Main Points

- Non-profits are required to submit Form 990 each year to maintain their tax-exempt status.

- Unrelated Business Income Tax (UBIT) is applicable to income from activities that are not part of the non-profit’s mission.

- Engaging the services of tax consultants can assist in navigating the complex tax regulations.

- Planned giving programs can improve financial stability and provide tax benefits.

- Keeping accurate records is vital for compliance and preparing for audits.

Important Non-Profit Tax Planning Considerations

“Non-profits are governed by different tax regulations than for-profit businesses, but compliance is just as important. Failure to comply with tax laws can put a non-profit’s tax-exempt status at risk, leading to unexpected penalties and increased scrutiny.”

Operating a non-profit organization has its unique hurdles, particularly in the realm of tax planning. Although non-profits have tax-exempt status, they must follow certain rules to keep this advantage. Grasping the subtleties of these rules is key for any non-profit that wants to succeed financially and carry out its mission efficiently.

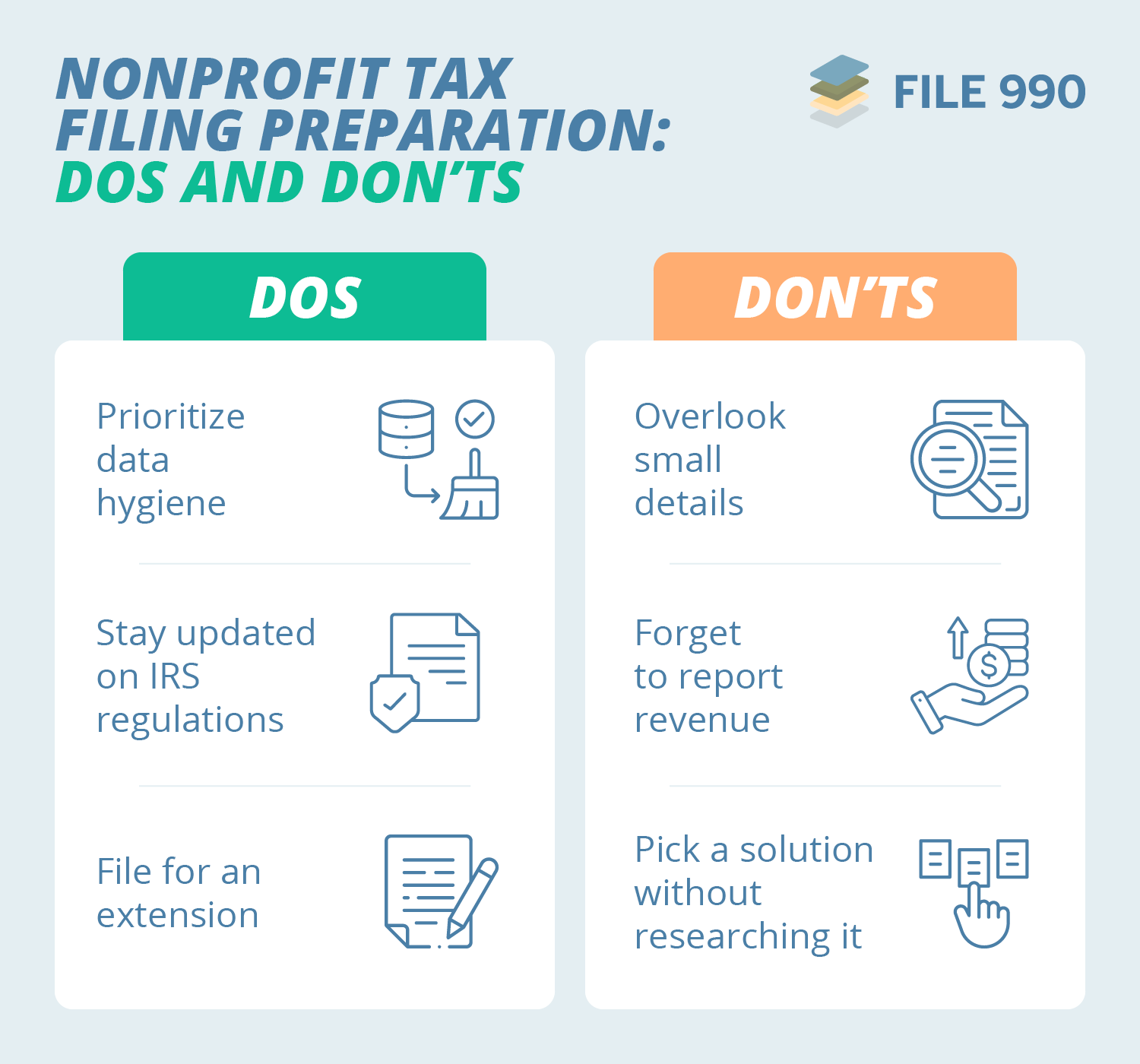

First and foremost, non-profits must stay informed about the tax laws that pertain to them. This involves staying current with IRS guidelines and making sure that all required forms, such as Form 990, are submitted on time. In addition, non-profits need to be careful about how they earn money, as not all income is exempt from taxes.

