Main Points

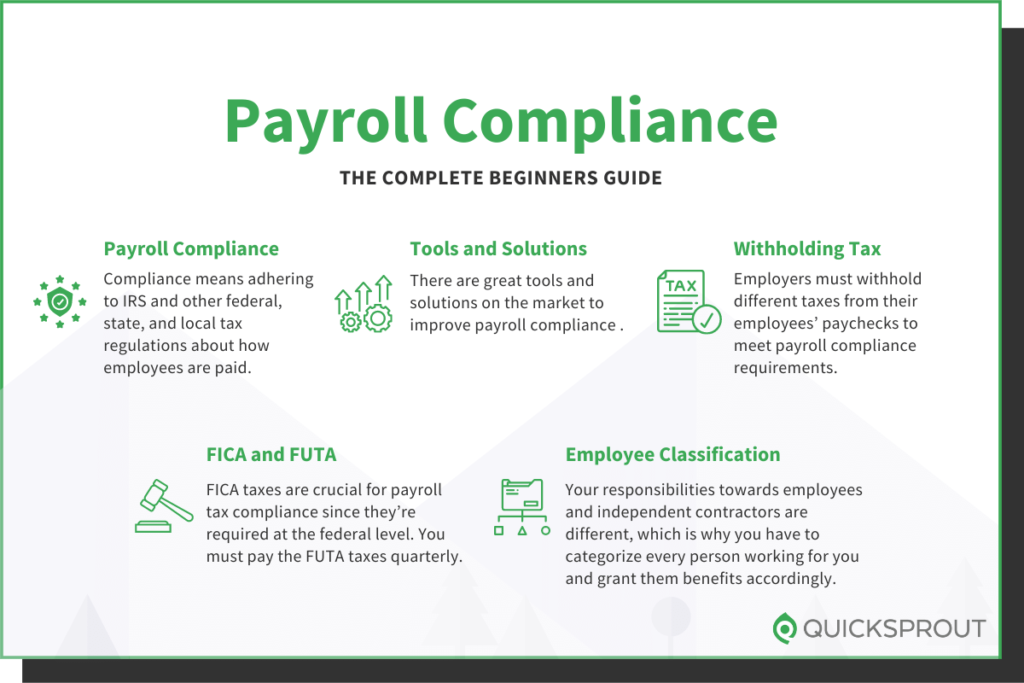

- Companies must adhere to payroll tax regulations to steer clear of fines and legal complications.

- The Employee Retention Tax Credit (ERTC) provides financial assistance to eligible businesses affected by COVID-19.

- It is vital to understand the various types of payroll taxes to ensure correct and timely submissions.

- Frequent changes to tax laws mean businesses must stay up to date and modify their compliance strategies accordingly.

- Employers should utilize tools and resources to simplify compliance and guarantee accurate tax filings.

Compliance with payroll taxes and the Employee Retention Tax Credit (ERTC) is a necessity for all businesses. While these responsibilities may appear intimidating, they are crucial for maintaining the financial wellbeing of your business and avoiding possible fines.

Why Payroll Taxes and ERTC Compliance Matter

The Need for Compliance in Businesses

Payroll tax compliance isn’t just a legal requirement; it’s a fundamental aspect of a company’s financial health. Compliance means businesses are not only contributing to crucial public services like Social Security and Medicare, but also avoiding substantial penalties.

Moreover, adhering to the ERTC guidelines can offer substantial financial benefits. This tax credit was established to aid businesses throughout the COVID-19 pandemic, providing a refundable credit to assist in keeping employees. Consequently, knowing and taking advantage of these credits can drastically help businesses that are having a hard time.

The Consequences of Not Complying

Not complying with payroll taxes can have serious repercussions. The penalties can range from fines to legal action, which can have a significant impact on a business’s operations and reputation. Most importantly, it can lead to a loss of trust from employees, clients, and partners. For more information on payroll tax compliance, you can refer to the IRS guidelines.

