your business’s potential for expansion and pave the way for new possibilities.

Securing Your Certifications

There are a few steps involved in securing VOSB and SDVOSB certifications, but it’s definitely worth the effort. First, make sure you’re eligible. For VOSB, veterans must own and control at least 51% of the business. For SDVOSB, service-disabled veterans must meet the same criteria. Be sure to have all your paperwork in order, including your DD-214 form, which proves your veteran status.

Then, sign up your company in the System for Award Management (SAM). This is a required step to do business with the federal government. Once you’ve registered, you can apply for certification through the SBA’s certification portal.

“Before you begin the application process, make sure you have all the necessary paperwork ready. This includes your DD-214 form and proof of business ownership.”

After you submit your application, it will be reviewed. This process can take a few weeks, so be patient. If your application is approved, you will receive official certification as a VOSB or SDVOSB. This certification will give you access to exclusive government contracts.

How to Successfully Secure Government Contracts

Securing government contracts can significantly boost your business. Here are some tips to help you get there:

- Go to government contracting workshops and networking events to meet potential buyers.

- Use resources like the SBA’s Procurement Technical Assistance Centers (PTACs) for help.

- Create a robust capability statement that shows off your business’s strengths and past performance.

Most importantly, keep going. Government contracting can be competitive, but if you approach it the right way, you can secure profitable contracts that will help your business grow. For more insights, check out these effective growth strategies for minority-owned businesses.

Adopting Cutting-Edge Technologies

Integrating cutting-edge technologies into your business operations can greatly improve efficiency and competitiveness. Let’s delve into some critical areas where technology can be a game changer.

Embracing AI and Automation

Artificial Intelligence (AI) and automation are capable of making many business processes more efficient, ranging from customer service to inventory management. By integrating AI chatbots into your website, you can offer immediate assistance to your customers. At the same time, automation tools can take care of routine tasks, allowing you to concentrate on strategic planning.

Making Use of Data Analytics

With data analytics tools, you can make decisions based on facts, not guesses. These tools give you a peek into customer behavior, market trends, and how your operations are performing. By looking at the data, you can see where you need to make changes and where there’s room to grow. For more insights, check out our content marketing and SEO solutions tips for small businesses.

For instance, you can employ data analytics to monitor the success of your marketing initiatives and tweak your tactics based on the outcomes. This guarantees that your marketing endeavors are focused and efficient.

- Use tools like Google Analytics to monitor website traffic and user behavior.

- Leverage customer relationship management (CRM) software to analyze sales data and customer interactions.

- Implement business intelligence (BI) platforms to gain a comprehensive view of your business’s performance.

Enhancing Cybersecurity Measures

As you integrate more technology into your business, it’s crucial to prioritize cybersecurity. Protecting your business and customer data from cyber threats is essential for maintaining trust and compliance with regulations.

Ensure you have strong cybersecurity protections in place, including firewalls, encryption, and multi-factor authentication. Keep your software up to date and perform regular security audits to find and fix any weaknesses.

Building Strategic Alliances and Partnerships

By creating strategic alliances and partnerships, you can speed up your business’s growth by taking advantage of the strengths and resources of other companies.

Finding the Right Partners

Seek out partners that share your values, objectives, and clientele. This might be other businesses owned by veterans, trade associations, or even big corporations that want to back veteran business owners.

Investigate potential partners and present them with a well-defined proposal that emphasizes the advantages of working together. Stress how the collaboration can create shared value and stimulate growth for both parties.

Creating Partnership Contracts

After you’ve found the right partner, you need to make the partnership official with a detailed contract. This should specify what each party is responsible for, what the partnership hopes to achieve, and the conditions of the partnership.

Make sure the agreement is legally binding and safeguards the interests of your business. You can create a comprehensive and fair collaboration agreement with the help of a legal professional.

Using Business Networks

Joining business networks and associations can provide valuable opportunities for networking, sharing knowledge, and collaboration. By joining relevant business groups and actively participating in events and forums, you can connect with potential partners and stay updated on the latest business trends.

In addition to that, these networks can provide access to resources, training, and support that can assist your business in growing and succeeding. For more details, check out this guide to becoming a certified veteran-owned small business.

- Get involved with veteran business organizations like the National Veteran-Owned Business Association (NaVOBA).

