Key Points

- Tax relief programs can drastically decrease the amount of taxes owed, aiding individuals and businesses in better managing their finances.

- Qualification for tax relief programs often hinges on income level, filing status, and the structure of the business.

- Federal, state, and local governments offer a variety of tax relief programs, each with its own criteria and benefits.

- Working with a Certified Public Accountant (CPA) can ensure adherence to tax laws and maximize tax relief opportunities.

- Staying updated on changes in tax laws and relief programs is essential for effective financial planning.

Getting Started with Tax Relief Program Basics

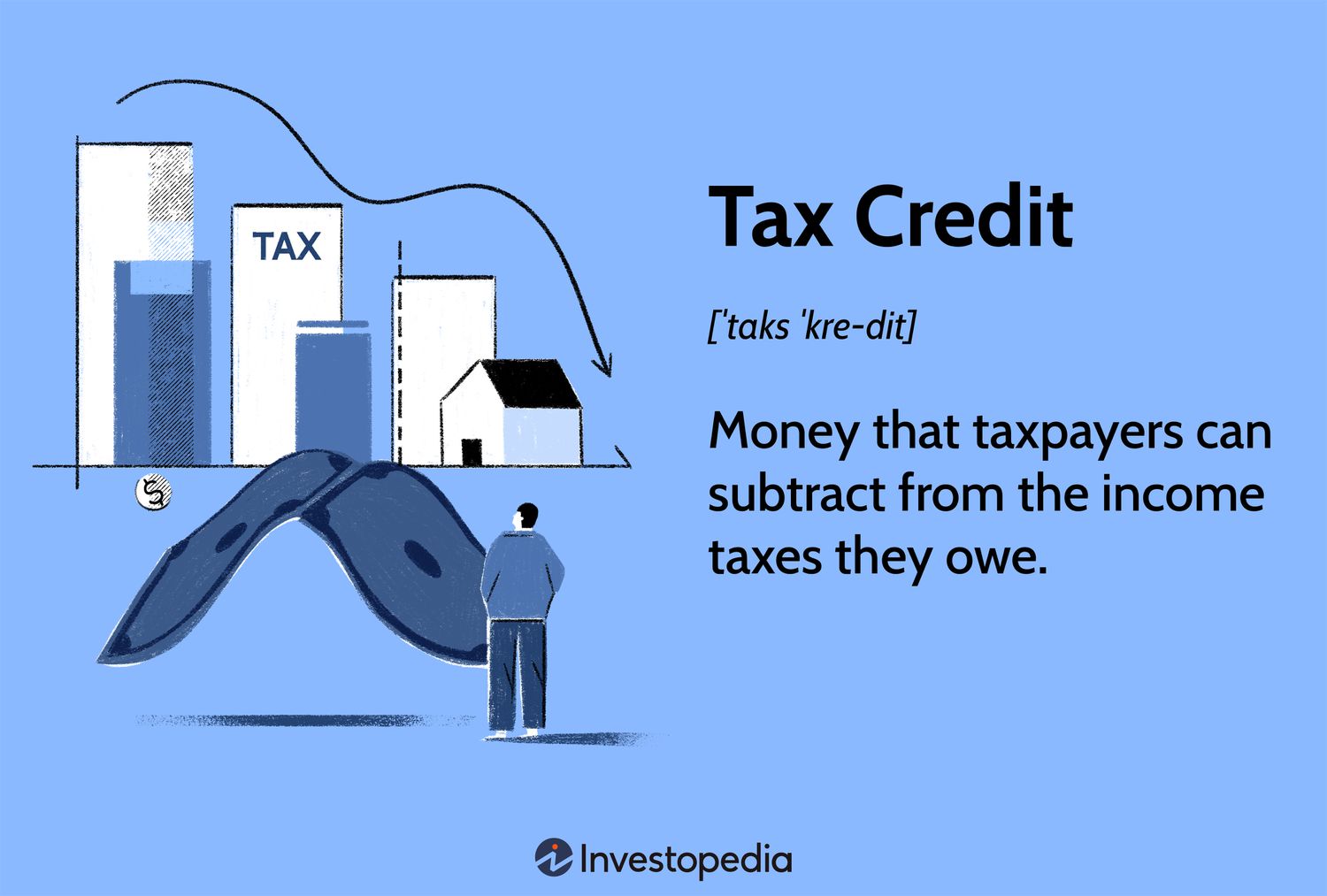

Grasping tax relief programs is essential for anyone seeking to lessen their tax burden and improve their financial status. These programs provide various methods to decrease the amount of taxes you owe, whether through deductions, credits, or other forms of relief. By capitalizing on these opportunities, individuals and businesses can more effectively manage their finances and ensure they’re following tax laws.

