Summary

- Select the best business structure to maximize tax benefits. Sole proprietorships and partnerships have different tax implications than LLCs and corporations.

- By meticulously tracking all business expenses, you can maximize deductions and credits. This can significantly lower your taxable income.

- Use tax-advantaged accounts like retirement savings and Health Savings Accounts (HSAs) to decrease taxable income.

- Keep up to date on state and local tax obligations to avoid penalties and ensure compliance.

- Consistently adapt to changes in tax law to take advantage of new opportunities and avoid potential pitfalls.

The Importance of Tax Strategies for Startups

Starting a business is like embarking on a new journey. But you must be ready to navigate through the complexities of tax regulations. Understanding and implementing effective tax strategies from the beginning can greatly affect the financial success of your startup. It not only keeps your business compliant, but it also helps in preserving capital and optimizing cash flow.

The Importance of Tax Planning from the Start

For startups, early tax planning is key. It’s the groundwork for financial stability and making informed decisions from the beginning. By planning ahead, you can avoid expensive errors and capitalize on tax savings. Think of it as laying down the tracks before the train starts to move. Without a clear path, you run the risk of derailing your financial goals.

How it Affects Your Financial Health and Room for Growth

Having a good tax strategy can greatly improve the financial health of your startup. By reducing how much you owe in taxes and making the most of the resources you have, you can improve your cash flow. Cash flow is important for growth and being able to keep your business going. This means you can put more money back into your business, which can help you grow and come up with new ideas. In other words, being smart about your taxes can help you succeed in the long run.

Picking the Best Business Structure

The business structure you choose is an important decision that affects your tax responsibilities. Each structure has its own set of pros and cons, particularly in relation to taxes. The trick is to comprehend these differences and choose the structure that matches your business objectives and financial circumstances. For more insights, consider exploring small veteran business incentive programs that might align with your goals.

Looking at Sole Proprietorships and Partnerships

Many startups choose to become sole proprietorships or partnerships because they are easy to set up and simple to run. However, these business structures come with certain tax considerations. With a sole proprietorship, you report your income on your personal tax return, and your business profits are subject to self-employment tax. Partnerships involve more than one owner, and the profits are passed on to the partners, who report them on their personal tax returns.

Advantages of LLCs and Corporations

When it comes to taxes, Limited Liability Companies (LLCs) and corporations provide more protection and are more flexible. Owners of LLCs enjoy limited liability protection and the advantage of pass-through taxation. S-Corps, a type of corporation, allows profits to be taxed at the shareholder level, which may lower the total tax liability. Although C-Corps are subject to double taxation, they provide more tax deduction opportunities and benefits.

How Different Business Structures Affect Your Taxes

It’s important to know that your taxes will be affected by the type of business structure you choose. For example, if you choose to structure your business as a sole proprietorship or partnership, you may end up paying higher personal tax rates because of self-employment taxes. On the other hand, if you structure your business as a corporation, you might enjoy lower tax rates, but you’ll have to deal with more paperwork and compliance issues. So, think about the nature, size, and growth potential of your business before you decide on a structure.

Getting the Most Out of Deductions and Credits

One of the most strategic decisions a startup can make is to fully utilize deductions and credits. These can dramatically decrease your taxable income, leading to considerable savings. The secret is to maintain thorough records of all expenses related to the business and to stay informed about available credits.

