The Employee Retention Tax Credit (ERTC) provides businesses with a great opportunity to get financial help. But, the process of making ERTC claims can be quite difficult, especially because there are strict deadlines. It’s important to understand these deadlines and get expert help so you can get the most benefits.

Important Points

- April 15, 2024, is the last date to file ERTC claims for 2020 and for 2021, it’s April 15, 2025.

- If you miss the deadline, you may lose the chance to claim a significant amount of financial aid.

- Working with a knowledgeable advisor can make the ERTC submission process easier.

- It is crucial to collect accurate documentation for a successful claim.

- Staying informed about possible legislative changes is crucial for future submissions.

ERTC Claims Final Submission: Important Deadlines and Expert Advice

Let’s go into the specifics of the ERTC program and how you can effectively meet its requirements. The ERTC was established under the CARES Act to assist businesses in keeping employees during difficult economic periods. It’s a refundable tax credit, meaning you can receive money back even if you don’t owe any taxes. However, to take advantage of it, you need to be aware of the deadlines and adhere to the proper submission process.

Getting to Know the ERTC Program

The ERTC program was established to assist businesses that have seen a drop in revenue or have been affected by government shutdown orders as a result of the pandemic. Qualified employers can claim a maximum of $5,000 per employee for 2020 and up to $7,000 per employee for each quarter of 2021. This can amount to a substantial sum, particularly for businesses with a large number of employees.

For a business to be eligible, it must have been fully or partially shut down due to governmental orders, or it must have seen a substantial drop in gross receipts. It’s crucial to confirm your eligibility before making a claim.

- Businesses with a full or partial suspension of operations due to COVID-19 orders.

- Businesses that experienced a significant decline in gross receipts.

- Must maintain accurate records of employee wages and hours worked.

Importance of Submission Deadlines

Meeting the ERTC submission deadlines is crucial. If you miss these deadlines, you may lose the opportunity to claim the credit altogether. The IRS has set specific deadlines for filing ERTC claims, and it’s essential to adhere to them to avoid missing out on this financial relief.

Important Deadlines for ERTC Claims

The first step to ensuring you don’t miss out on this valuable credit is understanding the important deadlines for ERTC claims. Let’s take a look at the key dates you need to remember.

ERTC Claims: When’s the Last Day to File?

The last day to file ERTC claims for the 2020 tax year is April 15, 2024. If you’re filing for the 2021 tax year, you have until April 15, 2025. It’s crucial to get ready well before these dates to make sure your claim goes through without any hitches.

These deadlines are non-negotiable, and failure to meet them could result in losing thousands of dollars in tax credits. Thus, it is essential to start getting your paperwork in order and gathering the necessary information as soon as possible.

Deadline Extensions and Special Cases

There may be special cases or deadline extensions when it comes to submitting ERTC claims. For instance, if you are dealing with a third-party payer or if the law changes, you may be able to extend the deadline for your claim submission.

Keeping abreast of the latest developments and changes to the ERTC program is crucial, especially if they affect the deadlines for filing your claims. Regularly consulting with your tax advisor or visiting the IRS website can help you keep track of these changes.

The Consequences of Not Meeting Deadlines

If you fail to meet the ERTC submission deadline, you may face serious repercussions. Not only could you lose out on important financial aid, but you could also be penalized or subject to increased scrutiny by the IRS. Therefore, it is essential to make your ERTC submission a priority and ensure it is submitted correctly and promptly.

Finding the Best Advisors

Choosing the right advisor to assist with your ERTC submission can make all the difference. An experienced advisor can guide you through the complex requirements and ensure your claim is thorough and accurate. So, where do you find these advisors? Begin by searching for professionals with a solid understanding of tax law and a history of successfully managing ERTC claims.

One way to find a reliable advisor is to ask other business owners or colleagues who have successfully claimed the ERTC for their recommendations. Also, consider contacting professional organizations like the American Institute of CPAs (AICPA) or the National Association of Tax Professionals (NATP) for advice on finding certified advisors.

