With the rapid pace of today’s business world, knowing and utilizing tax credits can have a profound effect on a company’s financial well-being. The Employee Retention Tax Credit (ERTC) is one such opportunity that businesses should not ignore. By using ERTC, businesses can realize significant financial savings, particularly in difficult economic circumstances.

Main Points

- Employee Retention Tax Credit (ERTC) can offer up to $21,000 per employee in tax credits.

- A lot of businesses don’t know they are eligible for the ERTC, and they could be missing out on substantial savings.

- ERTC Express is an expert in helping businesses get the most out of their tax credits.

- It’s important to have professional help to navigate the complicated ERTC application process.

- There are real success stories that show how ERTC can have a big impact on a business’s finances.

The Importance of ERTC

The COVID-19 pandemic brought a lot of challenges to businesses. The government created the Employee Retention Tax Credit (ERTC) to help businesses keep their employees and support the economy. This tax credit can provide financial help to businesses that are eligible.

Getting to Know the Employee Retention Tax Credit (ERTC)

The ERTC is a refundable tax credit that was created to motivate businesses to keep their employees on the payroll. It was first introduced in the CARES Act in 2020 and has been modified several times since then to increase its impact. The credit can be claimed against certain employment taxes, which makes it a great resource for businesses looking to improve their cash flow.

Meet ERTC Express

ERTC Express is a dedicated service provider that specializes in guiding businesses through the intricate ERTC application process. The team at ERTC Express is made up of seasoned CPAs and tax professionals who are committed to providing full support to businesses to ensure they receive the maximum tax credit they qualify for.

For a lot of entrepreneurs, the world of tax credits is intimidating and complex. This is where ERTC Express comes into play, providing businesses with professional advice and a simplified process to uncover substantial financial benefits. With their knowledge on your side, you can concentrate on running your business while ERTC Express takes care of the nitty-gritty details of the tax credit application.

ERTC’s Role in Boosting the Economy

ERTC is instrumental in boosting the economy by motivating businesses to keep their employees. It provides financial rewards for businesses that retain their employees, which helps keep jobs stable and supports consumer spending, both necessary for economic growth.

Furthermore, the ERTC helps to lessen the financial strain on businesses, providing them the opportunity to focus their resources on other vital areas like innovation, growth, and enhancing their customer service. This ultimately leads to a stronger, more adaptable economy.

Initial Hurdles in Understanding ERTC

Despite the advantages of the ERTC, many businesses face hurdles when trying to take advantage of this tax credit. Grasping the eligibility criteria, figuring out the credit amount, and making sure you’re following IRS rules can be intimidating tasks for business owners.

