Important Points

- There are nine primary types of small business loans, each of which serves a different purpose.

- SBA loans are a popular choice due to their beneficial terms, but they require a significant amount of paperwork.

- Term loans are perfect for established businesses that are planning significant expenses.

- Lines of credit provide flexibility for businesses that have fluctuating cash flow needs.

- Creating a robust business plan and improving your credit score can increase your chances of getting a loan.

Small Business Loans: Types, Requirements & Tips

Starting and operating a small business often necessitates funding beyond what you might have available. This is where small business loans come into play. These loans can help you pay for everything from initial startup costs to ongoing operational expenses. Let’s explore the types of small business loans that are available, what you need to qualify for them, and tips to improve your chances of getting approved.

A Look at Small Business Loan Choices

Many types of small business loans exist to cater to a range of financing necessities. Some loans are ideal for long-term investments such as commercial real estate, and others are just right for short-term needs like handling cash flow. Knowing the differences between these loan types is key to picking the best one for your business.

How Various Loans Address Different Business Needs

Each loan serves a unique purpose. For instance, if you need a large amount of money for a major purchase, a term loan might be your best bet. However, if you need continuous access to funds for varying costs, a line of credit might be more appropriate. Here’s a breakdown:

- Term Loans: Best for large, one-time expenses.

- SBA Loans: Ideal for working capital, significant expenses, or growth opportunities.

- Equipment Financing: Perfect for buying large equipment.

- Line of Credit: Suitable for handling inconsistent cash flow.

- Invoice Financing: Great for receiving cash advances on unpaid invoices.

- Merchant Cash Advances: Good for businesses with high credit card sales.

- Microloans: Excellent for startups and new businesses needing smaller amounts of money.

- Commercial Real Estate Loans: Best for buying or renovating business property.

Qualifying for a Small Business Loan: Key Requirements

Before you apply for any loan, it’s important to know the primary requirements. Most lenders will look at several crucial factors to determine your eligibility. These include your credit score, business plan, financial statements, collateral, and sometimes a personal guarantee.

Insider Advice for Boosting Your Loan Approval Odds

Securing a small business loan can be a challenge, but there are strategies you can use to increase your chances. Here are a few insider tips:

Consider exploring different types of small business loans to find the best fit for your needs.

- Boost Your Credit Score: A top-notch credit score can make you more likely to be approved and can get you better loan terms.

- Create a Strong Business Plan: A thorough, well-thought-out business plan can show lenders that you mean business and have a clear path to profitability.

- Get Your Financial Documents in Order: Being organized with your financial documents can make the application process go more smoothly and quickly.

- Develop Relationships with Lenders: Having a good relationship with your bank or other lenders can open up better loan options for you.