What are Tax Relief Programs?

Government tax relief programs are designed to help taxpayers lower their tax bills. They come in a variety of forms including tax credits, deductions, and exemptions. They are available at the federal, state, and local level. The main purpose of these programs is to provide financial assistance to those who qualify. This makes it easier for them to meet their tax obligations and avoid penalties.

Advantages of Tax Relief for People and Companies

For people, tax relief programs can result in substantial savings, freeing up more funds for other necessary costs or investments. For companies, these programs can enhance cash flow, making it simpler to invest in growth opportunities or manage operating expenses. Furthermore, tax relief can assist businesses in maintaining competitiveness by decreasing the total tax burden and freeing up money for other strategic initiatives.

Not only can tax relief programs save you money, but they can also give you peace of mind. When you know you’re using all the tax benefits you can and following all tax laws, you can feel less stress and worry less about audits or penalties. This is especially true for small business owners and self-employed people who might not have the resources to deal with complicated tax issues by themselves.

Examining Different Tax Relief Programs

There are many tax relief programs available to taxpayers, each with its own set of requirements and advantages. Knowing these options can help you find the best opportunities to decrease your tax obligations and enhance your financial situation. For businesses, exploring strategies to minimize business taxes can be particularly beneficial.

- Programs for Federal Tax Relief: The federal government offers these programs. They include options like the Earned Income Tax Credit (EITC), Child Tax Credit, and a variety of deductions for education, healthcare, and retirement savings.

- Programs for State and Local Tax Relief: Additional tax relief opportunities may be offered by states and local governments. These include property tax exemptions, sales tax holidays, or credits for investing in renewable energy.

- Special Programs for Disaster Areas: If natural disasters occur, the government may provide tax relief to affected businesses and individuals. This could be in the form of extended filing deadlines or deductions for expenses related to the disaster.

Opportunities for Federal Tax Relief

There are federal tax relief programs designed to help taxpayers reduce their liabilities for federal tax through various methods. Some well-known federal programs include the Earned Income Tax Credit (EITC), which provides financial help to families with low and moderate incomes, and the Child Tax Credit, which gives a tax break to families with dependent children.

Additional federal tax relief options encompass deductions for expenses related to education, healthcare, and contributions made towards retirement accounts. These programs have the potential to aid taxpayers in reducing their taxable income, which in the end, decreases the amount of taxes that are owed.

Local and State Tax Relief Programs

Local and state governments usually provide more tax relief programs to the residents and businesses in their areas. These programs can differ a lot from one place to another, so you need to research the options that are available in your location. Some of the typical local and state tax relief programs are property tax exemptions for veterans or senior citizens, sales tax holidays for certain items, and credits for investments in energy-efficient improvements or renewable energy.

Government Assistance for Disaster Areas

After a natural disaster, the government often steps in to provide tax relief to those affected, whether they are individuals or businesses. This assistance can take the form of extended deadlines for filing taxes, deductions for expenses related to the disaster, and tax credits for efforts to rebuild. Anyone affected by a disaster should make sure they are aware of these options and take full advantage of them to help get back on their feet financially.

Getting to Know the Qualifications for Tax Relief

If you want to take advantage of tax relief programs, you need to know the qualifications. These qualifications can change based on the program and may include things like how much money you make, your filing status, and the type of business you have. By knowing these qualifications, you can figure out which programs you can use and get the most out of your tax savings. For more strategies, check out minimizing business taxes for additional tips.

Earnings Guidelines

Most tax relief programs use earnings guidelines to decide who is eligible. These guidelines are frequently based on your adjusted gross income (AGI), which is your total income minus certain deductions. The Earned Income Tax Credit (EITC), for instance, is offered to low- and middle-income families, with eligibility limits determined by family income and the number of dependents.

Checking the income requirements for each program you’re considering is crucial. Make sure your AGI falls within the specified range. If your income is above the threshold, you might not qualify for the program, or your benefits might be reduced.

For instance, families with an AGI of up to $57,414 for the 2021 tax year may be eligible for the Earned Income Tax Credit (EITC), depending on how many qualifying children they have.