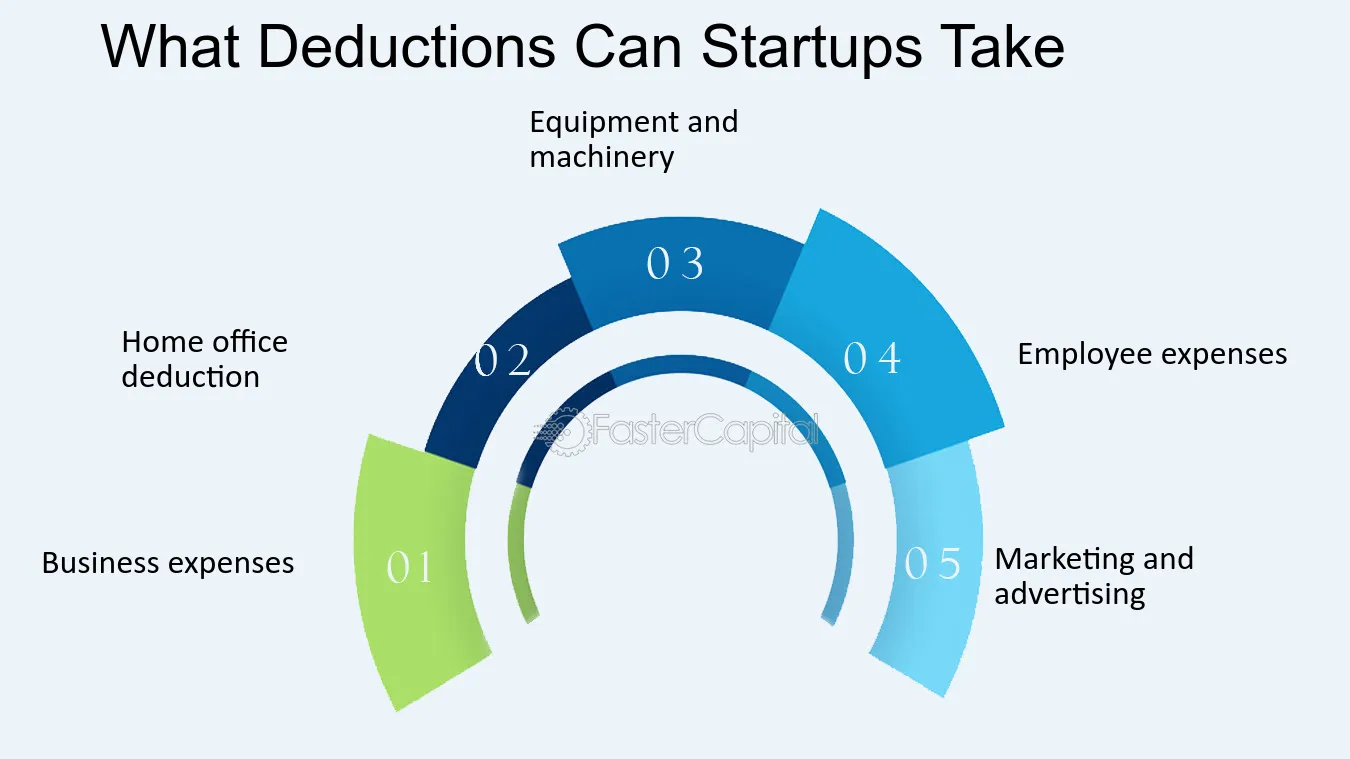

Typical Tax Deductions for Startups

There are several tax deductions that startups can benefit from. Some of the most common ones include office expenses, travel costs, and marketing expenses. Additionally, startup costs like legal fees and market research can also be deducted. It’s important to always keep your receipts and documentation to back up your deductions.

Tax Credits You Can Access and How to Get Qualified

Tax credits are more beneficial than deductions because they decrease your tax liability directly. For instance, the Research and Development (R&D) Tax Credit is available for startups engaged in innovation. To get qualified, make sure you fulfill all the requirements and keep proper records of your activities.

Keeping a Record of Expenses for Deductions

Keeping a detailed record is crucial for getting the most out of deductions. Use accounting software to keep track of all business expenses and categorize them accordingly. This makes filing taxes easier and ensures you don’t miss any potential deductions. For more information on managing expenses, explore home office deduction strategies.

Using Tax-Advantaged Accounts

Tax-advantaged accounts are an excellent tool for reducing taxable income and planning for the future. The tax benefits these accounts offer can result in substantial savings over time.

Getting to Know Your Retirement Savings Choices

As a startup owner, it’s crucial to think about your future while you’re keeping your business afloat. One method to ensure you’re financially stable in the future is by utilizing retirement savings options. These accounts can help you save for your retirement and offer tax advantages that can lower your taxable income now.

Startups often go for the Simplified Employee Pension (SEP) IRA. This lets you put in up to 25% of your earnings or $66,000, whichever is lower, tax-deferred. This implies you won’t be taxed on the money until you take it out when you retire. Another alternative is the Solo 401(k), which is tailored for self-employed people. It provides similar tax benefits and higher contribution limits, making it perfect for maximizing retirement savings. For additional insights, explore small business tax credit services that can further enhance your financial strategies.

The Perks of Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a stellar tax-advantaged choice, especially if you’re enrolled in a high-deductible health plan. When you contribute to an HSA, you can deduct those contributions on your taxes. Plus, you can withdraw money from your HSA tax-free if you use it for qualified medical expenses. So, you get a two-for-one benefit: you lower your taxable income and you have a way to pay for healthcare expenses.

Let’s look at a case study: Jane, who founded a startup, contributes $3,600 to her Health Savings Account (HSA) each year. This lowers her taxable income by $3,600, saving her about $900 in taxes based on a 25% tax rate.

