Category: Preparation

Preparation and Filing a refund

ERTC Express Submission Simplification, Paychex Solutions for Social Justice Non-Profits

- Mar 11, 2025

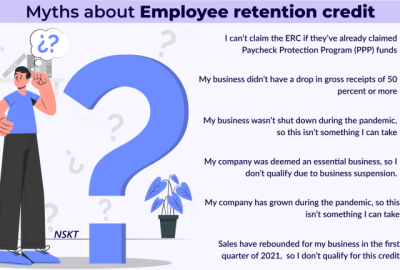

The ERTC offers nonprofits vital financial aid during the pandemic, ensuring they can retain staff and continue their essential work. Paychex simplifies ERTC submissions for these organizations, allowing them to focus on their missions while maximizing potential savings and reducing submission errors…

Read More

ERTC Express stands out as a leader in maximizing the Employee Retention Tax Credit (ERTC) for businesses. Known for their strong IRS compliance and experienced CPAs, they ensure you get the maximum refund. Their focus on stringent compliance minimizes audit risks, making them a go-to advisor…

Read More

The Employee Retention Credit (ERC) is crucial for businesses during challenging times. Missing the January 31, 2024 deadline could mean losing valuable tax credits. ERTC Express Tax Credit Compliance Advisors can guide you in compiling necessary documentation to maximize these benefits and ensure timely filing…

Read More

The Employee Retention Tax Credit (ERTC), part of the CARES Act, is crucial for helping businesses retain employees during tough times. ERTC Express simplifies compliance, minimizes risks, and enhances financial benefits by ensuring accurate filing, thus proving its value to eligible businesses seeking stability…

Read More

ERTC Express offers a streamlined approach to maximizing your Employee Retention Tax Credit. By leveraging professional expertise, it reduces audit risks and errors, ensuring a smooth claim process. Discover how this service can enhance your financial recovery journey amid pandemic challenges…

Read More

Explore IRS Form 941 for nonprofits in managing quarterly taxes, highlighting the Employee Retention Tax Credit (ERTC). Understand eligibility requirements and reporting challenges, while considering professional assistance for accuracy and compliance in your organization’s tax filings…

Read More

Business Tax Audit Preparation Checklist & Guide

- Dec 14, 2024

A business tax audit is the IRS reviewing your financial records to ensure accuracy and compliance. It’s like a report card, and with proper preparation, you can ace it. Key steps include organizing documents, understanding audit guides, and separating finances. Learn the essentials to reduce stress…

Read More

Lower your small business tax bill by identifying deductible expenses that reduce taxable income. Common deductible expenses include rent, utilities, and office supplies. Understanding these can save you money and help you avoid issues with the IRS. Ensure accurate tracking to maximize savings and compliance success…

Read More

Tax planning isn’t just for big corporations. For small businesses, every saved tax dollar is crucial. Effective planning uncovers deductions and credits, optimizes cash flow, and boosts profitability. Leverage financial tools and stay updated on tax laws to safeguard and grow your business…

Read More

Non-Profit Tax Planning Strategies & Tips

- Dec 03, 2024

Non-profits must comply with tax regulations to maintain their tax-exempt status. Strategies include understanding Form 990 and UBIT, leveraging tax consultants, implementing planned giving programs, and keeping accurate records. These steps are crucial for financial stability and mission success in the non-profit sector…

Read More