Key Points

- If you use a portion of your home solely for your business, you may be able to save money through home office deductions.

- If you use your vehicle for business purposes, you may be able to deduct vehicle expenses such as mileage and maintenance.

- Office supplies and equipment, including paper, computers, and furniture, are deductible.

- You can write off travel expenses for business trips, including airfare and lodging.

- Health insurance premiums are fully deductible for self-employed individuals.

Top 10 Tips: Essential Tax Deductions for Small Business Owners

The Importance of Tax Deductions

Let’s discuss why tax deductions are important. They lower your taxable income, which means you pay less in taxes. Every dollar saved is important for small business owners. As a result, understanding these deductions can help you keep more of the money you’ve worked hard to earn.

Summary of Essential Deductions

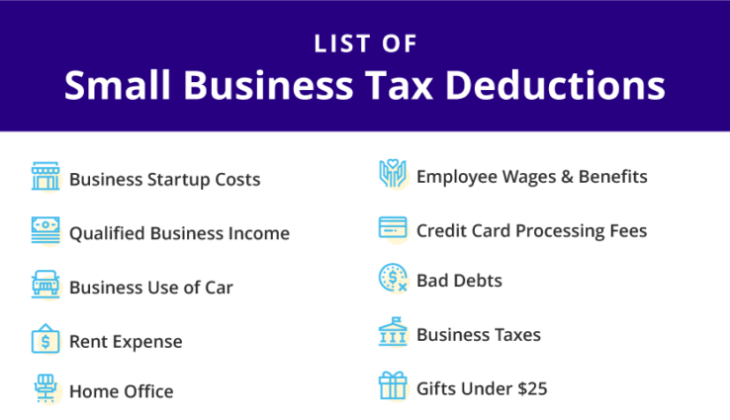

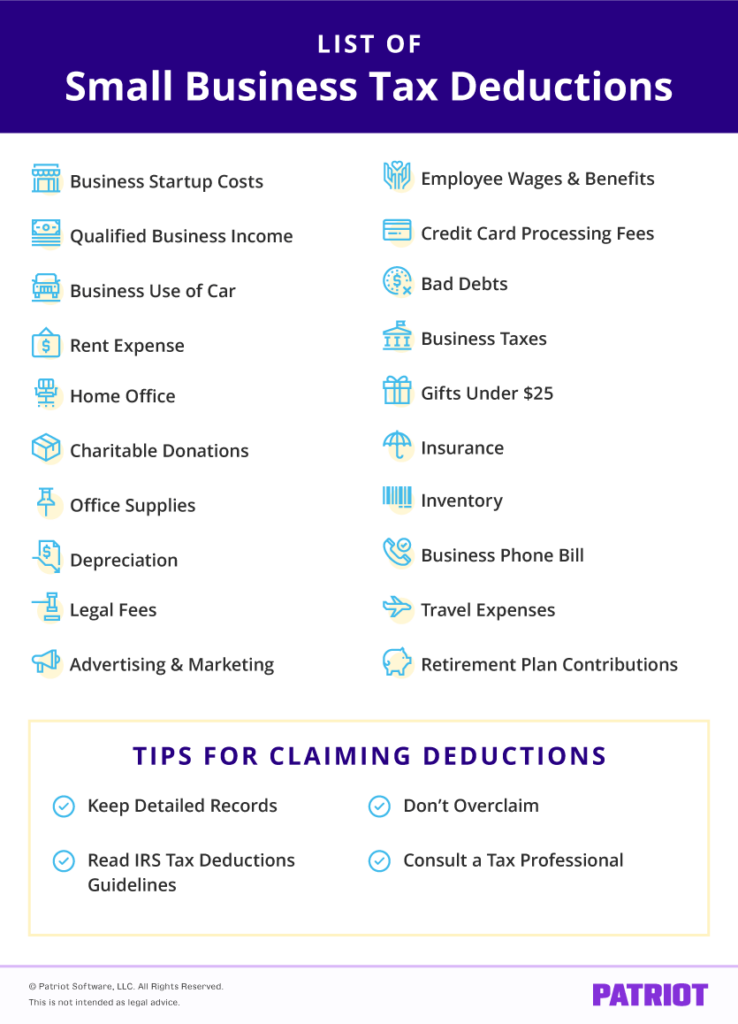

Before we get into the nitty-gritty, here’s a brief rundown of some important deductions you should be aware of:

