For many businesses, the Employee Retention Credit (ERC) is a financial godsend during tough times. It’s important to know when the application deadline is to get the most out of these benefits. This article will discuss what you need to know about the ERC application deadline and how ERTC Express Tax Credit Compliance Advisors can make this process easier for you.

Things to Remember

- Most businesses have until January 31, 2024, to apply for the ERC.

- If you miss the deadline, you could lose out on potential tax credits.

- The ERC is a refundable tax credit for businesses affected by COVID-19.

- ERTC Express can help you file accurately and on time.

- You need to have the right documentation to apply successfully.

Understanding the ERC Application Deadline

The ERC application deadline is a crucial date for businesses that want to claim this tax credit. If you miss the deadline, you could lose out on financial help that could be vital for your business’s recovery and growth. The ERC is a refundable tax credit that was created to help businesses keep their employees on the payroll during the COVID-19 pandemic. This credit is used against employment taxes, which can result in significant savings.

Getting to Know the ERC and Why It Matters

The Employee Retention Credit is a provision of the CARES Act, which was created to assist businesses during the economic slump brought on by the pandemic. The credit is accessible to qualifying employers who saw a substantial reduction in gross receipts or were forced to fully or partially close due to government mandates. The aim is to motivate businesses to keep their employees by offering financial rewards.

Claiming the ERC allows businesses to receive a refundable tax credit for a portion of the qualified wages they pay to their employees. This can add up to a significant amount, especially for businesses that qualify for the maximum credit. Thus, it’s important to understand how to apply for this credit and meet the deadline to take full advantage of the benefits.

Important Dates to Remember

The main cut-off date for ERC applications is April 15, 2025. This is the last chance for businesses to file their claims for the credit. Keep in mind that deadlines can change based on unique situations or changes, so it’s crucial to stay up-to-date and seek advice from tax experts if needed.

Moreover, companies need to keep in mind the temporary deadlines for submitting necessary paperwork and forms. Sending these documents on time makes sure your application is handled effectively and lowers the chance of delays or rejections.

What Happens if You Miss the Deadline

If you fail to meet the ERC application deadline, your business could be financially impacted. Without this credit, your employment tax liabilities could be higher, potentially putting a strain on your cash flow. Moreover, not claiming the ERC means you’re not taking advantage of a government-supported chance to alleviate your business’s financial stress during a tough economic time.

The ERC is a refundable credit, which means if your credit is more than your tax liability, you can get the difference as a refund. This can be a key source of funding for many businesses. So, missing the deadline doesn’t just affect your tax liability, but also the potential cash inflow from a refund.

Steps to Apply for ERC Successfully

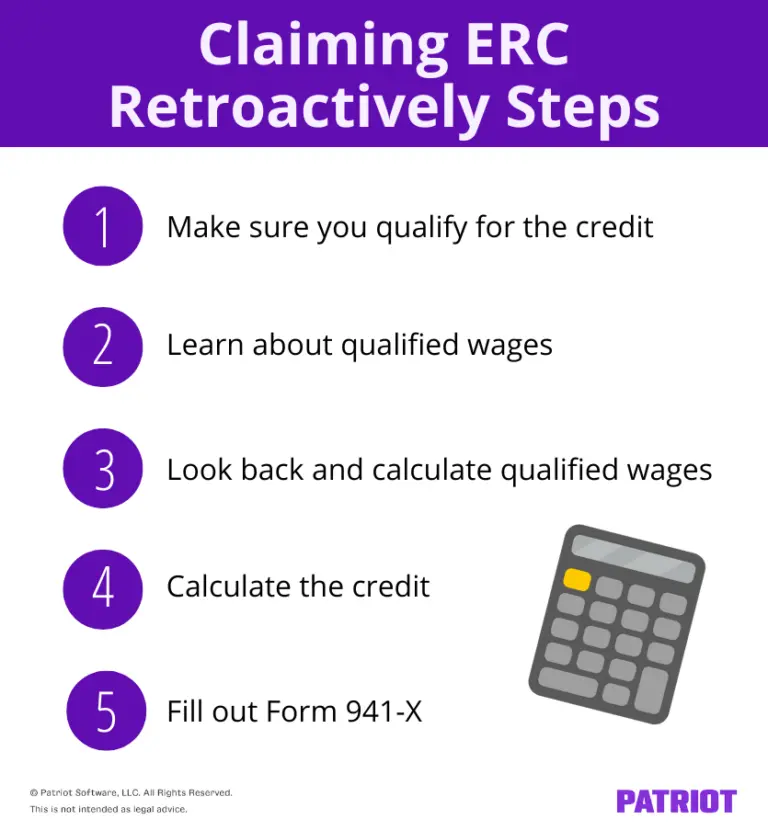

When applying for the ERC, it’s crucial to be detail-oriented and understand the process fully. By following a step-by-step approach, you can make sure that your application is thorough and submitted promptly. Here, we will discuss the steps to apply for the ERC and the necessary documents you need to prepare.

