Important Points

- Grasping tax planning is vital for the growth of small businesses and can significantly decrease your tax liabilities.

- Typical tax deductions include office supplies, utilities, and even a portion of your home if you operate from there.

- Tax laws frequently change; staying knowledgeable and compliant is crucial to avoid penalties.

- Seeking advice from a tax professional can offer insights into maximizing savings and selecting the appropriate business structure.

- Consistently updating your financial records and estimating taxes quarterly can keep your business running smoothly all year.

Crucial Tax Strategies for Small Businesses

Let’s be honest, taxes can be a pain. However, with the correct strategies, small business tax planning can become a beneficial tool rather than a daunting chore. The aim is to decrease your tax liabilities while remaining compliant with the law. This involves understanding deductions, credits, and how tax laws affect your business. So, let’s delve into the crucial strategies every small business owner should be aware of.

Why Tax Planning is Crucial for Business Expansion

Tax planning is more than just a way to save money; it’s a strategy for ensuring the success of your business. By managing your taxes effectively, you free up more resources to invest in your business’s growth. This could mean hiring new employees, investing in advertising, or expanding your range of products. The money you save can make a big impact.

Moreover, knowing what you owe in taxes and planning for it can help you avoid unpleasant surprises at the end of the year. Imagine getting a huge tax bill you didn’t expect. That’s not something you want, right? That’s why planning is so important.

“Integrating tax planning into your financial strategy can help you optimize your tax liabilities and maximize deductions and credits.” – Tax Planning Guide

Typical Tax Deductions and Credits

Let’s discuss deductions and credits. These are the keys to reducing your tax bill. Deductions decrease your taxable income, while credits reduce the amount of tax you owe. Understanding the difference is essential.

Here are some usual deductions:

- Office Supplies: This includes everything from pens and paper to that new office chair you’ve been eyeing.

- Utilities: If you have a dedicated office space, you can deduct a portion of your utility bills.

- Home Office: If you work from home, a portion of your rent or mortgage may be deductible.

But the most important thing is to keep records of all these expenses. The more organized you are, the easier it will be to claim these deductions.

How Tax Laws and Compliance Affect You

Tax laws are constantly changing. For business owners, it’s essential to stay on top of these changes. Not only can you benefit from new deductions or credits, but you can also avoid penalties by remaining compliant. To navigate these complexities, consider consulting with trusted tax advisors who can provide expert guidance.

For instance, new modifications may influence how you declare your earnings or what deductions you’re eligible for. As a result, it’s a good idea to frequently consult with a tax expert or stay informed via trustworthy sources.

Paying Taxes on a Quarterly Basis

Small business owners need to remember that taxes aren’t just an annual event. The IRS requires that businesses make estimated tax payments every quarter. This helps to prevent a massive tax bill in April and possible penalties for underpaying. For more detailed guidance, check out this small business tax filing deadline management guide.

Begin your quarterly tax estimation by determining your projected annual income, then subtract any applicable deductions and credits. Divide this total by four to get your quarterly payment. Remember, as your business expands, you may need to adjust these estimates. As such, it’s a good idea to regularly check your financials and update your estimates accordingly.

Using Retirement Plan Contributions as a Tax Strategy

Did you know that if you contribute to a retirement plan it can lower your taxable income? It’s a win-win situation: you’re saving for the future while reducing your tax bill today. Plans like a Simplified Employee Pension (SEP) IRA or a Solo 401(k) are great options for small business owners.

For example, with a SEP IRA, you can put in up to 25% of your net earnings from self-employment, up to a specific limit. These contributions are tax-deductible, so they lower your taxable income for the year. Most importantly, you’re investing in your future financial stability.

Tax-Saving Strategies for the End of the Year

As the year winds down, there are a number of steps you can take to minimize your tax burden. One effective approach is to speed up your expenses. If you have the cash flow, think about buying equipment or stocking up on supplies before the end of the year. This can boost your deductions for the current tax year. For more strategies, consider exploring small business tax planning strategies.

Another strategy is to postpone income. If it’s possible, hold off on receiving payments until the new year. This is especially beneficial if you anticipate being in a lower tax bracket the following year. In addition, review your financials to make sure you’re maximizing all possible deductions and credits. Taking this active approach can result in substantial tax savings.

