Let’s dive into the world of taxes, specifically the business tax code. Don’t worry, I’m not going to let you get overwhelmed. I’m going to simplify it for you, step by step, so you can understand how it impacts your business and how to manage it like a professional. Regardless if you’re a newbie or a seasoned business owner, understanding the nuances of the tax code is crucial for your success.

Article-at-a-Glance

- Get to know the different types of taxes your business might be liable for.

- Find out how to recognize your tax responsibilities and arrange your paperwork.

- Learn how to work out your taxable income correctly.

- Discover how to claim tax deductions and credits to save cash.

- See practical examples of how to use these steps in your business.

Demystifying the Business Tax Code

What the Tax Code Really Means for Your Business

The tax code might appear to be in a foreign language, but it’s actually just a series of rules that dictate how much you have to pay the government based on your earnings. Consider it as a recipe for your financial obligations. And, like any recipe, you need the correct ingredients—in this case, details about your income and outgoings—to ensure everything comes out perfectly.

Business Tax Structure: Types and Who They Apply To

Let’s start by understanding the different types of taxes your business may be subject to. You might have to pay income tax, self-employment tax, payroll tax, and potentially sales tax, depending on what you sell and where you’re based. Each type of tax comes with its own set of rules, and it’s crucial to understand which ones apply to your business. Because let’s be honest, overpaying on your taxes is equivalent to throwing money out the window, and nobody wants that.

Deciphering the Code: Step-By-Step Instructions

Determining Your Tax Responsibilities

So, how do you know what you owe? Begin by examining your business structure. Are you a sole proprietor, a partner in a partnership, or do you operate a corporation? This will dictate the forms you’ll fill out and the rates you’ll be charged. And don’t forget, organization is crucial. Maintain records of all your revenue and costs throughout the year; it’ll simplify your life significantly when it’s time to file taxes.

Get Your Documents in Order: A Handy Checklist

Alright, it’s time to organize those documents. Here’s a simple checklist to help you stay on track: For more detailed guidance, see our small business tax credit guide.

- Profit and loss statements and financial position statements

- Proof of business costs

- Past tax filings

- Salary records

- Details on assets such as machinery or real estate

Secure and easily accessible, keep these documents. You’ll be grateful to yourself later. For more information, review our effective record-keeping strategies.

Figuring Out Your Taxable Income

Figuring out your taxable income can seem daunting, but it’s as simple as subtracting your business expenses from your total income. Just be sure you’re only deducting legitimate business expenses. If you try to write off that vacation to Hawaii as a “business expense” and it wasn’t actually for business, the IRS won’t be happy.

- Take note of all your earnings

- Subtract the costs of doing business that are permitted

- Factor in any tax breaks or past payments that were too high

Voila! You’ve got your income that’s subject to tax.

Discovering and Utilizing Tax Deductions and Credits

Finally, the exciting part—deductions and credits. Think of these as the tax world’s version of coupons. They can decrease the amount you have to pay, sometimes by a large amount. Deductions decrease your taxable income, while credits decrease your tax bill on a one-to-one basis. So, ensure you’re not missing out on any money.

- Identify the deductions and credits that are applicable to your business

- Maintain meticulous records to substantiate your claims

- Seek advice from a tax expert if you have any doubts

Adhering to these guidelines will set you on the path to becoming proficient in the business tax code. Keep an eye out for more comprehensive examples and resources to assist you in your journey.

Practical Examples of Simplified Tax Situations

Let’s take a look at some real-world examples to understand how different types of businesses manage their taxes. Keep in mind that every business is different, and while these examples can provide some guidance, it’s always a good idea to speak with a tax professional for advice tailored to your situation.

Example 1: Sole Proprietorship

Let’s say you’re a freelance graphic designer, and you work from the comfort of your home office. As a sole proprietor, your business income is taxed on your personal tax return. This means you’ll report your earnings on a Schedule C form, which is part of your Form 1040. You can deduct business expenses like software subscriptions, home office costs, and travel expenses related to your work. After deductions, your net income is subject to income tax and self-employment tax, which covers Social Security and Medicare contributions.