How to Get Ready for ERTC Submission

Getting ready for your ERTC submission takes a lot of careful planning and focus on the small details. If you follow a few important steps, you can make the process smoother and improve your chances of having a successful claim.

First things first, you need to understand the eligibility criteria and make sure your business fits the bill. This means going over your financial records and checking any government orders that may have affected your business.

Collecting Essential Paperwork

Your ERTC claim is only as strong as your paperwork. You need to collect precise records of your employee wages, hours worked, and any government shutdown orders that impacted your business. These documents will provide the proof needed to back your claim and show your eligibility.

Understanding the Fine Print

Before you submit your claim, you should carefully read the conditions and terms of the ERTC program. This includes knowing how to calculate the credit and making sure your documents match the IRS guidelines. Checking everything carefully can help you avoid mistakes and lower the chances of your claim being denied.

Seeking Expert Advice Early On

Engaging with experts at the beginning of the process can offer invaluable advice and direction. A seasoned advisor can assist you in identifying any potential problems with your claim and provide ways to rectify them. It’s best not to wait until the eleventh hour to seek expert counsel—doing so can save you time and alleviate stress later on.

Aside from consulting with advisors, you might want to think about participating in webinars or workshops that concentrate on ERTC submissions. These resources can provide you with useful advice and the most current information to assist you in managing the process more efficiently.

Typical Errors and How to Prevent Them

Several entrepreneurs make typical errors when they file their ERTC claims, which can result in postponements or denials. By knowing about these traps, you can take steps to prevent them before they happen.

Many people make the mistake of not providing all the necessary documentation, or providing inaccurate information. This can lead to the IRS being unable to verify your claim, and you may miss out on the credit you are entitled to. It’s important to make sure your paperwork is complete and well-organized.

Commonly Missed Details

- Incorrect salary calculations for staff.

- Lack of or incomplete documentation for government shutdowns.

- Not updating company information with the IRS.

These commonly missed details can lead to major problems with your ERTC claim. Make sure to check your calculations twice and ensure all paperwork is filled out correctly and completely before you submit.

Another frequent error is misinterpreting the eligibility criteria. Ensure you comprehend the requirements thoroughly and confirm that your business is eligible for the credit.

How to File Accurately

For an accurate ERTC claim, create a checklist of necessary documents and steps to keep yourself organized and make sure nothing is overlooked. You may also want to use accounting software to track employee wages and hours worked, which can make it easier to gather the required information.

Why You Should Double-Check Your Information

- Go over all your calculations and documentation to make sure they’re correct.

- Make sure your business information is current with the IRS.

- Have an advisor look over your submission before you file it.

Double-checking your information can help you avoid expensive mistakes and make sure your claim goes through without any problems. It’s always smart to have someone else look over your submission to catch any mistakes you might have missed.

Getting Ready for Possible Changes and Updates

The ERTC program can change, and it’s important to stay informed about possible updates for future submissions. Changes in the law can affect who’s eligible, when the deadline is, and how to submit.

By staying updated with the latest industry news and frequently visiting the IRS website, you can be aware of any changes that may impact your ERTC claim. This proactive approach can assist you in quickly adapting and ensuring that your submission is in line with the latest guidelines.

Keeping Up With Law Changes

Consider setting up alerts for news about the ERTC program to keep track of law changes effectively. This will help you stay informed about any updates or changes that could affect your claim. Also, keeping the lines of communication open with your advisor can provide valuable insights and make sure you are ready for any potential changes.

Adjusting to New Submission Procedures

As the situation for ERTC claims changes, businesses need to be ready to adjust to any new submission procedures that may be introduced. The IRS sometimes updates its guidelines and forms, so it’s crucial to keep up to date and be prepared to change your strategy. One way to keep up is by regularly checking the IRS website or signing up for updates that give the most recent information on tax credits and submissions.

In addition to that, keeping a good rapport with your tax advisor can offer you insights into any changes in a timely manner. They can provide advice on how to handle new procedures effectively, making sure your claim is both precise and in compliance with the most recent standards. For specialized guidance, consider consulting an employee tax credit advisor who specializes in compliance.