High-Level Tax Planning Strategies to Explore

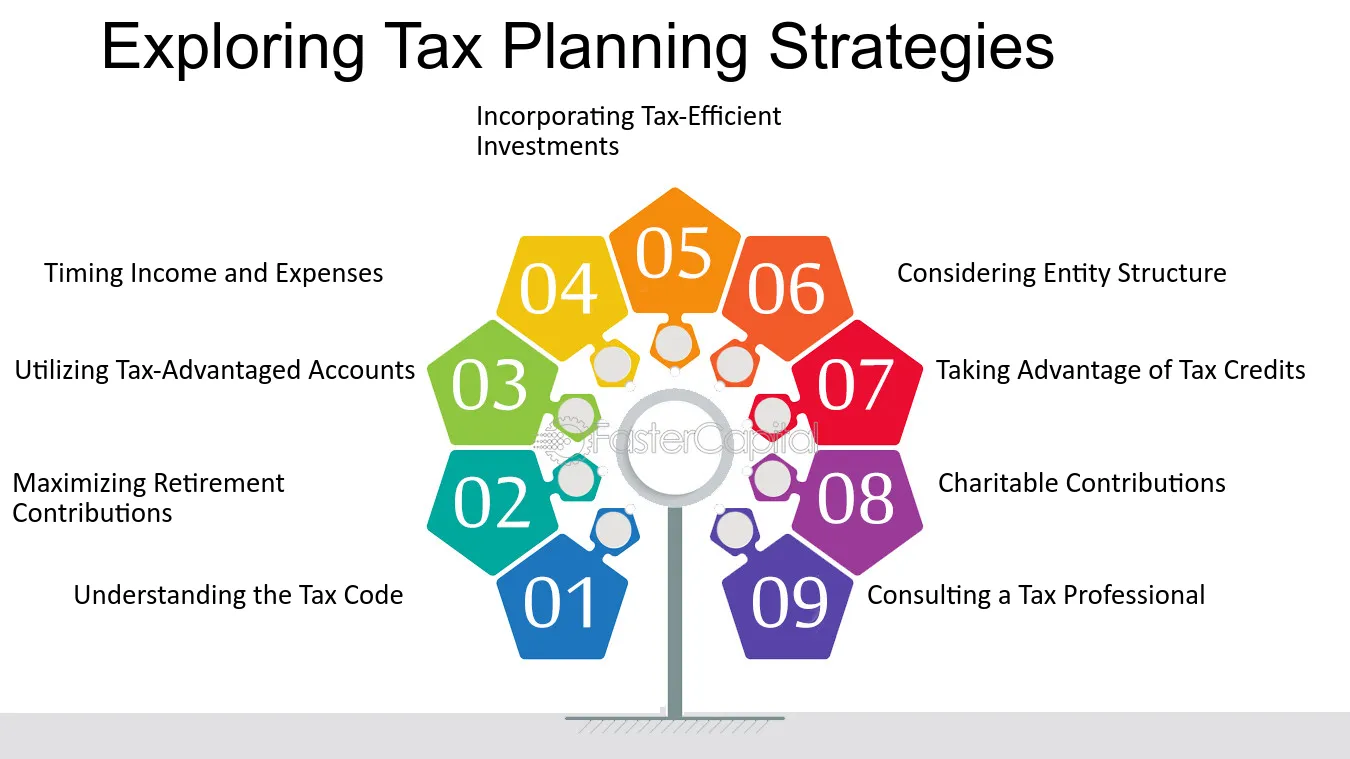

After you’ve mastered the basics, you can start looking into high-level tax planning strategies. These methods can help you decrease your taxes even more and improve your financial performance. But, they usually need a more comprehensive knowledge of tax regulations, so it’s recommended to seek advice from a professional.

These strategies can be a bit complex and involve some heavy number crunching, so let’s simplify a few key strategies you might want to consider.

Understanding Tax Loss Harvesting

When you sell investments at a loss, you can use the loss to offset gains in other parts of your portfolio. This is known as tax loss harvesting. It’s a strategy that can be especially useful if you’ve had a profitable year with some investments and a less profitable year with others.

You can lower your tax bill and keep your investment strategy on track by strategically selling underperforming assets. This allows you to use those losses to offset your taxable gains. However, it’s crucial to adhere to the IRS’s wash sale rule, which prohibits you from purchasing the same or a substantially similar investment within 30 days of the sale.

Taking Advantage of State Pass-Through Entity Perks

Certain states provide perks for pass-through entities such as S-corporations or partnerships. These entities are capable of passing income directly to owners, bypassing corporate tax. However, the details can differ greatly from state to state. For more insights, consider consulting trusted small business tax advisors.

Digging into these perks can result in considerable savings. For instance, some states permit owners to pay state taxes at the entity level, which could offer a federal deduction for those taxes. This is a complex area, but the potential for substantial tax cuts makes it worth looking into.

Using Depreciation to Reduce Taxes

Depreciation enables you to distribute the expense of a business asset over its lifespan. This can lower your taxable income each year you declare it. The IRS offers rules on the duration different kinds of property can be depreciated.

For example, if you purchase a new piece of equipment for your business, you can spread the cost over several years. There are different depreciation methods, such as straight-line or accelerated, each offering its own benefits. Selecting the right method can maximize your tax savings while meeting your business needs. For more detailed guidance, you can explore new business tax considerations that might affect your decision.

