Key Points

- Automated tax rebate calculators offer a speedy way to process your financial information, saving you time.

- By reducing the risk of human error in tax calculations, these calculators ensure accuracy.

- They stay current with the latest tax regulations, so you don’t have to worry about compliance issues.

- Both individuals and businesses can take advantage of the streamlined process of claiming tax rebates.

- Choosing the right calculator for your needs involves considering features like integration and user-friendliness.

The Importance of Automated Calculators for Tax Rebates

For many, tax season is a source of stress. The process of calculating taxes and claiming rebates can be complex and time-consuming. This is where automated tax rebate calculators come in. They are designed to make the process simpler, allowing everyone to handle their taxes efficiently.

Automated calculators make tax rebates simple. They help you claim every penny you deserve without making any errors. Since they’re updated often, they can also keep you up-to-date with the most recent tax laws.

A Brief Overview of Tax Rebate Calculators

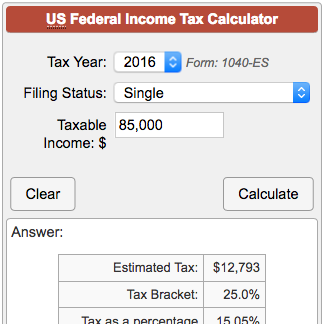

What are tax rebate calculators, you might ask? Simply put, these are software tools that help you figure out your tax rebates. They use algorithms to examine your financial information and calculate how much rebate you’re entitled to. These calculators can be independent tools or integrated into a larger accounting software suite.

The primary benefit of these calculators is their capacity to perform complex calculations rapidly and precisely. They remove the necessity for manual computations, which can frequently result in mistakes. Furthermore, these tools are available online, making them convenient and simple to use.

The Simplicity of Automated Tax Calculations

Automated tax calculations have revolutionized the way we do our taxes. They make the whole process, from inputting data to submitting the final forms, much easier. It’s simple: you put your financial data into the calculator, and it processes the information to work out your taxes and rebates. This is not only quicker, but it’s also more accurate than doing the calculations manually. For non-profit organizations, using QuickBooks ERTC claims can further streamline the process.

One of the biggest benefits of automated calculators is that they take the anxiety out of tax season. You can rest easy knowing that you haven’t made any errors or overlooked any rebates. The program does all the hard work for you, making sure everything is done right and done quickly.

Advantages for People and Companies

Automated tax rebate calculators can be a great asset for both individuals and businesses. For individuals, these calculators offer a sense of security, as they can be confident that their taxes are being calculated correctly. They also save time, freeing up individuals to concentrate on other essential tasks. Businesses can benefit from integrating these tools with accounting software to streamline their financial processes.

Companies in particular stand to gain a lot. Automated calculators are capable of processing huge amounts of data, which is perfect for businesses dealing with intricate financial circumstances. Moreover, they guarantee adherence to tax laws, thus lowering the chances of incurring penalties and fines.

Moreover, the use of these calculators can result in cost savings. By eliminating the need for manual calculations, businesses can use their resources more effectively. This can lead to increased productivity and profitability over time.

Benefits of Using Automated Calculators

Automated tax rebate calculators have several benefits that make them a must-have for anyone dealing with taxes. Let’s dive into some of these advantages in more depth.

These calculators are a real time-saver. They can crunch your numbers in minutes, saving you hours of manual calculations. This is especially useful for businesses that have to process a lot of data. Learn more about how AI technologies are streamlining tax compliance for businesses and individuals.

| Perk | Advantage |

|---|---|

| Speed | Cuts down on hours of manual calculations |

| Precision | Minimizes human mistakes |

| Regulation Adherence | Stays updated with tax laws |

Speed and Time Efficiency

One of the most notable perks of using automated calculators is their speed. They can handle data and produce results much quicker than manual methods. This is especially beneficial during tax season when time is critical.

- Just put in your financial information once, and the calculator takes care of the rest.

- Get immediate updates on your tax situation.

- Put less time into taxes and more time into other things.

Aside from speed, these calculators also provide convenience. They can be used from anywhere you can connect to the internet, so you can handle your taxes on the move.

Using Automated Calculators for Better Outcomes

Adding automated tax rebate calculators into your financial habits can revolutionize the way you handle taxes. Not only do these tools make the process easier, but they also guarantee that you’re getting the most out of your rebates. But, to get all the advantages, it’s important to use them properly. This means choosing the right tool, making it work with your current systems, and teaching your team how to use it to its fullest potential.