Why Non-Profits Need to Plan Their Taxes Effectively

Effective tax planning isn’t just about meeting the requirements of the law. It’s a strategic financial move. By planning their taxes effectively, non-profits can make the most of their resources and ensure that more of their funds go towards their programs and initiatives. This involves knowing which activities are considered mission-related and which could trigger UBIT.

Non-profits can also use tax planning to pinpoint areas where they can save money. By scrutinizing their financial activities, these organizations can figure out how to lower their tax bills and better their financial well-being. This forward-thinking approach is key to ensuring their longevity and expansion.

Frequent Tax Hurdles and How to Overcome Them

A frequent tax hurdle non-profits encounter is Unrelated Business Income Tax (UBIT). This tax is applied to income that comes from activities not directly connected to the organization’s primary mission. To avoid UBIT, non-profits need to clearly define activities related to their mission and make sure any activities that generate income are in line with this mission. For more information on managing taxes, check out these strategies for managing non-profit taxes.

Keeping up with federal and state tax regulations is another hurdle. Non-profits need to keep abreast of changes in tax laws and make sure they meet all filing requirements. This includes filing the Form 990 every year, which gives the IRS detailed information about the organization’s finances and activities.

Tips for Improving Non-Profit Tax Planning

Improving tax planning is not just about dodging penalties; it necessitates a strategic approach to managing finances. Non-profits can bolster their financial stability and concentrate more on their mission by adopting efficient tax strategies. For more insights, explore our non-profit tax credits maximization guide.

Hiring Professional Tax Advisors

One of the most effective methods to traverse the intricate realm of non-profit taxation is by hiring professional tax advisors. These professionals possess a profound knowledge of non-profit tax laws and can offer crucial advice on adherence and strategic planning.

- Tax consultants can help find possible tax savings opportunities.

- They provide understanding of the newest tax laws and how they affect non-profits.

- Professional guidance guarantees that all required forms and paperwork are filled out correctly and turned in on time.

Non-profits can concentrate on their main mission while knowing their financial operations are following all laws by working with tax consultants.

Establishing and Sustaining Planned Giving Initiatives

For non-profits, planned giving initiatives are a great method to ensure stable funding in the long run, while also providing tax advantages for donors. These initiatives enable donors to make large donations through bequests, trusts, or annuities, often leading to significant tax deductions.

In order to create a successful planned giving program, non-profits need to work hand in hand with financial advisors and legal experts. This will make sure that the program is set up in a way that benefits both the organization and its donors to the fullest extent.

Submitting Form 990 and Necessary Paperwork

Submitting Form 990 is a vital responsibility for non-profits to keep their tax-exempt status. This form gives the IRS crucial data about the organization’s financial situation, activities, and management. For further insights, you can explore our non-profit tax credits maximization guide. It needs to be submitted every year, and any mistakes or tardiness can result in fines or even the loss of tax-exempt status.

Non-profits should maintain meticulous records of all financial transactions throughout the year to guarantee precise filing. This includes documenting all income sources, expenses, and any governance changes. Moreover, it’s a good idea to check the IRS guidelines for Form 990 to ensure compliance with the most recent requirements.

Handling Unrelated Business Income Tax (UBIT)

Unrelated Business Income Tax (UBIT) can be a complex field for non-profits. UBIT applies to income from activities that are not substantially related to the organization’s tax-exempt purpose. For instance, if a non-profit runs a gift shop that sells items unrelated to its mission, the income earned may be subject to UBIT.

Non-profits need to frequently review their income-generating activities to handle UBIT efficiently. It’s crucial to differentiate between activities related to the mission and unrelated activities. If an activity is deemed unrelated, think about how to change it to align better with the organization’s mission or look into possible exemptions that might be applicable.

Boosting Savings Via Donor Donations

Donor donations are a critical funding source for non-profits, and there are tactical methods to boost savings via these donations. By using charitable donations and employing donor-advised funds, non-profits can improve their fiscal health while offering tax advantages to their backers.

