Main Points

- Payroll solutions for professionals make it easy for home service businesses to manage payments and taxes.

- Managers can keep track of employee hours with integrated time tracking.

- Automatic tax filing saves time during tax season and ensures compliance.

- Direct deposits are convenient for both employers and employees and provide flexibility.

- Job satisfaction and retention are improved with HR tools and employee benefits.

Begin Your Payroll Adventure with Assurance

Payroll management can seem like a huge undertaking, especially if you’re just starting. But don’t fret, I’m here to guide you through this crucial part of business operation. With the correct tools and knowledge, you’ll be able to tackle payroll like an expert. Let’s explore the realm of professional home services starter payroll solutions and see how they can simplify your life.

Why Home Services Need to Simplify Payroll

For a lot of home service businesses, payroll isn’t just about writing checks. It’s about making sure your employees are paid correctly and promptly, and also about staying on top of your tax obligations. Streamlining your payroll process can save you time and cut down on mistakes, which is key when you’re juggling a hectic schedule.

Think about it this way: if you’re spending too much time on payroll, you’re not focusing on what you do best—providing top-notch service to your customers. So, having a simplified payroll system is key to running a successful business.

The Biggest Payroll Management Struggles

Handling payroll is no easy task. It’s common for business owners to have a hard time with tracking employee hours, handling deductions, and staying tax compliant. These tasks can get pretty intense, especially if you’re doing them by hand.

Moreover, payroll mistakes can result in disgruntled workers and possible penalties. It is crucial to confront these issues directly by discovering solutions that are suitable for your company.

Why Should You Opt for Professional Payroll Solutions?

Professional payroll solutions are a great way to mitigate these issues. They come equipped with tools that streamline many of the tasks associated with payroll management. This leads to fewer mistakes and more time to concentrate on your business.

What’s great about these solutions is that they’re designed to be easy to use. You don’t need to be a pro to use them. With things like built-in time tracking and auto tax filing, you can handle payroll with ease.

What to Expect from Professional Payroll Solutions

Time Tracking Integration

Professional payroll solutions often come with time tracking integration, which is a major advantage. This feature makes it easy to keep track of how many hours each of your employees is working. This way, you can make sure everyone gets paid the right amount for the hours they put in, minimizing the chances of any disputes or mistakes.

Furthermore, integrated time tracking helps to simplify the payroll process by automatically calculating hours and wages. This saves you the trouble of manual entry and reduces the risk of errors. This is a game-changer for businesses that depend on accurate time management.

Automated Tax Filing and Compliance

For many business owners, tax season can be a source of stress. However, with automated tax filing, it doesn’t have to be. Professional payroll solutions take care of tax calculations and filings for you, ensuring that you remain compliant with the latest tax laws. This feature not only saves you time but also helps you steer clear of expensive penalties.

Staying compliant is key, and these solutions offer peace of mind by keeping up with ever-changing regulations. You can sleep well knowing that your payroll taxes are being handled correctly and efficiently.

Convenient Direct Deposits and Pay Options

Direct deposits make it easy to pay your employees on time. Professional payroll services include this option, which lets you put money straight into your employees’ bank accounts. No more paper checks and no more worries about payments getting lost or stolen.

Moreover, these solutions offer adaptable payment schedules and methods that cater to both salaried and hourly employees. Whether it’s weekly, bi-weekly, or monthly, you’re in the driver’s seat to create a payment system that works best for your team.

Human Resources Tools and Employee Benefits

Aside from payroll, numerous solutions provide HR tools that aid in the management of employee records, benefits, and more. These tools can help with the onboarding process, performance monitoring, and even employee engagement. By incorporating HR features, you can establish a more all-inclusive management system. For companies looking to streamline their operations, exploring CRM solutions and software management tools can be beneficial.

Providing perks such as health coverage and retirement schemes can improve employee happiness and loyalty. Many professional payroll services include options for managing these benefits smoothly, increasing your company’s attractiveness as an employer.

Choosing the Best Payroll Solution for Your Company

Assessing Your Company’s Requirements

- Identify the number of employees in your company and the intricacy of your payroll requirements.