Moreover, not adhering to ERTC rules could mean losing out on possible financial aid. Companies that ignore these credits may find it more difficult to stay afloat during economic slumps.

Latest Developments and Regulatory Shifts

The world of payroll taxes and ERTC is always in flux. The latest developments involve adjustments to the ERTC eligibility requirements and the way the credit is calculated, in response to the pandemic’s continuing economic effects. It’s essential for businesses to keep up with these changes to stay within the law and make the most of the credits they’re entitled to.

Businesses must stay updated by regularly reviewing IRS guidelines and consulting with tax professionals. This proactive approach ensures they are always prepared for any regulatory changes.

Getting to Know Payroll Taxes

Payroll taxes are a type of tax that both employers and employees must pay. They are typically a percentage of the wages that employers pay to their employees. These taxes are critical for providing funding for social insurance programs such as Social Security and Medicare.

Categories of Payroll Taxes

Businesses should be mindful of the following categories of payroll taxes:

- Federal Income Tax: Deducted from employee paychecks and remitted to the IRS.

- Social Security and Medicare Taxes: Also known as FICA, these are split between employers and employees.

- Federal Unemployment Tax (FUTA): Paid by employers to support unemployment benefits.

- State and Local Taxes: These vary by location and may include additional unemployment taxes.

What Employers Need to Do and When

Employers need to make sure they withhold the right amount of taxes from employee paychecks and deposit them on time with the IRS. They also need to file payroll tax returns, like Form 941, every quarter.

Deadlines are not flexible. If you miss them, you could face penalties. This is why it’s so important for employers to have a dependable system in place that can handle these tasks effectively.

