Quick Summary

- Learn about the different types of small business loans, including SBA, traditional bank loans, and alternative lenders.

- Understand how to determine if you are eligible for a small business loan, including credit score, financial health, and documentation requirements.

- Receive advice on preparing for the loan application process, including creating a strong business plan and collecting necessary paperwork.

- Learn tactics for using your loan effectively and planning for repayment to maintain financial stability.

- Discover how the ERTC Express can assist in maximizing your refundable tax credits with a straightforward, risk-free process.

Small Business Loan

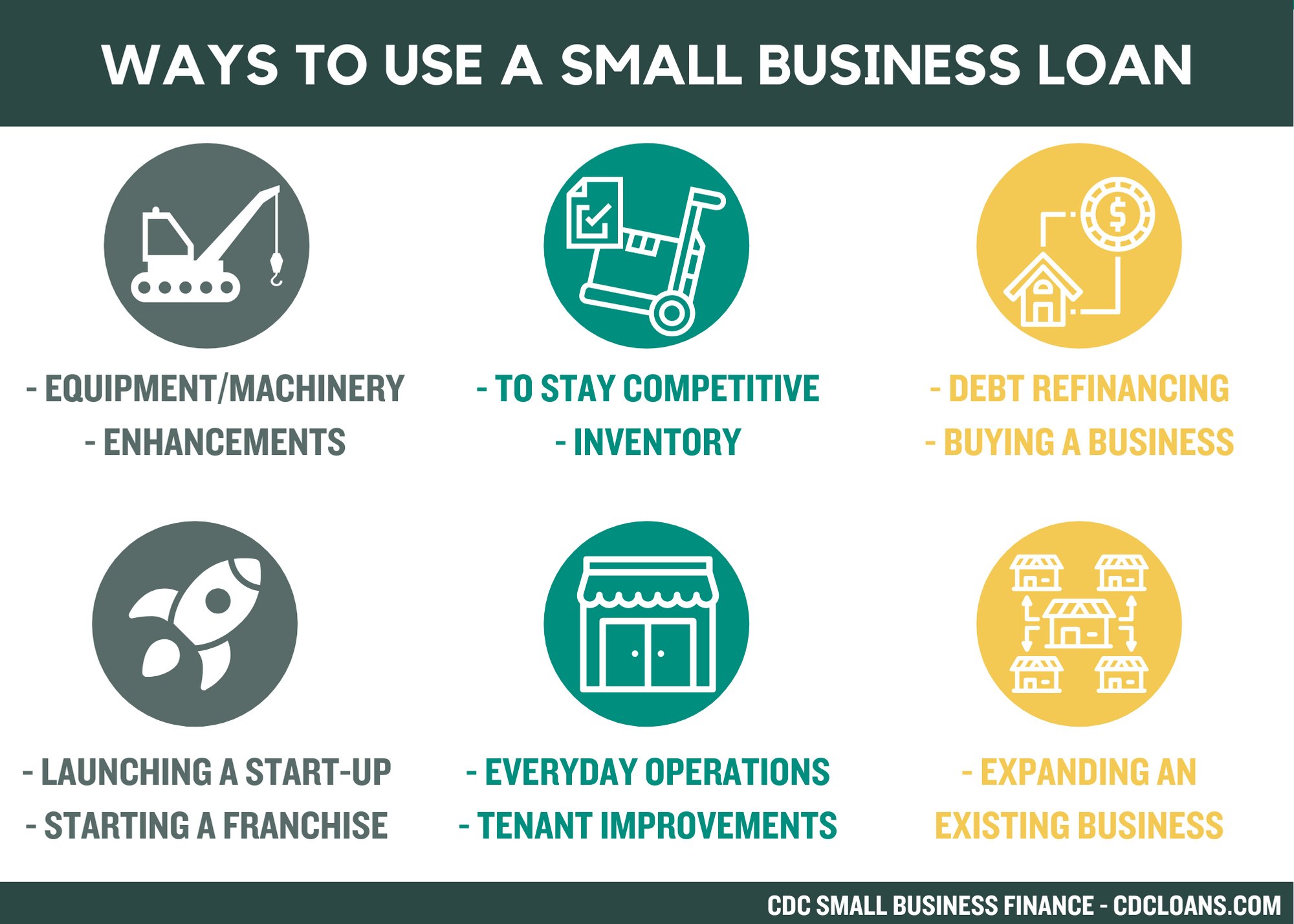

“small business loan …” from cdcloans.com and used with no modifications.