HSAs also permit unused funds to be carried over from one year to the next, creating a financial safety net for future medical costs. Moreover, after you turn 65, you can take out funds for any reason without incurring a penalty, although they will be taxed as income.

Taking Advantage of Depreciation and Amortization

Depreciation and amortization are accounting practices that enable you to distribute the expense of an asset throughout its lifespan. This can offer substantial tax advantages by lowering your taxable income annually.

Depreciation vs. Amortization: What’s the Difference?

Depreciation is used for tangible assets, such as machinery, vehicles, and office furniture. It accounts for the wear and tear or obsolescence of an asset over time. Amortization is used for intangible assets like patents, trademarks, and goodwill. It represents the gradual reduction in the value of an intangible asset over its useful life.

Both approaches offer a means to recoup the cost of assets, but it’s crucial to grasp the unique rules and methods that apply to each. For example, the Modified Accelerated Cost Recovery System (MACRS) is the most widely used depreciation method in the U.S., providing expedited write-offs for specific assets.

How to Get the Most Out of Depreciation Benefits

One way to get the most out of depreciation benefits is to use Section 179 deductions. This lets you deduct the full purchase price of qualifying assets the year you start using them instead of depreciating them over time. This is especially helpful for startups that need to invest a lot in equipment and technology.

Also, make sure you keep thorough records of all your asset purchases. This includes receipts and dates of service. By doing this, you can accurately calculate depreciation and claim the highest possible deductions.

Strategic Employee Benefits as a Startup

As a startup, offering employee benefits can be a strategic move. It not only helps attract and retain top talent, but it can also provide tax advantages that can lower your overall tax liability.

How Employee Benefits Can Lower Your Taxes

- Health Insurance: If you pay for it, you can generally deduct the premiums.

- Retirement Plans: You can deduct contributions to your employees’ retirement accounts.

- Education Assistance: You can provide up to $5,250 per employee per year tax-free.

By smartly providing these benefits, you can lower your taxable income while also investing in your team. It’s a win-win for both you and your employees.

The Influence of Benefits on Total Tax Liability

Providing benefits can have a substantial effect on the tax liability of your startup. For instance, offering a 401(k) plan decreases taxable income by the sum of employer contributions. Similarly, offering health insurance can decrease payroll taxes because premiums are not included in employee wages for tax purposes. To explore more about tax credits and benefits, check out this small business tax credit guide.

So, it’s important to take a close look at the types of benefits you offer and understand how they’ll affect your taxes. Talking with a tax professional can help you make the most of these benefits and make sure they fit in with your business goals.

Keeping Up with State and Local Tax Responsibilities

State and local taxes can differ greatly and often have special requirements for businesses. Keeping up with and adhering to these responsibilities is key to avoid fines and ensure seamless operations.

Dealing with Multi-State Tax Concerns

Running a startup in more than one state means you’ll have to deal with multi-state taxation, which can be complicated. Every state has its own tax laws, which include sales tax, income tax, and franchise tax. This means you need to know the specific rules in each state where you do business.

It is crucial to register for a sales tax permit in every state, monitor nexus thresholds, and file the correct tax returns when managing tax obligations in multiple states. Not doing so can lead to penalties and legal problems, so it’s important to keep up with these tasks.

Grasping Local Business Tax Demands

Alongside state taxes, local governments might enforce their own business taxes. These could involve business license fees, property taxes, and local income taxes. Investigating and grasping these demands is key to guarantee compliance.

Keep an eye on local tax laws and stay in touch with a local tax consultant to stay up-to-date on any modifications. Taking this initiative can keep you safe from unexpected tax liabilities and help your startup stay within the law.

Keeping Up with Changes in Tax Law

For startups, it’s crucial to stay updated on tax laws, which are always changing. By adapting to new laws, you can take advantage of opportunities and avoid potential problems. Understanding ERTC tax rebate claims can be particularly beneficial for new businesses navigating these changes.

Why You Should Keep Up with Tax Laws

Keeping up with tax laws means you can use new deductions, credits, and incentives. You also make sure you follow changing rules, which lowers the chance of audits and penalties.

Keep yourself updated by subscribing to tax newsletters, attending industry seminars, and regularly consulting with tax professionals. These resources can offer valuable insights and help you adjust your tax strategies to be in line with current laws.

How New Laws Affect Startups

Startups can be greatly affected by new laws. Any changes to tax rates, deductions, or credits can change how you plan and strategize financially. It’s important to stay up to date on these changes so you can take advantage of new opportunities and stay within the law.