Maximizing Charitable Donations

Charitable donations can have a big effect on a non-profit’s bottom line. To inspire more giving, make sure you clearly spell out the tax advantages to potential donors. Donors can often write off their donations on their taxes, which gives them a financial reason to donate.

Furthermore, non-profits should provide different giving alternatives, such as single donations, regular contributions, and legacy gifts. By offering versatility, organizations can attract a wider variety of donors and ensure more steady funding streams.

Using Donor-Advised Funds

Donor-advised funds are a useful tool for non-profits to receive donations and provide donors with a simple way to handle their charitable donations. These funds enable donors to give cash, securities, or other assets, get an immediate tax deduction, and then suggest grants to their preferred charities over time.

For successful use of donor-advised funds, non-profits need to collaborate with a financial institution or community foundation to manage the fund. This collaboration guarantees the fund is managed properly and gives donors peace of mind that their donations are put to good use. For more insights on compliance, explore tax compliance strategies for non-profits.

Explaining Tax Benefits to Donors

Non-profits need to make sure that they are clearly explaining the tax benefits of donating to their cause. A lot of potential donors might not know about the deductions that they could take advantage of, so it’s important to make sure that these benefits are clearly stated in fundraising materials and during conversations with donors. For more information, you can explore tax strategies for non-profits to ensure compliance and maximize benefits.

Think about offering instances of how contributions can decrease taxable income and add testimonials from existing donors who have profited from these deductions. This method not only informs donors but also establishes trust and promotes larger donations.

Getting Ready for IRS Audits and Checks

Although no non-profit wishes to confront an IRS audit, it’s crucial to be ready in case one transpires. Establishing a robust audit defense plan and guaranteeing precise record maintenance can assist organizations in handling this procedure effortlessly and preserving their tax-exempt standing.

Building a Solid Strategy for Audit Defense

Non-profits can start building a solid strategy for audit defense by making sure all financial records are correct and current. This includes keeping detailed documentation of all transactions, changes in governance, and compliance with IRS regulations.

In addition, it’s a good idea for non-profits to regularly carry out internal audits. This can help them spot any potential issues before they become a problem during an IRS examination. By dealing with these issues ahead of time, non-profits can present a well-organized and compliant case to the IRS.

Maintaining Precise Records

Keeping precise records is the key to any successful audit defense strategy. Non-profits should establish a trustworthy accounting system that monitors all financial activities as they happen. This system should be routinely checked and updated to mirror any changes in the organization’s operations or financial status.

It’s important for non-profits to keep not only financial records, but also a record of all governance decisions. This includes things like board meeting minutes and policy changes. Having these records provides proof that the organization is dedicated to being transparent and accountable. This can be helpful if an audit ever occurs.

Getting Help with IRS Audits

When a non-profit organization is chosen for an IRS audit, it is crucial to get help from a professional. Tax advisors and legal consultants who specialize in non-profit taxes can offer much-needed advice and help during the audit.

These experts can assist in preparing necessary paperwork, liaise with IRS representatives, and tackle any queries or issues that crop up during the review. By utilizing professional help, non-profits can confidently manage the audit process and reduce any potential interruptions to their work.

Final Thoughts on Tax Strategies for Non-Profits

Non-profits must strategically plan their taxes to stay compliant, save money, and concentrate on their mission. Non-profits can improve their financial stability and keep making a difference in their communities by using effective strategies such as hiring professional consultants, using donor contributions, and getting ready for audits. For more detailed guidance, explore tax strategies for non-profits to ensure federal and state compliance.

Non-profits need to keep their eyes on the ball when it comes to changes in tax laws and regulations. By staying on top of things and taking a proactive approach, they can adjust their strategies to keep on being successful and growing.

Why Strategic Tax Planning is Crucial for Non-Profits

Non-profit organizations can better protect their tax-exempt status and optimize their financial resources through strategic tax planning. By fully understanding and complying with tax laws, non-profits can avoid fines and reduce their tax obligations, thereby freeing up more money for their mission-focused activities.

Furthermore, strategic tax planning allows non-profits to pinpoint possible areas for cost reduction and financial expansion. By coordinating their financial strategies with their organizational objectives, non-profits can improve their longevity and influence on the communities they cater to. For more insights, explore these tax credits tips and strategies that can benefit your organization.

Looking Ahead: Non-Profit Expansion

Non-profits need to keep an eye on the horizon, staying up-to-date on shifts in tax laws and regulations. This requires routinely revisiting and revising tax strategies to maintain compliance and financial stability. Non-profits should also think outside the box when it comes to fundraising strategies and broaden their revenue streams to create a stronger financial base.