- Attend trade shows and conferences specific to your industry.

- Connect with industry-focused online forums and social media groups.

Improving Financial Management

Successful business expansion requires strong financial management. Here are some strategies to help you manage your finances effectively.

Creating a Solid Financial Plan

A solid financial plan gives your business direction and helps you use your resources wisely. Start by defining your financial goals and making a comprehensive budget that shows your projected income and expenses.

- Keep a close eye on your cash flow to make sure you have enough cash on hand to pay your bills.

- Regularly compare your actual financial results to your budget and adjust your budget as necessary.

- Prepare for the unexpected by setting aside money for unforeseen expenses or economic downturns.

By keeping your financial plan up-to-date, you can make smart decisions and keep your business in good financial shape.

Examining Different Ways to Fund Your Business

When you want to grow your business, you usually need more money. Look at different ways to fund your business to find the best one for you:

- Consider applying for a business loan through the SBA or another financial institution.

- Look for grants and funding programs that are specifically designed for businesses owned by veterans.

- Think about equity financing by attracting investors or partners.

Investigate each possibility in depth and select the one that best fits your business’s objectives and financial condition. For more information, check out this minority-owned business growth strategy guide.

Efficient Cash Flow Management

It’s important to manage your cash flow efficiently to keep your business running and support growth. Use strategies to optimize your cash flow:

- Work out the best possible payment terms with your suppliers and customers.

- Keep a close eye on your accounts receivable and chase up any late payments.

- Keep your expenses in check by finding ways to save money.

Keeping a close eye on your cash flow is crucial to making sure your business has the funds it needs to succeed. For additional strategies, check out our guide on veteran-owned business outsourcing vs in-house for more tips.

Establishing a Robust Internet Presence

In the modern world of digital technology, having a robust internet presence is critical for reaching more potential customers and expanding your business. Let’s take a closer look at some of the most important elements of creating and maintaining a strong internet presence, including strategies for veteran-owned small businesses.

“A well-designed website and active social media presence can significantly enhance your business’s visibility and credibility.”

Website Design that Works

Your website is often the first thing potential customers see. Make sure it’s a good first impression by focusing on a user-friendly design and relevant content.

Check out these helpful pointers for designing a successful website:

- Keep the design simple and user-friendly.

- Make sure your website is compatible with mobile devices and loads rapidly.

- Offer straightforward and brief descriptions of your products or services.

Furthermore, incorporate compelling calls to action that persuade visitors to reach out to you, buy something, or subscribe to your newsletter.

“A carefully crafted website can be a potent marketing instrument that draws in and keeps clients.”

Boosting Social Media Interaction

Social media platforms are a budget-friendly method to connect with and engage your intended audience. Create a social media plan that matches your business objectives and appeals to your audience. For more insights, explore these brand identity tips for minority-owned businesses.

Here are some strategies for boosting social media interaction:

- Make sure you’re posting regularly and consistently to keep your audience engaged.

- Share a variety of content, including promotional posts, industry news, and behind-the-scenes insights.

- Engage with your audience by responding to comments and messages promptly.

By using social media effectively, you can build a loyal following and drive traffic to your website.

Steps to Apply for Certifications

The process of obtaining VOSB and SDVOSB certifications can be daunting, but the payoff is well worth it. Begin by checking your eligibility. For VOSB, veterans need to own and control at least 51% of the business. For SDVOSB, service-disabled veterans must meet the same requirements. Ensure all your paperwork is up to date, including your DD-214 form, which verifies your veteran status.

After that, ensure your business is registered in the System for Award Management (SAM). This is a crucial step if you want to do business with the federal government. Once you’re registered, you can apply for certification via the SBA’s certification portal.

“Before you start the application process, make sure you have all the necessary paperwork, like your DD-214 form and proof of business ownership.”

After you submit your application, it will be reviewed. This can take a few weeks, so be patient. If your application is approved, you’ll be officially certified as a VOSB or SDVOSB, which gives you access to exclusive government contracts.

How to Get Government Contracts

Getting government contracts can be a big win for your business. Here are some tips to help you get there:

- Participate in government contracting workshops and networking events to meet potential buyers.

- Take advantage of resources such as the SBA’s Procurement Technical Assistance Centers (PTACs) for advice.

- Create a compelling capability statement that showcases your business’s strengths and track record.

