What You Should Know

For a small business to thrive, it is crucial to have a safety net in the form of an emergency fund. This fund serves as a financial cushion, providing the stability needed to keep the business afloat.

Unexpected situations such as natural disasters, economic downturns, or sudden legal issues can be managed more effectively if you have an emergency fund. This financial buffer allows you to navigate these challenges without putting your business at risk.

Establishing a realistic savings goal and regularly adding to your emergency fund are key steps in creating this safety net. Consistent contributions will help your fund grow, providing more security for your business.

An emergency fund can also help your business recover more quickly from unexpected events and take advantage of unforeseen opportunities. This financial cushion can help you bounce back from setbacks and seize new opportunities that may arise.

Automating your contributions and keeping your emergency fund in an account that earns interest can help your fund grow even more. These strategies can help you build your emergency fund more quickly and effectively.

Why You Need an Emergency Fund for Your Small Business

Think of an emergency fund as a safety net for your small business. It’s there to catch you when unexpected expenses come up that could disrupt your business operations. This fund provides a layer of financial protection that can help your business weather unexpected challenges.

The Necessity of an Emergency Fund for Every Small Business

An emergency fund is crucial for every small business as it serves as a safety net against financial instability. Consider it as a financial buffer that enables you to recover swiftly from setbacks. Without it, even a slight disturbance could disrupt your business plans.

Typical Financial Obstacles for Small Businesses

Small businesses often encounter a range of financial hurdles that can pop up without warning. These hurdles can interrupt your business operations and put your business in jeopardy. Here are a few typical problems:

- Natural disasters

- Economic downturns

- Unexpected legal issues

- Break-ins, theft, or damage to property

Natural Disasters and Business Impact

Natural disasters like hurricanes, floods, and earthquakes can strike without warning. They can cause significant damage to your business property and interrupt your operations. Having an emergency fund can help cover the costs of repairs and get your business back on its feet quickly.

Financial Crises and Economic Slumps

When the economy takes a hit, people tend to spend less, which can lead to a drop in your sales and disrupt your cash flow. Having an emergency fund can give you the financial safety net you need to weather a bad economy.

Unforeseen Legal Problems and Costs

Legal problems can pop up unexpectedly, resulting in unforeseen costs. Whether it’s a lawsuit, a fine, or legal fees, these expenses can accumulate rapidly. An emergency fund guarantees that you have the funds to deal with these costs without jeopardizing your business’s financial stability.

Property or Equipment Theft, Damage, or Break-ins

Significant financial losses can result from break-ins, theft, or damage to your property or equipment. It can be costly to replace stolen or damaged items. An emergency fund helps cover these costs and ensures that your business operations are not disrupted.