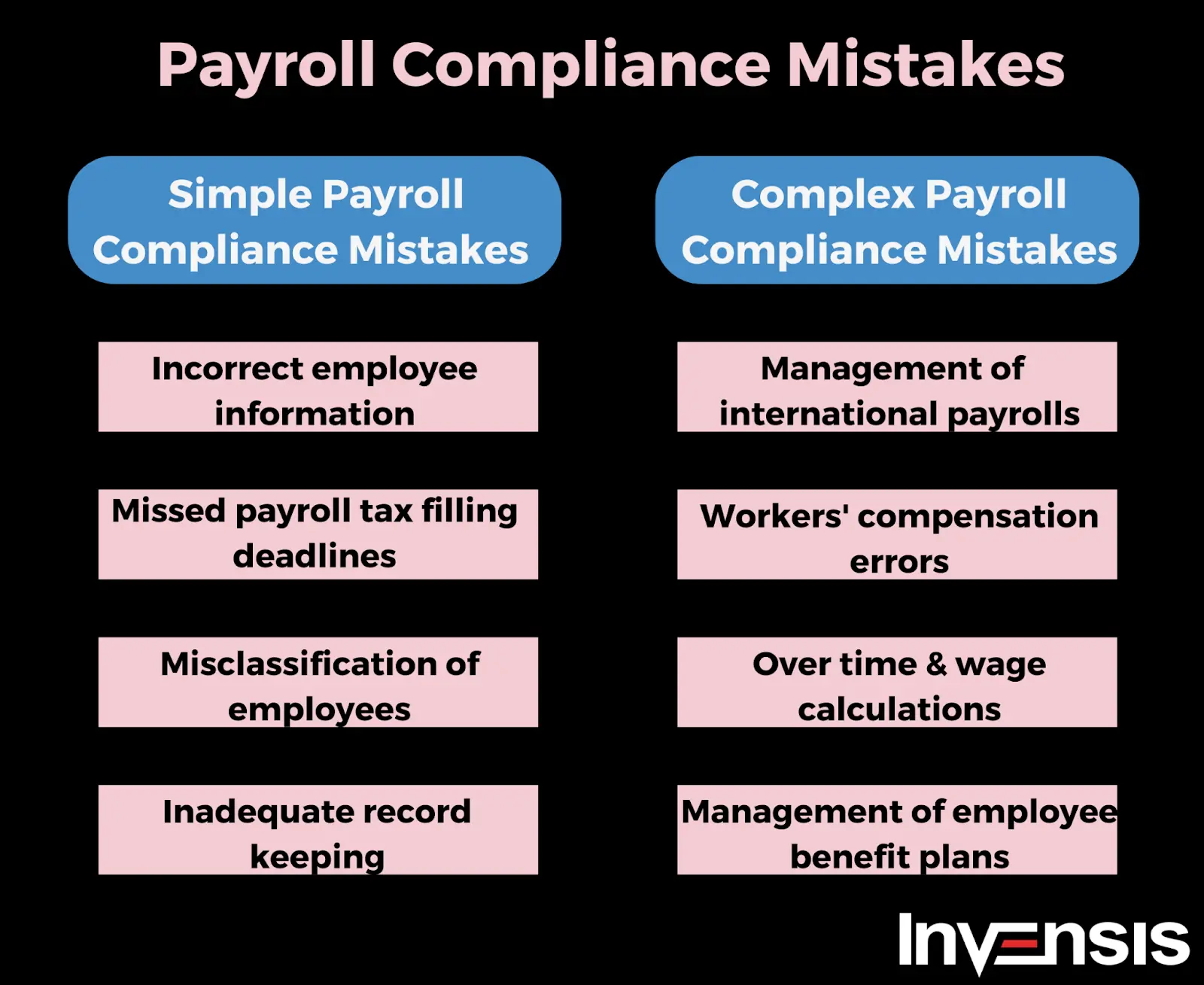

Avoiding Common Errors

There are a number of mistakes that businesses frequently make when it comes to payroll tax compliance. These mistakes include things like miscalculating withholdings and missing the deadlines for filing. Errors like these can result in expensive penalties and interest charges.

Businesses can avoid these pitfalls by:

- Employ robust payroll software to handle calculations and reminders automatically.

- Consistently check tax tables and IRS updates.

- Seek advice from a tax expert to guarantee all compliance areas are addressed.

ERTC Tax Credit, What Is It?