For example, the Tax Cuts and Jobs Act brought about several changes that impacted startups, like the lowering of the corporate tax rate and the creation of the Qualified Business Income Deduction for pass-through entities. Grasping these changes enabled startups to tweak their strategies and potentially decrease their tax liabilities.

Conclusion: Creating a Long-Lasting Tax Strategy

Creating a long-lasting tax strategy is crucial for the long-term success of any startup. By thoughtfully choosing the right business structure, maximizing deductions and credits, and staying up-to-date on tax law changes, you can improve your tax situation and boost your financial health.

Consistently checking and modifying your tax strategy guarantees you stay in compliance and seize new opportunities. This forward-thinking strategy helps protect your business’s financial health and fosters growth and innovation.

Keep in mind, tax planning isn’t a one-time event, but rather a continuous process. As your business grows and changes, so should your tax strategy. Stay educated, seek professional guidance when necessary, and always keep your financial objectives at the forefront.

For instance, a tech startup that was originally set up as a sole proprietorship switched to an LLC to take advantage of pass-through taxation and limited liability protection. This shift lowered their taxes and offered more room for expansion in the future.

Summary of Essential Strategies and Tips

In summary, choosing the best business structure, taking full advantage of deductions and credits, making use of tax-advantaged accounts, and keeping up to date with changes in tax laws are vital strategies for the success of a startup. These measures help to reduce tax liabilities and make the best use of financial resources, laying the groundwork for sustainable growth.

Focus on Planning and Flexibility

Both planning and flexibility are key elements of a good tax strategy. Continually reassess your tax situation, keep up with changes in tax laws, and adjust your strategy as necessary. This forward-thinking approach ensures your startup stays within the law and takes advantage of all available opportunities.

With a focus on planning and adaptability, you can develop a solid tax strategy that not only supports your business objectives, but also propels you towards long-term success.

Commonly Asked Questions

Startups usually have queries about tax strategies and responsibilities. Here are some commonly asked questions to assist you.

The following queries address usual worries and offer knowledge on successful tax strategies for startup businesses.

Which business structure will help me pay the least amount of taxes?

The business structure that will help you pay the least amount of taxes depends on your unique circumstances. Many startups find that LLCs and S-Corps provide tax benefits because of pass-through taxation. However, you should also consider other factors such as liability protection and your plans for future growth when you decide on a structure.

What should startups do to qualify for tax credits?

Startups can qualify for tax credits by engaging in activities that meet specific criteria, such as research and development. It’s important to keep detailed records and documentation of these activities to claim credits. It may also be beneficial to consult with a tax professional to identify eligible credits.

What tax errors do startups often make?

Startups often make tax errors such as not keeping track of expenses, not utilizing all the deductions and credits that are available to them, and not keeping up with changes in tax laws. These mistakes can result in higher tax bills and possible fines.

One common error is selecting an inappropriate business structure, which can lead to undesirable tax consequences. It’s crucial to thoroughly examine your choices and obtain expert guidance if necessary.

What are the tax implications of providing employee benefits?

Providing benefits to your employees can lower your taxable income and offer tax benefits. For instance, the money you contribute to your employees’ retirement plans and health insurance premiums is typically tax-deductible. Plus, these benefits can help you attract and keep skilled employees, which can help your business expand.

What state taxes are there and do they change for startups?

State taxes can include income tax, sales tax, and franchise tax, among others. They change by state, and startups must comply with the specific requirements in each state where they operate. Understanding these obligations is crucial to avoid penalties and ensure compliance.

Make sure to sign up for any required permits and submit the right tax returns in every state. A local tax advisor can help you understand these complexities.

How frequently should a startup seek advice from a tax expert?

Startups should seek advice from a tax expert on a regular basis, particularly during major business shifts or updates to tax laws. A tax expert can offer valuable advice, assist in improving your tax strategy, and ensure that you are following the rules. For more detailed guidance, you might consider reviewing this quarterly tax filing guide.

Do certain industries have specific tax strategies?

Indeed, certain tax strategies are specific to certain industries. For instance, tech startups might be eligible for R&D tax credits, while businesses in real estate can take advantage of depreciation deductions. Being aware of the tax opportunities specific to your industry can aid in optimizing your strategy and minimizing liabilities.

Keeping up with the latest tax trends in your industry and seeking professional advice to make sure you’re making the most of all available opportunities is crucial.

So, if you want your startup to succeed, you need to get serious about tax planning. Use these strategies and stay informed to keep your taxes low, make the most of your money, and set yourself up for long-term growth and stability.