Keeping Up with Industry News

For any business owner who wants to successfully claim the ERTC, keeping up with industry news is a must. If you’re informed, you can anticipate changes and get your business ready to meet new requirements. Follow reliable financial news outlets, join professional networks, and take part in webinars or workshops about tax credits.

First and foremost, think about establishing alerts for updates on tax laws and regulations. This forward-thinking strategy will assist you in staying ahead of any modifications and guarantee that your business is always prepared to adjust.

Common Queries

Let’s delve into some common questions to help you better understand the ERTC and its submission process. The aim of these responses is to clear up any confusion and offer advice on how to successfully navigate the ERTC claims process.

Understanding ERTC and its Eligibility Criteria

The Employee Retention Tax Credit (ERTC) is a refundable tax credit that was established to incentivize businesses to retain their employees during the COVID-19 pandemic. It provides financial assistance by permitting eligible employers to claim a portion of the qualified wages they paid to their employees.

Your business must meet certain criteria to be eligible for the ERTC. Specifically, your business operations must have been fully or partially suspended due to a government order, or your gross receipts must have significantly decreased. It’s crucial to evaluate your business against these criteria to determine if you’re eligible.

- Companies that had to shut down due to COVID-19 mandates.

- Companies that have experienced a substantial decrease in gross receipts.

- Meticulous payroll record keeping is required.

What is the last day to file ERTC claims?

ERTC claims for the 2020 tax year must be filed by April 15, 2024, and claims for the 2021 tax year must be filed by April 15, 2025. These deadlines are set in stone, so it’s important to get your paperwork in order and file your claims as soon as possible to avoid missing this financial benefit. For assistance, consider consulting with ERTC refund specialists who can help maximize your claims.