Remember, persistence is key. Government contracting can be a tough field, but with the right strategy, you can land profitable contracts that will help your business grow. For additional guidance, consider these conflict resolution strategies for small business owners.

Adopting New Tech

Bringing new tech into your business operations can greatly improve efficiency and competitiveness. Here are some areas where tech can really help.

Embracing Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are powerful tools that can simplify many aspects of your business, from customer service to inventory management. By adding AI chatbots to your website, you can offer immediate assistance to customers. Automation tools can take over monotonous tasks, leaving you more time to concentrate on strategic planning.

Making Use of Data Analytics

Tools for data analytics can be your guide to making decisions based on facts. They can offer a peek into how your customers behave, what the trends are in your market, and how your operations are performing. Looking into your data can help you see what you need to improve and where you can expand.

For instance, data analytics can be utilized to monitor the success of your marketing initiatives and alter your tactics based on the outcomes. This guarantees that your marketing endeavors are focused and successful.

- Utilize resources such as Google Analytics to track website visits and user activity.

- Take advantage of customer relationship management (CRM) software to study sales figures and customer interactions.

- Apply business intelligence (BI) platforms to acquire a complete understanding of your business’s performance.

Strengthening Cybersecurity Protocols

As your business becomes more technologically advanced, cybersecurity must be a top priority. Ensuring your business and customer data is safe from cyber threats is crucial for maintaining trust and regulatory compliance.

Establish strong cybersecurity protections like firewalls, encryption, and multi-factor authentication. Consistently update your software and carry out security audits to find and fix vulnerabilities. For more insights, check out these effective growth strategies for minority-owned businesses.

Forming Alliances and Partnerships

By forming alliances and partnerships, you can speed up your business’s growth by utilizing the resources and strengths of other organizations.

Finding the Right Partners

Seek out partners who share your values, objectives, and target audience. This might be other veteran-owned businesses, industry groups, or even major corporations that want to help veteran business owners.

Do your homework on possible collaborators and pitch them with a well-defined plan that spells out the advantages of working together. Emphasize how the collaboration can generate shared benefits and promote expansion for everyone involved. For example, understanding the balance between outsourcing and in-house operations can be crucial in forming effective partnerships.

Establishing Partnership Contracts

After you’ve found the right partner, you need to establish the partnership with a well-defined contract. This should detail the duties and responsibilities of each party, the goals of the partnership, and the conditions of the partnership.

Make sure the agreement is legally sound and safeguards your business’s interests. A legal professional can assist you in creating a detailed and equitable collaboration agreement.

Utilizing Business Networks

Joining business networks and associations can provide a wealth of opportunities for networking, sharing knowledge, and collaborating. By actively participating in events and forums, you can connect with potential partners and stay up-to-date with the latest industry trends.

Moreover, these networks can provide access to resources, training, and support that can assist your business in growing and thriving.

- Become a member of veteran business groups such as the National Veteran-Owned Business Association (NaVOBA).

- Attend trade shows and conferences that are specific to your industry.

- Get involved with online forums and social media groups that are centered around your industry.

Improving Financial Management

Proper financial management is essential for successfully growing your business. Here are some important strategies for improving your financial management.

Creating a Solid Financial Plan

A solid financial plan will provide a clear path for your business’s expansion and help you effectively manage your resources. Begin by establishing distinct financial objectives and crafting a comprehensive budget that details your projected revenue and costs.

- Keep an eye on your cash flow to make sure you have enough to pay your bills.

- Compare your financial results to your budget and make changes if necessary.

- Be prepared for the unexpected by having some money set aside for emergencies or slow periods.

Having a good financial plan will help you make smart decisions and keep your business in good financial shape.

Looking into Financing Possibilities

When you want to grow your business, you’ll likely need more money. Look into different financing possibilities to see which one is the best fit for your situation. For more insights, you can refer to this guide on veteran-owned business growth.

- Consider applying for a business loan through the SBA or other financial institutions.

- Look into grants and funding programs designed specifically for veteran-owned businesses.

- Think about equity financing by inviting investors or partners to join your business.

Make sure to research each option in depth and choose the one that fits your business’s goals and financial situation. For additional insights, check out these veteran-owned business tips.