- Think about your budget and the amount you’re prepared to pay for payroll services.

- Identify the specific features you need, such as time tracking or HR tools.

Before deciding on a payroll solution, it’s crucial to assess your company’s requirements. Begin by thinking about the number of employees in your company and the intricacy of your payroll requirements. A small company with a few employees will have different requirements than a large company with a diverse team. For small businesses, exploring CRM and accounting software can streamline operations and meet specific needs.

Now, consider your budget. How much can you afford to spend on a payroll solution? While some options may be pricier, they may provide features that are essential to your operations. Balancing cost with functionality is crucial.

Lastly, figure out the particular features you need. Is integrated time tracking necessary for you? Are HR tools crucial for your business? By identifying your priorities, you can trim down your choices and find a solution that matches your goals.

Investigating Major Suppliers and Their Services

After you’ve determined what you need, it’s time to look at the major suppliers in the payroll industry. Companies such as ADP, Gusto, and QuickBooks provide a variety of solutions that are customized to the needs and size of various businesses.

ADP is a well-known provider of extensive payroll and HR services, which is why it’s a favorite among big businesses. Gusto, meanwhile, provides a platform that’s easy to use, perfect for small to mid-sized firms.

QuickBooks offers a comprehensive solution for businesses that already utilize their accounting software. By looking into these providers, you can learn more about their services and choose the one that best suits your business needs.

- ADP: Comprehensive payroll and HR services, ideal for large businesses.

- Gusto: User-friendly platform, great for small to medium-sized companies.

- QuickBooks: Integrated solution for businesses using QuickBooks accounting software.

Comparing Costs and Features

After identifying potential providers, compare their costs and features. Look for a balance between affordability and the functionalities you need. Some providers may offer tiered pricing plans, allowing you to choose a package that fits your budget.

Securing and Complying with Data

When it comes to payroll information, data security is a top priority. You should find a provider that puts security and compliance first. Look for solutions that provide encryption, secure data storage, and frequent security updates.

In addition, it’s crucial to verify that the service provider adheres to the most recent laws and guidelines. This will safeguard your company from possible legal difficulties and provide you with a sense of security.

- Look for options for data encryption and secure storage.

- Ensure that industry regulations and standards are being met.

- Make sure that security updates and maintenance are being done regularly.

By making security and compliance a priority, you can keep your business safe and protect sensitive information.

