Important Points

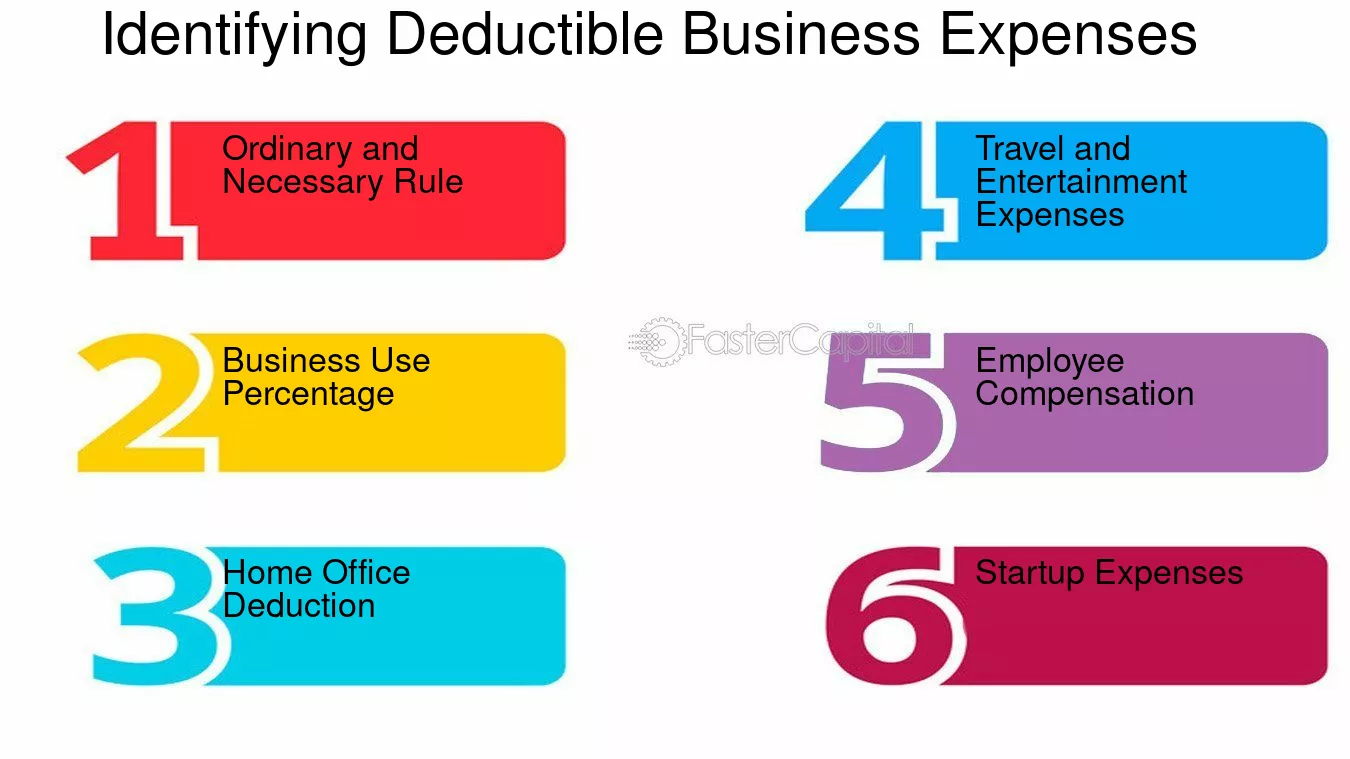

Knowing what business tax deductions you can claim can dramatically decrease your taxable income, which saves you money.

Office supplies, the cost of advertising, and the salaries you pay your employees are all examples of common deductible expenses.

In order to qualify for a deduction, the expense has to be “ordinary and necessary” in the course of your business.

Keeping detailed records is important in case you need to substantiate your deductions in the event of an audit.

Working with a tax professional can help you make the most of your deductions and ensure you’re in compliance with IRS guidelines.

The Importance of Identifying Business Tax Deductible Expenses

As a business owner, knowing what expenses are tax deductible is key. These deductions reduce your taxable income, so you pay less in taxes. It’s like having a secret weapon in your financial arsenal. But, figuring out which expenses qualify can be a bit of a challenge.

