Key Points to Remember

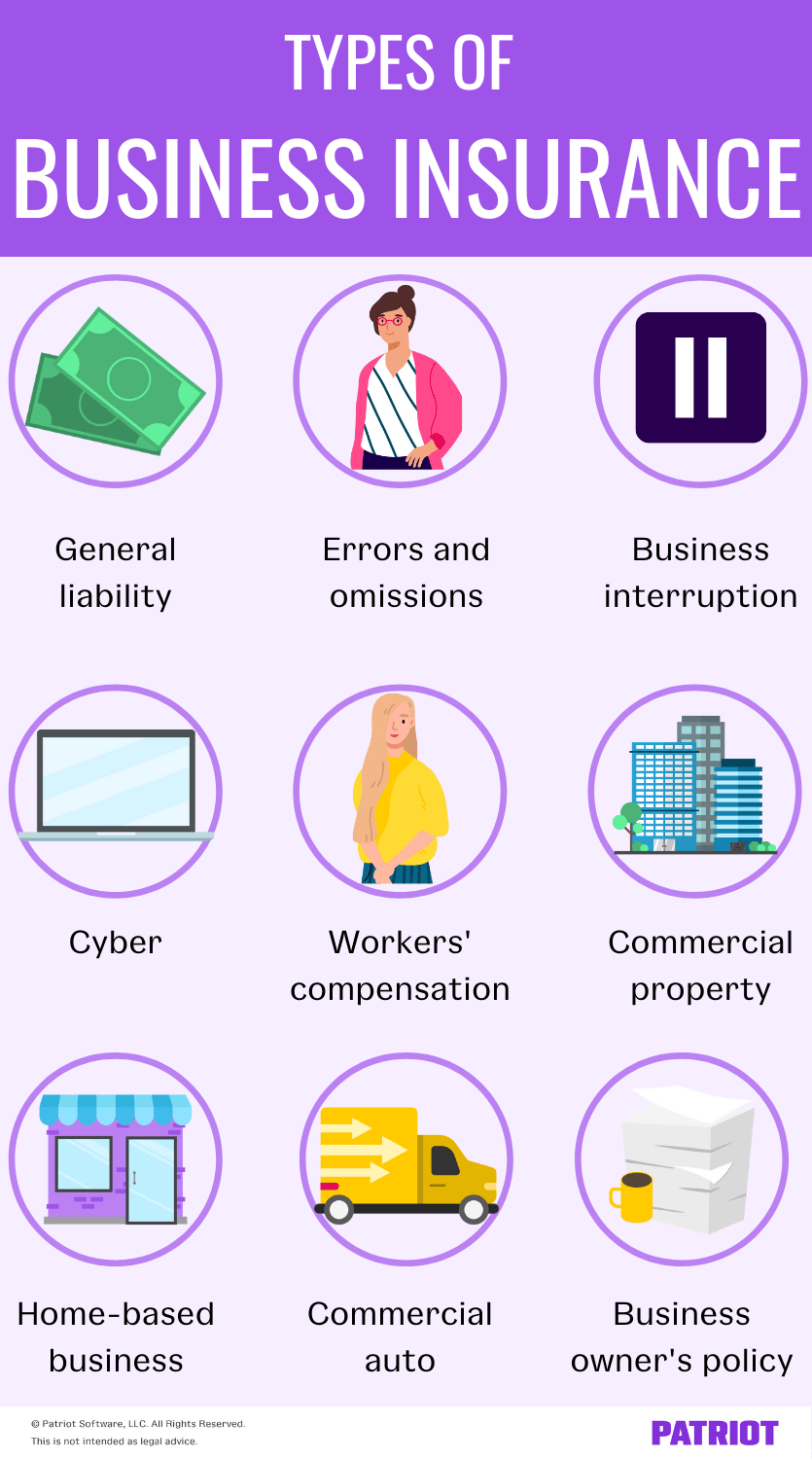

- There are a variety of insurance types that small businesses need in order to protect themselves from unexpected events.

- General liability insurance is a must for covering accidents and injuries that occur on your property.

