Main Points

- Fast online business funding can be approved in as short as 4 hours, giving you immediate access to capital.

- Working capital loans, merchant cash advances, and business lines of credit are types of funding available.

- Online applications are usually simple and require little documentation, making the process fast and efficient.

- Funds are often deposited directly into your business account, so you can use them almost immediately.

- Fast funding solutions help you maintain full control over your business without having to give up equity.

Fast Business Funding: A Beginner’s Guide

If you’re a business owner, you understand that having quick access to funds can be the difference between success and failure. Whether you’re looking to expand, cover unexpected expenses, or just maintain cash flow, fast online business funding can be a lifesaver. In this guide, I’ll explain the basics of getting quick funding for your business, so you can concentrate on what you do best—growing your business.

Why Rapid Financing is Crucial for Expansion

Rapid financing can provide the fiscal freedom necessary to take advantage of opportunities as they occur. Picture yourself having the opportunity to buy inventory at a reduced price or invest in new technology that could increase your productivity twofold. With rapid financing, you can react promptly without the waiting times associated with traditional loan procedures. This swiftness not only aids immediate business needs but also prepares you for sustained expansion.

Getting to Know the Basics of Online Business Loans

Online business loans are crafted to provide a swift and straightforward route to capital. They stand apart from conventional bank loans in a few key areas. To begin with, the application process is simplified, usually only necessitating basic business details and financial figures. Secondly, the time it takes to get approved is much shorter, sometimes only a matter of hours. Lastly, online lenders usually have a variety of loan products on offer that are suited to various business requirements.