How Filing Status Affects Eligibility

The filing status you choose can affect whether or not you’re eligible for tax relief programs. The most common filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with a dependent child. Each of these statuses has its own rules and can impact the benefits you can receive. For more information on minimizing taxes, consider these strategies and tips.

For instance, certain programs might provide more benefits to married couples who file jointly or to those who file as head of household. It’s important to comprehend how your filing status impacts your eligibility and to select the status that is most beneficial to you. For further guidance, consider consulting a federal tax credit consultancy to ensure compliance and maximize benefits.

Choosing the Right Business Structure and Industry

When it comes to tax relief programs, the structure of your business plays a significant role in determining your eligibility. Sole proprietorships, partnerships, corporations, and LLCs all have different tax implications. The structure of your business can affect your tax liability and whether you’re eligible for specific relief programs. For instance, some credits or deductions might only be available to corporations or partnerships.

Also, the business’s industry can affect its eligibility. Industries like renewable energy, technology, and manufacturing often have specialized tax credits and incentives available to them. So, understanding the connection between your business structure and industry can help you take advantage of the best tax relief programs.

CPA Compliance Rules for Tax Relief

Compliance is a key factor in successfully utilizing tax relief programs. Certified Public Accountants (CPAs) are crucial in making sure that individuals and businesses are meeting all the necessary requirements to take advantage of these programs. By working closely with a CPA, you can make sure that your tax filings are correct and that you’re maximizing the relief options available to you.

How CPAs Can Help with Tax Relief

CPAs are a critical part of the tax relief process because of their deep understanding of tax laws and rules. They can help you find programs you’re eligible for, figure out how much you could save, and make sure you’re following all the rules when you file. They’re always up-to-date on changes in tax laws and can give you advice that fits your exact situation. For more information on tax compliance, check out our top compliance CPA advisors.

Furthermore, CPAs can act as your representative in audits or disputes with tax authorities, providing a sense of security and minimizing the chance of expensive penalties. Their knowledge and comprehension of tax relief programs make them an essential tool for optimizing your tax savings.

Staying on Top of Paperwork and Records

Keeping your records neat and accurate is a must when it comes to tax compliance. Having the right documents in order means you can back up your claims for tax relief programs and answer any questions from tax authorities. The most important records to have include income statements, expense receipts, tax returns, and any letters from tax agencies.

CPAs can help you establish effective systems for keeping records, which can keep you organized and ready for tax time. Keeping detailed records can make the filing process smoother and reduce the chances of making mistakes or leaving something out. For more insights on maintaining tax compliance, check out essential steps for individuals and businesses.

Keeping Up with Tax Laws and Changes

With tax laws and rules always changing, it’s important to stay on top of any changes that could affect your eligibility for tax relief programs. CPAs are knowledgeable about the most recent tax changes and can advise you on how these changes might affect your finances.

Keeping in touch with a CPA on a regular basis can help you adjust to new tax laws and maintain compliance. By keeping yourself informed, you can make educated decisions and keep benefiting from tax relief opportunities that are available.

How to Successfully Navigate Tax Relief Programs

Successfully taking advantage of tax relief programs requires a strategic approach and attention to detail. Here are some expert tips to help you maximize these opportunities: consider consulting with top compliance CPA advisors to ensure you are fully compliant and making the most of available credits.

- Investigate Your Options: Spend some time looking into the different tax relief programs that are available at the federal, state, and local levels. By knowing what’s out there, you’ll be able to find the programs that will be the most beneficial for you.

- Work with a CPA: A qualified CPA can help you make sure you’re following all the rules and getting the most out of your tax savings. They can guide you through the complicated tax laws and help you find the programs you’re eligible for.

- Keep Good Records: It’s important to keep detailed records of your income, expenses, and any communications you have with tax authorities. You’ll need this documentation to back up any claims you make and to make sure you’re following all the rules.

- Stay Up-to-Date: Tax laws and regulations can change, and these changes could affect whether you’re eligible for certain tax relief programs. Regular meetings with a CPA can help you stay on top of these changes and adjust your plans as necessary.

These expert tips can help you confidently navigate the world of tax relief programs and take full advantage of the opportunities that are available to you. Remember, the key to success is staying informed, following the rules, and getting help from qualified professionals when you need it.

Finding the Perfect Tax Relief Programs

Choosing the perfect tax relief programs for your unique situation means understanding your individual financial needs and goals. When evaluating potential programs, consider factors such as your income level, filing status, and business structure. By matching your financial objectives with the tax relief options available, you can maximize your savings and reach your financial goals.