Where do you start? There are so many choices, it’s easy to get lost. Let’s navigate this maze together and find the route that’s right for your business.

SBA Loans: Fuel for Your Small Business

The Small Business Administration (SBA) offers loans that are often more accessible than traditional bank loans, especially if you’re a new business or don’t have an excellent credit score. These loans can be thought of as fuel—they’re designed to help your business take off. There are different types of SBA loans, such as the 7(a) program, CDC/504 loans, and microloans, each with its own purpose and benefits.

For instance, a 7(a) loan could assist you with operational capital, debt restructuring, or even acquiring new property. CDC/504 loans are ideal for procuring major fixed assets such as machinery or property. And if you require a smaller loan under $50,000, microloans could be your best option.

The Good and the Bad of Traditional Bank Loans

Traditional bank loans often have competitive interest rates and terms, but they usually require good credit and collateral. If you’ve been in business for a while and have a good track record, they’re a good option. However, if you’re new to business or don’t have a great credit score, you might find it difficult to get these loans.

Keep in mind that banks are not fans of risk. They want to lend to businesses that they believe can repay the loan. This means you’ll need to show that your business is a good risk, which typically requires detailed financial records and a strong business plan.

Other Financing Options: More than Just Banks and Credit Unions

What if you can’t get a traditional bank loan? That’s when you can consider other financing options. This can include anything from online lenders to crowdfunding. These options can be more adaptable and faster to fund than traditional banks, but they may have higher interest rates.

There are a variety of choices available, including peer-to-peer lending platforms, merchant cash advances, and business lines of credit from fintech firms. Each option has its own set of guidelines and prerequisites, so it’s crucial to do your research before getting started.

Choosing the Perfect Loan: The Different Types of Loans You Can Choose From

Choosing the perfect loan for your small business is like choosing the perfect tool for a job. If you use a hammer instead of a screwdriver, you’re going to end up with a mess. Let’s take a look at the different types of loans available.

Term Loans vs. Lines of Credit: What’s the Difference?

A term loan is a one-time lump sum of cash that you repay over a fixed period of time. This is a great option if you have a one-time expense, such as opening a new store or office. On the other hand, a business line of credit is similar to a credit card. You have a certain limit that you can borrow up to, and you only pay interest on the amount you use. This is an excellent choice for ongoing expenses like inventory or for covering occasional dips in cash flow.

The Pros and Cons of Unsecured Loans

Unsecured loans are loans that don’t need collateral, which may seem like a good deal, but there’s a downside. They usually come with higher interest rates because the lender is assuming a greater risk. However, if you’re sure your business can pay back the loan, an unsecured loan can provide you with immediate access to funds without tying up your assets.

- Increased interest rates: Be prepared to pay more due to the lack of collateral.

- Tough credit stipulations: Lenders will scrutinize your credit history as there’s no collateral to fall back on.

- Quick funding: These loans can often be approved and funded quickly, making them ideal for immediate needs.

Let’s consider a practical example. Suppose you own a small coffee shop and you’re prepared to expand with a second location. An unsecured loan could be the ideal solution to secure the funds you need without risking your original shop as collateral.

Equipment Financing: Fueling Expansion

Equipment financing is your best bet when you require particular equipment to grow your business. Be it a new oven for your bakery or a bunch of computers for your new venture, these loans are backed by the equipment itself, often making them more accessible. For a more comprehensive guide on small business funding options, including loans and grants, check out our detailed article.

Primarily, as the equipment serves as collateral, these loans generally have lower interest rates. And the cherry on top? You’re investing in the growth of your business, which could result in a boost in revenue in the future.

Now that we’ve examined the types of loans that exist, let’s delve into the specifics of eligibility and application. Applying for a small business loan isn’t just about asking for money, it’s about demonstrating that you’re a good investment. This involves displaying your business and personal financial health and ensuring all your paperwork is in order.

Your Business and Personal Finances

Think of your financial health as the heartbeat of your business—it gives lenders a snapshot of how well your business is doing. They’ll examine your cash flow, revenue, expenses, and profits. However, it’s not just about your business; your personal financial health is important too. Lenders frequently view your personal credit score as a gauge of your money management skills.