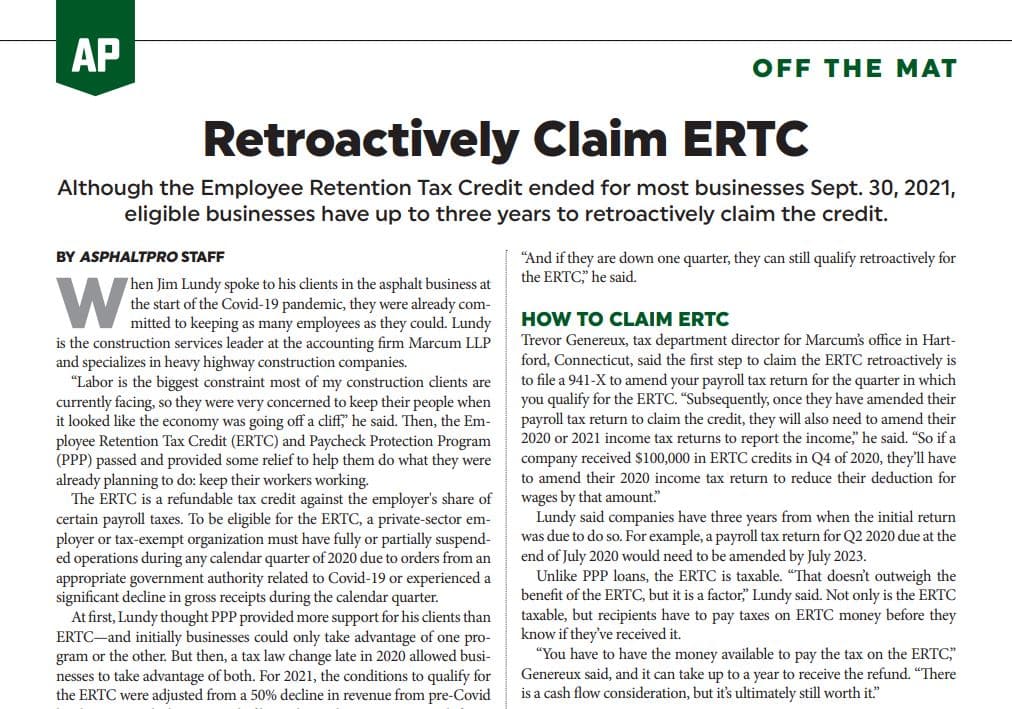

The Employee Retention Tax Credit (ERTC) is a refundable tax credit created to incentivize businesses to retain employees on their payroll throughout the COVID-19 pandemic. It offers financial aid to businesses impacted by economic slumps.

“Eligible businesses can claim the ERTC against a percentage of qualified wages paid to employees, which can result in substantial savings.”

Getting to grips with this credit can be a game-changer for businesses in financial difficulty. It means they can keep their workforce without putting their financial health at risk. For more information, you can visit the frequently asked questions about the Employee Retention Credit on the IRS website.

ERTC’s Introduction and Purpose

The ERTC was established in March 2020 as a part of the CARES Act. The main goal of this tax credit is to motivate businesses to keep their employees, even in the face of financial difficulties brought on by the pandemic.

Important Requirements for Eligibility

There are several factors that determine whether a business is eligible for the ERTC, including the size of the business and how much it was affected by COVID-19. In order to qualify, businesses must show a substantial decrease in gross receipts or have been forced to shut down by the government. For more information on tax relief options available for businesses affected by shutdowns, visit our ERTC tax credit guide.

Businesses must comprehend these criteria to establish their eligibility and guarantee they claim the proper credit amount.

What’s New with ERTC in 2021?

There have been quite a few changes to the ERTC in 2021, including a higher credit percentage and broader eligibility requirements. The goal of these changes is to give more aid to businesses as the pandemic continues to impact the economy.

As a result, companies should thoroughly examine these modifications to fully benefit from the ERTC.

Maintaining Payroll Tax Compliance

Keeping up with payroll tax compliance is crucial for any company that wants to steer clear of legal issues and monetary fines. It’s not just about paying taxes promptly; it’s about making sure every calculation is correct and every form is filled out properly. By prioritizing compliance, companies can shield themselves from expensive errors and uphold their good standing.

Procedure for Precise Calculation and Submission

The precise calculation of payroll taxes involves several important steps. Initially, you have to find out the right amount of taxes to withhold from each employee’s paycheck. This includes federal income tax, Social Security, and Medicare taxes. Using the latest tax tables and payroll software can make this process easier.

Then, be sure to deposit all withheld taxes with the IRS promptly. Employers are required to follow strict deadlines, which typically occur semi-weekly or monthly, depending on the size of their payroll. If you miss these deadlines, you could face penalties, so it can be beneficial to set up automatic reminders or use payroll services.

Importance of Payroll Services

Payroll services are vital in maintaining compliance. They take care of the intricate calculations and filings, allowing business owners to concentrate on other areas of their business. These services bring knowledge and technology to the table that can reduce mistakes and make the payroll process more efficient.

Furthermore, they stay informed about the most recent tax rules and modifications, guaranteeing that your company stays compliant without you having to constantly keep an eye on updates. This assistance can be priceless, particularly for small businesses with limited resources.

When it comes to picking a payroll provider, you should take into account their track record, the scope of services they provide, and their capacity to work seamlessly with your current systems. A trustworthy provider can be a key ally in ensuring compliance and lightening administrative loads.

Automation Tools and Resources

Tools for automation can significantly improve compliance by decreasing manual errors and improving efficiency. For example, payroll software can automate calculations, create reports, and remind you of critical deadlines. This software guarantees that all parts of payroll tax compliance are managed smoothly.