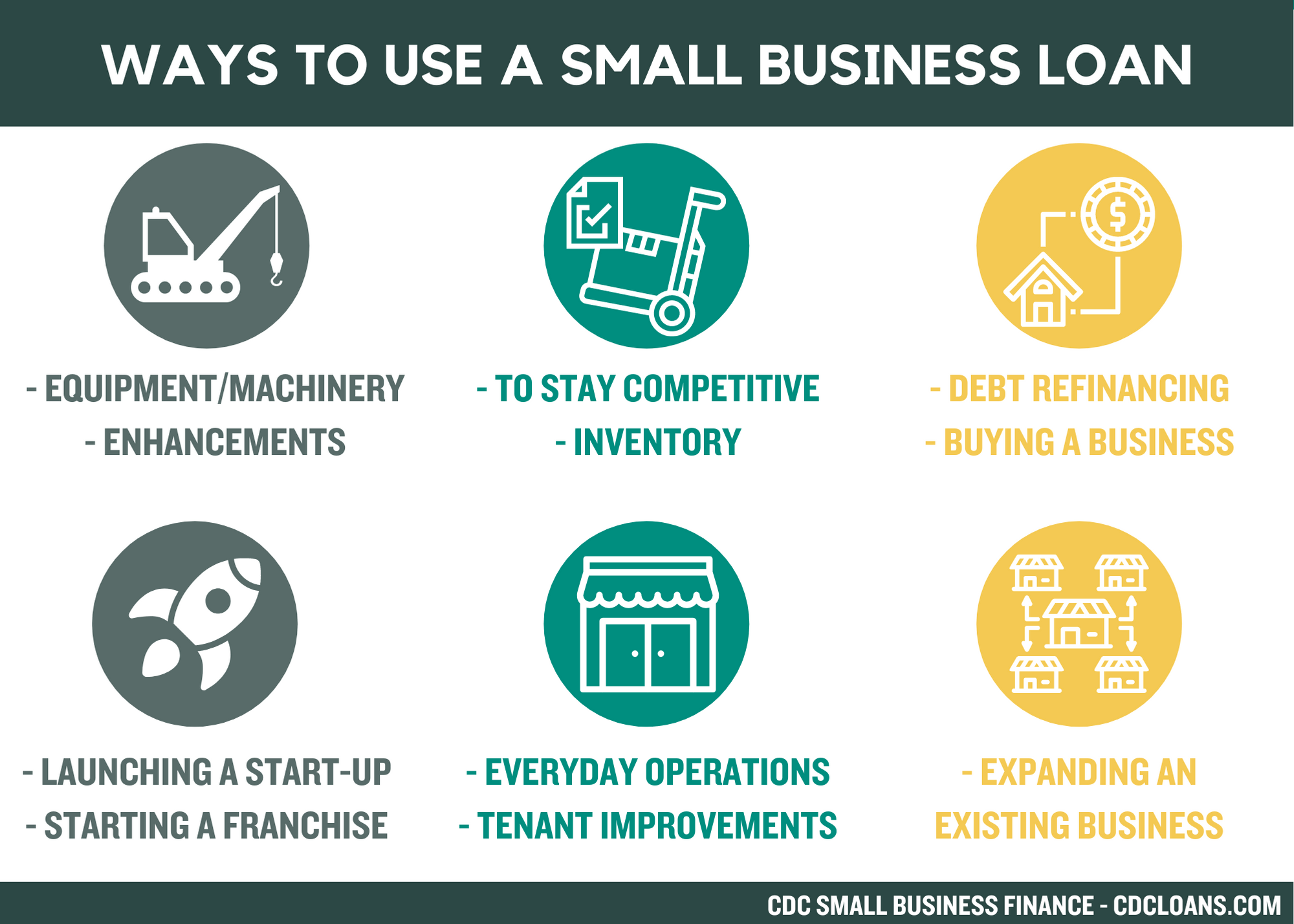

Various Types of Online Business Loans

Online business loans come in many forms, each with a different purpose. Knowing your options can help you pick the best one for your business.

Loans for Working Capital

Loans for working capital are meant to cover the daily costs of running a business. These loans can be used for a variety of purposes, such as buying inventory, paying workers, or covering rent. The primary benefit of loans for working capital is their flexibility, which allows business owners to use the funds as needed to keep their operations running smoothly.

Business Cash Advances

Business cash advances (BCA) allow you to receive a lump sum of cash now in return for a percentage of future sales. This is a great option for businesses whose sales fluctuate, as the repayment is tied to the revenue. BCAs are typically easy to get, but they often come with higher costs compared to other types of funding.

Business Credit Lines

- Think of a credit line as a business credit card. It provides a pool of funds that you can dip into as necessary.

- Only the amount you borrow accrues interest, making it a versatile tool for managing cash flow.

- Credit lines are often revolving, which means that as you repay what you’ve borrowed, the credit is replenished.

Business credit lines are very flexible and can be used for a variety of business needs, from unexpected expenses to new opportunities. For more information on how to manage your business finances, check out this guide on tax-deductible business loan repayments.

Equipment Financing Options

Equipment financing is a great choice when you need to buy or lease equipment. This kind of loan is specifically for purchasing equipment, and the equipment itself is often used as collateral. This makes equipment financing easier to get than unsecured loans, and it usually has better terms.

Knowing the different types of online business loans out there helps you figure out what kind of funding best suits your business needs and financial standing. In the next part, we’ll dive into the advantages of quick online business financing and how it can help your business projects.

Repayment Terms are Flexible

Fast online business funding offers a lot of benefits, but one of the best is flexible repayment terms. Traditional bank loans can have strict repayment schedules that may not work for your business. Online lenders, on the other hand, offer a variety of options that you can choose from to fit your business’s cash flow. This way, you can pick terms that work with your revenue cycles and reduce financial stress.

For instance, a few lenders provide daily or weekly repayments. This can be advantageous if your company has regular cash inflows. This model ensures that repayments are manageable and do not disrupt your everyday operations. Furthermore, flexible repayment terms can assist you in maintaining a good credit score by avoiding missed payments.

Moreover, having control over when you pay back your small business loans means you can better plan for future costs and investments. This flexibility not only helps your current financial health but also sets you up for future growth.

