Category: Tax Credits

Small business tax credits

ERTC Express provides essential tools for human services non-profits to claim the Employee Retention Credit (ERC). These tools ensure compliance, offer personalized support, and handle all paperwork, empowering non-profits to focus on their mission. With no upfront costs, it offers a hassle-free path to financial relief…

Read More

ERTC Express Submission Simplification, Paychex Solutions for Social Justice Non-Profits

- Mar 11, 2025

The ERTC offers nonprofits vital financial aid during the pandemic, ensuring they can retain staff and continue their essential work. Paychex simplifies ERTC submissions for these organizations, allowing them to focus on their missions while maximizing potential savings and reducing submission errors…

Read More

The Employee Retention Tax Credit (ERTC) is a vital financial relief for non-profits impacted by COVID-19. With the 2025 deadline approaching, it’s crucial to understand key terms to maximize benefits. Ensure eligibility, particularly through the Gross Receipts Test, before submitting claims by April 15, 2025…

Read More

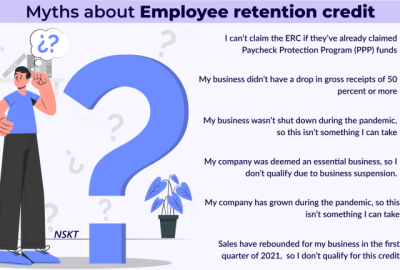

Animal shelters are vital community resources, but financial challenges can hinder their operations. The Employee Retention Tax Credit (ERTC) offers crucial support, allowing shelters to continue their mission during tough times. Understanding eligibility and dispelling myths is key to accessing this financial lifeline for non-profits…

Read More

Learn how historical societies can utilize the Employee Retention Tax Credit (ERTC) to support their mission during financial hardships. Discover eligibility requirements, tips for combining with other relief programs like PPP, and the importance of working with tax professionals to navigate the complexities of this lifeline…

Read More

ERTC Claim Guide for Educational Non-Profits & Tips

- Mar 01, 2025

Educational non-profits can benefit from the Employee Retention Tax Credit (ERTC) to support payroll expenses. By understanding eligibility criteria and utilizing IRS resources, these organizations can focus on their educational missions. Learn how to successfully claim and maximize this financial relief opportunity for your non-profit…

Read More

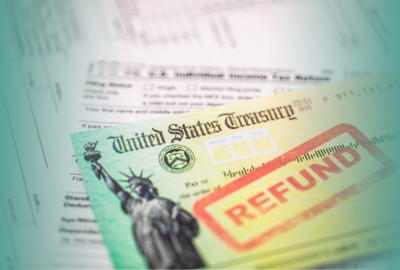

The Employee Retention Tax Credit (ERTC), a COVID-19 relief measure, offers a refundable tax credit to businesses maintaining staff. With an April 15, 2025 filing deadline for 2021 claims, prompt action is vital. Documentation and professional guidance can maximize benefits…

Read More

Navigating the Employee Retention Tax Credit (ERTC) can be complex, yet it’s invaluable for businesses aiming to maximize savings. With ERTC Express, companies can uncover hidden benefits, transforming confusion into clarity and financial gains, as they expertly guide you through the application process…

Read More

Discover how tax relief programs can help reduce your tax burden and streamline your finances. Learn about qualifying criteria and the various options available. Work with a CPA to maximize opportunities and ensure compliance with tax laws. Stay informed about changes to make sound financial decisions…

Read More

The Employee Retention Credit (ERC) is a vital tax credit introduced to aid businesses during COVID-19. Understanding eligibility, maintaining precise records, and meeting deadlines are crucial for compliance. Partnering with a tax professional can simplify complex processes and maximize refunds for businesses…

Read More