Express funding provides small businesses with quick access to capital, perfect for urgent needs. With interest rates from 5% to 12%, these loans often require a minimum credit score of 650. Understanding financial health and preparing documentation can ease the application process, enabling faster approval…

Read More

Top B2B CRM Software for Business Sales & Solutions

- Apr 13, 2025

CRM software is a game-changer for B2B businesses, centralizing customer data and enhancing sales processes. Top solutions like Salesforce and HubSpot streamline interactions, automate tasks, and provide invaluable insights, empowering companies to make informed decisions and strengthen client relationships for lasting success…

Read More

Innovation is pivotal in crafting a resilient business strategy, enabling adaptability to market disruptions. Companies embracing innovation are more likely to excel by integrating new ideas and technologies. A culture open to change, coupled with technological advancements, is essential for sustainable success and agility in today’s volatile landscape…

Read More

Launching a new product is pivotal for business success. It involves strategic planning, understanding your target market, and implementing diverse marketing channels. Engaging early adopters can create momentum. Let’s explore detailed strategies to ensure your next product launch propels your brand to new heights…

Read More

Automated tax rebate calculators simplify tax season by reducing the time and errors associated with manual calculations. With their accuracy and up-to-date compliance, they ensure you claim every eligible rebate without worry, making them invaluable tools for both individuals and businesses alike…

Read More

Speedy Business Funding Best Loans For Quick Captial

- Apr 09, 2025

Fast capital is essential for businesses needing quick solutions for unexpected challenges or growth opportunities. Options like short-term loans, business lines of credit, and invoice factoring provide quick access to funds, helping entrepreneurs remain competitive and agile in a fast-paced market…

Read More

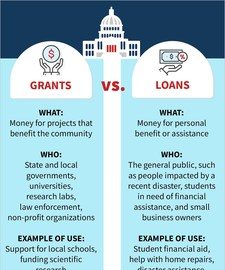

Discover how government small business grants can provide the financial boost your small business needs without the burden of repayment. Learn the key steps for applying, including understanding eligibility, creating a compelling business proposal, and conducting thorough research to enhance your chances of success…

Read More

Professional Home Services Starter Payroll Solutions

- Apr 06, 2025

Discover how professional home services starter payroll solutions can simplify payroll management for your business. Streamline payments, ensure tax compliance, and improve employee satisfaction with integrated tools. Focus on delivering exceptional service while leaving payroll headaches behind…

Read More

Preparing for an ERTC audit for your non-profit theater can seem daunting, but with organized documentation and a clear understanding of eligibility criteria, the process becomes manageable. Stay proactive, avoid common pitfalls, and ensure compliance to protect your theater and maximize your entitled benefits…

Read More

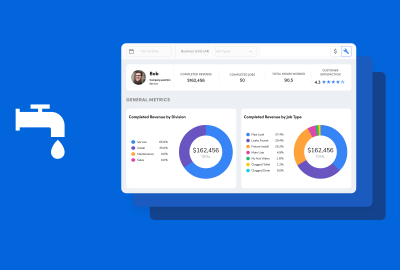

CRM software enhances plumbing businesses by managing customer interactions and streamlining operations. It boosts customer satisfaction, leading to increased revenue. Essential features include scheduling, invoicing, and tool integration. Top solutions like Nutshell and Commusoft offer comprehensive support for evolving needs, despite challenges like data migration and team resistance…

Read More