Example 2: Filing Taxes for a Partnership

Imagine you’re in a partnership and you run a busy café. Partnerships don’t pay income tax themselves. They file an informational return on Form 1065 instead. Each partner will receive a Schedule K-1, which shows their share of the profits or losses. They report this on their personal tax returns. This is why it’s so important to have clear records of the partnership’s financial activities and any personal contributions you’ve made during the year.

Example 3: Corporate Tax Planning

Imagine you’re the owner of a small tech startup that’s incorporated. As a corporation, your business is a separate tax entity. You’ll file a corporate tax return using Form 1120. Corporations can benefit from lower tax rates on retained earnings—profits that are kept in the company for future growth. However, if you pay yourself dividends, those will be taxed again on your personal return. Deciding how to distribute profits for tax efficiency is a balancing act.

Resources to Help You Stay on Top of Your Taxes and Save Money

Meeting your tax obligations is a must, but it doesn’t have to be a pain. There are resources available to help you stay organized and take full advantage of every chance to reduce your tax bill.

Whether it’s record-keeping software or personalized professional services, the right tools can make a world of difference. Let’s take a look at some of these resources and how they can help your business.

Software That Makes Tax Filing Easier

There are now several tax software options that are designed specifically for small businesses. These software programs can help you keep track of your income and expenses, calculate your deductions, and even file your taxes electronically. Look for software that can integrate with your accounting system and provides clear, step-by-step instructions on how to prepare your taxes.

Utilizing Professional Assistance

Software can be a great tool, but sometimes you need a human element. Tax professionals, such as CPAs or enrolled agents, have the knowledge to handle complicated tax scenarios and provide strategic guidance. They can assist you in planning for the future, ensuring that you’re taking full advantage of tax laws to help your business. And if you’re ever audited, having a professional on your team can be priceless.

When and How to Ask the IRS for Help

Sometimes, you just need to go to the horse’s mouth—the IRS. Their website is a gold mine of information, with comprehensive guides and FAQs on a variety of tax topics. If you need more information on a specific issue, you can call the IRS helpline or even schedule an in-person meeting at a local office.

What to Do Next: Follow-up Steps and Helpful Tools

Getting a grasp on the business tax code is only step one. The next step is to take charge and ensure you’re prepared for the future. This requires staying up-to-date, taking initiative, and understanding when it’s necessary to ask for assistance.

Here are a few practical steps and resources to keep you on track.