Why Documentation and Time in Business Are Essential for Verification

Consider your documentation as the evidence that supports your narrative. Lenders will want to see everything from tax returns and bank statements to financial projections. And the time you’ve been in business matters. If you’re a startup, you’re viewed as riskier than a business that’s been around for a few years. That’s why newer businesses might need to make a stronger case to get a loan.

Don’t let this deter you. Even start-ups can impress with a robust business strategy and clear financial forecasts. Demonstrate to lenders that you have a concrete plan for success, and they’ll be more inclined to invest in you.

Acing the Application Process

The application process is your time to shine. It’s your opportunity to show lenders why your business is special. This isn’t just about completing forms—it’s about sharing your business’s story in a way that makes lenders eager to join your journey.

Developing a Persuasive Business Plan

Your business plan is your roadmap to success. It’s where you outline your dream, your tactics, and your revenue plan. This isn’t just a requirement; it’s a tool that can tip the scales in your favor with lenders. Ensure it’s detailed, well-researched, and persuasive.

Necessary Paperwork for Loan Applications

When you’re preparing to apply, you’ll need to compile several important documents. For a comprehensive overview, consider reviewing this small business funding options guide to help you get started:

- Tax returns for both your business and personal taxes

- Bank statements for both your business and personal accounts

- Financial statements including a balance sheet, income statement, and cash flow statement

- Your business plan

- Documentation for any collateral, if applicable

- Legal documents such as business licenses, articles of incorporation, etc.

Being prepared with these documents will show lenders that you are serious and ready. It’s like showing up to a job interview in a sharp suit and with a polished resume—you’re there to impress.

Enhancing Your Financial Status

Prior to submitting your application, it’s worthwhile to scrutinize your financial status. Are there aspects that could use some improvement? Perhaps you could focus on reducing your debt or increasing your credit rating. Here are several steps to think about:

- Settle any existing debts to better your debt-to-income ratio.

- Examine your credit report for mistakes and challenge any inaccuracies.

- Maintain a low credit utilization—aim to use less than 30% of your available credit.

Boosting your financial profile is akin to tidying up your home before guests come over—it leaves a positive impression and demonstrates that you’re reliable and forward-thinking.

Seeking Expert Advice: The Right Time and Reasons

The process of obtaining a loan can be complicated, and it can be beneficial to seek expert advice. This could be a financial advisor, an accountant, or even a loan broker. They can guide you through the process, find the most competitive rates, and improve your chances of getting approved. But choose carefully—ensure that whoever you seek advice from has a solid track record and understands the needs of your business.

What Happens After You Apply?

Once you’ve sent in your application, the waiting game starts. But it’s not just a matter of sitting and waiting—you’re keeping an eye on your application and getting ready for what comes next.

Keeping Tabs on Your Loan Application Status

It’s important to stay on top of things and maintain communication with your lender. Don’t hesitate to ask for updates on your application status and be prepared to supply any extra information they may require. It’s similar to tracking a package you’ve been anxiously awaiting—you want to know its whereabouts at all times.

Before You Sign: Final Reviews and Considerations

Should your loan be approved, don’t be too hasty to sign the contract. Take a moment to thoroughly review the terms. Ensure you fully understand the interest rate, repayment plan, and any potential fees. It’s similar to signing a lease for a new apartment—you should know exactly what you’re agreeing to.

Rejected Loan: Understanding and Overcoming Denial

If your loan application has been rejected, don’t fret. Understand why it was rejected and what you can do to increase your chances of success in the future. Perhaps you need to improve your credit score or strengthen your business plan. Use denial as a chance to learn and bounce back even stronger.

Getting the Most out of Your Business Loan

Once you’ve secured the loan, it’s time to put those funds to good use. Use the loan to expand your business, whether that’s through developing new products, employing more staff, or ramping up your marketing campaigns. And always monitor your financial situation to make sure you’re using the loan wisely and can meet your repayment obligations.

How to Use Your Loan Effectively

Here are some ways to make sure you’re getting the most out of your loan:

- Adhere to your business plan and use the loan for the purpose it was intended for.

- Keep a close eye on your cash flow to prevent your finances from becoming overextended.

- Put profits back into the business to stimulate additional growth.