For business expenses to be deductible, they must meet specific criteria. They should be both “ordinary” and “necessary” for your industry. Ordinary implies that they are common and accepted in your field. Necessary means they are helpful and suitable for your business.

For instance, if you run a bakery, you’ll need to buy flour and sugar to make your products. These are ordinary and necessary expenses. On the other hand, a gym membership might not be necessary unless it’s directly related to your business operations.

Identifying the correct expenses can save you a lot of money. It enables you to put money back into your business, allowing it to expand and prosper. As a result, it’s critical to understand what you can deduct and how to correctly record it.

Understanding Tax Deductions for Entrepreneurs

Business tax deductions are costs that the IRS permits you to deduct from your overall income. This decreases your taxable income and, as a result, your tax liability. It’s akin to receiving a tax break.

As a business owner, tax deductions can make a huge difference. They can be the difference between a year of profit and a year of barely getting by. But to make the most of them, you need to know the rules and keep good records.

It’s crucial to keep your expenses organized throughout the year. This will make tax season much easier. You won’t have to stress about finding receipts or trying to remember what you spent money on months ago.

The Perks of Tax Deductions for Your Company

Think about having extra cash to put back into your company. That’s the advantage of tax deductions. They lower your taxable income, which in turn decreases your tax liability. As a result, you’ll have additional money to grow your business, employ more people, or enhance your products and services.

Moreover, tax deductions can boost your cash flow. Having more money at your disposal makes it easier to handle daily expenses. You can also plan for future growth without the stress of cash shortages. For more information, check out this guide on small business tax deductions.

Moreover, knowing about deductions enables you to make more informed business choices. For example, you might choose to buy new machinery before the year is over to benefit from a deduction. This sort of strategic planning can improve your business’s financial well-being.

Typical Business Tax Deductible Expenses

Let’s explore some of the most typical business expenses that you can deduct. Familiarizing yourself with these can help you identify opportunities to reduce your tax bill.

Costs of Office Supplies and Expenses

The office expenses category is a major source of deductions. It covers all the items you need to keep your office running efficiently. Consider items such as pens, paper, and printer ink. For more information on tax deductions, check out this guide on small business tax deductions.

- Office supplies: pens, paper, ink

- Furniture: desks, chairs

- Equipment: computers, printers

Typically, these items are deductible as long as they are used for business purposes. However, remember that personal use can make things more complicated. So, it’s always a good idea to keep business and personal expenses separate.

Costs for Advertising and Marketing

Advertising and marketing are crucial for business expansion. Luckily, these costs are generally tax-deductible. This encompasses expenses for online advertisements, promotions on social media, and even business cards.

Putting money into marketing not only boosts your exposure, but it also gives you a tax benefit. It’s a two-for-one deal. Just remember to keep track of all your marketing costs, such as receipts and invoices.

Wages and Benefits for Employees

Example: If you pay an employee an annual salary of $40,000, you can deduct that salary. Additionally, benefits such as health insurance and contributions to retirement are deductible.

For most businesses, employee compensation is one of the largest expenses. The good news is that these costs are tax deductible. This includes salaries, wages, and bonuses. Furthermore, employee benefits such as health insurance and retirement plans are also deductible. For more insights, check out these business tax planning tips and strategies.

Offering competitive salaries and benefits helps you attract and retain the best employees. Plus, with deductions, you can manage these expenses more effectively.

Exceptions and Restrictions

Although a lot of business expenses are tax deductible, not every cost is eligible. There are exceptions and restrictions, and it’s important to know these to prevent possible problems with the IRS. For example, personal expenses are usually not tax deductible unless they are directly connected to your business activities. So, you can’t write off the cost of a family holiday, even if you talk about business during the holiday.

Another typical deduction that is not allowed is for capital expenses. These are the costs that are associated with buying long-term assets like buildings or equipment. Instead of being able to deduct them all at once, you have to capitalize and depreciate these expenses over a period of time. This means that you have to spread the deduction over several years, which can make your tax filings more complicated. For further guidance, consider reviewing this business tax planning guide.

