Important Points

- Small businesses can achieve considerable revenue growth by venturing into new markets and product lines.

- Intelligent tax strategies, such as utilizing tax credits, can assist small businesses in saving money.

- Maintaining comprehensive records is crucial for claiming valid deductions and tax credits.

- For small businesses looking to reinvest and expand, the Employee Retention Tax Credit (ERTC) can be a game-changer.

- The process of claiming your ERTC is straightforward and can result in significant savings with minimal time commitment.

Hello, fellow business owners! If you own a small business, you understand that every cent is valuable. That’s why it’s so important to not only find ways to increase your revenue, but also to retain as much of it as possible by being savvy with taxes. Let’s look at some strategies that can help you achieve this.

The Strength of a Diversified Revenue Stream

Before we dive in, let’s discuss the importance of diversifying your revenue. This involves identifying various methods to generate income, so you’re not solely dependent on one source. It’s akin to not placing all your eggs in one basket. When one market is in a slump, another might be gaining momentum, ensuring your cash flow remains consistent.

So, how do you start diversifying? Look around at what you’re already good at and think about how you can spin that into something new. Maybe you’re a whiz at making custom cakes. Why not offer baking classes? Or, if you’re a pro at social media marketing, consider consulting other businesses on their strategies.

Crucially, when considering growth, pose these questions to yourself:

- What necessities are my customers lacking that I’m not currently supplying?

- Can I market my current products or services to a fresh set of customers?

- Can I transform a seasonal product into an item that can be sold all year round?

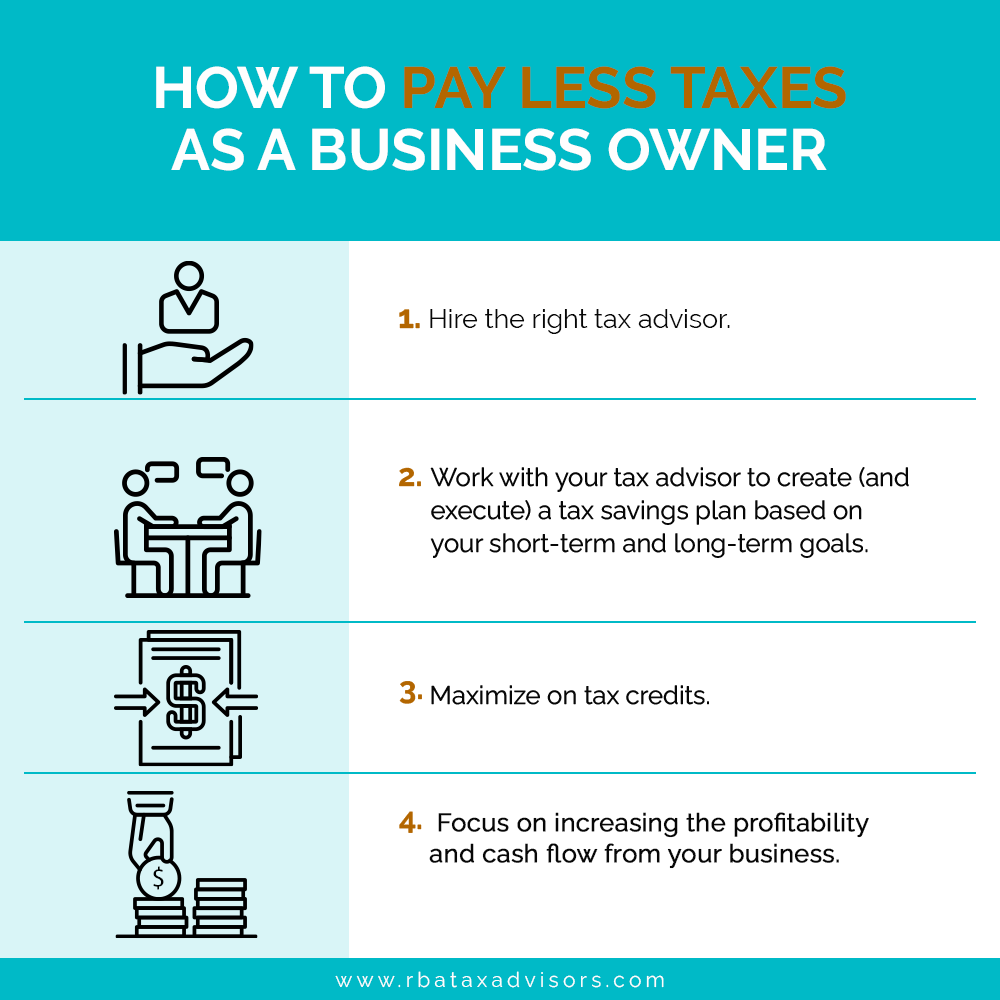

Reducing Taxes: Efficient Tactics for Small Companies

Now, let’s shift our focus to taxes. Nobody enjoys paying more than necessary, correct? That’s why understanding the tax tactics that can save your company money is crucial.