Gathering the Required Paperwork

It’s crucial to gather all the required paperwork for tax relief programs. Make sure you have all the necessary documents, like income statements, receipts for expenses, and tax returns, at hand. This will make the filing process easier and help you back up any tax relief claims you make.

Collaborating with a CPA can guide you in pinpointing the exact paperwork required for each program, and in establishing effective systems for record-keeping to keep everything in order. By keeping your records precise, you can simplify the application process and lessen the likelihood of mistakes or missing information.

Using Technology for Correct Filing

Technology is a powerful tool for accurate and efficient tax filing. By using tax software and digital tools, you can simplify the filing process and minimize the risk of mistakes. Many tax software programs provide features like automatic calculations, e-filing options, and safe document storage, making it simpler to handle your tax responsibilities.

Furthermore, technology can aid in keeping you up-to-date with tax law and regulation changes, offering immediate updates and alerts. By utilizing technology, the tax filing process can be simplified and all required compliance can be ensured.

Final Thoughts on Tax Relief and CPA Compliance

Tax relief programs provide invaluable chances for individuals and businesses to lessen their tax burdens and enhance their financial circumstances. By knowing the eligibility criteria and collaborating closely with a CPA, you can boost your tax savings and guarantee compliance with all essential requirements.

Smart Application of Tax Relief Perks

Applying tax relief perks smartly can greatly influence your financial well-being. By utilizing the programs that are available, you can allocate resources for other important costs or investments, which can ultimately support your long-term financial objectives.

Keep in mind, the secret to triumph is staying knowledgeable, adhering to compliance, and utilizing the skills of competent professionals. By adhering to these rules, you can confidently traverse the intricate world of tax relief and attain financial independence.

Why Businesses Should Consider Long-term Planning

Businesses can reap the benefits of tax relief programs by incorporating them into their long-term plans. By doing so, they can improve cash flow, reduce tax liabilities, and support growth. For example, businesses can use the money they save from tax relief to invest in new technologies, train employees, or expand, all of which can contribute to long-term success.

Furthermore, knowing how to take advantage of tax relief opportunities can boost a company’s competitive edge. By lowering the total tax load, companies can offer more attractive prices, draw in the best talent with superior compensation packages, and put money into research and development. These strategic decisions can set a company up for ongoing growth and profitability over time.

Commonly Asked Questions

There are often a lot of questions about tax relief programs and CPA compliance. Here, I’ve answered some of the most frequently asked questions to help you better understand these topics.

What does tax relief mean and who is eligible?

Tax relief is a term that encompasses a range of programs and incentives aimed at lowering the amount of tax that individuals and businesses are required to pay. This can take the form of deductions, credits, and exemptions. Whether or not you are eligible for tax relief depends on a variety of factors, including your income level, your filing status, and certain specific situations, such as natural disasters or business investments.

For instance, families with low to moderate income may be eligible for the Earned Income Tax Credit (EITC). On the other hand, businesses that invest in renewable energy may qualify for specific tax credits. It’s crucial to look into the specific criteria for each program to see if you’re eligible.

