Summary of the Article

- Get to know what small business tax credits are and how they can be advantageous to your business.

- Get informed about the eligibility requirements for different tax credits.

- Discover effective strategies to lower your tax bill and increase savings.

- Learn about the Work Opportunity Tax Credit and how to make the most of its benefits.

- Learn about tools and expert advice that can help manage tax credits efficiently.

Maximize the Full Potential of Small Business Tax Credits

Let’s discuss one of the most exciting parts of managing your business – tax credits. Wait, don’t roll your eyes! You may think of tax as a boring, headache-inducing subject, but hear me out: small business tax credits are like discovering buried gold in your financial reports. They can significantly reduce your tax bill and put money back into your pocket – money you can invest to expand your business.

What Exactly Are Small Business Tax Credits?

Understanding small business tax credits is crucial for any entrepreneur looking to maximize their savings and benefits come tax season.

First and foremost, it’s crucial to understand the definition of a small business tax credit. In layman’s terms, it’s a one-to-one decrease in your tax liability. Picture it as a discount; if your tax bill is $1,000 and you have a $300 tax credit, your new tax bill is $700. There are numerous tax credits available that are intended to promote specific business actions such as hiring new employees, research and development, or improving the accessibility of your business.

Qualifications for Tax Breaks

Understanding the qualifications for small business tax credits is crucial for any entrepreneur looking to maximize their savings and benefits during tax season.

However, since every business is unique, each tax credit comes with its own set of regulations. In general, to qualify, you must satisfy certain requirements related to your business’s size, your industry, or the type of expense for which you are seeking a credit. Some credits are also targeted at startups, while others are intended for established firms. And keep in mind, the government is eager to incentivize you to contribute to the economy in particular ways, and these credits are designed to assist you in doing so.

Ways to Lower Your Tax Payment

Let’s now explore some tactics that can assist you in retaining more of your well-deserved money.

Home Office Deductions: Stake Your Claim

Operating a business from home may qualify you for the home office deduction. This deduction can significantly lower your tax bill by allowing you to deduct a percentage of your home expenses – such as rent, utilities, and repairs – in proportion to the size of your home office. However, to qualify for this deduction, the space must be used solely for business purposes and must be your primary place of business.

For instance, Sarah operates a graphic design firm out of her home office, which occupies 10% of her apartment. As a result, she is able to deduct 10% of her rent, utilities, and home insurance as a home office expense.

Let’s break down the numbers. If Sarah’s monthly rent is $1,500 and her utilities and home insurance add up to $300, her total monthly home expenses come to $1,800. Ten percent of that is $180, so she could save $2,160 over the course of a year just on her home office space!

Equipment and Supplies: Spend Wisely to Save Money

Moreover, investing in supplies and equipment for your business can also result in tax savings. The IRS permits you to write off the cost of certain purchases such as computers, software, and office furniture. This is accomplished through depreciation or Section 179 expensing – which allows you to take the entire purchase price as a deduction in the year you purchase it.

For instance, let’s say Mark’s landscaping company purchased a new commercial lawn mower for $5,000. He can deduct the full cost of the mower in the year of purchase, which reduces his taxable income by $5,000.

As a result, if Mark’s in the 25% tax bracket, that $5,000 deduction saves him $1,250 in taxes. Now that’s what I call a wise investment!

Health Insurance Deductions: Ensuring Your Team’s Well-being

Providing health insurance to your employees isn’t just a kind gesture; it’s also a smart financial decision. You can generally deduct 100% of the premiums you pay on qualifying group health plans. This not only aids in attracting and keeping employees, but it also reduces your taxable income.

Remember, the lower your taxable income, the less you’ll owe in taxes. It’s a win for you and your employees!

Putting Money into Retirement Plans: Building a Secure Future

By making contributions to your own and your employees’ retirement plans, you can usually deduct those contributions from your taxes. Additionally, providing retirement benefits can make your business a more appealing place to work.

I understand that this is a lot to digest, but bear with me. There’s more positive news to come as we discuss particular tax credits that can have a substantial impact on your financial situation.

How to Get the Most Out of Work Opportunity Tax Credits (WOTC)

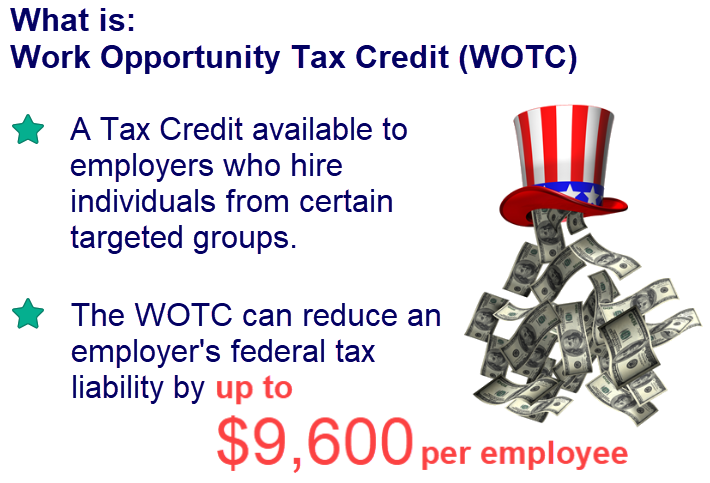

The Work Opportunity Tax Credit is the government’s way of saying thank you to businesses that employ individuals from certain groups that have traditionally struggled to find work. And we’re not talking about small change here – it can be up to $9,600 per employee!

