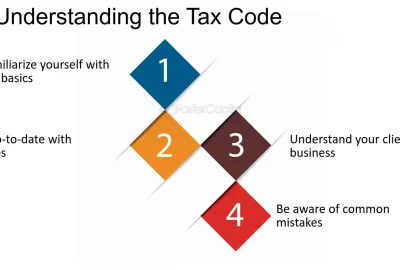

Navigating the business tax code can be daunting, but our step-by-step guide breaks down the essentials. Learn to manage taxes with ease, identify liabilities, and leverage deductions to benefit your business. Explore practical examples for a clearer understanding…

Read More

Unlock tax savings for your minority-owned business! Learn about tax benefits, credits, and resources to grow your business and maximize savings. Find out how to apply and save…

Read More

In the face of economic downturns, resilience is key. Strengthen your financial base, focus on customer retention, diversify your market, adapt offerings, and embrace tech advancements…

Read More

Small business owners, it’s time to bust some tax credit myths! Did you know you’re also entitled to these savings, not just large corporations? Learn the truths and optimize your tax advantages…

Read More

Navigating small business tax relief can be daunting. Discover how tools like the ERTC provide aid during shutdowns and proactive planning can secure financial stability. Learn the strategies to weather the storm…

Read More

Unlock the secrets of Small Business Tax Planning with our guide. Discover essential tools, smart tactics, and tax deductions to maximize your savings and empower your business’s financial health. Start your journey to tax savvy success…

Read More

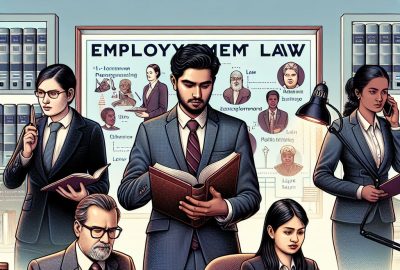

Small business owners juggle countless tasks, yet understanding employment laws is crucial for smooth operation. Learn to distinguish between employees and contractors, navigate legal hiring, ensure proper pay, and keep comprehensive records…

Read More

Unlock the power of blogging for your small business! Discover practical tips to engage customers, showcase your expertise, and improve online presence. Learn about finding your niche, content planning, SEO, and more…

Read More

Discover key strategies for managing remote teams effectively, from leveraging cutting-edge communication tools to fostering trust and collaboration across the digital divide. Learn how to keep your remote workforce engaged and productive, and create a harmonious online environment for small business success…

Read More

Combat small business employee burnout with practical strategies. Learn the importance of flexible scheduling, supportive environments, and setting achievable goals to prevent the energy drain that can cripple your team’s productivity and morale. Discover how…

Read More