Application Process in Detail

There are several important steps that businesses need to take to ensure their ERC application is successful:

- Check Your Eligibility: See if your business is eligible for the ERC based on a decrease in revenue or because of government-mandated shutdowns.

- Identify Qualified Wages: Determine the wages you’ve paid to employees that are eligible for the credit.

- Fill Out Necessary Forms: Complete IRS Form 941, Employer’s Quarterly Federal Tax Return, or Form 7200 for advance payment of employer credits.

- Provide Documentation: Give the necessary documentation to back up your claim, such as payroll records and financial statements.

- Meet the Deadline: Make sure all forms and documentation are submitted by January 31, 2024.

If you follow these steps, you can make the application process go more smoothly and increase your chances of a successful claim. It’s important to be thorough and make sure everything is accurate on all forms and calculations.

Advantages of Engaging Compliance Advisors

Engaging compliance advisors such as ERTC Express can greatly improve your ERC application process. These professionals are skilled in navigating the intricate tax credit terrain, ensuring that your business fully exploits its potential benefits. They keep abreast of the latest IRS guidelines and legislative changes, providing you with precise and current advice.

Compliance advisors can help identify eligible periods and qualified wages, ensuring that your application is both accurate and comprehensive. They also assist in compiling necessary documentation, reducing the likelihood of errors or omissions that could delay or jeopardize your claim. By partnering with a trusted advisor, you gain peace of mind knowing that your application is in capable hands.

How to Select the Right Advisor for Your Business

In choosing a compliance advisor, it’s crucial to take into account their experience and past performance. Search for advisors with a demonstrated track record of effectively managing ERC claims for businesses that are similar to yours. They should have a comprehensive knowledge of the ERC program and be able to provide testimonials or case studies that highlight their achievements.

Also, think about the kind of assistance and communication they provide. A competent advisor will be on hand to address inquiries and give updates throughout the application process. Openness and straightforward communication are essential for a seamless and effective experience. Spend some time investigating and selecting an advisor who is in line with your company’s requirements and principles.

ERTC Express Client Testimonials

ERTC Express has helped numerous businesses access the financial support they need. Take the example of a small transport company that found out, thanks to ERTC Express, that they were entitled to more than $500,000 in total ERTC credits. They had no idea they were even eligible, but ERTC Express walked them through the entire process, from working out which wages were eligible to filling out all the required forms. The financial help they received from the ERC meant they were able to keep their staff on and keep their business running during a tough economic time.

IRS Compliance and Filing Advice

When applying for the ERC, it is critical to comply with IRS regulations. Making sure your application is correct and comprehensive can help you avoid setbacks and possible audits. Below are a few pieces of advice to help you remain compliant and increase your odds of a successful claim, including how to report Employee Retention Credit on tax returns.

Start by getting to know the IRS’s specific requirements for the ERC. Knowing the eligibility criteria, what documents you need, and when you need to file will help you put together a comprehensive application. The IRS has resources and guidelines to help businesses work through the process, so make sure you use these tools.

Comprehending IRS Obligations

Businesses must show the IRS that they have experienced a substantial drop in gross receipts or a partial/complete halt in operations due to government orders. Make sure you have documents to back up these claims, such as financial reports and government orders. Keeping accurate records is crucial for confirming your eligibility and preventing potential problems during an audit.

Making Sure Your Filings are Correct and On Time

It’s crucial to be accurate when filling out your ERC application. Be sure to check your math twice, particularly when calculating qualified wages and credit amounts. Mistakes in these areas can cause your claim to be delayed or even denied. Use the resources you have at your disposal, like compliance advisors or accounting software, to make sure everything is correct.

Furthermore, punctuality is key. Send in your application and all necessary paperwork well before the deadline to avoid any last-minute problems. It might be a good idea to set reminders or create a schedule to keep track of important dates and guarantee a seamless submission process.

Keeping copies of all forms you’ve submitted and any correspondence with the IRS is a good idea. These documents can be useful if any questions or issues come up during the review process. For additional guidance, you might consider consulting ERTC Express Tax Credit Compliance Advisors.

Getting Ready for a Possible Audit

Even though audits are rare, having everything in order for one can save your business a lot of time and worry. Begin by gathering all necessary paperwork related to your ERC claim, such as payroll records, financial statements, and any IRS correspondence.

Make sure all your paperwork is clear, complete, and easy to find. This will make it easier to answer any questions from the IRS and show that you’re following the rules of the ERC program. Keep checking and updating your records to make sure they’re accurate and complete.

Concluding Thoughts on Meeting ERC Deadlines

Meeting the ERC application deadline is key to maximizing the financial benefits available to your business. By understanding the requirements, gathering the necessary documentation, and utilizing compliance advisors, you can streamline the application process and increase your chances of a successful claim.

Keep in mind, the ERC was created to offer critical financial assistance to businesses impacted by the pandemic. Don’t let this chance to aid your business’s recovery and expansion slip away.

Keeping on Schedule

Make sure you meet the ERC deadline by creating a detailed plan that includes each step of the application process. Set specific deadlines for gathering documentation, completing forms, and submitting your application. Use tools like calendars, reminders, and project management software to keep everything organized and on time.

