Organizing community events is an excellent way to engage with your local audience, build relationships, and market your brand. When done correctly, these events can leave a lasting impact and create a sense of community. Let’s explore how you can host successful community events…

Read More

Customer feedback is vital for understanding customer needs and enhancing products. It helps in building trust and loyalty, leading to increased retention. Grasping customer desires is key to providing a great experience and improving services…

Read More

Innovation is crucial for small business growth. By introducing new products, services, or processes, businesses can stay competitive and solve problems. Quick wins from innovation include better efficiency, lower costs, and happier customers. Learn how to drive growth through innovation with real-world examples…

Read More

Professional development is a vital investment for small businesses. By fostering employees’ growth in skills and knowledge, businesses can remain competitive and attain lasting success. Discover how enhancing employee performance boosts productivity and morale while reducing turnover, leading to a thriving enterprise…

Read More

Efficiency is vital for small businesses. When you operate efficiently, you save time and money, which can be put back into your business. This results in improved productivity, higher customer satisfaction, and increased profitability. Furthermore, efficient operations can give you a competitive advantage in the market…

Read More

Boosting cash flow is crucial for the survival of any business. One of the most effective ways to do this is by negotiating better terms with your vendors and suppliers. Here are some practical tips to help you accomplish this…

Read More

Discover how tax incentives for minority-owned businesses can lower your tax bill. Learn about certification requirements, federal and state tax advantages, and strategies to maximize savings by keeping accurate records and consulting tax professionals…

Read More

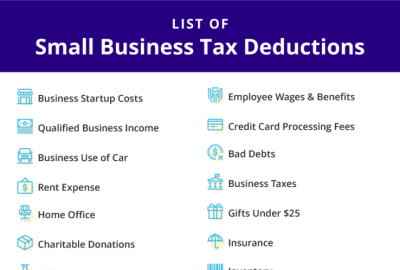

Tax deductions can significantly lower your taxable income, helping you save money. Understand essential deductions like home office, vehicle expenses, office supplies, travel costs, and health insurance premiums to keep more of your hard-earned money. Here are the top 10 tips for small business owners…

Read More

Growing a small business is about more than just increasing profits; it’s about creating a sustainable model that can adapt and thrive in a changing market. Understand your customers, create a detailed business plan, and ensure financial stability…

Read More

Small businesses can thrive in competitive markets through influencer marketing. By collaborating with trusted influencers, you can reach new audiences and drive revenue growth. Learn how to set clear objectives, choose the right influencers, and measure performance for continuous improvement…

Read More