Category: More

Professional Home Services Starter Payroll Solutions

- Apr 06, 2025

Discover how professional home services starter payroll solutions can simplify payroll management for your business. Streamline payments, ensure tax compliance, and improve employee satisfaction with integrated tools. Focus on delivering exceptional service while leaving payroll headaches behind…

Read More

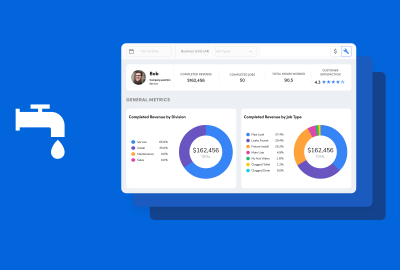

CRM software enhances plumbing businesses by managing customer interactions and streamlining operations. It boosts customer satisfaction, leading to increased revenue. Essential features include scheduling, invoicing, and tool integration. Top solutions like Nutshell and Commusoft offer comprehensive support for evolving needs, despite challenges like data migration and team resistance…

Read More

Best CRM And Accounting Software For Small Business

- Mar 30, 2025

Small businesses face challenges in multitasking with limited resources. CRM software aids in managing customer interactions while accounting software handles financial data. Choosing integrated solutions saves time and minimizes errors. Key features are usability, customization, and mobile access. Explore options like HubSpot and QuickBooks for efficiency…

Read More

Choosing the right CRM is vital for small businesses and accounting firms to enhance client management and boost productivity. Top choices like Zoho CRM, HubSpot, and TaxDome offer tailored solutions. Consider budget, customization, and integration capabilities when selecting the ideal CRM for your needs…

Read More

Employee Retention Tax Credit (ERTC) is crucial for non-profits, offering financial benefits to retain staff and sustain operations. ERTC Express aids organizations in compliance, maximizing their refund potential, and strategically using funds to expand initiatives while adhering to IRS guidelines…

Read More

Customer service is the lifeblood of small businesses, crucial for building trust and loyalty. By fostering personalized interactions and addressing issues promptly, businesses differentiate themselves, turning customers into advocates and driving success through repeat transactions and referrals, ultimately enhancing reputation and market presence…

Read More

Learn how historical societies can utilize the Employee Retention Tax Credit (ERTC) to support their mission during financial hardships. Discover eligibility requirements, tips for combining with other relief programs like PPP, and the importance of working with tax professionals to navigate the complexities of this lifeline…

Read More

Starting and growing a small business is daunting, but with the right support, it becomes easier. Non-profits offer grants, low-interest loans, and mentorship programs that can significantly impact success. Engaging with these resources can foster growth and provide much-needed guidance and capital for small businesses…

Read More

For small business owners, embracing a growth mindset is key to unlocking potential. By welcoming challenges, learning from setbacks, and fostering creativity, entrepreneurs can boost performance and innovation. Understand the principles of a growth mindset to propel success and foster adaptability in your business…

Read More

In today’s fast-paced business landscape, small businesses must embrace agile strategies to adapt swiftly to changes. By leveraging data analytics and fostering a culture of flexibility, they can identify market shifts early and enhance decision-making, ensuring longevity and success in a competitive environment…

Read More