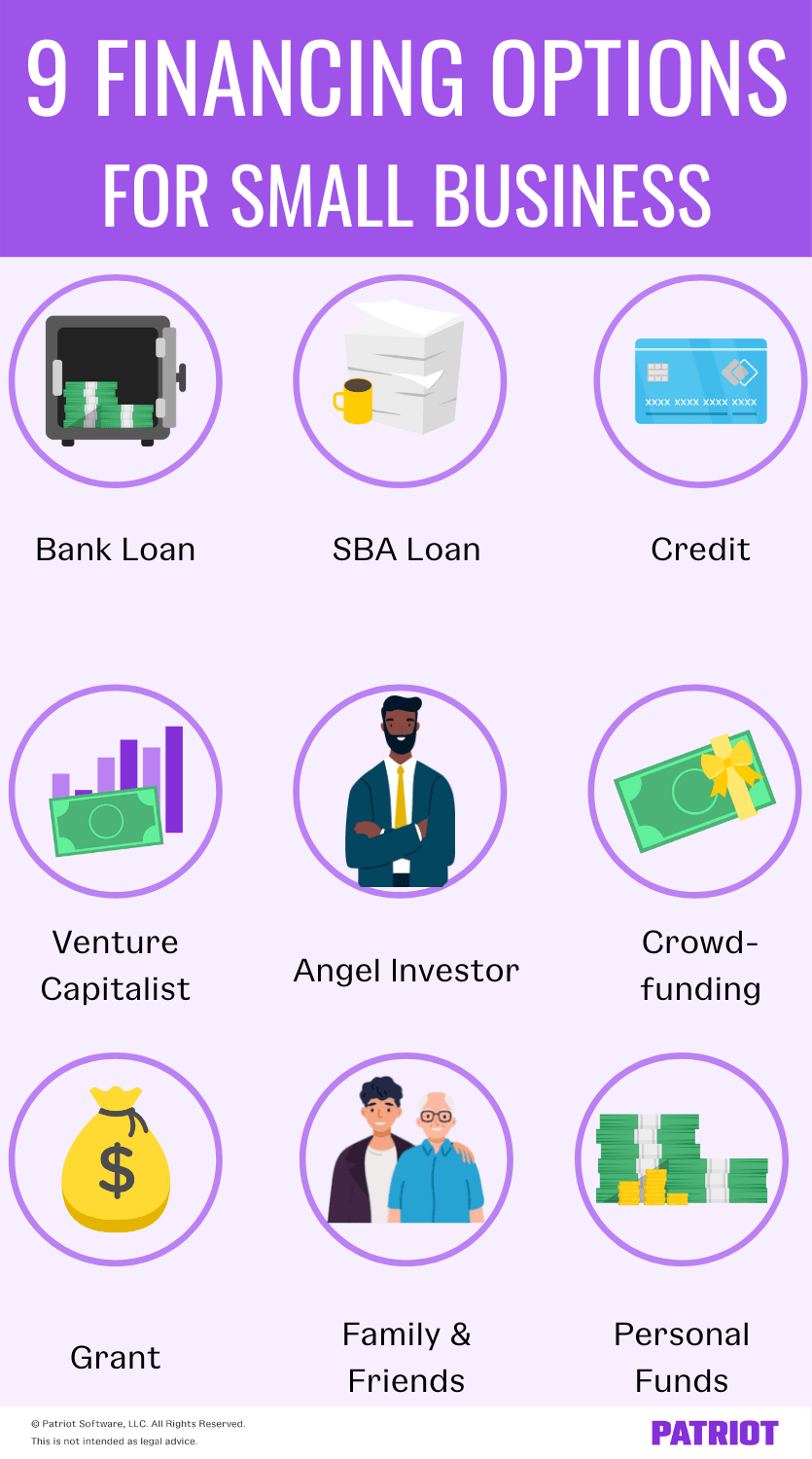

- Look at Other Funding Options: Sometimes a traditional loan isn’t the best fit. Don’t be shy about exploring other funding sources, like crowdfunding or grants.

Small Business Loan Types

Now, let’s delve into the various types of small business loans out there. Each one has its own pros and cons, so it’s important to understand what each one brings to the table.

Term Loans

Term loans are a popular choice for small business loans. They offer a one-time amount of money that you pay back over a set amount of time with interest. These loans are perfect for businesses that are already established and are planning big expenses, like growing their operations or buying major equipment.

Advantages:

- Steady repayment plan

- Decreased interest rates for eligible borrowers

- Multi-purpose use

Disadvantages:

While there are many advantages, it’s also important to consider the potential drawbacks of small business loans. For instance, some businesses may struggle with repayment if they don’t have a solid emergency fund. Learn more about the importance of building an emergency fund for small business success.

- Good credit and financial history are necessary

- Collateral may be needed

- Fixed monthly payments can be difficult during slow periods

SBA Loans

SBA loans, which are supported by the U.S. Small Business Administration, are known for their attractive terms and low-interest rates. These loans are a great choice for businesses that need working capital, are looking to expand, or have other large expenses. However, the application process can be long and requires a lot of documentation.

Advantages:

- Reduced interest rates

- Extended payment terms

- Adaptable fund usage

Disadvantages:

- Application process is long and complicated

- Needs a lot of paperwork

- May require a personal guarantee

Merchant Cash Advances

Merchant cash advances (MCAs) give businesses a big amount of cash, and in return, they get a percentage of future credit card sales. This type of financing is perfect for businesses that make a lot of their money from credit card sales and need cash fast. But, MCAs usually have higher fees and interest rates than other types of loans.