How to Get Fast Online Funding

Getting fast online funding is a simple process that is often designed to provide you with the funds you need without causing any unnecessary stress. Here is a step-by-step guide to help you go through the process smoothly.

Application Minimum Requirements

Before you start the application process, it’s important to know the basic requirements that most online lenders will ask for. Typically, you’ll need to provide:

Here’s what you’ll need to apply:

- Your business’s name, address, and contact information.

- Some financial documents, like bank statements and recent tax returns, that show your business is financially stable.

- A business bank account that’s in good standing. This is where we’ll deposit your funds and where you’ll make your loan payments from.

If you meet these minimum requirements, you’ll have a smoother application process and a better chance of getting approved.

The Swift Application Procedure

Fast online business funding applications are usually designed to be as streamlined as possible. Most lenders offer an online application form that can be filled out in minutes. Here’s how it usually goes:

- Go to the lender’s website and complete the application form with your company’s information.

- Provide the necessary financial documents, either by uploading them or linking your bank account for automatic verification.

- Allow the lender some time to review your application, which typically takes several hours to a day.

This efficient process does away with the need for cumbersome paperwork and face-to-face meetings, freeing you to concentrate on your business rather than red tape.

Timeline for Approval and Funding

After you’ve submitted your application, you can usually expect a quick approval process. Most online lenders will give you a decision within 24 hours, and some even offer immediate approvals. Here’s what the process looks like, including understanding tax-deductible business loan repayments as part of your financial planning:

“Once you’ve applied, one of our Funding Specialists will reach out to go over your choices. You could get an answer in just 4 hours, and the money is frequently sent to your account on the same day.”

Such a quick turnaround is especially helpful for companies that have pressing financial needs. It means you have the funds to deal with immediate problems and take advantage of opportunities without any delay.

By following these steps, you can get the funding you need fast and easy, letting you concentrate on the most important thing—expanding your business.

Finding the Best Financial Partner

It’s important to choose the right lender to ensure a positive and beneficial funding experience. Here’s how to evaluate potential financial partners effectively.

Assessing the Reputation of a Lender

The reputation of a lender can offer useful information about their dependability and the caliber of their services. Search for lenders that have favorable reviews and endorsements from other entrepreneurs. You might also want to look at their ratings with the Better Business Bureau and other industry oversight groups. A lender with a good reputation will have a history of being open and providing outstanding service to their customers.

Evaluating Loan Terms and Rates

It’s crucial to evaluate the loan terms and interest rates provided by various lenders. Take note of the total cost of the loan, including any fees or charges. Some lenders may provide lower interest rates but have higher fees, so it’s important to consider the total cost. Utilize a loan comparison table to consider your options and select the best deal for your business.

Thinking About Customer Assistance and Service

Good customer service can greatly improve your borrowing experience. Choose a lender that provides responsive and helpful customer assistance, as this will be very useful if you run into any problems or have questions during the loan term. Consider contacting their assistance team before applying to measure their responsiveness and willingness to help.

Getting the Most Out of Your Business Loan

After obtaining your business loan, it’s important to use it wisely to get the most out of it. Here are some suggestions on how to best utilize your funding.

Firstly, you need to put together a comprehensive plan for how you will use the money. This plan should be in line with your business objectives and should tackle any urgent financial requirements. Having a well-thought-out strategy will ensure that the loan will help your business to grow and succeed.

Strategically Allocating Funds

Think about prioritizing expenses that will yield the greatest return on investment. For instance, putting money into marketing campaigns or buying new equipment can result in more sales and revenue. By concentrating on areas that have a big impact, you can get the most out of your loan.

Furthermore, regularly check the financial health of your business to ensure that you are on track to meet your objectives. This proactive approach will assist you in making informed decisions and modifying your strategy as necessary.

Keeping Tabs on Your Financial Health

Once you’ve secured funding, it’s essential to keep a close watch on the financial health of your business. Make a habit of checking your financial statements regularly so you can keep track of your income, expenses, and cash flow. This will help you spot trends and potential problems early on, so you can make decisions based on solid information. For more tips, consider exploring strategies to minimize business taxes.