ERTC Myths Debunked

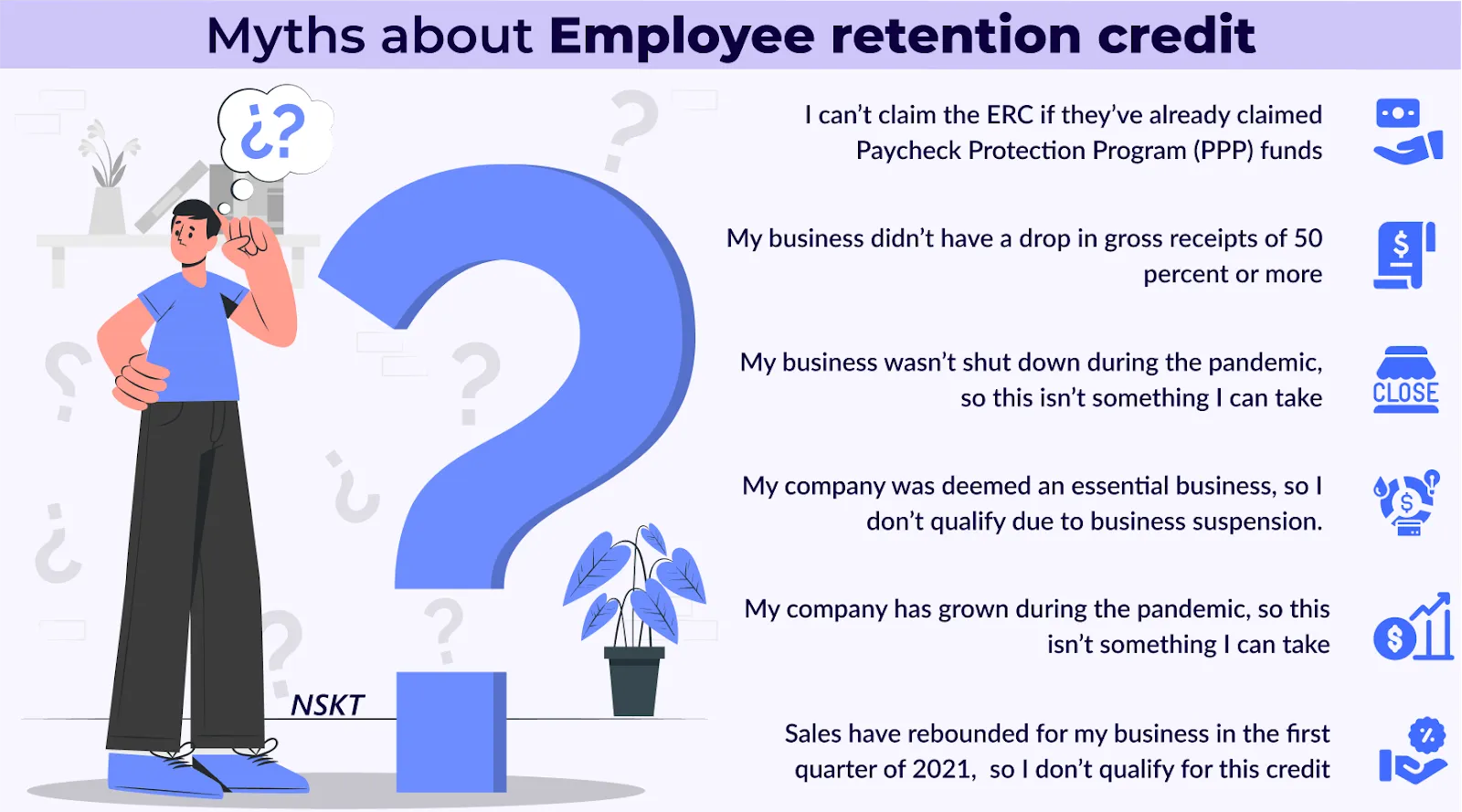

Many people believe that the ERTC is only for big businesses, but that’s not true. Businesses of any size can qualify if they meet certain requirements. Plus, some business owners think they can’t get the ERTC if they’ve already gotten a Paycheck Protection Program (PPP) loan. But recent law changes mean businesses can get both, as long as they don’t use the same wages to get both credits. For more insights, you can explore ERTC compliance tips from top CPA advisors.

Commonly Missed Disqualifiers for Businesses

There are a number of factors that can prevent a business from being able to claim the ERTC, and many business owners miss these. For example, businesses must be able to show that they had a large drop in gross receipts or that they had to fully or partially suspend operations due to government orders. If they can’t meet these requirements, their claim may be denied.

- Not meeting the decline in gross receipts requirement.

- Using the same wages for both ERTC and PPP forgiveness.

- Incorrectly calculating qualified wages.

Importance of Professional Guidance

Given the complexities involved in the ERTC application process, seeking professional guidance is essential. Tax professionals, like those at ERTC Express, have the expertise to navigate the intricate details of the tax code and ensure businesses claim the maximum credit available. This not only saves time and effort but also minimizes the risk of errors that could lead to audits or penalties.

“ERTC Express was a lifesaver for us – they patiently answered all of our questions. I am especially grateful to our account manager who walked us through every step of the process.”

Finally, the ERTC is a great chance for businesses to boost their financial health. By knowing the eligibility criteria, getting expert advice, and using ERTC Express services, businesses can easily go through their tax credit journey and uncover valuable savings.

– A happy ERTC Express client

Guiding You Through Each Step of the Application Process

Applying for the Employee Retention Tax Credit can feel daunting, but with the right help, it can be made easy. ERTC Express provides a thorough method to make sure each step is well explained and carried out. Here’s how they help you through the application process:

Initially, they carry out a comprehensive evaluation of your business’s suitability. This includes scrutinizing your financial documentation to ascertain if you qualify for a substantial reduction in gross receipts or if your business activities were disrupted by government mandates. This phase is vital as it lays the groundwork for your application. For further insights on compliance and advisory services, consider exploring ERTC Express’s top compliance CPA advisors.

“ERTC Express helped our transportation company qualify for more than $500,000 in ERTC credits. They took the time to answer all our questions.”

After the eligibility of the client has been confirmed, ERTC Express helps in collecting the required documents. These documents include payroll records, financial statements, and any government orders that have affected your operations. ERTC Express ensures that all these documents are accurate and complete. This reduces the risk of making errors that could delay your application.

– CFO of a Transportation Company in California

How Technology and Expertise Ensure Accuracy

- State-of-the-art software tools for financial data analysis.

- Seasoned CPAs for calculation verification.

- Instant updates on application status.

ERTC Express uses the latest technology to improve the accuracy of your application. Their state-of-the-art software tools allow them to analyze your financial data effectively and ensure that all calculations are correct. This technological edge is backed up by their team

of seasoned CPAs, who double-check and confirm every detail.