Legitimate Deductions: How to Save Money Wisely

One of the most straightforward ways to reduce your tax bill is by taking advantage of deductions. This involves subtracting certain expenses from your income before you calculate how much tax you owe. Some common deductions for small businesses include:

- Home office expenses, if you work from home

- Costs of goods sold, like materials and direct labor

- Business-related travel and vehicle expenses

- Marketing and advertising costs

It’s essential to keep as much money as possible in your business, so make sure to keep track of every expense. If you lose a receipt, you’re losing money, so stay organized!

Utilizing Tax Credits: Understanding What’s Relevant to Your Business

In addition to deductions, tax credits are a treasure trove for small businesses. They directly decrease the amount of tax you have to pay, on a dollar-for-dollar basis. One of the most beneficial credits available is the Employee Retention Tax Credit (ERTC). It provides incentives for businesses to retain employees on their payroll during difficult periods.

You might be wondering, “How can I apply for this credit?” The process is simpler than you might think. If you’ve maintained your staff throughout the pandemic, you may already be eligible. And what’s the cherry on top? You can use the ERTC to reinvest directly into your business.

True Story: Small Businesses That Flourished Through Diversification

I want to share a story about a friend who owns a local bookstore. When e-readers hit the market, their sales began to decline. However, instead of throwing in the towel, they diversified. They began to organize book clubs, author autograph sessions, and even started a small café inside the store. Now, they’re the popular spot in the neighborhood, not only for books, but for community and coffee as well.

Scaling Up: Expanding Your Product Lines for Success

It’s not just about adding services; it’s also about expanding what you sell. Consider your most popular product. Can you offer variations? Different sizes, colors, or even bundled packages can attract new customers and give existing ones more options.

Keep in mind, the objective is to develop several income streams. That way, if one aspect of your business encounters a problem, you have other sources to sustain you. It’s about demonstrating resilience and adaptability – crucial characteristics for any thriving business.

Market Expansion: The Next Step in Small Business Growth

One of the most effective ways to grow your business is to expand your market. This involves taking your business model that has been successful locally and duplicating it in a new location. This could be as easy as starting an online store to reach customers on a global scale or opening a new store in a nearby town. Consider where your products or services could meet a need, and then take action!

Fueling Growth: Marketing Strategies to Increase Your Business Revenue

Marketing is the lifeblood of business growth. It’s how you make your business known and attract customers. But it’s not just about throwing money at advertisements; it’s about being strategic. Identify where your customers spend their time online, and focus on those areas. Utilize social media, email newsletters, and even community events to spread the word about your amazing business.

Creating a Devoted Clientele: The Bedrock of Consistent Growth

Returning customers are invaluable. To foster loyalty, you need to establish a connection with them. Provide excellent service, solicit their opinions, and genuinely use their feedback to make improvements. Loyalty schemes or exclusive discounts for regular customers can also entice them to continue doing business with you.

Remember, there’s no advertising quite like the good old word-of-mouth. Satisfied customers will share their experience with their friends and soon enough, you’ll see new customers showing up.

Boosting Your Business With Social Media and SEO

In today’s digital age, not having an online presence is like being invisible. Social media platforms are a great way to showcase your products and let your customers know who’s behind the scenes. By using SEO (Search Engine Optimization), you can ensure that when potential customers are looking for the products or services you offer, they’ll find you instead of your competition.

How to Start Saving on Taxes Today

Okay, let’s get real. Tax savings don’t have to be a big mystery. Start by going through your expenses and finding out what you can write off. And don’t leave anything out – sometimes even the little things can lead to big savings.

Business Framework: Selecting the Best Approach

The framework of your business has a direct impact on your tax liabilities. If you are operating as a sole proprietor, you could be paying more taxes than necessary. In some cases, transitioning to a different framework such as an LLC or corporation could result in tax savings. Consult with a tax professional to determine if a change would be advantageous for you.

However, keep in mind that there’s no one-size-fits-all answer here. What works for one business may not work for another. So it’s best to seek personalized advice before making any major decisions.

Be Diligent in Your Record Keeping: It’s Essential for Deductions

You have to have evidence to claim deductions. Save receipts for every single thing that’s connected to your business. If your car is part of your work, make sure you’re logging your miles. If you’re working from your house, don’t forget to save your utility bills. When tax season rolls around, you’ll be happy you were so diligent.