Moreover, there are internet resources and platforms that provide complete guides and updates on tax rules. You can use these resources to educate yourself and your team, ensuring that everyone knows the compliance requirements.

Understanding ERTC Compliance

ERTC compliance means knowing what you need to do and what documentation you need to provide to correctly claim the Employee Retention Tax Credit. This is important if you want to get the most out of the program.

Keeping Records and Documenting

For ERTC compliance, appropriate documentation is critical. Companies need to keep comprehensive records of employee salaries, business income, and any government directives that affected operations. This data is required to confirm eligibility for the credit.

Keeping these records tidy and within reach is critical because the IRS may ask for them to confirm your assertions. Using a digital filing system can streamline this process and minimize the chance of misplacing critical paperwork. For more information, you can refer to the IRS guidelines on record-keeping.

- Hold onto copies of all payroll tax filings and any documents that support them.

- Make a record of any changes in your business operations that were caused by COVID-19.

- Keep a record of all communications with your tax professionals or advisors.

Keeping thorough records will help your business be ready for any audits or inquiries that relate to your ERTC claims.

Accurate ERTC Credit Calculation

For compliance and to get the most out of your credit, it’s critical to calculate the ERTC accurately. The credit amount is determined by a percentage of the qualified wages you pay your employees. This percentage has shifted over time due to changes in legislation.

Hence, keeping up-to-date with the latest rules and seeking advice from a tax expert if necessary is crucial. They can confirm that your calculations are correct and that you’re claiming the appropriate amount of credit.

Correcting Mistakes on Returns: Using Form 941-X

Should you find mistakes on your original payroll tax filings or if you need to claim more ERTC credits, you might need to file a corrected return using Form 941-X. This form gives you the ability to fix previously filed Forms 941 and claim any extra credits you are owed.

It’s a good idea to get help from a tax professional or your payroll provider when filing an amended return. They can guide you through the process and make sure your amended return is accurate and complete.

Ways to Make Compliance Easier

Making compliance with payroll taxes and ERTC rules simpler can save business owners time and stress. By using certain tactics, you can make the process more efficient and concentrate on expanding your business.

As previously discussed, a good approach is to take advantage of technology and automation tools. These tools can take care of many of the day-to-day tasks related to compliance, lowering the chances of mistakes and providing more time for other important tasks.

Delegating compliance tasks to professionals can be advantageous. Collaborating with specialists guarantees that your business meets all regulatory standards without you having to become a specialist.

Lastly, providing consistent training and updates for your staff can ensure everyone is aware of compliance requirements and any changes in regulations. This will ensure your team is prepared to handle compliance tasks efficiently and with confidence.

Understanding payroll taxes is crucial for business owners to ensure compliance with federal regulations. One important aspect to consider is the Employee Retention Tax Credit (ERTC), which can provide significant financial relief. To navigate these complexities, many businesses seek expert guidance from consultants who specialize in tax credits and compliance. Staying informed about the latest updates and strategies can help businesses maximize their benefits while adhering to legal requirements.

Using Technology for Better Tax Management

Technology is a game-changer in today’s tax management. It can automate everything from payroll processing to tax filings, making the lives of business owners easier and ensuring accuracy.

Delegating Compliance Responsibilities

Delegating compliance responsibilities to professionals can offer a sense of security. Tax professionals and payroll service providers possess the expertise and tools to make sure your business stays in line with all rules and regulations.

Continuous Education and Updates for Your Team

It’s important to keep your team in the loop about compliance needs. By providing continuous education and updates on tax laws, your team will be better equipped to manage compliance tasks.

Final Thoughts: Protecting Your Business From Non-Compliance

Failing to comply with payroll taxes and ERTC rules can have severe consequences for any business. By making compliance a priority, you protect your business from possible legal problems and financial penalties. Compliance also helps preserve your business’s reputation and builds trust with employees and stakeholders.