Using your loan in a smart way is like planting a high-quality seed in your garden. With the right care and planning, you can cultivate a successful business that will be profitable for many years.

Repayment Planning: Ensuring Financial Stability

From the moment you take out a loan, start planning how you’ll pay it back. Each month, put a portion of your profits aside to cover your loan payments. This will ensure that you’re not caught off guard when it’s time to pay the piper. Think of it as saving for a rainy day – when the storm comes, you’ll be glad you did.

- Comprehend the interest rate of your loan and its impact on your payments.

- Think about establishing automatic payments to prevent due date oversights.

- Investigate early repayment possibilities if you happen to have additional money.

Bear in mind, a loan is an instrument to facilitate your business expansion, not a liability. By strategizing in advance and handling your finances prudently, you can ensure your loan serves you, not vice versa.

Why Opt for ERTC Express?

Beyond the usual and alternative funding, you may be missing out on another potent tool: the Employee Retention Tax Credit (ERTC). This is a frequently misunderstood funding avenue that can greatly enhance your business’s cash flow.

ERTC Express prides itself on helping you get the most out of your refundable claims for the ERTC. They have a straightforward process that takes less than 15 minutes of your time. Here are a few reasons why businesses are choosing ERTC Express:

- Ensures maximum refundable credits for local and small to medium-sized businesses.

- So simple that all it takes is 15 minutes of your time.

- No upfront fees to qualify—100% dependent on your refund.

- Documentation that is audit-proof for IRS support.

- Specializes in maximizing Employee Retention Tax Credits for small business owners.

“Home – ERTC Express” from ertcexpress.com and used with no modifications.

ERTC Express is not just a service, but a team of experts dedicated to your success. They offer the 15 Minute Refund™ to ensure you take full advantage of this opportunity. It’s a must-have for any business aiming to secure a substantial refund check from the IRS.

If you are ready to take advantage of the ERTC for your business, click here to Start Your ERTC Express Claim. Don’t let this opportunity to strengthen your business’s financial position with little time commitment pass you by.

Getting the right loan is just the start; what you do with it is what truly matters. Your small business loan is a tool to take your business to new heights, and how you put it to use can be a game changer. Let’s discuss how to leverage that loan for your success.

Start by making a plan. Decide where you want to put your money in your business. This could be new tools, hiring people, or increasing your marketing. Whatever it is, make sure it will make you more money, not just cost you more.

Getting the Most Out of Your Refundable Credits: The Quick 15-Minute Refund

ERTC is a powerful funding tool that is often overlooked or misunderstood. It was created to encourage businesses to keep employees on the payroll during difficult times. With ERTC Express, you can take full advantage of these refundable credits through a simple, straightforward process. It’s a quick victory for the financial health of your business.

Zero Risk Qualification: No Upfront Charges Rule

ERTC Express works on a zero-risk qualification premise, which means there are no upfront charges to fret about. You only pay when you get your refundable credits. This rule is in line with your business’s success, making sure that the service is available to all businesses, no matter what their current cash flow situation is.

Defendable Documentation and Professional Assistance

When dealing with IRS issues, it’s essential to have defendable documentation. ERTC Express offers professional assistance to make sure your claim is supported by substantial documentation. This not only increases your likelihood of getting credits but also provides you with assurance if the IRS ever disputes your claim.

Let’s Get Going

Your business has the potential to soar with the appropriate funding. Be it a conventional bank loan, an SBA loan, or alternative financing, the crucial part is to select the option that best fits your business objectives and financial status. And don’t forget, the loan isn’t just about acquiring it—it’s about how you use it.

Start Your Financial Adventure

With the understanding and resources to guide you through the small business loan process, it’s time to start your journey. Evaluate your business requirements, check your eligibility, and organize your paperwork. Then, select the financing option that fits you and your business best. It’s a journey that’s worth taking for the prosperity of your small business.

When it’s time to claim your ERTC credits, ERTC Express is ready to help. They’re committed to getting you the highest refundable credits possible, and they make the process easy and efficient. They’re the partner you need to get what you deserve.

“ERTC Express isn’t about making you jump through hoops; it’s about providing a clear path to financial empowerment for your small business.”

Start Your Claim with ERTC Express

Don’t delay in taking advantage of the ERTC. Click the link above to begin your claim process with ERTC Express and find the financial boost your business.