Wrapping Up: The Importance of Tax Planning for Business Success

Good tax planning is fundamental to the success of your business. It ensures you’re not paying more taxes than necessary, freeing up those savings for reinvestment in your business. From simple deductions to complex strategies, there are many ways to minimize your tax liabilities.

Recap of Important Tactics and Suggestions

We’ve gone through a lot, from grasping the significance of tax planning to delving into sophisticated methods. Important tactics include paying quarterly, taking advantage of retirement contributions, and making use of depreciation.

If you want to make the most of your tax efficiency, think about hiring a tax professional who can develop strategies based on your unique business requirements. It’s important to keep in mind that staying knowledgeable and proactive is key when it comes to dealing with the constantly evolving world of tax laws.

Long-Term Tax Planning Steps

As a small business owner, it is crucial for you to take steps towards long-term tax planning. Start by evaluating your current financial situation and identifying areas where you can improve. Are you fully utilizing the deductions and credits available to you? If not, make it a priority to learn about them and apply them to your business.

Then, you need to establish a method for monitoring your earnings and outgoings all year round. This could be as straightforward as utilizing accounting software or employing a bookkeeper. Keeping records consistently will make tax season less taxing and guarantee you don’t overlook any valuable deductions. Plus, you should frequently reassess your business structure to see if it’s still the most suitable for your requirements.

Common Questions

Tax planning might feel like a lot to take in, but understanding the answers to common questions can make it feel less daunting. Here are some of the most common questions about small business tax planning.

How can I effectively calculate my quarterly taxes?

Begin your quarterly tax calculation by determining your projected annual income. After you have that figure, subtract any deductions and credits you anticipate. Then, divide the remaining amount by four to find your quarterly payments. To prevent penalties for underpayment, regularly review your finances and adjust your estimates as necessary. For additional guidance, consider consulting trusted tax advisors who can help optimize your tax strategy.

What can I do to increase my tax deductions each year?

If you want to increase your tax deductions, it’s important to keep a detailed record of all your business expenses. This can include anything from office supplies and travel costs to equipment purchases. It can also be beneficial to work with a tax professional who can help you find deductions that you might not have known about. Keeping up to date with changes in tax law can also help you take advantage of new savings opportunities.

Also, you might want to think about when you make your purchases. If you’re thinking about making a big purchase, buying it before the year ends could increase your deductions for that tax year. For more information, consider exploring small business tax filing deadline management best practices.

Why should you seek advice from a tax professional?

It’s important to seek advice from a tax professional because tax laws are complicated and constantly changing. A professional can provide advice that’s specific to your business’s unique situation. They can help you find deductions you might have missed and make sure you’re following all tax rules. Most importantly, they can save you time and potentially lower your tax bill.

In addition to that, having a tax professional on your team can provide you with peace of mind, knowing that your tax affairs are being handled accurately and efficiently.

What paperwork do I need to keep for tax reasons?

It’s important to keep your records neat and accurate for tax reasons. Keep track of all your income and expenses, including receipts, invoices, and bank statements. Also, keep records of any deductions or credits you’re claiming, such as home office expenses or charitable donations.

Keeping track of any large purchases or sales of business assets is crucial as these can have a big effect on your taxes. For a comprehensive understanding of how to manage these transactions, consider referring to this small business tax guide. Keep these records safe and make sure they’re easy to get to when you need them.

What effect can altering my business structure have on my taxes?

Altering the structure of your business can greatly affect your taxes. For instance, if you change from being a sole proprietor to an LLC or S-corporation, the way your income is taxed can change. Each structure has different tax consequences, so it’s crucial to know these before you make a change.

Speaking with a tax expert can assist you in determining if a structural change could be financially beneficial for your business. They can walk you through the process and make sure you follow all the required rules.

How do retirement contributions help with taxes?

By making contributions to a retirement plan, you can take advantage of some substantial tax benefits. If you contribute to a SEP IRA or Solo 401(k), those contributions are tax-deductible. This reduces your taxable income for the year, allowing you to pay less in taxes while also saving for your retirement.

Not only do retirement contributions help you build a nest egg for the future, but they also provide immediate and long-term benefits. It’s important to understand the specific contribution limits and rules for the plan you’ve chosen in order to get the most out of these benefits.

What is the relationship between state and federal taxes for businesses?

State and federal taxes can often have a complicated relationship. Federal taxes are a given for every business, but state taxes can vary based on location and can include income, sales, and employment taxes. It’s crucial to understand your state’s specific tax obligations and how they impact your federal tax return.

In some states, businesses can benefit from pass-through entity perks, which permit them to pay state taxes at the entity level and potentially claim a federal deduction for those taxes. However, understanding these interactions can be difficult, so it’s recommended to seek advice from a tax professional who is knowledgeable in both federal and state tax laws.

By grasping these facets of tax planning and remaining proactive, you can fine-tune your tax approach and bolster the growth and success of your small business.