Main Points

- Quarterly tax payments are essential for self-employed individuals and small businesses to avoid penalties.

- Missing quarterly tax deadlines can lead to severe penalties and interest charges.

- Self-employed individuals, independent contractors, and small business owners are typically required to file quarterly taxes.

- Using accounting software can help track income and expenses, making quarterly tax reporting easier.

- Consulting a tax professional can ensure accurate calculations and compliance with tax laws.

Why Quarterly Tax Reporting Matters for Businesses

Quarterly tax reporting is not just a mundane task that businesses must endure. It’s a crucial practice that keeps businesses financially healthy and compliant with tax regulations. By paying taxes quarterly, businesses can manage their cash flow better and avoid the surprise of a hefty tax bill at the end of the year.

A Quick Look at Quarterly Taxes

Quarterly taxes are essentially tax payments that are made four times a year. They are mostly applicable to those who do not have taxes withheld from their income. This includes self-employed individuals, freelancers, and small business owners. The IRS requires these payments to make sure that taxes are paid as income is earned, instead of waiting until the end of the year.

Primarily, these payments include both income tax and self-employment tax, which encompasses Social Security and Medicare taxes. The IRS has established due dates for these payments, typically in April, June, September, and January of the next year. Failing to meet these due dates can lead to penalties, making it essential to monitor them.

The Impact of Ignoring Quarterly Payments

Ignoring your quarterly tax payments can have serious financial consequences. If a business doesn’t pay on time, the IRS can impose penalties and interest. These can pile up fast, adding to the total tax load on the business.

For instance, a business that fails to make a quarterly payment could be penalized up to 5% of the unpaid tax for each month the payment is overdue. This can be a significant blow for small businesses that operate on thin margins. Therefore, grasping the significance of prompt payments is crucial for maintaining financial stability.

Who Is Required to File Quarterly Taxes?

Quarterly taxes are not a requirement for everyone. However, if you belong to certain groups, it is essential. Understanding whether you need to file can help you avoid unnecessary fines and make sure you are following IRS rules.

- Self-employed individuals

- Independent contractors

- Small business owners

- Partners in partnerships

- Individuals with significant income not subject to withholding

Self-Employed and Independent Contractors

If you are self-employed or work as an independent contractor, quarterly tax payments are typically required. This includes freelancers, gig workers, and anyone who earns income outside of a traditional employer-employee relationship. Since taxes are not withheld from your income, you need to estimate and pay them quarterly.

Partnerships and Small Businesses

Partnerships and small businesses are also required to pay taxes quarterly. This is to ensure that income and self-employment taxes are paid as income is earned. These entities must keep track of their estimated taxes to avoid interest and penalties.

Who Needs to File Quarterly Taxes?

Typically, if you think you’ll owe $1,000 or more when you file your tax return, you’ll need to make quarterly tax payments. If your withholdings and refundable credits are less than either 90% of the tax shown on your current year’s tax return or 100% of the tax shown on your previous year’s return, you’ll also need to make these payments.

What You Need to Know for Quarterly Tax Reporting

When it’s time to do your quarterly tax reporting, you’ll need to have certain information ready. This includes forms, income information, and expense tracking. Keeping accurate records will help you pay the right amount and avoid problems with the IRS. For new business owners, understanding essential tax tips and strategies can be particularly beneficial.

Required Forms

When it comes to federal taxes, you’ll be using Form 1040-ES to calculate and pay your estimated taxes. This form will help you determine your estimated tax liability based on your projected income, deductions, and credits. It’s crucial to fill out this form correctly to avoid penalties for underpayment.

In addition to federal forms, you may also need to take into account forms specific to your state if your state requires quarterly tax payments. Each state has its own set of rules, so it’s a good idea to check with your state’s tax agency to make sure you’re following all the rules.