Finally, some entertainment costs are no longer deductible. While you can still deduct some meal costs, the IRS has made the rules for entertainment costs more strict. It’s crucial to stay up-to-date on these limits to make sure you’re following the rules and getting as many deductions as you can.

The Struggles of Categorizing Deductible Expenses

It can be a real headache trying to figure out how to classify deductible expenses, especially when you have to navigate the maze of complicated tax laws. Getting your expenses in the right categories is crucial if you want to avoid the stress of audits and the pain of penalties. When you get it wrong, your deductions could be disallowed, and you could end up with a higher tax bill.

The Intricacies of Understanding Tax Law

Tax laws can be intricate and open to interpretation. What one individual deems as an “ordinary and necessary” expense may not be viewed the same by another. This vagueness can make it challenging to identify which expenses are eligible for deductions.

Take, for instance, attending a conference. The registration fee you paid is probably deductible. But if you decided to extend your stay for a vacation, that expense may not be deductible. Knowing these distinctions is key to making sure you’re taking the right deductions.

Steering Clear of Typical Misclassifications

Typical misclassifications can happen when expenses are not correctly categorized. For example, blending personal and business expenses can result in mistakes. To prevent this problem, always maintain separate accounts for business and personal finances. For more insights on managing finances, explore these business tax planning tips.

Another frequent error is misidentifying capital expenses as current expenses. Keep in mind, capital expenses must be depreciated over time. Correctly classifying your expenses guarantees precise tax filings and maximizes your deductions.

Consulting a Tax Professional

With tax laws being so complex, it can be incredibly beneficial to seek the advice of a professional. They can guide you through the maze of deductions, making sure you comply with the law and save as much money as possible.

Additionally, professionals keep up with changes in tax law, which can affect your deductions. By partnering with a specialist, you can concentrate on expanding your business while they take care of the tax specifics.

Useful Tips for Making the Most of Deductions

Getting the most out of your deductions requires careful planning and meticulous record-keeping. By applying a few useful tips, you can make sure you’re making the most of your tax deductions.

Making Use of Tax Software and Tools

By using tax software and tools, you can make the task of keeping track of and categorizing expenses much easier. These tools usually have features that help you find deductions that you might have missed. You can save time and decrease mistakes by automating some of the record-keeping, as explained in this business tax planning guide.

Several tax software programs also provide instructions on the latest tax laws, making sure you’re current with any modifications. This can be especially helpful for small business owners who may not have the means to employ a full-time accountant.

In addition to this, these tools frequently work in tandem with your accounting software, simplifying the task of monitoring expenses and creating reports. This integration can make your tax filing process more efficient and assist you in identifying areas where you could save additional money.

Consulting with a Tax Expert

Even though tax software can be useful, it can’t beat the personalized advice you get from a tax expert. They can offer insights that are specific to your business and help you handle complex tax scenarios.

Moreover, tax experts can provide long-term tax planning assistance, guiding you in making decisions that will be advantageous for your business in the long run. Collaborating with a professional allows you to make sure you’re leveraging all possible deductions.

Keeping Up with Changes in Tax Laws

It’s important to keep up with the frequent changes in tax laws in order to get the most out of your deductions. You can do this by subscribing to tax newsletters, attending seminars, or talking to your tax professional about any changes that could impact your business.

By staying on top of these changes, you can adapt your strategies and ensure you’re following the rules. For example, if new deductions are introduced, you can plan your expenses in a way that lets you benefit fully.

Keeping up-to-date allows you to make tactical choices that match your business objectives and maximize your tax benefits.

How Strategic Planning Affects Tax Deductions

Strategic planning is crucial for making the most of tax deductions. By matching your expenses to your business objectives, you can make sure you’re taking full advantage of your potential deductions.

Matching Expenses with Business Objectives

As you plan your business expenses, think about how they match up with your overall objectives. For instance, investing in new technology could result in deductions and at the same time improve your operations.

When you align your expenses with your goals, you benefit from tax deductions and contribute to the growth and success of your business. This strategy ensures that every dollar you spend supports your long-term objectives.

Expense Timing and Management

Strategically timing your expenses can also have an impact on your deductions. For example, making a large purchase at the end of the year could potentially allow you to benefit from a deduction sooner. For more insights, explore business tax planning techniques that can optimize your financial strategy.