Moreover, putting resources into technology and financial management systems can simplify processes and boost efficiency. By using data and analytics, non-profits can make educated decisions that stimulate growth and boost the impact of their mission. For more insights, explore these small business tax planning tips to enhance financial strategies.

Common Questions

Here are some common questions and answers to help non-profits understand the ins and outs of tax planning:

Why is Form 990 important for non-profits?

Form 990 is important for non-profits because it gives the IRS a detailed look at the organization’s finances, activities, and governance. It’s necessary to file this form every year to keep your tax-exempt status and show transparency and accountability to donors and stakeholders. For more information on maintaining compliance, explore these strategies for non-profit organizations.

What steps should a non-profit take to keep its tax-exempt status?

A non-profit needs to exclusively engage in activities that are charitable, religious, or educational to keep its tax-exempt status. It’s also important that the non-profit’s activities stay true to its mission statement. On top of that, the non-profit must regularly file the necessary forms, such as Form 990, and stick to IRS rules.

Non-profits need to steer clear of too much lobbying or political activities, as it could put their tax-exempt status at risk. Frequently checking and updating organizational policies and procedures can help maintain compliance. For more information on maintaining compliance, consider these tax credit opportunities that can benefit your organization.

How do Unrelated Business Income Taxes (UBIT) impact non-profits?

When a non-profit organization earns income from activities that are not directly related to their main mission, they are subject to Unrelated Business Income Tax (UBIT). This tax has the potential to increase the tax liabilities of non-profits and necessitate the filing of extra tax forms.

Non-profits need to carefully review their income-generating activities to reduce UBIT. If they find an activity that doesn’t align with their mission, they should consider changing it to better fit their purpose or look into possible exemptions.

What are the financial benefits of planned giving programs for non-profits?

Planned giving programs provide non-profits with a strategy for securing funding over the long term, while also offering tax benefits to donors. These programs enable donors to make major donations in the form of bequests, trusts, or annuities, which often lead to significant tax deductions.

Setting up a planned giving program can provide non-profits with a solid financial base and inspire donors to give more substantial, more meaningful donations. This approach also helps to solidify relationships with donors and guarantees continued backing for the organization’s objectives.

- Meet with financial advisors to properly structure planned giving programs.

- Clearly convey the advantages of planned giving to prospective donors.

- Provide a variety of planned giving options to attract a wide range of donors.

How do tax consultants assist in non-profit tax planning?

Tax consultants are crucial to non-profit tax planning as they offer expert advice on compliance, tax strategies, and financial management. They assist non-profits in understanding complicated tax regulations and finding potential savings opportunities.

Advisors also help with the preparation and filing of necessary tax forms, such as Form 990, to ensure accuracy and adherence to IRS guidelines. By working with tax advisors, non-profits can focus on their mission while maintaining financial stability and transparency. For new organizations, understanding essential tax guidance is crucial for compliance and growth.

Non-profit organizations face unique challenges when it comes to tax planning and compliance. Understanding the intricacies of non-profit tax laws is crucial for maintaining compliance and maximizing the organization’s financial health. For those looking to deepen their understanding, exploring tax strategies for non-profits can provide valuable insights into federal and state compliance requirements.

Besides adhering to the rules, advisors provide strategic advice that can improve a non-profit’s financial stability and longevity. Their knowledge enables institutions to adjust to evolving tax regulations and make educated choices that promote expansion, such as understanding complex regulations.

What steps can a non-profit take to prepare for a possible IRS audit?

Being prepared is crucial for successfully getting through an IRS audit. Non-profits need to keep precise and current financial records, which includes keeping track of all transactions, changes in governance, and adherence to IRS rules.

By carrying out regular internal audits, non-profit organizations can pinpoint potential issues before they become a problem during an IRS examination. By taking a proactive approach to these issues, non-profits can present a well-structured and compliant case to the IRS.

What is the role of donor-advised funds in non-profit organizations?

Donor-advised funds offer a versatile giving alternative. Donors can donate cash, securities, or other assets to these funds, get an instant tax deduction, and then suggest grants to their preferred charities over time. For more information on maximizing tax benefits, explore our non-profit tax credits maximization guide.

By teaming up with a financial institution or community foundation that oversees the fund, non-profits can take advantage of donor-advised funds. This collaboration guarantees that the fund is managed properly and gives donors confidence that their donations will be put to good use.

Non-profits can draw in more donors and ensure steady funding for their projects and campaigns by providing donor-advised funds. This method of giving also gives donors more influence over their charitable donations, improving their overall experience of giving.