Important Points

- You can deduct education expenses if they maintain or improve skills needed in your current job.

- Education required by law or your employer to keep your job can also be deductible.

- Expenses that qualify include tuition, books, supplies, and certain travel costs.

- Education leading to a new trade or business is not deductible.

- Self-employed individuals report these expenses on Schedule C or F.

Article-at-a-Glance

Understanding how to deduct education expenses for your business can save you money and keep your skills sharp. Knowing which expenses qualify and how to report them is crucial. Let’s dive into the details.

Can I Deduct Education Expenses for My Business?

Many business owners often ask whether they can deduct education expenses on their taxes. The answer is yes, you can, but there are certain rules you must follow. The IRS allows you to deduct education expenses that help maintain or improve the skills needed in your present business. This is a great way to invest in yourself and your business financially.

What Education Expenses Can I Deduct?

You may be wondering what types of education expenses you can deduct. Here are some examples:

- Course tuition and fees that relate to your current line of work.

- Books, supplies, and lab fees that are necessary for your coursework.

- Transportation and travel costs that are directly related to getting to and from class.

- Research and typing expenses that are related to course projects.

For instance, if you’re a graphic designer and you’re taking a course on advanced digital design to improve your skills, the tuition and related costs may be deductible.

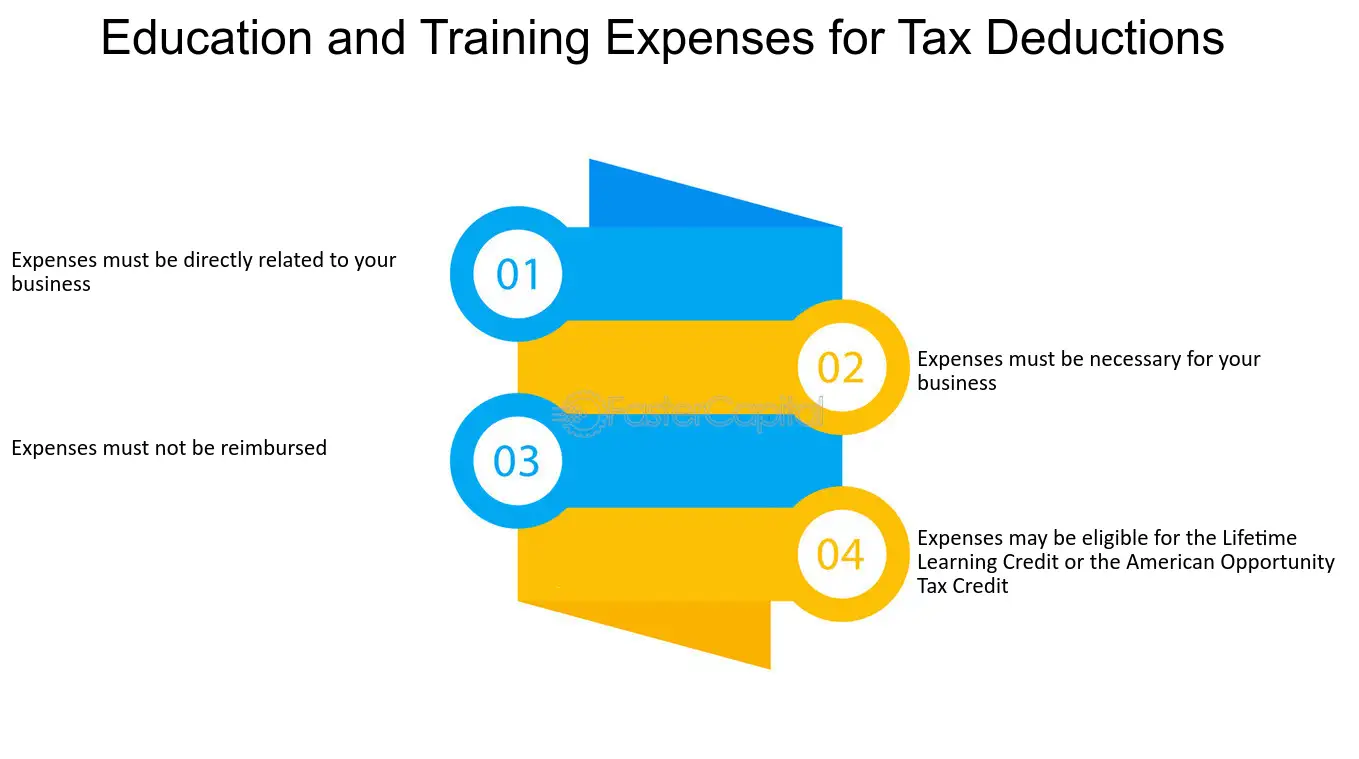

IRS Guidelines for Eligible Education Expenses

The IRS has specific guidelines on what counts as eligible education expenses. First, the education must maintain or improve skills needed in your current line of work. Alternatively, it can be education that is required by law or by your employer to keep your current job, status, or salary. It’s important to make sure that the education does not qualify you for a new trade or business, as these expenses are not deductible.

For example, if you own a photography business and enroll in a class to learn advanced photography techniques, you can probably deduct this as a business expense. But if you take a cooking class to become a chef, these expenses wouldn’t qualify because they’re preparing you for a new trade. For more information, check out this guide on tax-deductible business expenses.

How Education Deductions Can Benefit Your Business

Education deductions can help your business by lowering your taxable income and, as a result, your tax liability. This allows you to keep more money in your business that you can use to invest in other areas or save for future needs. On top of that, improving your skills through education can make your business more successful and competitive.

Eligibility Requirements for Education Expense Deductions

Maintenance and Enhancement of Skills

A major requirement for deducting education expenses is that the education must be for the purpose of maintaining or improving skills required in your current business. This implies that the course or program should be directly connected to the work you’re currently doing. For instance, if you’re a marketing consultant, a course on the latest digital marketing trends would likely be eligible.

Make sure to maintain records that illustrate the connection between your education and your present business operations. This could encompass things like course outlines, syllabi, or notes that demonstrate the pertinence of your education to your job.