Effective Cash Flow Management

It’s crucial to manage your cash flow effectively to keep your business running and facilitate expansion. Here are some strategies to improve your cash flow:

- Work out beneficial payment conditions with your suppliers and customers.

- Consistently check your accounts receivable and chase up any late payments.

- Keep your expenses in check by finding ways to save costs.

Keeping a close watch on your cash flow will help ensure your business has what it needs to succeed.

Establishing a Solid Online Presence

In this era of digital technology, a solid online presence is vital for reaching a larger audience and promoting business expansion. We will discuss some crucial factors of creating and sustaining an efficient online presence.

“A well-designed website and active social media presence can significantly enhance your business’s visibility and credibility.”

Effective Website Design

Your website is often the first point of contact for potential customers. Ensure it makes a positive impression by focusing on user-friendly design and relevant content.

Here are a few pointers on how to design a website effectively:

- Make sure your layout is neat and simple to use.

- Check that your website is compatible with mobile devices and loads fast.

- Give clear and brief details about what you’re selling or offering.

Furthermore, make sure to have compelling calls to action that encourage users to reach out to you, buy something, or subscribe to your newsletter.

“A well-structured website can act as a strong marketing instrument to draw in and keep customers.”

Boosting Social Media Interaction

Social media platforms provide an affordable means to connect and interact with your intended audience. Create a social media plan that is in line with your business objectives and appeals to your audience.

Here are some strategies for boosting your social media engagement: consider implementing content marketing and SEO solutions to enhance your reach and interaction.

- Keep your audience interested by posting regularly and consistently.

- Post a variety of content, such as promotional posts, industry news, and behind-the-scenes insights.

- Interact with your audience by promptly responding to comments and messages.

By using social media effectively, you can develop a dedicated following and increase traffic to your website.

Maximizing SEO and Online Marketing

Search Engine Optimization (SEO) and online marketing are crucial for improving your online presence and drawing in possible clients. Dedicate time and resources to enhancing your website for search engines and creating specific online marketing campaigns. For more detailed strategies, check out these effective plans and tips for business growth.

Let’s dive into some important tactics for leveraging SEO and online marketing:

- Perform keyword research to find out what terms your target market is looking for.

- Optimize your website’s content, meta tags, and images for these keywords.

- Create high-quality, engaging content that provides value to your audience.

- Use email marketing to nurture leads and keep your audience informed about your offerings.

By putting these strategies into action, you can boost your search engine rankings and draw more visitors to your website.

Expanding Your Team and Business

As your business begins to expand, it’s important to grow your team and operations as well. This includes bringing on new employees, providing necessary training, and improving your day-to-day operations.

Recruiting the Right Team

Recruiting the right team is a key factor in the success of your business. Seek out potential team members with the skills and experience necessary to help your business grow. Also, think about recruiting other veterans, as they possess unique skills and a strong work ethic that can greatly benefit your business.

Here are some suggestions for recruiting competent workers:

- Ensure each position has a clear definition of roles and responsibilities.

- Use job boards and networking events to find potential employees.

- Interview thoroughly and check references to ensure a good match.

Invest in Employee Training

Investing in training for your employees is key to keeping a skilled and motivated workforce. Provide ongoing training and development opportunities to help your employees succeed and grow in their roles.

Here are some tactics for investing in employee training:

- Hold frequent training sessions and workshops on topics that are relevant to your industry.

- Encourage your employees to obtain certifications and pursue further education.

- Offer mentorship and coaching programs to help your employees grow and develop.

Improving Operational Processes

Improving your operational processes is a great way to increase efficiency and lower costs. Take a look at your current processes and see where you can make improvements. By using best practices and technology, you can make your operations more efficient and help your business grow.

Here are some tips to improve your operational processes:

- Regularly check your processes to find any inefficiencies.

- Use automation tools to make repetitive tasks more efficient.

- Make sure your processes and procedures are standardized to ensure consistency.

Case Studies: Success Stories from Veteran-Owned Businesses

Looking at the success stories of other veteran-owned businesses can provide valuable insights and inspiration. Let’s take a look at some real-life examples of successful expansions.

Case Studies of Successful Business Growth

One veteran-owned business that has seen successful growth is XYZ Company. The founder, a former Marine, started XYZ Company as a small local business and grew it into a nationally recognized brand. The owner used his military experience and the resources available to him through veteran-focused programs to drive the business’s growth.