Getting a Grip on Estimated Taxes

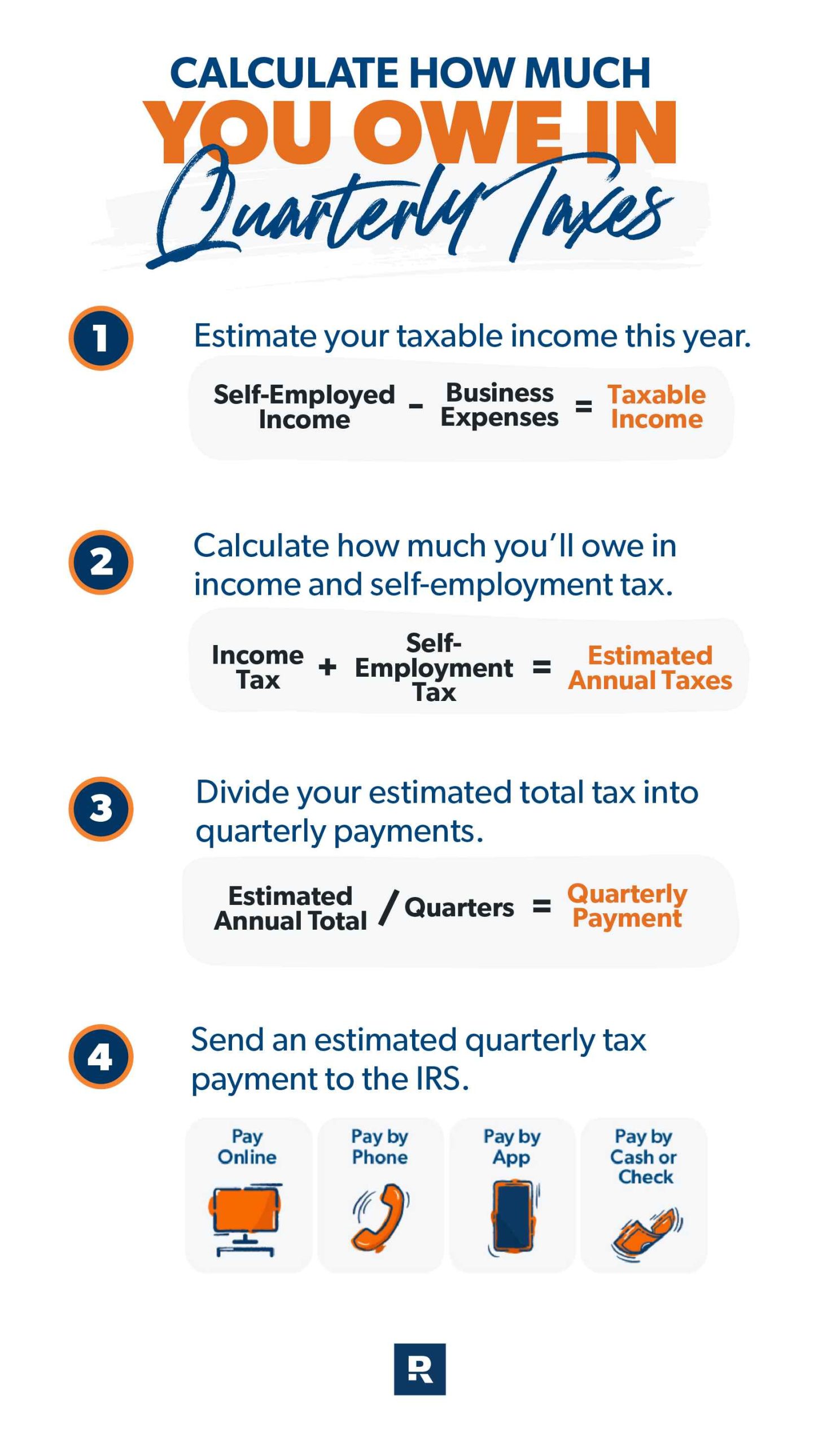

Estimated taxes are what you pay on income that doesn’t have withholding. This income can come from self-employment, rent, dividends, and interest. To figure out your estimated taxes, you have to forecast your total income for the year, figure out how much you owe in taxes, and then break it down into four payments.

The “safe harbor” method is a popular way to calculate estimated taxes. It involves paying 100% of what you owed in taxes the previous year, or 110% if you made more than $150,000. This method helps protect you from penalties for underpaying.

Keeping Track of Earnings and Costs

It’s essential to keep precise records of your earnings and costs for your estimated tax calculations. Detailed records help you figure out your actual earnings and pinpoint any costs you can deduct. This not only guarantees you’re paying the right amount of tax, but it also helps you get the most out of your deductions.