- Deducting Your Home Office

- Automobile Expenses

- Office Supplies and Equipment

- Travel Costs

- Health Insurance Premiums

- Retirement Contributions

- Advertising and Marketing Expenses

- Professional Services and Subscriptions

- Depreciation

- Unrecoverable Debt

Deducting Your Home Office

Qualification Requirements

Firstly, you need to determine whether you qualify for the home office deduction. To qualify, you must use part of your home exclusively and regularly for your business. This means that the area must not be used for personal activities. This could be a room or a designated area within a room.

Figuring Out Your Deduction

You have two options for determining your home office deduction:

- Regular Method: This method requires you to compute the actual expenses of your home office, such as rent, utilities, and insurance.

- Simple Method: This allows you to deduct $5 per square foot of your home used for business, up to a maximum of 300 square feet.

Tips for Keeping Records

It’s important to keep thorough records to support your deductions. Save all receipts, utility bills, and mortgage statements. Keep track of these expenses using a spreadsheet or accounting software. Doing so will make tax time much easier.

Automobile Costs

Car Expenses That Can Be Deducted

When you utilize your vehicle for your business, you can write off a few costs. To avoid common errors, check out these small business tax mistakes to avoid.

Here are some of the vehicle expenses you can deduct:

- Fuel

- Oil changes

- Repairs and maintenance

- Insurance

- Depreciation

Standard Mileage Rate vs. Actual Expenses

You can deduct vehicle expenses in one of two ways:

- Standard Mileage Rate: The IRS standard mileage rate multiplied by your business miles driven.

- Actual Expenses: The percentage of business use multiplied by all car-related expenses.

Keeping Accurate Vehicle Logs

Keep a log of your business miles in detail. Include the date, miles driven, and purpose of the trip. This log will help you back up your deductions if the IRS asks.

Materials and Machinery for Your Business

Supplies for the Office

Common items such as paper, pens, and printer ink can be deducted. Save your receipts and keep track of these costs all year.

Big-Ticket Items

More expensive items such as computers, furniture, and machinery are also deductible. These are known as capital expenses and typically depreciate over time.

Section 179 Write-off

Section 179 allows you to write off the entire cost of eligible equipment in the year you purchase it. This is a fantastic way to quickly decrease your taxable income.

On the Road

What You Can Write Off

Did you hit the road for work? You can write off:

- Plane tickets

- Accommodations

- Food

- Vehicle hire

- Event costs

Business Travel Guidelines

Your trip must be mostly for business purposes to be eligible. Maintain a thorough record of your travel schedule, including the reason for the trip and business-related activities.

Mixing Business and Personal Travel

Even if you combine business and personal travel, the business portion can still be deducted. For instance, if you go to a conference for three days and then take a vacation for two days, the expenses for the three business days can be deducted.

First and foremost, travel expenses can accumulate rapidly, so it’s crucial to keep track of every single cent. Utilize apps or spreadsheets to record your expenses as they happen. This will make your life easier when tax season rolls around.

Health Insurance Premiums

Health insurance can be a significant cost, but the silver lining is that premiums are often deductible. Let’s divide this into two groups: self-employed individuals and employees.

Health Insurance Deduction for Self-Employed

As a self-employed individual, you can write off 100% of your health insurance premiums. This includes the coverage for you, your spouse, and your dependents. This deduction is available regardless if you itemize your deductions or not.

Writing Off Employee Premiums

For small business owners with employees, you can write off the premiums you pay for their health insurance. This is considered a business expense and it lowers your taxable income. It’s important to keep detailed records of these payments for your deduction.

Making Health Insurance Paperwork Easier

Stay on top of your health insurance paperwork by keeping everything in one place. Consider using a dedicated folder for insurance costs and software to keep track of these expenses. This will help you figure out your deductions and make sure you don’t overlook any.

Contributions to Retirement

Retirement savings are an essential aspect of financial planning, and the government provides tax deductions to promote this. We’ll go over the various retirement plans you can contribute to and get tax deductions for in the next section.