Preparing for Future Tax Credit Opportunities

While you work through the ERC application process, think about how you can use this experience for future tax credit opportunities. Keep up-to-date on new programs and incentives that may help your business. By keeping accurate records and staying proactive, you can set your business up to benefit from future financial opportunities.

To wrap up, it’s crucial to comprehend and meet the ERC application deadline to maximize the advantages available to your company. With proper planning and assistance, you can successfully navigate this process and secure valuable financial relief.

Common Queries

The Employee Retention Credit (ERC) is an essential financial relief measure for businesses during tough times. Here are some commonly asked questions to help you understand the ERC and its effects better.

Understanding the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a refundable tax credit designed to assist businesses in retaining their employees during the COVID-19 pandemic. It was established under the CARES Act and is accessible to eligible employers who have seen a substantial decrease in gross receipts or were forced to halt operations due to government mandates.

The ERC permits companies to get a percentage of the wages they pay to their employees as a refundable tax credit against employment taxes. It can provide a lot of financial relief, particularly for companies that qualify for the maximum credit, allowing them to keep their workforce during tough economic times.

It’s important for businesses to grasp the details of the ERC, such as who is eligible and what wages qualify. This is because they can lower their tax bill and even get a refund if the credit is more than what they owe in taxes. For more information on compliance, you can check out ERTC Express.

Why should you care about the ERC application deadline?

The ERC application deadline is a key date for businesses who want to claim this valuable tax credit. If you miss the deadline, you could lose out on financial relief that could be critical for your business’s recovery and growth. The main deadline for ERC applications is January 31, 2024.

Ensuring that you meet this deadline will allow your business to fully benefit from the ERC. These benefits include a reduction in your employment tax liabilities and the potential to receive a refund if your credit is greater than your tax obligations. As such, it is essential that you submit your application on time in order to maximize the benefits available to you.

Moreover, sticking to the deadline helps to avoid any eleventh-hour problems or hold-ups in processing your application. By staying updated and methodical, you can make sure that your business fulfills the needed prerequisites and deadlines to claim the ERC successfully.

What are the consequences of missing the deadline for my business?

Not meeting the deadline for the ERC application can result in serious financial implications for your business. Without this credit, your business may have increased employment tax liabilities, potentially affecting your cash flow and slowing down your business’s recovery efforts.

Additionally, not claiming the ERC is a missed chance to use a government-provided opportunity to alleviate your business’s financial strain during tough economic conditions. The ERC is a refundable credit, meaning that if your credit is more than your tax liability, you can get the difference as a refund. Missing the deadline not only impacts your tax liability but also the potential cash inflow from a refund.

What paperwork do I need to apply for the ERC?

In order to apply for the ERC, businesses need to collect and submit certain documents to back up their application. Important documents include payroll records, financial statements, and any government orders or directives that show that their operations were partially or fully shut down.

Moreover, companies are required to fill out IRS Form 941, the Employer’s Quarterly Federal Tax Return, or Form 7200 for advance payment of employer credits. Keeping accurate records and providing comprehensive documentation is crucial for confirming eligibility and facilitating a seamless application process.

What role do ERTC Express Advisors play in compliance?

ERTC Express Advisors are experts in the intricate world of tax credits. They help businesses get the most out of their ERC benefits. They stay on top of the latest IRS guidelines and legislative changes to provide accurate and timely advice. Learn more about their role as a top tax credit compliance advisor.

When will I receive my tax credits after I apply?

The time it takes to receive ERC tax credits can differ based on a number of factors, such as how complete your application is and how long it takes the IRS to process it. Typically, businesses can expect to get their credits a few weeks to a few months after they send in a complete and correct application.

What happens if I make a mistake on my application?

If you submit an application with errors, it could slow down the process and potentially lead to penalties or extra attention from the IRS. To prevent this, make sure all of your forms and calculations are correct and complete.

By using compliance advisors or accounting software, you can lessen the chances of making mistakes and make sure your application is up to par. Also, having detailed records and documents can help clear up any issues that may come up.

Businesses can reduce the risk of penalties and increase the chances of a successful ERC claim by following the rules and ensuring accuracy.

- Ensure all forms and calculations are correct before submitting.

- Keep precise records and documents to back up your claim.

- Think about partnering with compliance advisors to guarantee precision and compliance.

Is it possible for me to apply for ERC if I’ve been granted PPP loans?

Yes, companies that have been granted Paycheck Protection Program (PPP) loans are still eligible to apply for the ERC. However, there are specific rules and restrictions regarding the use of the same wages for both PPP loan forgiveness and ERC claims.

Companies have to make sure that the wages they use to figure out the ERC aren’t the same wages they use for PPP loan forgiveness. They need to document and calculate this carefully to avoid any overlap and to make sure they’re following IRS rules.

Getting advice from a compliance advisor can help businesses steer through these complexities and make sure that they get the most out of their ERC benefits while sticking to the necessary requirements.