Small business owners! I understand that you have a lot to deal with, but let’s discuss how to ensure your business is legally compliant when it comes to hiring and managing your staff. Don’t worry, I’ll break it down for you, and you’ll leave with the essential knowledge to keep your business operating efficiently.

Main Points

- Understanding the employment laws that impact your business is not only smart, it’s necessary.

- Know the difference between employees and independent contractors to avoid legal issues.

- Ensure your hiring process is equitable and legal, beginning with job descriptions and interviews.

- Understand wage laws, including minimum wage and overtime, to compensate your team accurately.

- Keep up with record-keeping to protect your business and comply with the Fair Labor Standards Act (FLSA).

Demystifying Employment Law For Small Business

Launching a business is exhilarating, but it also comes with significant responsibility, especially when you begin to hire employees. The first thing you need to do is familiarize yourself with employment laws. These laws exist to ensure workers are treated justly and to regulate businesses like yours. Think of them as the rules of the road for hiring and managing employees.

Legal Basics: Where to Begin

Before you even consider posting a job opening, let’s review the basics. Employment laws may seem complex, but they’re really about treating employees fairly and compensating them properly. Keep in mind that these laws can differ depending on location, so you’ll need to research the specific laws in your state or city.

First and foremost, here’s a quick summary of what you should be aware of:

Option A.

What distinguishes an employee from an independent contractor?

It’s crucial to understand the distinction between an employee and an independent contractor. If you don’t, you could find yourself in a tricky situation. Here’s the lowdown:

- Employees are an integral part of your business operation. You dictate their working hours and location, and you provide the necessary tools for them to perform their duties.

- Independent contractors operate as their own entity. They determine the best approach to complete the task at hand and typically have their own equipment.

The IRS has established clear guidelines on this matter, and failure to comply could result in substantial penalties. Therefore, it’s crucial to ensure you understand and adhere to these rules.

Imagine this: You contract a graphic designer to create a logo for your coffee shop. They use their own tools, set their own hours, and work for other clients. This person is likely an independent contractor. However, if you hire someone to work the register from 9 to 5 every day using your equipment, this person is an employee. For more information, check out these small business hiring strategies to better understand the distinction and responsibilities.

In summary: If you dictate the what, when, and how of someone’s work, they’re probably an employee. If they’re in charge of their own work, they’re probably an independent contractor.

You now have a basic understanding. It’s time to dig in and get to the heart of the hiring process. Hiring the right people is more than just finding individuals with the right skills. It’s about doing it in a way that is both fair and legal.

Adding to Your Team? Know Your Legal Responsibilities

Expanding your small business team is an exciting step. But it’s also one that comes with a lot of legal responsibilities. If you don’t handle the hiring process correctly, you could expose your business to legal problems. So, let’s make sure you’re starting off on the right foot.

How to Keep Job Descriptions and Interviews Legal

Job descriptions are the first step in hiring. They need to be clear and precise. They should describe what the job entails and what skills are required. But be careful – this isn’t the place for any kind of discrimination. Stick to the essentials for the job and don’t include anything that could be interpreted as excluding certain groups.

During interviews, it’s crucial to concentrate on questions related to the job. It’s easy to drift into informal chatter, but inquiring about someone’s personal life, such as their marital status or if they intend to start a family, is off-limits. Maintain a professional demeanor and focus on the job.

Understanding Background Checks and Employment Eligibility

Background checks can be a useful resource to ensure you’re employing reliable individuals, but there are guidelines. You must first obtain written consent, and if you choose not to employ someone based on the results, you must inform them of the reason and allow them an opportunity to respond. For more detailed guidance on this process, consider reviewing HR compliance tips that can help you navigate these situations.

Also, remember to verify your employees’ eligibility to work. In the U.S., you need to ensure that your employees are legally permitted to work. This involves completing an I-9 form for each employee and keeping it in your records. There’s no way around this – it’s a legal requirement.

