Key Takeaways

- Resilience is vital for small business success, aiding owners in overcoming obstacles and setbacks.

- Being adaptable and flexible can turn adversity into opportunity.

- Strong community ties offer support and resources for small businesses during difficult times.

- Learning from past mistakes can lead to innovation and growth.

- Taking full advantage of Employee Retention Tax Credits (ERTC) can provide significant financial relief.

The Importance of Resilience in Small Business Success

Small businesses encounter many challenges, from economic slumps to unforeseen crises. Resilience, the capacity to bounce back from setbacks and keep pushing forward, is crucial for overcoming these hurdles. In this article, I’ll share motivational stories of small business resilience and offer practical advice to help you build a resilient business.

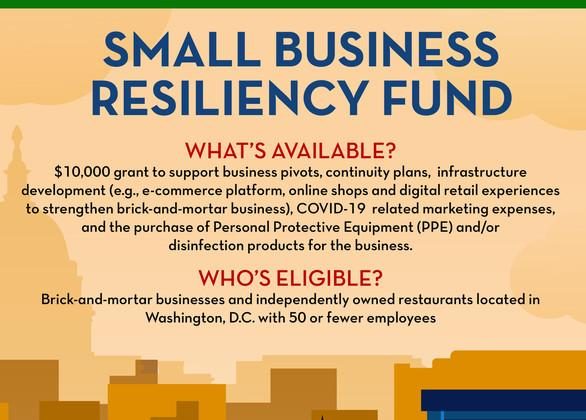

“Small Business Resiliency Fund …” from coronavirus.dc.gov and used with no modifications.

Grasping the Concept of Resilience

Resilience is not just about recovery; it’s about becoming stronger in the face of adversity. When a business hits a bump in the road, resilience allows it to adjust, learn, and prosper. This trait is crucial for small business owners who often deal with scarce resources and fierce competition.

Why is Resilience Important for Small Business Owners?

For small business owners, being resilient can mean the difference between shutting down and finding new paths to success. It’s about having the grit to keep going, even when things are hard. Businesses that are resilient are better prepared to deal with disruptions, whether they come from changes in the economy, natural disasters, or other unforeseen circumstances.

Real-Life Examples of Resilient Small Businesses

Here are some real-world examples of small businesses that have shown amazing resilience. These stories emphasize how grit, creativity, and community backing can help businesses conquer adversity and come out on top. For instance, understanding cash flow strategies is crucial for maintaining stability during tough times.

“A small Houston, Texas restaurant was hit hard by the pandemic. Indoor dining was not an option, so they quickly switched gears to provide takeout and delivery services. They used digital marketing and teamed up with delivery platforms to not just stay afloat, but increase their sales by 20%.”

A Montessori school in Addison, Illinois, also demonstrated resilience in the face of adversity. When the pandemic forced the closure of physical classrooms, the school quickly pivoted to virtual learning. They invested in the necessary technology and trained their teachers to deliver engaging lessons online. This allowed them to not only retain their current students but also attract new ones from families looking for quality education during the lockdown.

Adjusting to New Circumstances in the Face of Challenges

Change is the only constant, but your reaction to it can be the deciding factor. Small businesses that are able to adjust to new circumstances are more likely to thrive in the long term. Here are some tactics to help you handle change effectively.

The Strength of Adaptability

Adaptability is a crucial element of resilience. Embracing fresh concepts and having the courage to modify your business model can aid in keeping your business current and competitive. As an example, numerous businesses that transitioned to e-commerce during the pandemic managed to connect with new customers and preserve their revenue streams.

Creative Solutions to Challenges

Another essential facet of resilience is innovation. When confronted with an obstacle, brainstorm unique solutions. This could mean creating new products or services, investigating alternative marketing avenues, or discovering more efficient operational methods.

Let’s take a look at the journey of John Davis, a proprietor of a thriving travel agency. The travel sector was severely impacted by the pandemic, prompting John to rethink his business strategy. He used his knowledge of travel planning to provide virtual travel experiences and bespoke travel consulting. This creative solution not only saved his business from going under but also introduced new income sources.