Getting to Know WOTC Qualifications

So, who’s eligible? Veterans, ex-felons, recipients of certain public assistance programs, among others. However, you need to ensure that the paperwork is correct, and there are deadlines to meet. But don’t fret, I’m here to help you navigate through it.

Assessing the Effect on Your Company’s Net Income

Suppose you employ a veteran who meets the qualifications, and you compensate them $15,000 in their initial year. If they work a minimum of 400 hours, you might be entitled to a tax credit worth 40% of their initial $6,000 in earnings. That equates to a $2,400 credit – solely for employing someone who is deserving of a fantastic job opportunity.

And that’s just the tip of the iceberg. There are other credits available, such as the R&D credit for businesses that are developing new products or processes. The trick is to know what’s out there for you and how to go about claiming it.

However, it’s not enough to just be aware of these credits. You need to actively pursue them. This is where it can get a little complicated. You need to have the appropriate paperwork, fill out the right forms, and meet all the necessary deadlines.

Don’t worry if you’re feeling a bit lost right now. There are resources and professionals available who can guide you through this process. All you have to do is ask for help. Believe me, the potential savings make it all worthwhile.

Are you prepared to start saving? Continue reading to learn more about additional tax credits, how to avoid common mistakes, and how to use these credits to achieve real growth for your company.

Small Business Tax Credit Expertise: Maximize Savings & Benefits by exploring small business tax deductions for financial growth.

Understanding Eligible Research Activities

The Research and Development (R&D) Tax Credit is one of the most profitable credits available to small businesses. This credit is for the innovators and dreamers who are always asking, “What if?” If your business is developing new products, improving existing ones, or creating new processes or software, you could be eligible for significant tax savings. The R&D credit can cover a portion of your expenses related to wages, supplies, and even some third-party contractor costs.

Keeping Track of R&D Costs for Credit Applications

Here’s the thing: you need to support your case. This entails maintaining comprehensive records of all your R&D activities. Document everything, from the brainstorming meetings to the unsuccessful tests. The IRS wants to see that you’ve put in the effort and that your work is based on science or technology. They’re not interested in a wild goose chase; they want to see a genuine effort to resolve a technical uncertainty.

Efficient Tools and Resources for Managing Tax Credits

You don’t have to tackle your tax credits alone. There are a variety of tools and resources available to help you understand your tax situation and get the most savings possible. Whether you use a software program or hire a tax advisor, you can claim the credits you’re eligible for without the usual tax season stress and confusion.

Software Solutions for Easier Tax Preparation

For small business owners, tax season can be a complex and stressful time. That’s why it’s crucial to have the right software solutions to streamline the tax preparation process, ensuring accuracy and maximizing potential refunds or credits.

There are numerous software options available that aim to simplify tax preparation for small businesses. These applications can assist you in tracking costs, keeping records organized, and even guiding you through the process of applying for tax credits. Some of them are even available at no cost, although the more comprehensive options may require a small investment. But, think of purchasing a good tax software as hiring a round-the-clock tax aide who doesn’t need to take breaks for coffee.

Professional Consultants: When You Should Bring in a Specialist

However, there are times when software alone can’t handle the job. This is especially true when dealing with complicated tax situations. If you’re not comfortable handling these issues on your own, it’s time to hire a professional. Hiring a CPA or tax advisor who specializes in small business taxes can be invaluable. They’ll understand the complexities of tax credits and will ensure you claim every dollar you’re owed.

Typical Mistakes and How to Prevent Them

Even with the best intentions, it’s easy to stumble when it comes to taxes. But with a bit of knowledge and planning, you can sidestep common pitfalls that might otherwise trip up your business.

Confusing Employees with Independent Contractors

One common issue that small businesses face is the confusion between classifying workers as employees or independent contractors. This distinction is crucial for tax reporting and compliance. To better understand the implications and tax benefits of proper worker classification, businesses can refer to small business tax deductions that may apply.

Many businesses fall into the trap of misclassifying their workers. It’s important to know the difference between an employee and an independent contractor as it impacts the way you withhold taxes and the tax credits you are eligible for.

Imagine you bring a web developer on board for a project. If you are the one telling them when and how to work, they are probably an employee. However, if they are choosing their own hours and using their own tools, they could be an independent contractor.

Incorrectly identifying this can result in expensive fines and lost tax credit chances. So make sure you take the time to correctly identify this.

Understanding the Shifts in Tax Regulations

Tax laws are always evolving, and it’s your responsibility to stay informed. A shift in the law might open up new avenues for credits or necessitate a change in your business operations to stay within the law. It’s crucial to stay informed. You don’t need to be a tax expert, but you should at least be aware of the changes that impact your business.