Picking the Best Tool for You

Automated tax rebate calculators come in all shapes and sizes, and it’s crucial to pick one that’s right for you. Things to think about include how easy it is to use, what features it has, and whether it will work with your existing financial systems. Good customer support and regular updates to reflect changes in tax laws are also important.

For example, as a small business owner, you may want a calculator that works well with your accounting software. But if you’re a personal taxpayer, a basic online tool may be all you need. Spend some time comparing different choices and pick the one that fits your needs best.

Working With What You Have

Automated calculators can be made even more effective when they’re integrated with your existing systems. That means making sure the calculator can talk to your accounting software or financial management tools. This integration allows data to be transferred seamlessly, reducing the need for you to enter data manually and lessening the chance of making mistakes.

First, you need to determine what systems you’re already using and see if the calculator will work with them. Most up-to-date calculators have APIs or plugins that make integration easier. After you’ve integrated it, test the system to make sure the data is moving smoothly between different platforms. For businesses using accounting software, exploring QuickBooks ERTC claims can provide additional insights into integration processes.

Moreover, integration can also enhance teamwork. When everyone can see the same data, it’s easier to collaborate and make smart decisions.

Getting Your Team Up to Speed

For automated tax rebate calculators to be truly beneficial, your team needs to know how to use them properly. This means knowing what the tool can do and how to enter data correctly. Training can take the form of workshops, online tutorials, or hands-on sessions.

Additionally, urge your staff to provide feedback on the usability of the tool. This can help pinpoint areas that need improvement and ensure that everyone is comfortable using the calculator. Regular training updates can also keep your staff up-to-date on new features or changes in tax regulations.

Obstacles and Thoughts

Although automated tax rebate calculators provide countless advantages, there are a few obstacles and thoughts to remember. Being aware of these can assist you in dealing with any problems that may arise and in getting the most out of the tool.

One of the main challenges is ensuring data accuracy. Even though automated calculators reduce the risk of human error, incorrect data entry can still lead to inaccurate results. Therefore, it’s important to double-check the information you input.

Another thing to keep in mind is the price of using these tools. While some calculators are free, others may require a subscription or a one-time purchase. It’s crucial to compare the costs and the benefits to see if the investment is worth it.

- Data accuracy is crucial for reliable results.

- Consider the cost of the tool and its long-term benefits.

- Ensure that the calculator is regularly updated with the latest tax laws.

Potential Technical Issues

Technical issues can arise when using automated calculators, such as software bugs or integration problems. These can disrupt your workflow and lead to delays in processing tax rebates. To mitigate these issues, choose a calculator with a strong support team that can address technical problems promptly.

Moreover, make sure to consistently update your software to the most recent version to prevent any compatibility issues. Regular upkeep and troubleshooting can also assist in avoiding potential issues before they even occur.

Financial Assessment and Budget Planning

Before deciding on an automated calculator, it’s crucial to carry out a financial assessment. This includes taking into account the initial buying price, any subscription costs, and any extra charges for integration or training. Weigh these costs against the possible savings and productivity improvements to see if the tool is worth the investment.

Answering Typical User Questions

Typical questions from users include data privacy, ease of use, and the accuracy of calculations. Answer these questions by selecting a calculator with strong security measures to safeguard sensitive information. Additionally, choose easy-to-use tools that provide tutorials or customer support to help with any problems.

It’s also a good idea to check out what other people have to say about the tool. Reading reviews or testimonials can give you a good idea of how well the calculator works and how reliable it is.

Automated Calculators Success Stories

There are many success stories of individuals and businesses who have used automated calculators to simplify their tax rebate claims. These stories illustrate the real advantages of using these tools.

Savings for Individual Taxpayers

Automated calculators have provided substantial savings for individual taxpayers. By precisely calculating rebates, these tools guarantee that individuals get the maximum amount they deserve. This has resulted in lower tax bills and bigger refunds for many users.

A user commented,

“Using an automated calculator helped me discover deductions I wasn’t aware of. It made the entire tax filing process stress-free and saved me a considerable amount of money.”

Business Efficiency Improvements

Businesses have also benefited from the efficiency improvements brought by automated calculators. By automating tax calculations, companies have been able to reduce the time spent on tax preparation and focus on core business activities.

Take for instance, a report from a small business owner,

“Using an automated tax calculator with our accounting software has made our tax filing process so much easier. We can now spend more time growing our business instead of being buried under tax paperwork.”

Government Support

Government bodies in certain areas have shown support for the use of automated calculators to encourage correct and prompt tax filing. These endorsements highlight the dependability and efficiency of these tools in handling tax-related duties.

Looking Ahead at Automated Tax Solutions

With the rapid pace of technological advancements, it’s clear that automated tax solutions have a bright future. The ongoing improvements in artificial intelligence and machine learning are set to further boost the performance of these calculators, making them more precise and speedy.