Advantages:

One of the key advantages of small business loans is the ability to avoid common financial pitfalls. For instance, understanding and avoiding small business tax mistakes can significantly improve your business’s financial health.

- Quick availability of funds

- Repayment is linked to sales, meaning payments will vary with revenue

- No need for collateral

Downsides:

- Higher fees and interest rates

- Can lead to cash flow issues if sales are lower than expected

- Not ideal for businesses with low credit card sales

Microloans

Microloans are small loans, typically under $50,000, that are designed to help startups and small businesses get off the ground. These loans are often provided by nonprofit organizations and can be easier to qualify for than traditional loans. Microloans can be used for various purposes, including working capital, inventory, and equipment purchases. Cash flow management is crucial for businesses utilizing microloans to ensure financial stability.

Advantages:

- Available to startups and new businesses

- Use of funds is flexible

- Lower loan amounts mean less risk

Disadvantages:

- Not all business needs can be met with smaller loan amounts

- Interest rates are typically higher than traditional loans

- Repayment terms are generally shorter

Loans for Commercial Real Estate

Loans for commercial real estate are utilized to purchase, construct, or revamp property for business use. These loans are akin to residential mortgages, but they are specifically tailored for commercial properties. They often have longer repayment terms and may offer lower interest rates, which makes them a desirable choice for businesses looking to invest in property.

Advantages:

- Extended payback periods

- Reduced rates of interest

- Assists businesses in accumulating property equity

Disadvantages:

- Collateral is needed (in this case, the property itself)

- The application process is long and complicated

- A substantial down payment is often necessary

What You Need for a Loan

Before you begin applying for a small business loan, it’s important to understand what you’ll need. Different lenders have different requirements, but most will want to see your credit score, business plan, financial statements, collateral, and personal guarantee.

Importance of Credit Score

Your credit score is a key consideration for lenders when you apply for a loan. The higher your credit score, the better your chances of not only getting approved, but also getting a favorable interest rate. While many lenders typically want a credit score of 680 or above, some are willing to approve loans for those with credit scores as low as 600.

Here’s how you can boost your credit score: Building an emergency fund is crucial for maintaining financial health and ensuring your credit score remains strong. Learn more about the importance of building an emergency fund for small business success.

- Ensure you pay your bills when they’re due

- Lower the amount of debt you owe

- Review your credit report for mistakes and challenge any discrepancies

Business Strategy

A well-thought-out business strategy is crucial when applying for a loan. It gives lenders confidence that you have a well-defined plan for prosperity and can pay back the loan. Your business strategy should include:

- Overview of your business

- What your business does

- Analysis of your industry

- Who runs your business and how it’s structured

- What you sell or what services you offer

- How you plan on attracting customers and making sales

- How much money you need and what you’ll do with it

Financial Reports

Banks and other lenders will want to look at your financial reports to get a sense of how well your business is doing financially. These reports show how much money you’re making, how much you’re spending, and how profitable you are. The most common types of financial reports are:

- Earnings report

- Statement of financial position

- Statement of cash flows

Security

Security is an asset that you promise to give to the lender if you can’t pay back the loan. If you can’t pay back the loan, the lender can take the security to get their money back. Common types of security are buildings, machines, and products. Having security can make it more likely that you will be approved and can help you get a better loan deal.

What is a Personal Guarantee?

When it comes to small business loans, a lot of lenders will ask for a personal guarantee. This essentially means that if your business can’t pay back the loan, you, the business owner, are personally responsible for the money owed. A personal guarantee can put your personal assets in danger, so it’s critical to understand what you’re getting into before you sign on the dotted line.

Advice for Getting a Small Business Loan

Getting a small business loan can be difficult, but there are many things you can do to increase your odds of getting approved. Here are some suggestions to help you get through the process:

Boost Your Credit Rating

As we touched on before, a better credit rating can greatly boost your chances of being approved for a loan. Make sure to boost your credit rating by paying your bills when they’re due, lowering your debt, and checking your credit report for any mistakes.