What’s more, ERTC Express keeps you in the loop with live updates on your application’s progress. This openness means you’re always in the know, which can help to alleviate any worries or doubts you might have. Given their proficiency and technological capabilities, you can trust that your application is being well taken care of.

ERTC Express doesn’t just handle the technical side of things. They also offer customized support to answer any questions or concerns you might have. Their team is always on standby to provide clear explanations and direction, making sure your experience is seamless and worry-free.

Success Stories from the Real World

Success stories from businesses that have benefited from ERTC Express’s services illustrate the transformative power of the Employee Retention Tax Credit. These real-life examples highlight the substantial financial impact that can be achieved with the right guidance.

Success Story: How a California Transportation Company Saved $500k

When the pandemic hit, a California transportation company was hit hard. With less demand and operational issues, they didn’t know if they were eligible for the ERTC. So, they reached out to ERTC Express. After a complete evaluation, the ERTC Express team determined that the company was indeed eligible for the credit.

ERTC Express led the way, and the company was able to apply for and receive more than $500,000 in ERTC credits. This financial windfall enabled them to keep their employees and invest in new technologies that improved their operations. The company’s CFO had nothing but positive things to say about ERTC Express’s knowledge and assistance throughout the process.

Case Study: How a Restaurant Found $400k in Three Weeks

- First meeting and eligibility check.

- Collection of required paperwork.

- Successful application and receiving of credits.

A family-run restaurant was barely surviving due to the difficulties of the pandemic. They had no idea about the ERTC until they contacted ERTC Express. In just three weeks, the team had a first meeting, checked their eligibility, and collected the required paperwork.

The restaurant was able to successfully apply and receive $400,000 in tax credits. This unexpected boon gave them the financial relief they needed to keep their business open and their staff employed. The restaurant owners were thankful for the quick and effective help from ERTC Express.

The success stories we’ve shared illustrate the considerable financial savings that can be realized with the proper assistance. Businesses can successfully navigate the complexities of the ERTC and unlock valuable credits to strengthen their financial stability by partnering with ERTC Express.

Case Study: A Church’s Path to a Mid-Six-Figure Refund

A local church was struggling financially due to a drop in donations and attendance during the pandemic. They were unsure if they were eligible for the ERTC, but they decided to look into it with ERTC Express. After a thorough evaluation, the team was able to confirm that the church was eligible for the credit.

Thanks to the help of ERTC Express, the church was able to successfully apply for and receive refunds in the mid-six figures. This money helped them to keep their community programs running and support their staff. The leaders of the church had nothing but praise for ERTC Express, commending them for their dedication and expertise in securing the credits.

The Advantages of Using ERTC Express

ERTC Express offers more than just tax credits. They offer a full suite of services designed to help businesses improve their financial health and secure their future success.

Get the Most Out of Your Tax Credit

ERTC Express’s team of experts ensures that businesses get the most tax credit they’re entitled to. They conduct a thorough review to identify all eligible expenses and their calculations are so accurate, they don’t miss a single dollar of potential savings. For more insights, you can explore their position as top compliance CPA advisors. This means businesses can enjoy significant financial benefits.

In addition, ERTC Express keeps abreast of the most recent tax laws and modifications, guaranteeing that companies can benefit from any new savings possibilities. Their forward-thinking strategy aids companies in staying ahead of the game and making the most of their financial resources.

Reducing Risks and Preventing Audits

Attempting to secure tax credits can be a gamble if not executed properly, as mistakes can result in audits and fines. ERTC Express lessens these risks by guaranteeing that all applications are precise and in accordance with IRS rules. Their painstaking focus on accuracy and comprehensive documentation procedure lessen the potential for mistakes and diminish the probability of audits.

Boosting Business Cash Flow

The financial aid offered by the ERTC can drastically enhance a business’s cash flow. By tapping into substantial tax credits, businesses can divert resources to key areas like keeping employees, innovation, and growth. This boosted cash flow strengthens a business’s capacity to endure economic hardships and grab new growth opportunities.

Conclusion and Suggestions

The Employee Retention Tax Credit is an excellent chance for companies to improve their financial status and aid in economic recovery. With ERTC Express as their partner, companies can confidently maneuver through the intricate ERTC application process and discover significant financial savings.

Professional advice is crucial for businesses wanting to maximize their tax credit potential and increase their financial stability. ERTC Express provides the necessary expertise and support to ensure a successful application and secure valuable tax credits. Don’t miss out on the financial benefits of the ERTC—contact ERTC Express today and start your journey to savings.

Keeping Your Business in Line and Avoiding Common Mistakes

Compliance is a key part of applying for the Employee Retention Tax Credit (ERTC). It’s important to make sure your business meets all the requirements and follows IRS rules to avoid any problems. The IRS has certain rules that businesses need to follow to qualify for the ERTC, including showing a big drop in gross receipts or having to stop all or part of their operations because of government orders.