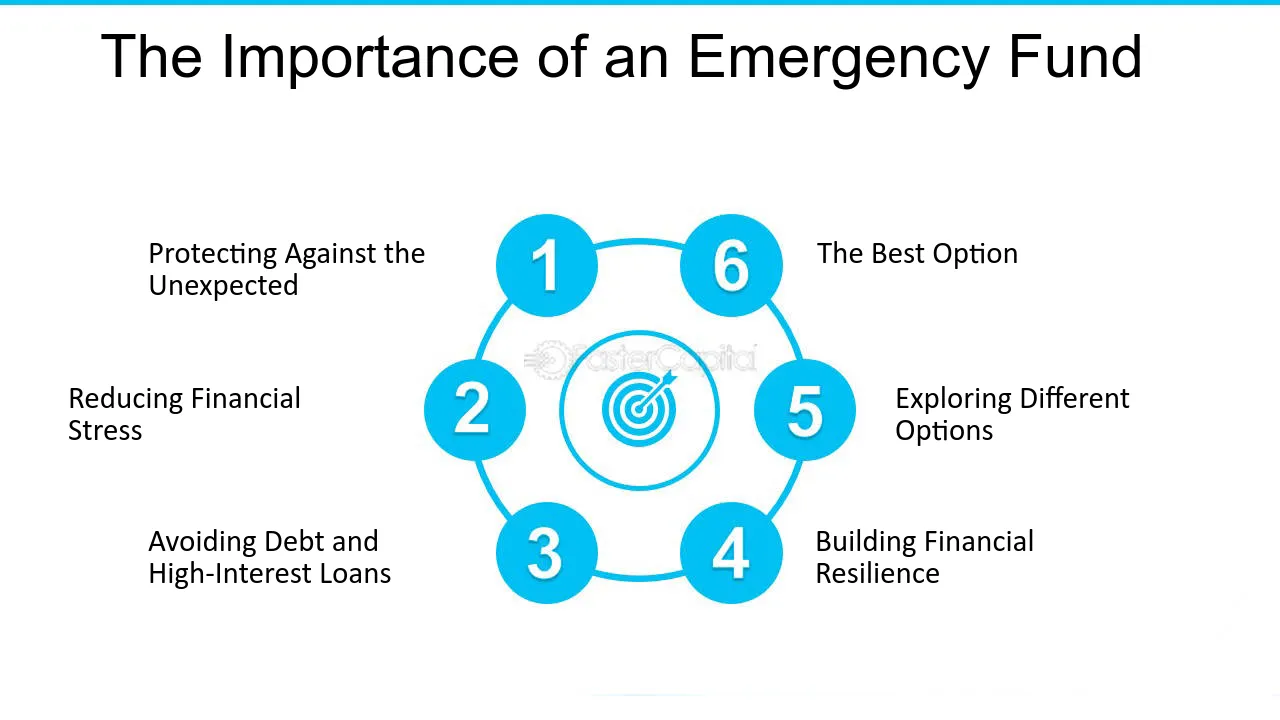

Why You Need an Emergency Fund

An emergency fund can do wonders for your business, especially when times get tough. Here’s why:

Offers Monetary Protection

By acting as a safety net, an emergency fund offers monetary protection. It makes sure that you have the means to manage unforeseen costs without having to touch your usual operating budget.

Guarantees the Lifespan and Steadiness of Your Business

Creating an emergency fund guarantees the lifespan and steadiness of your business. This fund enables you to carry on with your operations even when you encounter financial difficulties, which assists you in surviving during challenging times.

Enables Capitalizing on Unforeseen Opportunities

An emergency fund doesn’t just offer a safety net, it also allows you to take advantage of unexpected opportunities. Imagine if a prime retail space suddenly becomes available or there’s a chance to buy inventory at a discount. Having an emergency fund means you can seize these opportunities without scrambling for funds.

How to Create an Emergency Fund

Establishing an emergency fund is crucial for the stability of any business. To learn more about the process, you can refer to this guide on how to establish a small business emergency fund.

Now that we’ve grasped the significance of an emergency fund, let’s explore how to create one. It’s not just about hoarding money; it’s about devising a systematic strategy to guarantee your business is safeguarded.

Recognize Possible Emergency Situations

Start by figuring out what possible emergencies could affect your business. Think about the most probable events that could interrupt your operations. Think about things like natural disasters, economic downturns, legal issues, and equipment failures. For additional support, you can explore various small business resilience resources.

Establish Practical Savings Objectives

After you’ve pinpointed the possible emergencies, the following move is to establish attainable savings objectives. Figure out how much cash you’ll need to deal with these emergencies. It’s a good idea to save enough to cover three to six months’ worth of operating costs.

Formulate and Adhere to a Financial Plan

Building an emergency fund begins with budgeting. Examine your current income and expenses. Find places where you can save money and put those savings into your emergency fund. Stay disciplined and adhere to your budget to guarantee consistent contributions.

Look into Various Funding Sources to Begin Your Fund

At times, your existing income may not be sufficient to quickly build your emergency fund. You should consider various funding options such as small business loans, grants, or even crowdfunding to give your fund a boost. However, ensure that any borrowed funds are manageable and will not put a strain on your finances.

Consistently Assess and Modify Your Fund

Don’t just set up your emergency fund and then forget about it. You need to regularly check on your fund to make sure it’s growing and that it’s meeting your needs. As your business changes and new potential emergencies come up, you should adjust your savings goals.

Here are some suggestions to keep your emergency fund in check:

- Set up automatic deposits to guarantee steady savings.

- Store the fund in an account that earns interest to increase your savings.

- Periodically review and modify your savings goals to align with your business requirements.

Case Studies: Actual Success Stories of Emergency Funds

Let’s take a look at some real-life success stories that highlight the importance of having an emergency fund. These examples will show you how having a financial safety net can make all the difference.

Case Study 1: Surviving an Unexpected Economic Slump

Meet Jane, a small boutique owner. When the economy took an unexpected downturn, her sales took a nosedive. However, she had an emergency fund that she could dip into to cover her operating expenses and keep her employees on payroll. This safety net allowed her business to weather the storm and bounce back when the economy picked up again.