The Long-Term Payoff of Following Tax Rules

Sticking to tax rules pays off in the long run. It lets businesses run smoothly without worrying about surprise fines or audits. On top of that, being compliant means businesses can make the most of tax credits and deductions that are available, which helps them stay financially healthy.

- Enhanced financial stability and predictability.

- Boosted trust and credibility with stakeholders.

- Eligibility for financial incentives and credits like the ERTC.

Crucially, compliance allows businesses to lay a solid foundation for growth and success. By following tax regulations, businesses can concentrate on growing their operations and reaching their objectives.

Additionally, maintaining compliance creates a positive workplace. Workers are more inclined to trust and stay loyal to companies that fulfill their legal and financial responsibilities.

Last Minute Advice for Staying Updated

It’s essential to stay updated on payroll tax and ERTC rules to maintain compliance. Businesses can keep abreast of changes and sidestep potential issues by frequently checking IRS updates and seeking advice from tax professionals.

Moreover, using technology and automation tools can make compliance efforts easier and decrease the likelihood of mistakes. By putting these strategies into action, companies can make sure they stay compliant and get the most out of their financial benefits.

Common Questions

It’s not always easy to get a handle on payroll taxes and ERTC compliance. Here are some common questions to help clear up any confusion:

What are the consequences of not adhering to payroll tax laws?

If your business does not adhere to payroll tax laws, it could face penalties, interest charges, and even legal action. This could significantly harm your business’s financial health and reputation. For more information on maintaining compliance, you can refer to the IRS guidelines.

“Failing to comply can result in substantial monetary and legal penalties, such as fines and audits.”

As a result, it’s essential to put compliance first and make sure all tax responsibilities are fulfilled correctly and promptly.

How do I know if my business is eligible for the ERTC?

You can find out if your business is eligible for the ERTC by looking at the eligibility criteria provided by the IRS. This involves evaluating how COVID-19 has affected your business and whether there has been a reduction in gross receipts. For further guidance, you might want to explore ERTC tax relief options to better understand your eligibility.

Are payroll providers capable of managing all aspects of ERTC compliance?

Payroll providers can help with a lot of ERTC compliance aspects, including making calculations and submissions. However, you should make sure they have the knowledge and resources to manage ERTC-specific requirements.

Getting advice from a tax expert can also give you extra help and make sure all compliance issues are taken care of.

What happens if I file ERTC incorrectly?

Unfortunately, you could face penalties and interest charges if you file ERTC incorrectly. That’s why it’s so important to double-check your calculations and make sure you have all your documentation in order.

How frequently should I check my company’s compliance status?

It is crucial to frequently check your company’s compliance status to ensure that all requirements are being met. You might want to consider doing this on a quarterly or yearly basis to identify and resolve any possible problems.

What can small businesses use to improve compliance?

There are several resources small businesses can use to improve compliance, including:

- IRS’s online guides and tutorials.

- Advice from tax professionals or advisors.

- Tools for payroll software and automation.

Businesses can improve their compliance efforts and reduce the risk of errors by using these resources.

What changes have been made to the ERTC since it was first introduced?

The ERTC has seen numerous changes since it was first introduced, including changes to who can qualify and how much they can receive. These changes were made in response to the changing economic landscape caused by the COVID-19 pandemic and are designed to provide more support to businesses. For more information on tax relief options, visit our guide on ERTC tax credit relief options.

What steps should I take if I find mistakes in previous returns?

If you find mistakes in previous returns, it’s crucial to rectify them as soon as possible. You may want to file an amended return using Form 941-X to fix any errors and claim any extra credits you’re entitled to. For more information on compliance, consider reviewing ERTC tax regulations.

By consulting a tax professional, you can get guidance and ensure that the amended return is accurate and complete. By addressing errors quickly, you can minimize potential penalties and protect your business’s financial health.

In the end, making payroll tax and ERTC compliance a priority is critical for any company. By staying up-to-date and utilizing the resources at your disposal, you can guarantee that your company stays compliant and takes full advantage of its financial benefits.