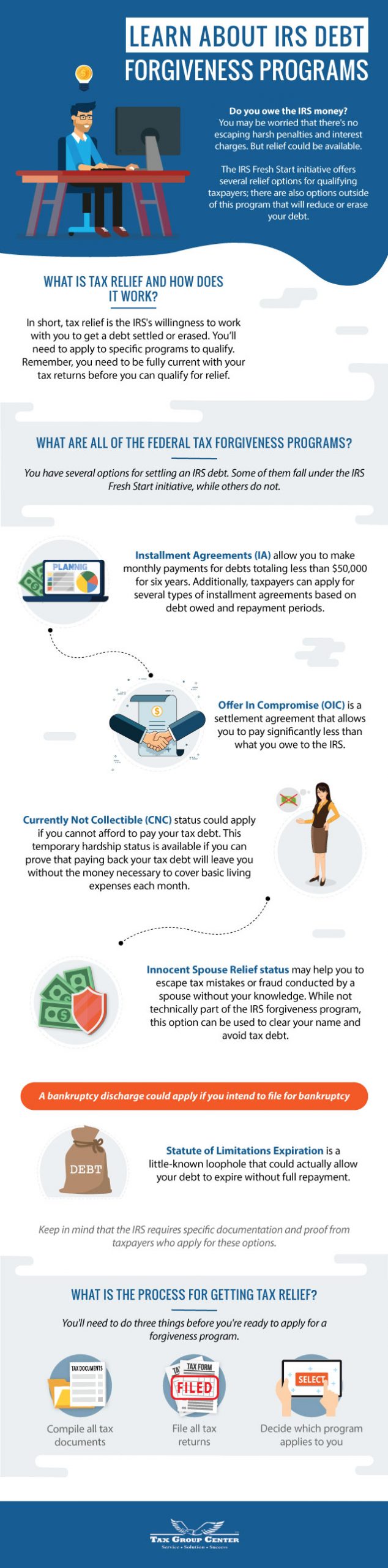

How can I apply for a tax relief program?

To apply for a tax relief program, you’ll need to fill out the required forms and paperwork and submit them to the correct tax authority, which could be the IRS or your state tax agency. The application process can change based on the program and your personal situation.

Utilizing the services of a Certified Public Accountant (CPA) can assist you in ensuring that the application process is completed accurately and all necessary paperwork is provided. A CPA can also assist you in determining which programs you are eligible for and walking you through the application process.

What happens if I don’t meet CPA compliance requirements?

Unfortunately, there are penalties for not meeting CPA compliance requirements. These can include fines, interest charges, and even legal consequences. To be compliant, you must accurately report income, deductions, and credits on your tax return and keep appropriate documentation to support your claims. For more detailed guidance, you can refer to our ERTC tax credit compliance guide.

Working with a CPA can help you ensure that your tax filings are correct and meet all necessary regulations. This proactive approach can help you avoid expensive penalties and protect your financial health.

What are the most frequent errors in tax relief applications?

The most frequent errors in tax relief applications include not providing correct information, missing eligible programs, and failing to keep proper documentation. These mistakes can lead to delays, application rejections, or fines.

In order to steer clear of these potential problems, it’s crucial to keep up-to-date on tax relief programs that are available, collaborate with a CPA to guarantee precision, and maintain meticulous records of all pertinent financial data. By doing these things, you can boost your odds of successfully getting tax relief.

How frequently are tax relief programs altered?

Tax relief programs are prone to frequent changes, typically in response to new laws, economic situations, or governmental priorities. These modifications can affect who is eligible, the amount of benefits, and the procedures for applying. For strategies on how to manage these changes, consider exploring minimizing business taxes.

Keeping up with the latest tax laws and regulations is key to maximizing your tax relief opportunities. Having regular check-ins with a CPA can help you stay in the loop on any changes and adjust your financial strategies as needed.

Can I really save a lot of money with tax relief programs?

Yes, depending on your eligibility and the specific programs you qualify for, tax relief programs can save you a significant amount of money on your tax bill. For instance, tax credits can directly decrease the amount of taxes you owe, while deductions can reduce your taxable income, which in turn can lower your overall tax liability.

Utilizing the tax relief programs that are available to you can save you thousands of dollars on your tax bill. It’s important to do your homework and understand what programs you qualify for and then work with a CPA to make sure you’re getting the most out of them.

- Research available tax relief programs at the federal, state, and local levels.

- Consult with a CPA to ensure compliance and maximize your tax savings.

- Maintain accurate records of income, expenses, and correspondence with tax authorities.

- Stay informed about changes in tax laws and regulations that may impact your eligibility for tax relief programs.

What should I look for in a CPA to help with tax relief?

When selecting a CPA to help with tax relief, consider their experience, expertise, and specialization in tax relief programs. Look for a CPA with a proven track record of successfully navigating complex tax issues and maximizing tax savings for clients.

Moreover, select a CPA who keeps abreast of the most recent tax laws and regulations and can give you advice that fits your unique financial circumstances. When you collaborate with a CPA who is both knowledgeable and experienced, you can be confident in your compliance and maximize the tax relief options available to you.

What are the risks of seeking tax relief?

While there can be many benefits to seeking tax relief, you should also be aware of the potential risks. These can include providing inaccurate information, not meeting compliance requirements, or not understanding the eligibility criteria. Any of these issues can lead to denied applications, penalties, or audits.

It’s important to work with a CPA to reduce these risks and ensure everything is accurate and compliant. You should also keep yourself updated on the specific criteria and requirements of each tax relief program to avoid any possible issues.

With a proactive mindset and the help of experienced professionals, you can confidently make your way through the intricate landscape of tax relief and reach your financial goals.