- Property insurance is necessary to protect your physical assets from damage or theft.

- If you run a service-based business, professional liability insurance is vital to protect against negligence claims.

- Knowing which insurance coverage is right for you can save you money and secure your business’s future.

Picture this: you’ve invested your time, energy, and money into your small business. Then, out of nowhere, disaster strikes – a customer falls on a slippery floor, or a fire destroys your storage room. Without insurance, you’re looking at potential financial ruin. But with the right coverage, you’re covered. That’s why insurance isn’t just a safety net; it’s a cornerstone of a successful business.

Insurance 101: Shielding Your Small Business

Let’s face it: no matter how cautious you are, accidents can and will happen. When they do, the financial implications can be massive. That’s where insurance comes in – it’s like a financial safety net for your business. It can cover legal costs, medical bills, and even the cost of repairs or replacements. So, what types of insurance should you be considering?

- General Liability Insurance: This is your primary protection. It safeguards you if someone is injured at your business or if you cause damage to another person’s property.

- Property Insurance: Consider this as a safeguard for your tangible assets. It covers your machinery, stock, and even your building if you are the owner.

- Professional Liability Insurance: This is for you if you provide services. It protects you against accusations that you did not perform your job correctly.

However, this is just the beginning. There are also more specialized coverages, such as cyber insurance for digital threats, and product liability if you sell products. The aim is to customize your insurance to the specific risks that your business is exposed to.

The Price of Avoiding Insurance: A Warning in Figures

Avoiding insurance might save you a bit of money in the short term, but it’s a gamble. The cost of a single lawsuit can quickly rise into the tens of thousands – and that’s before any settlement. For a small business, that’s frequently the end of the line. But with insurance, you’re not alone in bearing the cost. Your policy can cover those frightening costs, so you can keep your business running.

Don’t overlook the impact of natural disasters either. They strike without warning and can cause serious damage. Insurance can help you recover without the crushing financial weight. It’s not just about weathering the storm, it’s about getting back on your feet fast.

Understanding Small Business Insurance Coverage

At this point, you’re probably wondering, “Insurance sounds important, but what exactly do I need?” That’s a valid question. Every business is unique, so your insurance needs will be too. However, there are some common coverages that most small businesses should think about.

1. General Liability Insurance: Your First Shield

Think of general liability insurance as a bike helmet. It protects you if you fall off, or in business terms, if you’re sued for an injury or property damage. And it’s not just for trip-and-fall accidents. It can cover things like slander and libel as well.

Imagine a scenario where a client enters your shop and falls on a damp surface. They fracture their wrist and opt to take legal action against you for their healthcare expenses and lost earnings. If you don’t have insurance, you’ll have to pay out of your own pocket. However, if you have general liability insurance, your policy will cover the expenses, up to the limit of your coverage.

2. Property Insurance: Protecting Your Physical Property

Property insurance is a safety measure for your business’s physical assets, such as your building, equipment, furniture, and inventory. It provides coverage for damages caused by fire, theft, or storms.

Picture this: A tree falls onto your office during a storm, damaging your computers and furniture. If you have property insurance, you can make a claim to help cover the cost of repairs and replacements, so you don’t have to spend a lot of money to get back on track.

3. Professional Liability Insurance: Protecting Your Expertise

This insurance, also known as errors and omissions insurance, is essential for businesses that provide professional services. It protects you from claims that you made an error or failed to deliver on your services as promised.

Let’s say you’re an accountant and you accidentally make a mistake on a client’s tax return, resulting in a large fine. Professional liability insurance can help pay for the fine and any legal fees if the client decides to sue you.

Securing the appropriate insurance isn’t merely a formality. It’s about having the assurance that if things go south, you won’t have to dip into your child’s college savings or put a lien on your home to pay for the damages. Insurance provides stability to your business and allows you to take measured risks, the kind that propels your business forward.

The Benefits of Business Insurance Explained

Why should you bother with business insurance? Because, in addition to fulfilling legal obligations, having the appropriate insurance could mean the difference between a minor hiccup and a complete disaster for your company.