Retirement Plan Options

Here are a few retirement plans you might want to think about:

- SEP IRA: This is a Simplified Employee Pension plan that is easy to set up and allows for high contribution limits.

- SIMPLE IRA: This Savings Incentive Match Plan for Employees enables both employer and employee contributions.

- 401(k): This plan offers high contribution limits and the potential for employer matching.

Contribution Limits

Each of these plans has different contribution limits:

- SEP IRA: You can deduct up to 25% of your net earnings, up to a limit of $58,000 (as of 2021).

- SIMPLE IRA: You can deduct $13,500, plus an extra $3,000 if you’re over 50.

- 401(k): You can deduct $19,500, plus an extra $6,500 if you’re over 50.

The Tax Advantages of Retirement Plans

Contributions to these plans are tax-deductible, which reduces your taxable income. You save on taxes now and build up a nest egg for the future. It’s a double win.

Promotion and Publicity Expenses

Promotion and publicity are crucial to your business’s expansion, and a good portion of these costs can be deducted. Let’s discuss what you can deduct.

Permissible Advertising Costs

Typical tax-deductible advertising costs include:

- Advertisements on the internet

- Advertisements in print media

- Billboard advertisements

- Business card expenses

- Costs for brochures

Digital Marketing Deductions

In our modern, digital world, marketing online is key. You can deduct the costs of:

- Advertisements on social media

- Google’s AdWords

- Developing a website

- Campaigns for email marketing

Keeping Track of Marketing Campaigns

Make sure to maintain thorough records of your marketing expenses. Utilize software to keep track of your campaigns as well as their costs. This will not only assist you in deductions but also demonstrate which campaigns are the most successful.

Expert Services and Membership Fees

Operating a business typically necessitates the use of expert services and memberships. These expenses are generally deductible, so we’ll delve into this a little deeper.

Legal and Accounting Costs

You can deduct the fees you pay to your lawyer or accountant. This includes costs for legal advice, preparing your taxes, and other professional services.

Business-Related Subscriptions

Subscriptions to trade magazines, industry journals, and online services are deductible. These resources can help you stay up-to-date and competitive in your industry.

Allocating Funds for Professional Services

Allocate a part of your budget for professional services. Maintain receipts and invoices as proof of your deductions. This will enable you to handle your finances more efficiently and avoid common tax mistakes.

Asset Depreciation

When you purchase a high-priced piece of equipment, you aren’t allowed to deduct the full cost in the year you bought it. You are required to depreciate it over time. Let’s take a closer look at how this operates. For more detailed information on this topic, check out these small business tax deductions.

Grasping the Concept of Asset Depreciation

Depreciation enables you to distribute the expense of an asset throughout its lifespan. This implies that you deduct a fraction of the cost annually, instead of in one lump sum.

How the Modified Accelerated Cost Recovery System (MACRS) Works

The IRS uses the MACRS method to calculate how much you can deduct for depreciation each year. This system applies different rates of depreciation depending on the type of asset and its useful life. To avoid common errors, check out these small business tax mistakes to avoid.

Figuring Out Depreciation

In order to figure out depreciation, you need to know how much the asset cost, how long it’s useful for, and what it’s worth at the end of its life. You can use tables from the IRS to find out how much to depreciate each year. This will help you report your deductions accurately.

Unpaid Invoices

There may be times when a client or customer doesn’t pay you. When this occurs, you can write off the unpaid invoice as bad debt. Here’s how to manage that.

When customers don’t pay their bills or loans aren’t repaid, you have what’s called bad debt. You can write this off and reduce your taxable income, but there are certain rules you need to follow.

Unpaid Debts

There are times when clients fail to pay their dues. In such cases, you can consider the unpaid debt as a write-off. Here’s how you can go about it.

What is Bad Debt and What are Some Examples?

Bad debt is money that you are unable to collect from your customers. This could be unpaid invoices or loans that will not be paid back. By writing off bad debt, you can reduce your taxable income, but you must follow certain rules.

Let’s say you sold a product worth $1,000 to a client who ended up not paying. That $1,000 can be written off as bad debt, which in turn reduces your taxable income by the same amount.