“XYZ Company was able to expand its operations and find new customers by taking advantage of SBA resources and winning government contracts.”

Consider the case of ABC Enterprises, which was started by a Navy veteran. The company originally provided IT services to local businesses but later added cybersecurity solutions to its product line. ABC Enterprises was able to grow substantially by broadening its product line and forming partnerships with other businesses owned by veterans.

Key Takeaways

These success stories underscore a few important takeaways for veteran entrepreneurs:

- Use resources and support programs that are available to veteran-owned businesses.

- Find and take advantage of new market opportunities.

- Develop strong partnerships and collaborations to help your business grow.

When you apply these lessons, you can improve the chances of your business succeeding and reach your growth goals. For additional insights, explore our tips for veteran-owned businesses.

What Works

Here are some strategies that have been proven to work for successful veteran-owned businesses:

- Obtaining VOSB and SDVOSB certifications to tap into exclusive government contracts.

- Expanding your product and service offerings to attract new customer segments.

- Putting resources into technology and innovation to increase efficiency and stay competitive.

Implementing these strategies can help your business achieve long-term growth and success.

Final Thoughts

To grow a veteran-owned business, you must plan carefully, make strategic decisions, and use all available resources. Here are some final thoughts to help you succeed.

Recap

To recap, here are the key points to consider when you want to expand your veteran-owned business:

- Assess your business’s current performance and the market’s demand before considering expansion.

- Expand your product and service offerings to create new income opportunities.

- Utilize federal programs and certifications to gain access to unique opportunities.

- Use cutting-edge technologies to improve efficiency and stay competitive.

- Establish solid partnerships and fine-tune your financial management.

Steps to Take for Implementation

Here are some steps to take to put these strategies into action:

- Evaluate your business’s preparedness for expansion in a comprehensive manner.

- Pinpoint fresh market opportunities and craft a meticulous expansion strategy.

- Apply for VOSB or SDVOSB certifications and examine government contracting prospects.

- Invest resources in technology and staff training to facilitate growth.

- Establish robust partnerships and refine your financial management.

By adhering to these guidelines, you can steer your business towards successful expansion and sustained growth. For additional insights, explore our guide on outsourcing vs in-house balance tips.

Commonly Asked Questions

Why should I get certified as a VOSB or SDVOSB?

There are several reasons to get certified as a VOSB or SDVOSB. Some of the main benefits include gaining access to government contracts that are only available to certified businesses, enhancing your business’s reputation and credibility, and connecting with other veteran-owned businesses. These certifications can provide a significant boost to your business and open up a world of new opportunities.

How do I know if my business is ready to expand?

Here are some things to consider when deciding if your business is ready to expand: Have you established a strong brand identity? Are your current operations running smoothly? Do you have a reliable customer base and sufficient financial resources? Answering these questions can help you determine if it’s the right time to grow your business.

- Consistent financial performance and profitability.

- Stable customer base and growing market demand.

- Availability of sufficient capital to cover expansion costs.

- Ability to manage increased operational complexity.

“Conduct a thorough assessment of your business’s readiness for expansion, including financial performance, market demand, and operational capacity.”

What are some effective ways to diversify my revenue streams?

Diversifying your revenue streams can involve offering new products or services, expanding into new markets, and forming strategic partnerships. For example, if you run a fitness center, you might add nutritional counseling or sell fitness-related products. By diversifying, you can attract new customers and provide more value to your existing ones. To learn more about expansion, check out this guide to becoming a certified veteran-owned small business.

What are some government programs that are helpful for businesses owned by veterans?

There are many government programs that are helpful for businesses owned by veterans, including:

- The Small Business Administration’s Veteran-Owned Small Business and Service-Disabled Veteran-Owned Small Business certification programs.

- The Veterans Business Outreach Center Program.

- The Procurement Technical Assistance Centers.

- The Small Business Administration’s Boots to Business program.

These initiatives offer a wealth of resources, training, and support designed to help businesses owned by veterans to expand and thrive.

Growing your veteran-owned business is a path filled with potential and obstacles. By using the advice and tactics highlighted in this guide, you can traverse this road successfully and reach your growth goals. Remember to remain tenacious, constantly pursue new potential, and use the resources available to you as a veteran business owner. Best of luck on your journey to business growth and success!