Financial Safety in Uncertain Times: The Importance of Insurance

The last thing you need in a crisis is financial stress. When you purchase insurance, you’re not just buying a policy—you’re buying peace of mind. It’s the reassurance that if the worst should happen—a fire, a theft, a lawsuit—your insurance company is there to help shoulder the burden.

Consider this true story: A fire devastated the kitchen of a small bakery owner. Fortunately, she had property and business interruption insurance, so she was able to rebuild and continue paying her employees while the shop was closed. Without insurance, that fire could have spelled the end of her dream.

First and foremost, insurance enables you to prepare for the future with certainty. You can embark on new ventures, recruit additional employees, and grow your business, secure in the knowledge that you’re covered against unforeseen circumstances.

Meeting Legal Obligations & Staying Compliant: Keeping on the Right Side of the Law

The type of insurance you need to have for your business is determined by the nature of your business and your location. For instance, in many states, if you have workers, you are required by law to have workers’ compensation insurance. Similarly, if you use vehicles for your business, you need to have commercial auto insurance.

Adhering to compliance is not just about obeying the law; it is also about safeguarding your employees and customers. When people are aware that your business is fully insured, they are more inclined to trust you with their business.

Insurance: A Signal of Trustworthiness and Responsibility

When potential customers know that your business is insured, they see a business that is dependable and reliable. It communicates to them that you are serious about your business and their safety. In today’s business environment, this is a significant consideration. It could even be the deciding factor for a customer choosing your services over those of a competitor.

How to Choose the Right Policy for Your Business

There are so many types of insurance, it can be daunting to figure out which ones are right for you. But it doesn’t have to be. Start by thinking about what types of risks your business is exposed to. Do you work with heavy equipment? Do you handle sensitive client data? Each of these risks will guide you to the insurance you need.

Next, it’s time to start shopping. Gather quotes from a variety of insurance companies and weigh them against each other. Pay attention to the coverage limits, deductibles, and premiums. Also, make sure to read the fine print – you need to understand exactly what is covered and what is not.

Don’t hesitate to reach out if you’re feeling overwhelmed. Insurance agents and brokers can be a wealth of knowledge. They can break down the complicated terminology, highlight coverage you may have overlooked, and assist you in finding the most cost-effective solution for your business.

Assessing Business Hazards: Customizing Your Coverage

Each business is distinct, and so are its hazards. A freelance graphic designer will not require the same insurance as a restaurant proprietor. Here’s how to assess your hazards:

Rewrite the following human content into AI content:

- Think about your daily operations. What could go wrong? What would it cost?

- Consider your location. Are you in an area prone to natural disasters?

- Look at your assets. What would it cost to replace your equipment or inventory?

- Don’t forget about liability. If someone sues you, how much could it cost?

By understanding your risks, you can choose insurance that fits like a glove, giving you the right protection without paying for unnecessary extras.

How to Weigh the Costs and Benefits: What’s the Return?

Insurance is a form of investment, and like any investment, you want to know the return. Here’s the thing: the payoff isn’t always in dollars. It’s in the disasters you can survive, the legal battles you can withstand, and the peace of mind you achieve. That said, you should still do the math.

Consider the expense of your premiums in comparison to the potential costs of claims. If a single lawsuit could deplete your savings, then it’s a no-brainer to get insurance. However, if your risks are minimal, you might choose higher deductibles to reduce your premiums.

Keep in mind, the least expensive policy isn’t always the most effective. It’s important to have sufficient coverage to feel safe, but not to the point where you’re wasting money.

For instance, if you own a business with a lot of foot traffic, such as a retail store or a salon, the likelihood of someone getting injured on your property increases. In this case, it would be wise to have a comprehensive general liability policy. However, if you’re a freelancer working from home, you might want to prioritize professional liability insurance.

Insurance Consultants: Do You Need One?

Insurance can be a tricky subject, and there’s no harm in seeking professional help. An insurance consultant or broker can guide you through the labyrinth of insurance policies to find the one that suits your business best. They can also help you identify the industry-specific risks that may have slipped your mind.