Accounting software can streamline this process. With tools like QuickBooks or FreshBooks, you can automatically track income and expenses, categorize them, and generate reports. This makes filling out forms and making accurate quarterly payments easier. For new businesses, understanding these tools can be part of essential business tax tips and strategies.

Typical Errors to Steer Clear Of

Even minor errors in quarterly tax reporting can cause major problems. You can prevent unnecessary complications and ensure your business’s tax reporting goes smoothly by being aware of these typical errors.

Misjudged Income Forecasts

One of the most common mistakes is misjudging income forecasts. When figuring out your quarterly taxes, it’s important to have a clear picture of your income. Over-forecasting can cause cash flow issues, while under-forecasting can lead to fines. Regularly reviewing your income and adjusting your forecasts as necessary can help keep you on the right path.

Forgetting to Claim Tax Deductions

One mistake that is often made is forgetting to claim tax deductions. Deductions can lower your taxable income quite a bit, but you have to know they exist and claim them. Keep track of all expenses related to your business, like office supplies, travel, and home office costs. This will help you claim the most deductions and lower your tax bill.

Consequences of Late Payments

Not meeting the deadline for a quarterly tax payment can be an expensive mistake. The IRS can hit you with penalties and interest for late payments, which can accumulate rapidly. To avoid this, take note of payment deadlines and set up reminders. Paying on time consistently can shield your business from unnecessary financial stress.

Helpful Advice for Quarterly Tax Reporting

Getting a handle on quarterly tax reporting takes some initiative. By using some tried and true methods, you can make the process smoother and lower the chance of mistakes. For additional insights, consider exploring this guide on new business tax tips and strategies.

Benefits of Accounting Software

When it comes to handling your quarterly taxes, accounting software can make a world of difference. Software such as QuickBooks or Xero can automatically keep track of your income and expenses, sort transactions into categories, and produce the reports you need. This can make tax preparation much simpler and more accurate.

“Implementing accounting software not only saves time but also minimizes the chances of miscalculations in your tax computations.”

Think about linking your accounting software with your bank accounts for instant updates and insights into your financial situation. This connection can assist you in staying current with your finances and making knowledgeable decisions. For further guidance, check out IRS resources for small businesses.

Getting Advice from Tax Experts

Getting advice from tax experts can offer useful knowledge and reassurance. Tax consultants can help you navigate complicated tax laws, find deductions you may have overlooked, and make sure you meet IRS standards. Their knowledge can be particularly useful if your business income varies or if you’re newly self-employed.

Modifying Payments in Accordance with Income Fluctuations

Fluctuations in your income can influence your projected tax payments. If there are substantial changes in your income throughout the year, either increases or decreases, it’s important to modify your payments to match. This will help you avoid overpaying or underpaying, which will keep your cash flow steady and prevent you from being penalized.

How to Pay Your Quarterly Taxes

Paying your quarterly taxes can be an overwhelming task, but it doesn’t have to be. These easy-to-follow steps will help you streamline the process and make sure your payments are correct and on schedule.

Paying Taxes Online through the IRS

The IRS offers a secure and convenient way to pay your taxes online through the Electronic Federal Tax Payment System (EFTPS). This system eliminates the need for mailing checks and allows you to schedule your payments in advance to ensure you never miss a deadline. To get started, simply register for an account.

Submitting Paper Forms

For those who prefer the old-fashioned way, payments can still be made using paper forms. Complete Form 1040-ES and send it along with your check or money order to the correct IRS address. Be sure to send it early enough to account for mail delivery time and meet the payment deadline.

No matter which way you decide to pay, make sure to keep a record of all payments. These can be very useful if you ever have any disagreements with the IRS.

Making Sure Payments are On Time

It’s important to make your quarterly tax payments on time. To make sure you never forget a due date, you can set reminders on your phone or calendar. If you use the IRS online payment option, you might want to set up automatic payments. This way, you can concentrate on running your business instead of worrying about forgetting to make a payment.

Applying these tips will help you master your quarterly tax reporting and dodge needless worries and fines.

