Category: Tax Credits

Small business tax credits

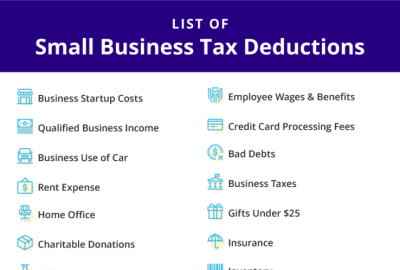

Tax deductions can significantly lower your taxable income, helping you save money. Understand essential deductions like home office, vehicle expenses, office supplies, travel costs, and health insurance premiums to keep more of your hard-earned money. Here are the top 10 tips for small business owners…

Read More

Correct tax management is crucial for the success of your small business. Avoid common mistakes like not separating business and personal accounts, misunderstanding home office deductions, and misclassifying employees. Stay compliant and reduce stress…

Read More

Discover how the Employee Retention Tax Credit (ERTC) can significantly boost your business’s cash flow. Learn the key benefits and essential strategies for maximizing your financial health with this powerful tax credit…

Read More

Explore how the Employee Retention Tax Credit (ERTC) can provide substantial financial relief for restaurants. Learn from real-world examples, understand eligibility criteria, and get tips for a successful claim…

Read More

Best ERTC Guide & Restaurant Industry Tips

- Aug 24, 2024

The Employee Retention Tax Credit (ERTC) is a lifeline for restaurants, offering up to $7,000 per employee per quarter in 2021. Keep your staff and stabilize cash flow with this essential financial aid…

Read More

Small business tax credits can significantly reduce your tax liability and free up capital for growth. By taking advantage of these credits, you can reduce your tax liability and reinvest in your business. Learn how to claim these credits and boost your bottom line…

Read More

Easy Tax Document Organization & Preparation Tips

- Aug 18, 2024

Being organized with your tax documents can save you plenty of time and keep your stress levels down. When it’s tax season, you’ll know exactly where everything is and you won’t have to go on a scavenger hunt to find what you need…

Read More

Best Tax Strategies & Foundations for Startups

- Aug 17, 2024

Choosing the right business structure, optimizing deductions, leveraging Section 179, and meticulous record-keeping are crucial tax strategies for startups. Effective tax planning saves money and prevents legal issues, ensuring more funds for business reinvestment…

Read More

The Employee Retention Credit (ERC) is a significant tax relief tool for businesses impacted by COVID-19. Discover insights on eligibility, compliance, and application processes, and learn how the right advisor can maximize your benefits…

Read More

The ERC moratorium will stay in place until at least September 2023. The IRS is concentrating on reviewing and processing current ERC claims during this period. Businesses can still seek advice from tax professionals to determine their ERC eligibility…

Read More