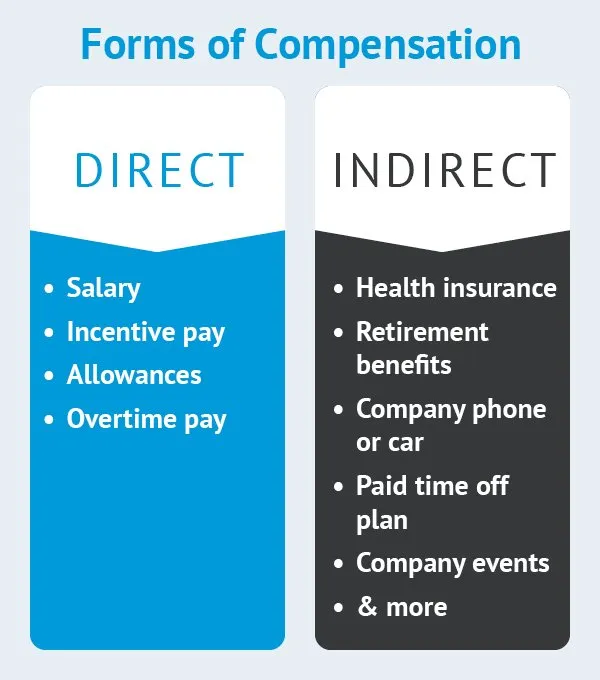

Compensation and Time: Correctly Remunerating Your Workers

Compensating your workers is more than just writing checks. You need to do it in a manner that adheres to the law. This entails comprehending the Fair Labor Standards Act (FLSA) and any state legislation regarding minimum wage and overtime.

Keeping accurate records of hours worked is crucial. This ensures that you are paying your employees their due wages and protects you in case any pay disputes arise.

So, don’t forget, always pay your employees at least the minimum wage, monitor overtime, and maintain accurate records. It’s beneficial for your team and your business.

Getting to Know the Fair Labor Standards Act (FLSA)

Good job on paying your employees at least the minimum wage and keeping track of their hours for overtime! But let’s get to know the Fair Labor Standards Act (FLSA) a little better. This law is the foundation of wage and hour regulations. Its main goal is to ensure that employees are paid fairly for their hard work.

The FLSA is the foundation for minimum wage, overtime pay, recordkeeping, and youth employment standards that apply to employees in the private sector and in federal, state, and local governments. Here’s what you need to know:

- Minimum Wage: The national minimum wage is $7.25 per hour, but some states have set their own minimum wage rates that are higher. You are required to pay the higher rate.

- Overtime Pay: Nonexempt employees must be paid overtime at a rate of one and a half times their regular rate of pay for all hours worked over 40 in a workweek.

- Recordkeeping: You must keep records of employee time and pay for at least three years. This is where good record keeping comes in handy.

- Youth Employment: There are restrictions on the hours that employees under 18 can work and the types of jobs they can do. Safety is a priority!

Remember, some employees are exempt from overtime pay, such as certain administrative, professional, and executive employees. But be careful here – just because someone has a certain title does not automatically make them exempt. Their job duties and salary must meet specific criteria.

Don’t worry if you’re finding all this FLSA information a bit much. You’re not the only one. Many small business owners choose to work with a payroll service or HR professional to ensure they’re doing everything correctly. This is a wise decision that could save you a lot of trouble in the future.

Mastering the Art of Recordkeeping

Recordkeeping may not be the most glamorous aspect of running a business, but it is undeniably crucial. It is through meticulous recordkeeping that you can demonstrate your adherence to the law and your commitment to fair pay. Furthermore, in the event of a dispute or query regarding pay, your records will provide the most solid defense.

Here’s what you need to have in your records:

- Personal information, including the employee’s name, address, job title, and social security number.

- The hour and day when the workweek starts.

- The total hours worked each day and each workweek.

- The basis on which the employee’s wages are paid (hourly, salary, commission, etc.).

- The total regular earnings for each workday and each workweek.

- The total overtime earnings for the workweek.

- All additions to or subtractions from the employee’s wages.

- The total wages paid each pay period.

- The date of payment and the pay period that the payment covers.

Keep these records for at least three years, and keep any records that wage computations are based on for two years, like time cards and piece work tickets.

Establishing a Secure and All-Inclusive Work Environment

Finally, we will discuss the importance of establishing a work environment that is secure and welcoming to all. This is not just about complying with the law, it’s about creating a business that employees are proud to be a part of.

Ensure you are adhering to the safety standards established by the Occupational Safety and Health Administration (OSHA). This includes maintaining a clean workspace, educating your employees on safety procedures, and supplying them with the necessary equipment to perform their tasks safely.

Diversity and inclusion aren’t just trendy phrases – they’re actually beneficial to your business. Teams composed of individuals with diverse backgrounds and viewpoints are generally more creative, make superior decisions, and connect better with your customers. Additionally, when people feel appreciated and included, they’re more likely to stay.

Therefore, it’s important to review your company’s policies and practices. Are you offering the same opportunities to all? Are you accommodating those with disabilities? Are you preventing harassment and discrimination? These are the aspects that make a business truly exceptional.