Concluding Remarks on Quarterly Tax Reporting

Quarterly tax reporting is an essential part of running a thriving business. It guarantees that taxes are paid punctually, assists in keeping a robust cash flow, and averts the shock of a hefty tax bill at the year’s end. Businesses can easily tackle the intricacies of quarterly taxes by being systematic and proactive. For additional guidance, consider following a tax audit preparation checklist to ensure compliance and accuracy.

Keeping an Eye on Your Finances

Keeping an eye on your financial health is key to accurate quarterly tax reporting. This means you need to keep track of what you’re making and what you’re spending, and you need to regularly review your financial statements. This way, you can make the best decisions and adjust your estimated tax payments as needed.

- Keep your accounting software up-to-date with the latest transactions.

- Make it a habit to review your financial statements each month to identify any trends.

- Be sure to adjust your estimated taxes if you see any major changes in your income.

Keep in mind, knowledge and preparation are the secret to effective tax management. By keeping a close eye on your finances, you can prevent unexpected surprises and make sure you’re following all tax laws.

Furthermore, maintaining precise records will assist not only with tax reporting but also provide a glimpse into the overall financial health of your business.

Keeping Up with Changes in Tax Laws

It’s important to keep yourself updated on changes to tax laws and regulations to ensure you’re in compliance. Sign up for updates from the IRS and your state tax agency. You might also want to consider joining professional organizations that offer news and resources related to taxes.

Keeping up-to-date allows you to promptly adjust to tax law changes and keep your business in line with the rules.

Commonly Asked Questions

Business owners often have questions about quarterly tax reporting. Below are some of the most frequently asked questions and their answers to help you better understand the process.

What are the consequences of missing a quarterly tax payment deadline?

If you miss a quarterly tax payment deadline, you may be subject to penalties and interest charges. The IRS generally charges a penalty of 0.5% of the unpaid tax for each month the payment is late, up to a maximum of 25% of the unpaid tax.

“If you miss a deadline, pay as soon as possible to minimize penalties and interest.”

If you happen to miss a payment, it’s crucial to make that payment as soon as you can to lessen the financial burden on your business.

What’s the best way to figure out my estimated taxes?

Use Form 1040-ES to calculate your estimated taxes for the year. Once you have that number, divide it by four to get your quarterly payments. Another way to go about it is to use the “safe harbor” method. This involves paying either 100% of last year’s tax liability, or 110% if you made more than $150,000.

Consistently check your income and expenses to make sure your estimates stay precise all year round. For more detailed advice, consider these new business tax tips and strategies.

Is it possible to modify my quarterly tax payments if there’s a significant change in my income?

Definitely, you can modify your quarterly tax payments if there’s a significant change in your income during the year. You should recalculate your estimated taxes based on your new income projections and adjust your payments accordingly.

Do I have to pay quarterly taxes if I have a regular job and a side hustle?

Even if you have a regular job where taxes are withheld, you may still need to make quarterly tax payments for the income you earn from your side hustle. You can use Form 1040-ES to estimate the tax you owe from your side hustle and see if you need to make quarterly payments. For more guidance, check out these new business tax tips and strategies.

What’s the simplest method for paying my quarterly taxes?

The simplest method for paying your quarterly taxes is by using the IRS’s Electronic Federal Tax Payment System (EFTPS). This secure online system lets you schedule payments ahead of time and saves you the trouble of sending checks in the mail.

“Signing up for EFTPS makes paying your taxes easier and guarantees you never miss a due date.”

Create an account and schedule automatic payments to make your tax reporting process more efficient. For new businesses, consider these tax tips and strategies to ensure compliance and efficiency.

What happens if I don’t pay enough in quarterly taxes?

If you don’t pay enough in each quarterly tax payment, you could be penalized by the IRS. To avoid penalties, make sure you’re calculating your estimated payments correctly and that they’re based on a realistic projection of your income. For additional guidance, check out these new business tax tips to ensure you’re on the right track.

How can I locate a dependable tax advisor?

Locating a dependable tax advisor requires research and interviews with potential candidates. Search for advisors who have experience in your field and positive feedback from clients. Request recommendations from other business owners and verify qualifications with professional associations.

Investing in a tax advisor who is knowledgeable can be worthwhile because they can provide valuable insights and ensure you comply with tax regulations.