Furthermore, there is an increasing demand for personalized solutions that address the unique financial circumstances of individuals and businesses. Automated calculators are perfectly suited to meet this need by providing customized advice and insights.

In general, the future of tax management will probably be automated, making the process more streamlined and less stressful for users. For small businesses, integrating CRM and accounting software can significantly enhance efficiency and accuracy in handling taxes.

Future of Technology

Looking ahead, it’s clear that technology will play a significant role in changing the way we deal with taxes. Tax rebate calculators that automate the process are expected to take advantage of advancements in artificial intelligence and machine learning. These technologies have the ability to improve the precision of calculations by learning from previous data and adjusting to new tax laws as they are introduced.

Moreover, the popularity of cloud-based solutions is on the rise. These solutions provide the benefit of being accessible from any device, which simplifies the process of managing taxes on the go for users. With ongoing updates and enhancements, automated calculators are set to become even more efficient and easy to use.

Increasing Demand for Customized Financial Solutions

In the modern era, the need for personalized financial solutions is ever-increasing. Automated tax rebate calculators are perfectly equipped to cater to this demand. By examining personal financial information, these tools can offer customized advice and insights, assisting users in maximizing their tax rebates. For more information on how to streamline your financial processes, check out this guide on QuickBooks ERTC claims for non-profits.

“Automated calculators are more than just number-crunchers; they’re your personalized financial advisors offering solutions tailored to your specific needs.”

This personalized approach ensures that you are not only in compliance with tax laws but also taking full advantage of all deductions and credits available to you. The result is improved financial outcomes and peace of mind.

Green Tax Management Practices

Green practices are becoming more important in every aspect of life, including tax management. Automated calculators support green practices by reducing the need for paper-based processes. They allow for electronic filing and storage of tax documents, which helps to reduce environmental impact.

Moreover, these tools promote resourceful use of resources. By automating repetitive tasks, they save time and energy for more strategic financial planning. This not only benefits individuals and businesses but also contributes to a more sustainable future.

Common Questions

If you’re just getting started with automated tax rebate calculators, you probably have a lot of questions. Here are some answers to frequently asked questions to help you get a better grasp on these tools.

What is an automated tax rebate calculator?

An automated tax rebate calculator is a computer program that helps you work out how much tax rebate you are entitled to. It uses a set of rules to process your financial data and work out how much rebate you can claim. This makes the process of filing your tax return easier and more accurate.

How do automated calculators stay current with tax laws?

Automated calculators are consistently updated to mirror the most recent tax laws. The developers of these calculators collaborate with tax professionals to confirm that the software aligns with the present laws. Therefore, you can rely on the calculator to give precise and current data.

Can I trust automated calculators?

Definitely, automated calculators are built to be secure. They use encryption and other security measures to protect your sensitive financial information. Always go for reputable tools with strong privacy policies to ensure your data is safe.

Can businesses gain from automated tax computations?

Definitely. Businesses can gain a lot from automated tax computations. These tools simplify the tax filing process, decrease mistakes, and guarantee compliance with tax regulations. This lets businesses concentrate on their main operations while reducing the chance of penalties.

What steps should I take to incorporate automated calculators into my current system?

The integration process varies depending on the calculator you choose and the system you currently have in place. Many calculators provide APIs or plugins that make it easier to integrate with your accounting software. It’s crucial to select a calculator that works well with your systems and to thoroughly test the integration to ensure it functions properly.

Can I use automated tax calculators for free?

Indeed, you can find free automated tax calculators. While they may not have as many features as their paid counterparts, they can still be very useful in helping you calculate your tax rebates. You should assess your needs to see if a free calculator will work for you. For more advanced features, consider exploring QuickBooks ERTC claims for a streamlined process.

What do I do if I see a mistake in the calculations?

If you see a mistake in the calculations, check the data you entered again. If the problem continues, get in touch with the calculator’s customer service for help. Make sure you fix any mistakes quickly to make sure your tax return is correct. For more insights on how technology can aid in tax processes, you might find this article on AI technologies in tax compliance useful.

Can I get help if I run into problems with the calculator?

Most of the best automated tax rebate calculators have a support system in place. This could be in the form of online guides, customer service phone lines, and live chat. Having this support means you can get any problems fixed quickly and get back to using the calculator as it should be used.

To sum it up, automated tax rebate calculators are a great help in simplifying the process of filing taxes and maximizing your rebates. By knowing the advantages and dealing with possible challenges, you can maximize the use of these tools and reach a better financial result.