Moreover, it may be beneficial to seek assistance from a credit counselor or financial advisor to devise a strategy for enhancing your credit rating. They can give tailored advice and assist you in staying on track.

Create a Comprehensive Business Plan

Creating a comprehensive business plan is key to securing a loan. It’s important that your business plan is thorough, practical, and shows a clear path to profitability. Make sure to include all necessary sections, like an executive summary, market analysis, and financial projections.

If you’re not sure how to put together a business plan, consider getting help from a business consultant or using online resources and templates. A solid business plan can make a big difference in your loan application.

Look Into Other Financing Options

Other than conventional loans, there are other financing options that might be a better fit for your business. These options include crowdfunding, grants, and angel investors. Each option has its own advantages and disadvantages, so it’s important to do your research and understand what’s best for your business.

Crowdfunding: Websites such as Kickstarter and Indiegogo give you the opportunity to gather small contributions from a multitude of individuals. This is a fantastic method to evaluate the market potential of your product and create excitement.

Grants: Unlike loans, grants don’t have to be paid back. They are often available from government agencies, nonprofits, and private organizations. But, the application process can be competitive and time-consuming.

Angel Investors: These are people who put their own money into startups and, in return, get a share of the company. They can also offer helpful advice and connections. However, you should be ready to give up some of your ownership. For more information on financing options, check out the types of small business loans available.

Conclusion: Moving Forward

Obtaining a small business loan can significantly impact your business. Whether you need capital to begin, expand, or maintain your business, it’s important to know the different types of loans available and what they require. Spend time creating a strong business plan, enhancing your credit score, and collecting all required paperwork. Establishing relationships with lenders and looking into other funding options can also improve your likelihood of success. Keep in mind, the right loan can give you the financial lift necessary to reach your business objectives.

Commonly Asked Questions

Do you still have some questions? Here are some frequently asked questions about small business loans to help you make the best decisions.

What type of loan is best for a startup?

Microloans and SBA loans are often the best choices for startups. Microloans are easier to get approved for and offer smaller loan amounts, making them perfect for new businesses. SBA loans have better terms and lower interest rates but require more paperwork and take longer to get approved.

What is the timeframe for approval of a small business loan?

- Traditional bank loans: 1-3 months

- SBA loans: 1-3 months

- Online lenders: 1-2 weeks

- Merchant cash advances: 1-3 days

The time it takes to get approved for a loan can vary based on the type of loan and the lender. Traditional bank loans and SBA loans usually take longer because they require more paperwork and a more thorough approval process. Online lenders and merchant cash advances can approve loans more quickly, but they often have higher interest rates. For more information on how to support your business during these times, check out these resources for small business owners.

Is it possible to get a small business loan with poor credit?

Absolutely, it’s possible to secure a small business loan with poor credit, but it might be more difficult, and you may have to pay higher interest rates. Here are a few resources and support for owners with poor credit:

- Advances from merchants

- Financing through invoices

- Small-scale loans

- Non-traditional lenders

Boosting your credit rating and offering collateral could better your odds of approval. You might want to think about collaborating with a credit advisor to devise a strategy for enhancing your credit rating.

What’s the lowest credit score you can have to get an SBA loan?

The lowest credit score you can have to get an SBA loan is usually between 640 and 680. But, if you have a better credit score, you’re more likely to be approved and you might get better terms for your loan. Make sure to check with different lenders because their requirements might be different.

Do women or minority-owned businesses have unique loan options?

Absolutely, women and minority-owned businesses have a variety of unique loans and grants available to them. The SBA has initiatives such as the 8(a) Business Development Program and the Women’s Business Center Program. On top of that, a wide range of private organizations and nonprofits offer grants and funding opportunities specifically for businesses owned by women and minorities.

How can I figure out how much my business needs to borrow?

Figuring out how much your business needs to borrow begins with creating a detailed budget. Take into account all costs, including startup expenses, operating costs, and any planned investments. Be realistic about your revenue projections and include a buffer for unexpected expenses. You might also want to consider talking to a financial advisor to help you figure out the right loan amount for your business.