Managing your expenses efficiently means planning your purchases and investments in a way that gets you the most tax benefits. This strategy requires thinking ahead and carefully considering your business needs and financial situation.

How Tax Planning Affects Cash Flow

When you plan your taxes, you’re directly affecting your business’s cash flow. By timing your expenses and deductions strategically, you can ensure you have more cash on hand when you need it most. For example, if you know a big tax bill is on the horizon, planning your deductions can help you offset some of that expense.

Furthermore, successful tax planning can lower your total tax obligation, giving you more money to put back into your business. This could result in more chances for growth and better financial security. Thus, it is crucial to include tax planning in your overall business plan to keep your cash flow strong.

Conclusion: Using Tax Deductions to Boost Your Business

Knowing how to use tax deductions can really help your business. If you know what expenses you can deduct, keep good records, and plan well, you can cut your taxes a lot. That means you have more money to put back into your business, which can help it grow and come up with new ideas.

Furthermore, keeping up-to-date with tax law changes and getting professional advice can help you get through the complexity of tax deductions. This way, you are assured of compliance while maximizing your savings. In summary, tax deductions are not just a way to save money—they are a crucial part of a successful business strategy.

Common Questions

If you’re trying to figure out business tax deductions, you probably have a lot of questions. Here are some of the most common ones and their answers to help you get a handle on this complicated subject. For more detailed insights, you might find these business tax planning tips helpful.

Which business tax deductions are most commonly missed?

Many business owners forget to claim deductions for home office expenses, depreciation of assets, and educational expenses. These can be substantial and should be investigated to ensure you’re claiming as many deductions as possible. For more tips, consider exploring business tax planning strategies.

How can I ensure all my expenses are categorized correctly?

To ensure your expenses are categorized correctly, you should keep detailed records and separate your personal and business expenses. Using accounting software to track your expenses and regularly consulting with a tax professional to review your categories can also be helpful.

Regularly checking your categories can also help you notice any misclassifications before they become a problem.

Have there been any new tax deductions added for this tax year?

Tax laws often change, so it’s important to keep up to date with any new deductions. Speak with a tax professional or check for updates from the IRS to make sure you’re not missing out on any new deductions.

What if I make a mistake on my deduction claim?

Mistakes on your deduction claims can lead to penalties or even an audit by the IRS. Make sure to double-check your deductions and get professional advice if you’re uncertain about any of your claims.

While it is possible in certain situations to amend your tax return to correct any mistakes, it is recommended that you avoid errors from the beginning by keeping accurate records and seeking professional advice.

Are personal expenses tax deductible if they’re business-related?

As a rule of thumb, personal expenses are not tax deductible unless they are directly related to your business. For instance, if you use your personal vehicle for business, you might be able to deduct some of the costs associated with its operation.

Nonetheless, it’s essential to maintain meticulous records and separate your personal and business expenses to steer clear of any problems with the IRS.

What is the impact of tax deductions on my total taxable income?

When you subtract tax deductions from your total income, it reduces your overall taxable income. This means you will owe less in taxes. The more deductions you have, the lower your tax liability will be. For additional insights, consider exploring business tax planning tips to maximize your deductions.

- Find all the deductions your business is eligible for.

- Deduct these from your total income.

- Work out your new taxable income.

- Pay taxes on this lower amount.

Following this process can help you save a lot, which means you can put more money into running your business.

What kind of paperwork do I need for travel and meal deductions?

When it comes to travel and meal deductions, you need to keep a good record. This includes receipts, dates, places, and the reason for each expense. This paperwork is important if you get audited and it also makes sure you are following IRS rules.

Is there a maximum amount I can deduct for start-up costs?

Indeed, there is a maximum deduction for start-up costs. Typically, you can deduct up to $5,000 in start-up costs, although this amount may be lowered if your total start-up costs surpass $50,000. The remaining costs have to be amortized over a period of 15 years.

By being aware of these limits, you can plan your expenses and make the most of the deductions that are available. By managing your start-up costs strategically, you can maximize your tax benefits and support your business’s growth from the very beginning.