Case Study 2: Bouncing Back from Property Damage

Small businesses often face unexpected challenges, such as property damage. Learning how to recover and build resilience is crucial. For more resources on how small business owners can support their ventures during tough times, check out these small business resilience resources.

Tom is the owner of a quaint little café. During a particularly violent storm one evening, his café suffered extensive damage. The repairs were expensive, but fortunately, Tom had set aside an emergency fund. He was able to use this money to get the necessary repairs done swiftly, which meant he could reopen his café without delay. If he hadn’t had an emergency fund, he would have had to keep his café closed for an extended period, which could have resulted in him losing customers.

Case Study 3: Steering Through Legal Issues

Susan’s technology-based startup was hit with an unexpected legal issue. The costs for legal representation were piling up, and without a safety net of funds set aside for emergencies, her business could have been in danger of going under. Susan’s emergency fund took care of the legal costs, allowing her to concentrate on resolving the problem and keeping her business running. For more tips on how to build resilience in your business, check out these small business resilience resources.

Advice for Sustaining and Expanding Your Emergency Fund

It is important to keep your emergency fund healthy and growing. Here are some tips to help you maintain and grow your fund.

Set Up Automatic Payments

By setting up automatic transfers from your business account to your emergency fund, you can guarantee regular savings. This method helps you avoid forgetting to contribute and allows your fund to grow consistently over time. For more resources on building resilience, check out small business resilience resources.

Important Points

- An emergency fund is essential for small business survival, providing financial security and stability.

- Common challenges like natural disasters, economic downturns, and unexpected legal issues can be managed with an emergency fund.

- Setting realistic savings goals and regularly contributing to your fund are crucial steps in building an emergency fund.

- Emergency funds help businesses recover quickly from unexpected events and capitalize on unforeseen opportunities.

- Automating contributions and keeping the fund in an interest-bearing account can help grow your emergency fund.

Store Your Fund in an Account That Earns Interest

Storing your emergency fund in an account that earns interest allows your savings to increase. Search for accounts that provide competitive interest rates and easy access to funds when necessary. This way, your money is working for you, and your fund increases over time.

Continually Assess and Amend Savings Goals

As your business changes and grows, your emergency fund should as well. Continually assess and amend your savings goals to reflect the current needs of your business. If your business expands, you may need to augment your emergency fund to cover increased operating costs.

Keep in Mind: Consistency is Essential

Consistency is the secret to building and maintaining a healthy emergency fund. Regular contributions to your fund and close monitoring of your savings goals will ensure that your business is always ready for the unexpected.

Little by Little, a Little Becomes a Lot

Even small, regular contributions can accumulate over time. The key is to start and remain consistent. Over time, these little steps will create a large safety net that can shield your business from financial shocks.

Regular Check-ins and Modifications Guarantee Sufficient Protection

Regularly checking in on and modifying your emergency fund guarantees that it stays sufficient for your business requirements. Your fund should evolve and expand as your business does. Regular check-ins assist you in maintaining your financial security blanket.

Stay Concentrated on Fiscal Wellbeing

It’s vital to keep a keen eye on your company’s fiscal wellbeing. An emergency fund is merely one component of a larger financial plan. To keep your company in good financial shape, make sure you’re also managing your cash flow, budgeting wisely, and planning ahead with resources and support for small business resilience.

Commonly Asked Questions

Here are some frequently asked questions about creating a safety net for your small business:

What amount should I set aside for an emergency fund?

It’s generally recommended to have enough saved to cover three to six months of business expenses. This should be enough to help you weather most financial storms.

Is an emergency fund useful for cash flow problems?

Absolutely, an emergency fund can assist with cash flow problems by serving as a financial safety net. It enables you to handle unforeseen costs without interrupting your normal cash flow.

Where is the best place to store my emergency fund?

Store your emergency fund in an interest-bearing account that provides easy access to funds. Look for accounts that offer competitive interest rates to help your savings grow. For more details, you can refer to this guide on establishing a small business emergency fund.

How frequently should I reevaluate my emergency fund strategy?

It’s important to review your emergency fund strategy on a regular basis, ideally once a year, or whenever there are substantial changes in your business. This guarantees that your fund is always sufficient for your current requirements.