Accounting software is a great tool to keep track of your financial status in real time. You could also consider hiring a financial advisor for personalized expert advice and guidance that fits your business.

Importance of Prompt Loan Repayment

Paying back your loan on time is crucial for maintaining a good relationship with your lender and keeping your credit score intact. By setting up automatic payments, you can ensure that you never miss a payment deadline. If your lender provides flexible repayment options, select a schedule that matches your cash flow to reduce financial stress.

If you’re having trouble making payments, let your lender know as soon as possible. Many lenders are flexible and will work with you to temporarily adjust your loan terms, but they can’t help if they don’t know what’s going on.

Commonly Asked Questions

Fast online business funding can be a bit tricky to understand. For more clarity, you might want to explore tax-deductible business loan repayments to help clear up any confusion.

What’s the quickest method to secure business funding?

The fastest way to get business funding is through online lenders who offer fast application and approval processes. Many of these lenders offer same-day funding, so you can get the money you need within hours.

When businesses face financial challenges, understanding the options available for tax relief can be crucial. One such option is the Employee Retention Tax Credit (ERTC), which provides significant benefits to businesses that have been affected by economic downturns. For more detailed information on how the ERTC can aid in tax relief during business shutdowns, consider exploring this ERTC tax relief guide.

To speed up the process, make sure you have all the necessary documents ready before you apply, such as financial statements and bank details.

What’s the process for an online business loan?

Online business loans work much like traditional loans, but the process is quicker and more efficient. You apply on the lender’s website, upload the necessary documents, and get a decision fast. Once you’re approved, the money goes straight into your business bank account, so you can start using it right away. For businesses affected by shutdowns, exploring tax relief options can also be beneficial.

What do I need to qualify for quick business funding?

Each lender has different qualifications, but most require a minimum time in business, a certain level of annual revenue, and a valid business bank account. Some lenders may also look at your credit score, but there are options for those with not-so-great credit.

Is it possible to obtain a business loan if my credit is bad?

Indeed, a variety of online lenders provide solutions for businesses with bad credit. These loans may carry higher interest rates or require more collateral, but they offer a source of funds for those who may not be eligible for conventional bank loans.

Which businesses can take advantage of quick online financing?

Almost every business can take advantage of quick online financing, particularly those in industries with variable cash flow or seasonal needs. Retail, hospitality, and service-based businesses frequently use quick financing to manage inventory, payroll, and other operational expenses.

“Fast funding is especially helpful for businesses that are faced with pressing financial needs, guaranteeing that you have the resources you need to tackle immediate problems and take advantage of opportunities without any delay.”

How do repayment terms vary among online loans?

Online loans offer a variety of repayment terms, including daily, weekly, and monthly schedules. Interest rates and fees also differ, so it’s important to compare options and select terms that match your business’s cash flow.

What are the risks of fast online business loans?

Fast online business loans, while beneficial, do come with their own set of risks. These can include higher interest rates and fees compared to traditional loans. It’s important to read the terms carefully and understand the total cost of the loan before committing.

Also, bear in mind that some lenders might charge you a fee if you pay back the loan early. So, make sure you know all the terms and conditions before you sign anything.

What’s the best way to select the right financing solution for my business?

Identifying the right financing solution requires you to assess your company’s financial position, objectives, and repayment ability. You should take into account things like the loan amount, interest rates, fees, and repayment conditions. It’s also crucial to select a lender with a good reputation, positive feedback, and outstanding customer service. For guidance on handling tax-deductible business loan repayments, be sure to consult expert resources.

Take the time to compare different options and consult with financial advisors if needed. This thorough approach ensures that you select a funding solution that supports your business’s growth and success.

By adhering to these tips and gaining a deeper understanding of fast online business funding, you can make knowledgeable choices that enable your business to flourish.