A common mistake is miscalculating qualified wages. It’s crucial to correctly identify which wages are eligible for the credit and make sure they’re not being used for other tax credits, like the Paycheck Protection Program (PPP) loan forgiveness. Another possible problem is not maintaining detailed records and documentation, which could cause issues if the IRS audits your application.

Companies looking to avoid these issues should think about getting professional help. Tax professionals, such as the ones at ERTC Express, are experts in dealing with the complicated tax code and making sure everything is in order. They can help you figure out your credit accurately, keep the right documents, and lower the chance of making mistakes that could result in audits or fines.

“ERTC Express really did a lot for us, they answered all our questions with patience. I’m really grateful for our account manager who helped us through every step.”

– A happy ERTC Express customer

What Happens to ERTC After the 2025 Filing Deadline?

ERTC is available for wages paid up until 2021, and companies can apply for the credit retroactively. But, businesses only have until 2025 to file amended returns to claim the ERTC. So, it’s important for companies to act fast so they don’t miss out on this chance to save money. For more information, you can visit ERTC Express.

It’s unclear whether the ERTC will be extended or changed after the present filing deadline. Therefore, companies should make it a priority to understand if they’re eligible and apply for the credit as soon as they can. This way, they can ensure they get financial help and improve their financial situation for the future. For more information, check out this guide on tax relief programs criteria.

Common Questions

The Employee Retention Tax Credit (ERTC) can be confusing, so we’ve compiled a list of commonly asked questions to help you understand the process:

Understanding the ERTC and its Qualifications

The ERTC is a refundable tax credit that was created to motivate businesses to retain their employees during difficult economic conditions. In order to qualify, businesses must prove a substantial decrease in gross receipts or a full or partial suspension of operations due to governmental orders.

Companies that qualify can use the credit to offset specific employment taxes, which helps to improve their financial situation and cash flow. It’s worth mentioning that businesses of all sizes can take advantage of the ERTC, as long as they meet the necessary requirements.

What role does ERTC Express play in helping businesses claim these credits?

ERTC Express is a company that helps businesses through the intricate ERTC application process. They have a team of seasoned CPAs and tax professionals who provide all-encompassing support, from determining if a business is eligible to collecting the necessary paperwork and making sure all IRS rules are followed.

Are all businesses eligible for the ERTC?

All businesses are not eligible for the ERTC. Eligibility is based on certain conditions, like a substantial decrease in gross receipts or a full or partial shutdown of operations due to government orders. Businesses also have to make sure they don’t use the same wages for both ERTC and other tax credits, like the PPP loan forgiveness.

What is the expected waiting period to get credits after application?

The waiting period for ERTC credits is not fixed and can fluctuate based on a few factors such as the correctness of the application and how long the IRS takes to process it. However, in most cases, businesses should anticipate getting their credits a few months after they have successfully submitted a complete and correct application.

Is it possible for businesses to retroactively apply for ERTC credits?

Absolutely, businesses can retroactively apply for ERTC credits by submitting amended returns for the relevant tax years. The cut-off for these amended returns is 2025, so businesses should move quickly to make sure they don’t lose out on this chance to save money.

What are some reasons a business might not qualify for ERTC?

There are a few reasons why a business might not qualify for the ERTC. Some of the most common reasons include not having a sufficient decrease in gross receipts, using the same wages for both ERTC and PPP forgiveness, and miscalculating qualified wages.

Businesses need to make sure they know the eligibility requirements to avoid being disqualified. If they need help, they should seek professional advice. This will help reduce the risk of mistakes and make sure they are following IRS rules.

Why do you need professional help with ERTC?

Professional help is key to successfully navigating the complex ERTC application process. Tax professionals, such as the ones at ERTC Express, have the know-how to make sure businesses correctly figure out their credit, keep the right documentation, and reduce the chance of mistakes that could result in audits or penalties.

- Correctly determining the amount of eligible wages.

- Making sure to follow all IRS rules.

- Reducing the chance of audits and fines.

With the help of experienced professionals, companies can successfully make their way through the tax credit process and open up significant financial benefits.

To sum it up, the Employee Retention Tax Credit is a precious chance for companies to improve their financial status and help the economy recover. By teaming up with ERTC Express, companies can confidently tackle the intricacies of the ERTC application process and unearth significant financial savings.

What are the consequences of a mistake in a company’s ERTC application?

If a company makes a mistake in its ERTC application, it may lead to delays, audits, or fines. Typical mistakes include miscalculations of eligible wages, incomplete paperwork, and not meeting the requirements for eligibility.

For businesses to avoid these issues, they should seek professional guidance and ensure that their application is accurate and compliant with IRS guidelines. If a business finds an error after submission, they should promptly correct it by filing an amended return.

Businesses can reduce the chances of making mistakes and guarantee a successful ERTC application by taking these precautions.