Legal or Regulatory Requirements

There are instances where the law or your employer will require you to take specific courses to continue working in your field. These expenses are generally deductible. For instance, if you are a real estate agent and you are required to take continuing education courses to keep your license, these costs can be deducted.

Hold onto any documents that show the education is required by law or for regulatory purposes. You may need this paperwork if the IRS ever questions your deduction.

Exceptions: Education That Leads to a New Profession or Business

- Education that prepares you for a new profession, like a degree in a different field, is not deductible.

- Courses that prepare you for a new job or career change are also not deductible.

It’s important to distinguish between education that improves your current skills and education that changes your career path. The latter is not deductible because the IRS sees it as a personal expense rather than a business expense.

Education-Related Transportation and Travel Expenses

Traveling to and from classes, seminars, or other educational events can be costly, especially if you’re required to travel out of town. Luckily, these costs can be deducted if they are directly related to your education. This includes transportation and travel costs.

For your travel to be eligible, it must be essential for your education and not just a personal preference. For example, if you go to a conference in another city that is directly related to your business, you can write off the travel expenses, including airfare, hotel stays, and meals. Remember, these costs must be reasonable and directly related to your education.

Course Completion Costs for Research and Typing

If you’re taking a course that requires a lot of research or typing, you may be able to deduct these costs. This could include expenses for accessing research databases, printing materials, or even hiring someone to type up your notes or papers.

Make sure to keep track of these expenses in detail, because you will have to prove that they are directly related to your education. For instance, if you are taking a class that requires a research paper, you can deduct the cost of printing and binding the paper, as well as any fees for accessing necessary research materials.

How to Report Education Expenses on Your Taxes

When it comes to reporting education expenses, it’s essential to do so correctly to get the deductions you deserve. The process can be different depending on your business structure and how you file your taxes. Here’s a roadmap to guide you through the reporting process.

Start by collecting all your receipts and paperwork associated with your education expenses. This should include bills for tuition, books, supplies, and any costs related to travel or research. It’s crucial to keep accurate records to back up your deductions. For additional guidance, you might find this guide on tax-deductible business expenses helpful.

After that, you’ll need to figure out which tax forms you’ll need based on the type of business you own. For example, sole proprietors will report these expenses differently than a partnership or corporation would.

Sole Proprietors and Schedule C Filing

As a sole proprietor, you will record your education expenses on Schedule C, which is a component of IRS Form 1040. This form is utilized to report earnings or losses from a business you ran or a profession you practiced as a sole proprietor. For more information on tax compliance, you can explore tax filing misconceptions to ensure accurate reporting.