Claiming Bad Debt as a Deduction

In order to claim bad debt as a deduction, you have to demonstrate that you’ve made a reasonable attempt to collect it. This could involve sending out bills, making phone calls, or even employing a debt collection agency. Once you’ve established that the debt can’t be collected, you can claim it as a deduction on your tax return.

- Add the total of your business’s bad debt to your income.

- Take away the bad debt from your total income.

Always remember to keep a thorough record of your attempts to collect the debt and any conversations you have with the person who owes you money. If the IRS ever doubts your write-off, this paperwork will be key. For more tips, check out these common tax mistakes to avoid.

Avoiding Unpaid Debt

Start avoiding unpaid debt with good business practices. Here are some tips to decrease the risk: ensuring you are taking advantage of small business tax deductions can significantly help in managing your finances.

- Perform credit checks on new clients.

- Ask for deposits or partial payments in advance.

- Quickly send out invoices and chase after late payments.

- Provide discounts for payments made early.

These actions can lower the chances of uncollectable debt and boost your cash flow. For more insights, read about the ERTC impact on business cash flow.

Getting the Most Out of Your Tax Deductions

Getting the most out of your tax deductions requires careful planning and record-keeping. Here are some strategies to help you maximize your deductions.

Keeping Your Records in Order

Having good records is key to getting the most deductions. Save all receipts, invoices, and other paperwork for all business costs. Use a bookkeeping program to keep track of your costs and create reports.

Keep your receipts in order by category, such as office supplies, travel, and advertising. This will help you spot deductible expenses and make sure you don’t miss any deductions.

Employing Tax Software

By employing tax software, you can easily identify and claim deductions. These software programs guide you step by step through the process and ensure you are following tax laws. Some popular choices include TurboTax, H&R Block, and TaxAct.

Employing tax software can conserve your time and lower the likelihood of making mistakes. It can also assist you in discovering deductions you might not have thought of.

Seeking Advice from a Tax Expert

If you’re uncertain about which deductions to make or how to get the most out of your savings, seek advice from a tax expert. They can give you tailored advice and help you understand complicated tax laws.

Working with a tax professional can also assist you in planning ahead and finding ways to reduce your tax burden. This investment can yield long-term benefits by saving you money and preventing expensive errors.

Conclusion

Knowing and taking full advantage of your tax deductions can make a big difference in your net income. Keeping detailed records, using tax software, and consulting with a tax professional can help you make sure you’re getting all the deductions you’re entitled to.

Wrapping Up on Tax Deductions

Tax deductions are an effective way to lower your taxable income and hold onto more of your hard-earned cash. By staying knowledgeable and ahead of the game, you can optimize your savings and boost your business’s financial wellbeing. For more insights, check out these small business tax deductions worth knowing.

What Small Business Owners Should Do Next

Begin by going over your expenses and finding possible deductions. Get your records in order and think about using tax software to make the process easier. If necessary, seek the advice of a tax professional for personalized guidance.

Don’t forget, the secret to taking full advantage of your deductions is to stay organized and ahead of the game. This way, you can save money and put more back into the growth and success of your business.

More Help and Assistance

If you need more details about tax deductions and other finance topics for small businesses, consider the following resources:

Frequently Asked Questions (FAQs)

What qualifies as a home office?

A home office must be used exclusively and regularly for business purposes. It can be a separate room or a specific area in a room. The space should not be used for personal activities.

Can I write off both the miles I drive and the expenses of my vehicle?

No, you must select either the standard mileage rate or actual expenses. The standard mileage rate is easier, but actual expenses may provide a larger deduction if you have large car-related expenses.

What travel expenses are tax deductible?

Business travel expenses such as airfare, hotel accommodations, meals, car rentals, and conference fees can be deducted. The trip must be mainly for business purposes, and you should maintain detailed records of your travel itinerary and expenses.

Can I deduct 100% of my health insurance premiums?

Yes, if you’re a self-employed individual, you can deduct the entire cost of your health insurance premiums. This includes coverage for you, your spouse, and your dependents. For employees, the premiums paid by the business are also deductible as a business expense.

Get to grips with these tax deductions and you’ll be able to reduce your taxable income and keep more of your earnings. Start getting your records in order and planning your deductions now, don’t wait until tax season. For more detailed guidance, Learn More about how to optimize your tax strategy and grow your business.