Take for instance the case of John Davis, a man who owned a small business in the form of a prosperous travel agency. The travel sector was hit hard by the pandemic, and John knew he had to make a change. He used his travel planning skills to provide virtual travel experiences and personalized travel consulting. This creative solution not only kept his business going but also created new sources of income. Read more about other resilient entrepreneurs.

Building Solid Community Connections

A strong bond with the local community is one of the most valuable tools a small business can possess. The support of the community can offer resources, motivation, and a faithful clientele that can help businesses withstand challenging periods. For more insights, check out these small business leadership skills.

Why Community Support Matters

Community support can be a lifeline, particularly during tough times. When businesses make an effort to connect with their local communities, they create relationships that can result in reciprocal support. This could mean local customers opting to shop at your store, community members promoting your business, or even local organizations providing help.

Connecting with Local Communities

Building a strong community connection requires active engagement with local networks. Get involved in community events, partner with other local businesses, and become a member of local business associations. These activities not only raise your profile but also show your dedication to the community.

Case Study: Business Bouncing Back with Community Help

Let’s look at a real example. A bakery in Nashville, Tennessee, faced closure due to the pandemic. The owner, Maria, decided to reach out to her local community for support. She started a crowdfunding campaign and organized virtual baking classes. The community rallied behind her, and the bakery received enough funds to stay open. Additionally, the virtual classes became a new revenue stream, attracting customers from outside the local area.

Lessons from Previous Mistakes

Mistakes are a natural part of the journey of entrepreneurship. The important thing is to learn from these experiences and use them as stepping stones to success. Embracing failures can lead to innovation and growth, turning problems into possibilities.

Learning From Your Mistakes

Each mistake is a chance to learn. Don’t see failure as a stopping point, but rather as a chance to learn. Look at what didn’t work, figure out why it didn’t, and use that information to improve your business plans. This change in perspective can turn what might have been failures into valuable learning experiences.

Turning Points That Lead to Expansion

Many prosperous companies have turning points where they encountered failure but came out more robust. These moments frequently result in considerable expansion and innovation. For instance, a tech startup might fail to launch a product successfully, but the lessons learned during that process could lead to the creation of a revolutionary new technology.

Case Study: Turning Defeat into Victory

Take the example of a small manufacturing business in California. They initially faced challenges with quality control that resulted in product recalls and financial setbacks. Rather than throwing in the towel, the proprietor invested in enhanced employee training and updated their machinery. These modifications boosted the quality of their goods and reestablished consumer confidence, which led to higher sales and a more robust market presence.

Examining the ERTC and Its Impact on Your Small Business

The Employee Retention Tax Credit (ERTC) is a beneficial tool for small businesses seeking to optimize their financial aid. Knowing how to utilize this credit can yield substantial advantages for your business.

How to Make the Most of Employee Retention Tax Credits

The ERTC is a refundable tax credit for businesses that retained their employees during the pandemic. To get the most out of these credits, it’s important to meet the eligibility requirements and accurately calculate the wages paid to eligible employees. This can result in significant refunds that help keep your business financially stable. Learn more about maximizing business credit tax credits for small business growth and success.

Why ERTC Experts are the Best Choice

ERTC Experts have a focus on helping small business owners get the most out of their Employee Retention Tax Credits. They offer a straightforward process that requires less than a quarter of an hour from you, and they don’t charge any fees upfront. Their knowledge and experience guarantee that you’ll get the highest refundable credits possible, and they’ll provide you with documentation that’s solid enough to stand up to an IRS audit.

How to Start Your Claim

- Go to the ERTC Experts website.

- Complete the initial claim form.

- Give the necessary payroll and financial details.

- Get your estimated refundable credits.

- Send in your claim and get your refund.

For more information on how ERTC Experts can assist your business, click here.

Wrapping Up: Lessons Learned and Motivations

Resilience is the bedrock of triumph in small business. By being flexible to change, fostering robust community relationships, and learning from previous mistakes, you can tackle obstacles and come out stronger. The stories featured in this article highlight the importance of resilience and provide useful tips for creating a resilient business.

Recap of Resilience Strategies

To recap, here are some essential strategies for developing resilience in your small business:

- Be flexible and open to change.

- Be innovative and find creative solutions to problems.

- Engage with your local community and build strong relationships.

- Learn from past failures and use them as opportunities for growth.