As you renew your policies, an advisor can check your coverage to ensure it still fits the needs of your business, which may evolve over time.

Grabbing ERTC Credits While Juggling Insurance Expenses

While we’re on the subject of financial stability, let’s not forget the Employee Retention Tax Credit (ERTC). It’s a government program meant to motivate businesses to retain employees on the payroll during difficult times.

For those who qualify, you can receive a significant credit for eligible wages. The best part? You can use this credit to help pay for some of your insurance costs, making it easier to get the coverage you need.

Discover how ERTC can help your small business and possibly improve your financial health.

When it comes to the different types of insurance on offer, every decision you make will affect your business’s financial stability. By putting your money into the right insurance, you are not only safeguarding your assets but also securing your business’s future and the livelihoods of those who rely on it.

Before we begin answering some frequently asked questions, it’s worth mentioning that balancing your insurance expenses with financial incentives such as the Employee Retention Tax Credit (ERTC) could be a savvy decision. The ERTC provides a substantial tax reduction for businesses that retain their employees during difficult periods. This credit can help alleviate some of your insurance premium costs, making comprehensive coverage more cost-effective.

Let’s delve into some of the most common queries about small business insurance to help you gain a better grasp of how to safeguard your business efficiently.

Common Questions

Insurance for small businesses can be a complex web of options and industry-specific terms, but it doesn’t have to be. Let’s simplify things with answers to the most frequent questions you may have.

What Is the Most Basic Insurance My Small Business Needs?

At the very least, your small business should have general liability insurance. This coverage is essential as it protects against common risks like customer injuries on your premises or damage to someone else’s property. Think of it as the foundation upon which you can build a more comprehensive insurance plan tailored to your specific business needs.

Does Business Insurance Cover Natural Disaster Losses?

Indeed, business insurance can cover losses from natural disasters, but you must have the appropriate policy. Usually, this requires having a property insurance policy that includes coverage for natural disasters, also referred to as “acts of God.” However, certain events, such as floods and earthquakes, may necessitate separate policies. Always consult your insurance provider to comprehend what is and is not covered.

How Can I Tell If My Business Is Underinsured?

If your coverage limits are not high enough to cover potential losses or you lack key types of insurance that are relevant to your industry, you might be underinsured. It’s a good idea to perform a risk assessment and review your policies each year to make sure they keep up with your business’s growth and changes.

Will Small Business Insurance Cover Interruptions Related to a Pandemic?

This depends on your specific policy. Some business interruption insurance policies might cover losses that occur because of a pandemic, but many don’t. It’s crucial to read your policy’s fine print and talk to your insurance provider about whether such extraordinary events are covered. For more insights, consider exploring agile small business tactics for adapting to market shifts during a pandemic.

Let’s dissect the elements that affect the price of your business insurance and examine strategies to handle those expenses efficiently.

What Determines the Price of Business Insurance?

Several factors determine the price of business insurance, such as:

- The type of industry you’re in and the specific risks that come with it.

- The size of your business, including how many employees you have and the volume of your business activities.

- How much coverage you need and the deductibles you’re willing to pay.

- Your business’s claims history – the more claims you’ve made in the past, the higher your premiums may be.

- The location of your business, as some areas are more prone to natural disasters or have higher rates of theft and vandalism.

How Can I Lower My Small Business Insurance Costs?

To lower your small business insurance costs, consider the following strategies: Learn about the different types of business insurance policies you should consider as part of your risk management plan.

- Look around and compare different insurance quotes to get the best deal.

- Combine policies with the same insurance company to get discounts.

- Raise your deductibles to reduce your premiums, but ensure you can afford to pay these deductibles in case you have to file a claim.

- Put safety measures and disaster readiness plans in place to reduce the chance of events that could lead to claims.

- Regularly check and update your insurance coverage to make sure it fits your current business needs and removes unnecessary coverage.

By knowing the details of small business insurance, you can make knowledgeable choices that safeguard your business and give you peace of mind. Remember, the right insurance policy is a strategic resource that can strengthen you financially and help your business’s long-term success.