When you fill out Schedule C, you should list your education expenses under the category of “Other Expenses.” Make sure you are specific about what these expenses are for to avoid any misunderstandings. For example, you could label them as “Continuing Education” or “Professional Development” to make it clear what they were for.

Make sure these expenses are clearly linked to your business operations. Deductions that aren’t well-documented or don’t have a clear link to your business are more likely to be scrutinized by the IRS.

Here’s a straightforward example of how you might complete this section: if you are wondering, “Can I deduct work-related education expenses?” you can find more information on the Intuit TurboTax support page.

Expense Type Amount Tuition for Online Marketing Course $500 Books and Supplies $200 Travel to Conference $300

Using Schedule F for Farming Businesses

For those involved in farming, education expenses can be reported on Schedule F, which is used to calculate profit or loss from farming. This form works similarly to Schedule C but is tailored for farming operations.

Again, make sure that your education expenses are directly related to your farming business. For instance, if you go to a workshop on sustainable farming techniques, you can deduct those costs on Schedule F.

Why You Need to Keep Accurate Records

Keeping accurate records isn’t just a good idea—it’s a must. The IRS mandates that you back up your deductions with the right documentation. This means holding onto all receipts, invoices, and any communication related to your education costs.

Moreover, keeping your records neat and tidy can spare you a great deal of trouble when tax season rolls around. It also leaves a clean paper trail in the event of an audit. You might want to think about using accounting software to keep tabs on these expenses all year long, which will make it simpler to report them correctly on your tax forms.

Real-World Applications and Examples

Let’s take a look at some real-world examples to better understand how these deductions work. These examples will help you understand what types of education expenses you can deduct and how they apply to different business situations.

Keep in mind that the most important thing is to make sure that the education is directly related to your existing business and doesn’t qualify you for a new job or career. For more guidance, consider consulting a federal tax credit consultancy.

Example: Ongoing Education for a Licensed Professional

Imagine you’re a licensed real estate agent who needs to take yearly ongoing education classes to keep your license. You can deduct the tuition for these classes, as well as any related costs like textbooks, because they’re required to maintain your license and continue your current business.

This deduction is pretty straightforward, as the education is a legal requirement to maintain your professional status. Just be sure to keep records of the course requirements and any correspondence from your licensing board.

Example: Short-Course for Skill Enhancement

Let’s say you’re a freelance graphic designer and you take a short course to learn the latest design software. This course helps you keep up with the competition and enhance the services you provide to your clients. The costs you incur from this course, including tuition and any necessary materials, are deductible.

Keep track of how the class improves your existing skills and benefits your company. This could include examples of projects completed using the new software or testimonials from clients who appreciated the updated designs. For further guidance on maximizing business benefits, you might consider exploring tax planning strategies for small businesses.

Scenario: Education During Temporary Work Absence

Imagine you take a temporary leave from your business with the intention to return to the same line of work. During this time off, you enroll in a course to brush up on your skills and stay current with industry trends. These expenses could be deductible, as long as you return to your business after the course is completed.

Make sure you record your temporary leave and your plan to go back to the same line of work. This will help show that the education was needed to keep your skills up to date and not to start a new career.

Getting the Most Out of Education Deductions

To get the most out of education deductions, you’ll need to plan strategically and have a solid grasp on your business objectives. By making sure your educational investments align with your business goals, you can improve your skills and enjoy tax benefits at the same time.

Think about these tactics to maximize your educational deductions:

Planning Ahead for Educational Investments

Planning ahead for your educational investments can help you maximize your deductions. Here are a few tips to keep in mind:

- Pinpoint classes that match up with your company’s objectives and provide the biggest boost in abilities.

- Arrange for classes during times that won’t interfere with your company’s operations, allowing you to put new abilities to use right away.

- Set aside funds for education costs throughout the year to manage cash flow effectively.

In addition to planning, speaking with a tax expert can offer insights into how to get the most out of your education deductions. They can assist in ensuring that you’re making the most of all available deductions and adhering to IRS rules.

Strategically investing in your education can not only improve your business skills but also provide you with important tax deductions.

Matching Your Educational Aims with Your Business Goals

It is important to match your educational aims with your business goals in order to make the most of your educational investments. When planning your educational costs, think about how the skills you learn will directly benefit your business. For instance, if you want to broaden your range of services, pick courses that will improve your skills in those areas. You might also want to explore whether you can deduct work-related education expenses to further optimize your investment.