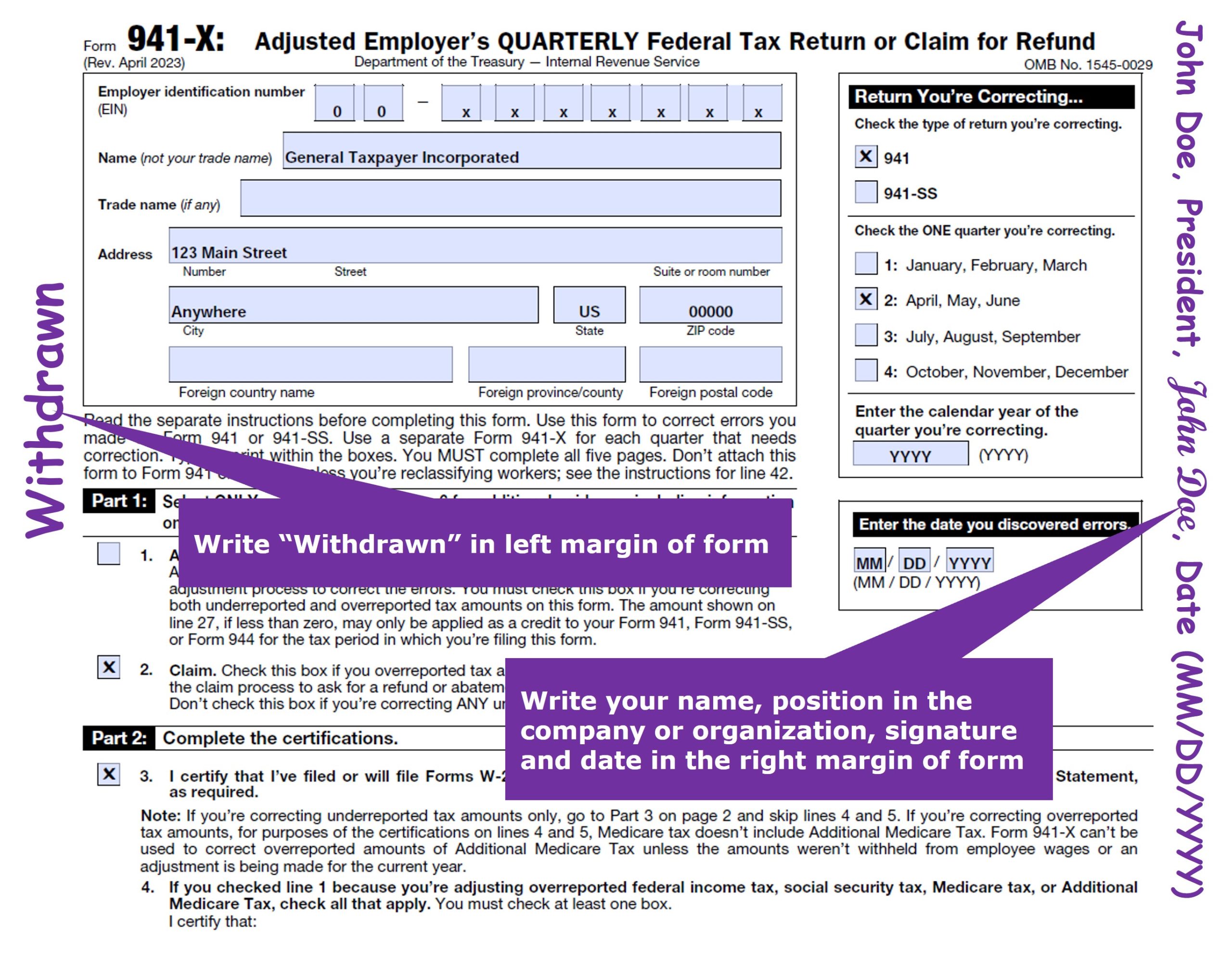

Is it possible to alter an ERTC claim that has already been submitted?

Indeed, if you find any mistakes or omissions in your ERTC claim, you can alter it. You’ll need to submit an amended return using Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to do so. This form allows you to correct any errors in your original submission.

If you need to make changes to your claim, it’s crucial to do so as soon as possible. Any delay in submitting corrections could affect how long it takes to process your claim and may even result in penalties. So, make sure all your paperwork is correct before you file it, and deal with any errors straight away.

What steps can I take to ensure a submission advisor is legitimate?

To ensure a submission advisor is legitimate, you should begin by checking their qualifications and professional memberships. Look for advisors who are certified public accountants (CPAs) or enrolled agents (EAs) with experience in managing ERTC claims. You can also request references from past clients to assess their dependability and efficiency.

Moreover, it may be beneficial to look for advisors who are part of esteemed groups like the American Institute of CPAs (AICPA) or the National Association of Tax Professionals (NATP). Being part of these organizations can serve as proof of their knowledge and dedication to ethical conduct.

What paperwork do I need to submit for ERTC?

You’ll need detailed payroll records, proof of any government orders that affected your business, and financial statements showing a decrease in gross receipts to submit for ERTC. These documents are important because they show that you’re eligible and support your claim. For expert guidance on ensuring compliance and maximizing your returns, consider consulting with ERTC Express compliance experts.

What happens if I submit late?

If you submit your ERTC claim late, you could lose the credit and face fines from the IRS. It’s important to stick to the submission schedule and make sure your claim is submitted on time.

Remember to mark the important dates on your calendar to avoid fines, and work hand in hand with your advisor to make sure all forms are filled out and turned in on time.

What impact do legislative changes have on my ERTC claim?

Legislative changes can influence many parts of your ERTC claim, such as eligibility requirements, credit values, and submission procedures. It is important to stay up-to-date with these changes to keep your claim compliant and take full advantage of the benefits available.

Stay on top of IRS updates and talk with your advisor to comprehend how legislative changes might impact your claim. If you stay ahead of the curve with new requirements, you can keep your eligibility and avoid possible problems.

What part do third-party payers play in ERTC submission?

Third-party payers, like payroll service providers, can be a huge help in the ERTC submission process. They can help with figuring out the credit, preparing the needed documentation, and making sure claims are submitted on time.

Collaborating with a trustworthy external payer can make the submission process more efficient and minimize the likelihood of mistakes. Nonetheless, it’s crucial to keep communication lines open and double-check all data supplied by the external payer for correctness.