- Maximize financial relief options like the Employee Retention Tax Credit.

Remember, resilience is not just about surviving; it’s about thriving in the face of adversity. By implementing these practices, you can create a strong foundation for long-term success. For instance, consider maximizing business credit to support your growth initiatives.

Small businesses thrive on resilience. By embracing change, fostering community relationships, and learning from past mistakes, you can overcome obstacles and come out on top. The stories in this article highlight the strength of resilience and provide practical tips to help you create a resilient business.

Overview of Resilient Practices

In conclusion, here are some important practices to build resilience in your small business:

- Stay flexible and welcome change.

- Be innovative and come up with creative solutions to problems.

- Engage with your local community and establish strong relationships.

- Learn from past failures and use them as opportunities for growth.

- Take advantage of financial relief options like the Employee Retention Tax Credit.

Remember, resilience is not just about surviving; it’s about thriving despite adversity. By implementing these practices, you can create a strong foundation for long-term success.

Inspiration for Entrepreneurs

If you’re an entrepreneur, you have the ability to determine your own future. See the obstacles you face as chances to evolve and get better. Your ability to bounce back will motivate others and add to your community’s overall prosperity. Keep going, and remember that every failure is an opportunity to learn and grow stronger.

What to do next to build resilience

Now that you have a better understanding of what resilience is and how it can help your business, it’s time to put it into practice. Start by implementing the suggestions in this article and look for other resources to help you along the way. Surround yourself with a strong network of support, and don’t hesitate to ask for help when you need it. With determination and persistence, you can build a business that is resilient and can thrive in any situation.

Common Questions

What does Small Business Resilience mean?

Small business resilience is the capacity of a company to bounce back and recover from difficulties, obstacles, and unforeseen circumstances. It includes adjusting to changes, learning from mistakes, and discovering creative ways to solve problems.

Why is Adaptability Important for My Business?

Being adaptable gives your business the ability to react to changing situations in a positive way. It allows you to be flexible and open-minded to new concepts, enabling you to shift your business model, investigate new prospects, and remain a strong competitor in your industry. This can result in higher profits and prolonged prosperity. For more insights, check out these small business leadership skills.

Why is Community Important for Business Success?

Having the backing of your community is vital for small businesses. Building a relationship with your local community not only provides you with a strong support network and access to valuable resources, but it also gives you a loyal customer base. In times of adversity, the support of your community can provide the encouragement and help you need to keep your business running and prosperous.

How Can I Benefit from Past Mistakes?

Benefiting from past mistakes means looking at what didn’t work, figuring out why it didn’t, and applying that information to enhance your business plans. View obstacles as chances to learn and use them to innovate and expand. Changing your perspective in this way can turn possible mistakes into beneficial experiences that lead to achievement.

Understanding the Employee Retention Tax Credit (ERTC)

The Employee Retention Tax Credit (ERTC) is a tax credit that is refundable and was created to assist businesses that continued to pay their employees throughout the pandemic. It offers financial relief by providing credits against the wages paid to employees who qualify. This can result in significant refunds that can help maintain the financial stability of your business. For more insights on maintaining financial health, check out these cash flow strategies for small businesses.

Am I Eligible for ERTC if I’ve Already Received PPP Funds?

Absolutely, you’re still eligible for ERTC even if you’ve already received PPP funds. In the beginning, businesses had to pick between the PPP and ERTC, but recent updates have made it possible for businesses to claim both. This allows you to get the most out of your financial relief by utilizing both programs.

What Are the Steps to Start My ERTC Claim Process?

Here are the steps to start your ERTC claim process:

- Go to the ERTC Experts website.

- Complete the initial claim form.

- Submit the required payroll and financial information.

- Get your estimated refundable credits.

- File your claim and get your refund.

For more information on how ERTC Experts can assist your business, click here. Additionally, you can read inspiring stories of resilience to motivate your journey.

Creating a resilient small business is a journey that requires commitment, adaptability, and a readiness to learn from obstacles. By adopting these values and utilizing resources such as the Employee Retention Tax Credit, you can build a robust base for lasting success. Remember, each setback is a chance to develop and enhance. Keep moving ahead, and your resilience will result in a flourishing, successful business.