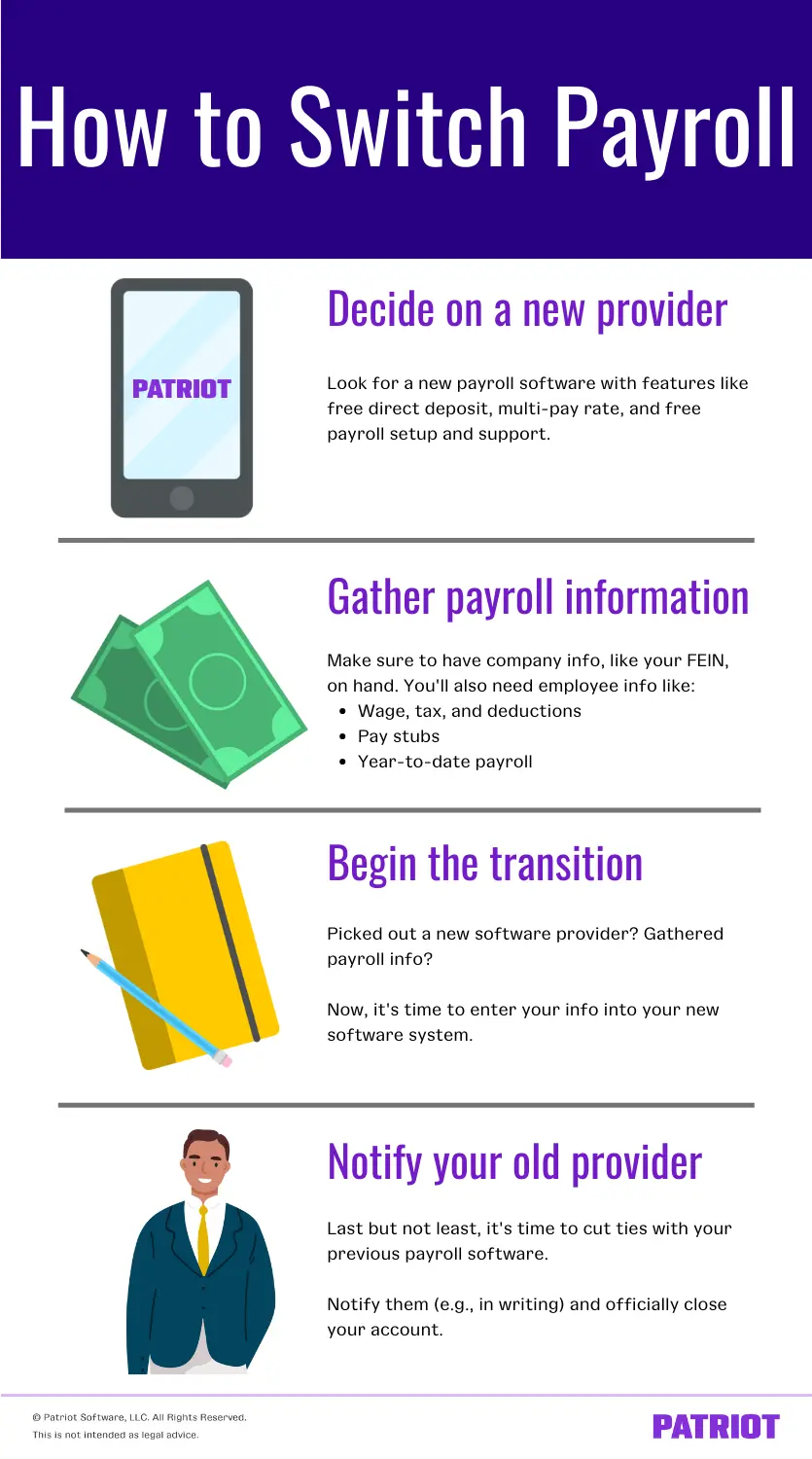

Making the Switch to a New Payroll System

While moving to a new payroll system can seem daunting, with the right strategy, it can be a seamless transition. The keys to a successful switch are planning and communication.

Begin with a detailed plan of how to put the new system into action. This will keep you on track and make sure no steps are missed. For businesses looking to enhance their workflow, exploring CRM software solutions can be a valuable step in the planning process.

Transitioning with Ease

Start by collecting all essential data, like employee specifics and payroll history. This information will be key in configuring the new system. For small businesses, using the best CRM and accounting software can streamline this process significantly.

Training Your Employees

After the system has been set up, it’s crucial to properly train your employees on how to use it. Make sure to provide them with the necessary resources and support so they can adjust to the new process.

With consistent training and open lines of communication, everyone can feel at ease and adapt to the new payroll system smoothly.

Assessing the Success of the Switch

Once the switch has been made, assess its success by collecting feedback from your team. Identify any areas that may need to be improved and make the necessary changes.

Regular evaluation and improvement will ensure you get the most out of your new payroll system.

With these steps, you can guarantee a seamless transition and prepare your business for success.

Getting the Most Out of a Professional Payroll System

Having a professional payroll system allows you to reap its benefits for your business. It can help boost employee satisfaction and make operations more efficient, among other things.

Boosting Employee Happiness

Having a well-run payroll system in place can do wonders for boosting the happiness of your employees. When you make sure that payments are made accurately and on time, you are showing your team that you are trustworthy and dependable. Plus, when you offer benefits and flexible payment options, you can increase how satisfied your employees are with their jobs and how long they stay with your company.

Making Business Operations More Efficient

Implementing a professional payroll system can make your business operations more efficient. These solutions automate many tasks that would otherwise require manual input, freeing up time for you and your team. This means you can focus more on delivering excellent service to your clients and growing your business. For more information on integrating these systems, check out CRM and accounting software for small businesses.