Converting Tax Credits into Real Growth

For small businesses, understanding and utilizing tax credits can be a game-changer for growth and sustainability. By effectively maximizing tax credits, companies can reinvest in their operations, fostering development and expansion.

Let’s get to the exciting bit – leveraging those tax credits to propel your business forward. It’s not just about cutting costs; it’s about smartly putting those savings back into your enterprise. Whether it’s bringing on more staff, stepping up your marketing game, or creating new offerings, tax credits can provide the financial shot in the arm you need to get to the next stage.

Creative Ways to Reinvest Your Tax Savings

Consider tax credits as a down payment on your business’s success. When you lower your tax bill, you release funds that can be invested in your business to help it grow and succeed. This could involve improving your machinery, educating your employees, or even entering new markets.

Case Studies: Successful Use of Tax Credits

Many small businesses are unaware of the significant savings that can be achieved through tax credits. By examining case studies of those who have successfully utilized these credits, it’s possible to uncover strategies that could be beneficial for your business.

Imagine a neighborhood bakery that hired a veteran through the Work Opportunity Tax Credit. This not only resulted in them getting a loyal worker, but they also got a tax credit that allowed them to launch a new gluten-free product line that was a big success with their customers.

What To Do Next: Get Your Credits Now

What’s holding you back from claiming your tax credits? If you’re unsure about where to begin, the initial step is to educate yourself about what credits are available for you. Next, get your documents in order and consider getting professional help if necessary. The savings are there for you – all you have to do is reach out and take them.

Don’t forget, if you’re interested in finding out more about how to get the most out of your refundable Employee Retention Tax Credits with minimal time and effort, Click Here to explore your options. It’s a straightforward process that could result in substantial savings for your company.

Discover More About Your Tax Credit Choices

By keeping precise records, you’re essentially fortifying your claim and protecting your tax savings. This means that if the IRS ever comes calling, you’ll be prepared with a solid defense. Keep track of all qualifying expenses, employee data for credits such as WOTC, and any other relevant information that backs up your claim. The idea is to make your tax credit claim as ironclad as possible, eliminating any room for doubt or mistakes.

Here’s what you need to do:

- Save all receipts and invoices related to eligible expenses.

- Keep detailed employment records, including job descriptions and hours worked.

- Record all research and development activities, noting the objectives, experiments, and results.

- Record any changes in business activities that may affect your eligibility for credits.

- Speak with a tax professional to ensure that you’re capturing all available credits.

Tax credits are not just about immediate benefits; they’re an investment in the future of your business. By using these incentives, you can channel more resources into growth and development, positioning your company for long-term success. And that’s something worth exploring further.

Commonly Asked Questions

For more insights on how to maximize your small business savings and understand essential tax credits, explore our expert guide on small business tax strategies.

What is a small business tax credit, and why is it important?

Small business tax credits are set amounts that you can deduct from the taxes you owe to the government. Unlike deductions, which decrease the amount of taxable income, tax credits decrease your tax bill on a dollar-for-dollar basis. They are important because they can significantly decrease the taxes you pay, which frees up money for reinvestment in your business.

- They promote business investments and activities that are beneficial to the economy.

- They can offer significant savings, making them more beneficial than deductions.

- They can be aimed at specific business objectives, such as hiring or innovation.

Are tax credits the same as tax deductions?

No, tax credits and tax deductions are not the same. Tax deductions decrease your taxable income, while tax credits reduce the amount of tax you owe on a dollar-for-dollar basis. For instance, a $1,000 tax credit will decrease your tax bill by $1,000, whereas a $1,000 deduction will only decrease your tax bill by the amount of your marginal tax rate.

How can I find out if my business is eligible for specific tax credits?

To find out if your business is eligible for specific tax credits, you need to look at the criteria for each credit. You can find this information on the IRS website or by talking to a tax professional. Eligibility can depend on things like what industry you’re in, how big your business is, and what activities you’re doing.

What kind of documentation do I need to back up my tax credit claims?

In order to back up your tax credit claims, you should have:

- Employee-related credit payroll records.

- Eligible credit expense receipts and invoices.

- Research and development activity documentation.

- Business change records that could affect credit eligibility.

Am I able to claim tax credits as a sole proprietor with no employees?

Yes, you may still qualify for certain tax credits as a sole proprietor, even without employees. Credits such as the home office deduction and the health insurance premium deduction can benefit sole proprietors. However, credits like the WOTC, which are employee-hiring related, would not be applicable.

How can my business benefit from the Work Opportunity Tax Credit?

The Work Opportunity Tax Credit can be beneficial for your business as it provides a tax credit when you hire individuals from certain target groups who have faced significant barriers to employment. This credit can reduce your tax liability and support social initiatives, making it a win-win for your business and the community.

Can I still claim a tax credit that I missed in previous years?

Yes, in most cases, you can claim certain tax credits retroactively by filing an amended tax return. The specific time frame for amending a return varies, so it’s important to act quickly if you discover a missed credit. Consulting with a tax professional can help you navigate this process.

Keep in mind that small business tax credits are available for you to use, but you have to be the one to claim them. With the right knowledge and plan, you can get the most out of your savings and make tax season a time of opportunity for your business. So go ahead, get into the details, and start saving money today!