For instance, my next-door neighbor, who operates a graphic design business from her home, didn’t think she had much to claim until she began keeping track of her home office space, internet bills, and even the new computer she purchased. She was able to save several thousand dollars on her taxes simply by maintaining accurate records.

It’s not just about saving money in the present; it’s about preparing for future success. Maintaining accurate records can also assist you in identifying trends in your expenditures and revenue, which can be incredibly beneficial in making intelligent business decisions.

Start Saving on Taxes with ERTC Express

Let’s discuss the Employee Retention Tax Credit (ERTC). It’s an excellent tax-saving strategy for small businesses, particularly if you’ve been affected by recent circumstances. And the best part? It’s not a loan; it’s a credit. So, it’s money you get to keep, not a liability you have to pay off.

Easy Ways to Get the Most Out of Your Employee Retention Credit

Getting the ERTC is not as complicated as it may seem. First, determine if you’re eligible. Did your business experience interruptions or a major decrease in revenue? Then, compute your credit based on eligible wages. And don’t fret; you don’t have to do it by yourself. There are professionals who can assist you in claiming every dollar you deserve.

ERTC Crash Course: Frequently Asked Questions for Small Businesses

- What is the ERTC? It’s a tax credit that benefits businesses that continued to pay employees during specific periods of disruption.

- Can I still claim it if I received a PPP loan? Yes, you can now claim both, but not for the same wages.

- How much can I get? It varies depending on your situation, but it could be up to $7,000 per employee, per quarter.

So why not get started? Visit ERTC Express and start your claim. It takes less than 15 minutes, and you could unlock substantial savings for your business. With their assistance, you can maximize your ERTC claim, ensure proper documentation, and even get a refund from the IRS.

Don’t forget, this isn’t just about surviving hard times; it’s about emerging stronger once they’re over. By implementing these strategies to diversify your revenue and save on taxes, you’re paving the way for your business to thrive in the long run. So go ahead, start expanding your business and hold on to more of the money you worked so hard to earn. You can do it!

FAQ: Understanding the Importance of Diversifying Revenue and Saving on Taxes

What Does It Mean to Diversify Revenue and Why Should I Care?

Diversifying revenue means creating multiple streams of income for your business. This is crucial because it helps to mitigate risk—if one aspect of your business suffers, you have other income sources to keep things running smoothly. It’s like a farmer growing different types of crops; if one crop fails due to poor weather conditions, the others may still be successful, keeping the farm in business. For more information on how this can also lead to tax savings, read our detailed guide.

How Do I Determine the Most Effective Tax Saving Strategies for My Company?

The most effective tax saving strategies are often those that are customized to your specific business circumstances. In general, you should look for valid deductions you can take, such as home office expenses or the cost of goods sold. Additionally, be aware of tax credits like the ERTC. However, the most important rule is to get individualized advice from a tax professional—they will assist you in navigating the complicated tax environment and identifying the strategies that will provide the most benefit to you.

What are the most common pitfalls in revenue growth strategies?

One of the most common pitfalls is overconcentration in one area and neglecting others. For instance, a business may put too much emphasis on acquiring new customers and not enough on retaining existing ones. Another pitfall is failing to adapt to market changes or neglecting the potential of online sales channels. Diversification is the key to avoiding these pitfalls and ensuring steady growth.

For example, a neighborhood gym that used to rely only on membership fees started offering online workout classes during the pandemic. This not only provided a new source of income but also helped keep members who couldn’t visit in person.

Can Tax Strategies Affect My Business’s Revenue Growth?

Definitely. Good tax strategies can free up more money for you to reinvest in your business, whether that’s for marketing, product development, or expanding your operations. The less you pay in taxes (legitimately, of course), the more capital you have to drive your business’s growth.

How Often Should I Revisit and Modify My Company’s Tax Strategies?

You should revisit your tax strategies at least annually, but ideally, you’d do it more often. Tax laws can shift, and your company’s situation can change—keeping abreast of these changes ensures you’re always employing the most efficient strategies. Additionally, frequent reviews can help you spot any errors or overlooked opportunities from the past.

Imagine a tiny tech startup that started as a one-person operation. As the business grew, the owner realized that becoming an S-corporation saved them thousands of dollars in self-employment taxes every year—a tactic they would not have found without regular check-ins.

What Is the Employee Retention Credit and How Do I Get It?

The Employee Retention Credit (ERTC) is a tax credit for businesses that kept their employees on the payroll during the COVID-19 pandemic. To claim it, you need to figure out if you qualify, calculate the credit based on eligible wages, and then claim it on your tax returns. The IRS has comprehensive instructions on how to do this, but if you’re not sure, get help from a tax professional or a specialized service like ERTC Express to make sure you’re getting the most out of it.