Furthermore, when you combine payroll with other business systems, such as accounting and human resources, you can establish a smooth workflow. This combination minimizes the likelihood of mistakes and guarantees that all aspects of your business are functioning together effectively. As a result, a streamlined operation isn’t simply about saving time—it’s about improving the overall efficiency of your business operations.

Common Questions

It’s normal to have a few questions when you’re thinking about using a professional payroll solution. Here are some frequently asked questions that can help you make the best decision.

Grasping these elements can shed light on how payroll solutions can aid your business and resolve any worries you may have.

What are the top three advantages of professional payroll services?

Professional payroll services offer three primary advantages: automation, precision, and compliance. Automation decreases the amount of time spent on manual labor, freeing up time for you to concentrate on other aspects of your business. Precision ensures that employees are paid correctly, reducing errors and disputes. Compliance keeps you current with tax laws and regulations, reducing the risk of penalties. For small businesses looking to streamline their operations, exploring the best CRM and accounting software can further enhance efficiency.

Companies can take advantage of these benefits to streamline their operations and alleviate the burden of managing payroll.

What are the advantages of integrated time tracking for managers?

Integrated time tracking gives managers the advantage of having precise and up-to-the-minute data on how many hours their employees have worked. This function removes the necessity for manual time cards, minimizes mistakes, and guarantees that employees are compensated for the exact amount of time they have worked. For small businesses, choosing the best CRM and accounting software can further enhance efficiency and accuracy in managing employee time tracking.

Moreover, it enables supervisors to track attendance and productivity, simplifying the process of spotting patterns and dealing with any problems quickly. This results in enhanced workforce management and increased operational effectiveness.

What are the hidden costs in starter payroll solutions?

- Some providers may charge extra for additional features or services, such as advanced reporting or employee benefits management.

- Be aware of setup fees or charges for customer support beyond basic assistance.

- It’s important to read the fine print and ask about any potential costs that might arise as your business grows.

While starter payroll solutions often advertise low initial costs, it’s crucial to consider the potential for additional charges. Understanding the full scope of costs will help you budget effectively and avoid surprises.

What are the necessary security features for a payroll system?

An effective payroll system should have strong security features, such as data encryption, secure sign-in procedures, and frequent security checks. These features safeguard confidential employee data and stop unapproved access. For more on how technology can enhance business operations, explore the best CRM and accounting software for small business.

Furthermore, it’s important that the system adheres to industry standards and regulations to guarantee the privacy and protection of data. By making security a priority, you can protect your business and keep your employees’ trust.

What is the role of direct deposit in these solutions?

Direct deposit in payroll solutions gives employers the ability to deposit employee salaries straight into their bank accounts. This is an automated process that removes the requirement for paper checks, offering convenience and efficiency for everyone involved.

Workers get their paychecks on time and safely, which cuts down on the chances of lost or late payments. Employers also profit from simplified payroll procedures and less paperwork.

Are these payroll systems capable of managing both W-2 and 1099 employees?

Absolutely, the majority of professional payroll systems can manage both W-2 and 1099 employees. They are capable of handling the varying tax requirements and reporting responsibilities for each type of employee, ensuring they are in compliance with IRS rules.

This feature is particularly useful for companies that have a combination of full-time staff and freelance workers.

What if my business needs evolve over time?

If your business needs evolve, it’s crucial to select a payroll solution that can adjust to your changing needs. Many providers offer scalable solutions that can grow alongside your business, offering more features or support as necessary.

It is important to consistently evaluate your payroll system and measure its efficiency to identify if any changes are required to accommodate your evolving requirements.

How do payroll solutions help with tax law compliance?

Payroll solutions help with tax law compliance by doing the tax calculations and filings automatically. This lowers the chance of human error and makes sure all tax obligations are fulfilled promptly. For small businesses, integrating CRM and accounting software can further streamline these processes.

Moreover, these systems typically update themselves to reflect changes in tax laws, keeping your business in compliance without the need for manual intervention. By remaining in compliance, you can avoid fines and concentrate on running your business efficiently. For businesses looking for reliable solutions, consider using a payroll software for small businesses to streamline your operations.