Consider the long-term benefits of the education for your business. Will it help you gain new customers, enhance productivity, or boost your income? By linking your education to your business goals, you guarantee that the money invested in education will yield a concrete return on investment.

Getting Advice from a Tax Professional

Getting advice from a tax professional is a smart way to make sure you’re getting the most out of your education deductions. Tax professionals can give you the most up-to-date information on IRS rules and make sure you’re using all the deductions you’re eligible for. They can also help you keep track of your records and give you tips on how to keep track of your expenses. For small business owners, here are some tax planning strategies and tips that might be useful.

Furthermore, a tax expert can guide you in planning your educational expenses to suit your business objectives and tax planning. This will result in substantial savings and a clearer comprehension of how educational expenses fit into your overall financial plan.

Commonly Asked Questions

If you’re a business owner, you might have a lot of questions about how to deduct education expenses. Here are some of the most frequently asked questions and their answers to help clear up any confusion.

What types of education expenses can be deducted?

You can deduct education expenses that maintain or improve skills required in your current business. This includes tuition, books, supplies, and some travel costs for attending classes or seminars.

However, expenses that qualify you for a new trade or business are not deductible. Make sure to document how the education relates to your current business to ensure it qualifies for deductions. For more insights on business-related tax strategies, you might consider exploring tax planning strategies.

Can I write off online course expenses?

Yes, you can write off online course expenses if they meet the criteria for maintaining or improving skills in your current business. This includes tuition fees, as well as any necessary materials or supplies required for the course.

Keep track of the course description and how it pertains to your business operations. If you need to explain the deduction to the IRS, this paperwork will come in handy.

Can I deduct the cost of traveling to a conference?

If the conference you are attending is directly related to your current business, you can deduct your travel expenses. This includes the cost of your flight, hotel, and meals, as long as they are reasonable and necessary for your education.

Make sure to hold onto all receipts and paperwork related to travel expenses. This will help support the deduction and provide a clear paper trail for your records.

What’s the best way to keep track of my education expenses for tax purposes?

It’s really important to keep track of your education expenses if you’re planning on claiming deductions. Make sure you keep all your receipts, invoices, and any other paperwork related to your education. This includes things like tuition receipts, books, and even travel expenses. For more guidance on tax planning, you might find these tax planning strategies helpful.

Arrange these papers so it’s clear how they’re connected to your current business. Think about using accounting software to keep track of these costs throughout the year, which will make it simpler to report them correctly on your tax forms.

Can I deduct education expenses if I change industries?

Unfortunately, education expenses that qualify you for a new trade or business are not deductible. If you’re changing industries, the IRS views these expenses as personal investments rather than business-related.

That being said, if the education is related to your current business and enhances your skills, it may still be deductible. It’s crucial to clearly document how the education relates to your current business activities, similar to how tax planning strategies can be crucial for small veteran-owned businesses.

Can I always deduct continuing education that’s required by law?

Generally, yes. If the law requires continuing education to keep your license or status, you can typically deduct it. This includes any courses that are necessary to keep practicing in your profession. For further guidance on tax-related deductions, you might find this tax-deductible guide helpful.

For instance, a CPA who must complete a set number of continuing education hours annually can deduct the cost of these courses because they are required to keep their professional status.

It’s important to keep a record of the legal or regulatory requirements and any communication from your licensing board to support the deduction.

What happens if my education costs are more than my business earnings?

If your education costs are more than your business earnings, you might be able to move the excess costs to future tax years. This means you can use the deductions when your business earnings go up.

Speaking with a tax expert can help you understand the specific rules and how they apply to your specific situation. They can help you strategize the best way to handle excess education expenses.

Is it possible to deduct education expenses for employees?

There are some instances where the education expenses for employees can be written off as a business expense. This is usually applicable if the education is directly related to their present job and it benefits your business.

Make sure you note how the education is useful to your business and keep track of the costs. This will help to back up the deduction and give you a clear record for your files. For more guidance, consider exploring tax-deductible business strategies.

Knowing the rules and guidelines for deducting education expenses can help you make smarter decisions about your education investments and get the most tax savings possible. Just remember, the key is to make sure the education directly relates to your current business and enhances your skills. With a little careful planning and documentation, you can take full advantage of these valuable deductions.