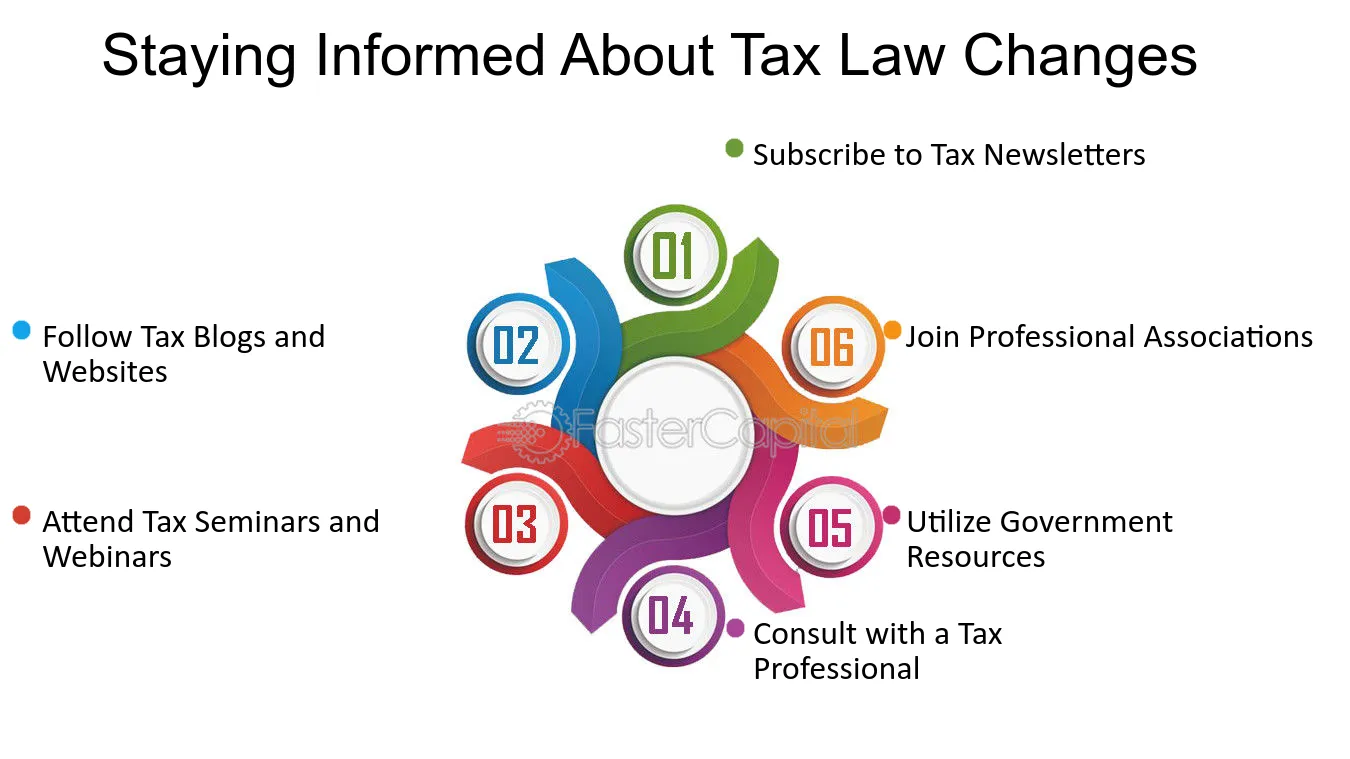

Staying Informed About Tax Law Modifications

It’s a fact of life that tax laws are constantly evolving. You need to be aware of any new laws that might impact your business. Subscribing to tax newsletters, participating in webinars, and even joining business groups that provide updates and resources to their members are all good ways to stay informed.

How to Use Tax Benefits to Boost Your Business

It’s not enough to just pay your taxes; you should also be using them to help grow your business. By understanding how the tax code works, you can find ways to invest in your business that also offer tax benefits, such as buying energy-efficient equipment or providing training for your employees. Additionally, always be on the lookout for new deductions and credits that can help lower your tax bill.

Crucially, remember that the best time to start planning for your taxes is right now. Don’t leave it until the end of the year or the tax season to start thinking about your tax strategy. By taking action now, you can make sure you’re ready and able to take full advantage of the opportunities that are open to you.

If you’re in need of professional assistance to make sure you’re getting the most out of your refundable claims, you might want to think about consulting with the experts at ERTC Filing Pros. Their area of expertise is Employee Retention Tax Credits, and they provide a straightforward process that will take up less than 15 minutes of your time, without any upfront costs. When it comes to ensuring the best possible results for your business, they’re the ones to call.

So, why wait? Apply Now and start your journey towards efficient and optimized tax filing. It’s one of the best decisions you can make for your business.

Let’s now address some common questions that may be on your mind. It’s as if you have your own personal tax guide, answering questions you didn’t even realize you had. So, get ready and let’s demystify those tax confusions.

What’s the Biggest Tax Code Misunderstanding for Small Businesses?

The biggest mistake I see is blending personal and business expenses. It’s like using your toothbrush to clean the grout in your bathroom—it’s just not a good idea. Keep them separate to avoid a headache with the IRS. And always, always document every expense that’s for your business. If you’re ever unsure, ask yourself, ‘Would I buy this if I didn’t have my business?’ If the answer is no, then you’re probably safe.

How Frequently Should I Assess My Business Structure for Tax Implications?

Just as you would check your smoke detectors once a year, you should also review your business structure annually. Your tax requirements will evolve as your business grows and changes. Perhaps you started as a sole proprietor, but now you’re ready to become an LLC. This could alter your tax status and your allowable deductions. Stay one step ahead by making this an annual practice.

Am I Eligible to Deduct Home Office Expenses, and How Does This Affect My Taxes?

Indeed, you can deduct home office expenses, but there’s a caveat. The area must be devoted solely to business. So, if you’re operating from your dining room table where you also eat your meals, that won’t suffice. If you do have a dedicated area, you can deduct a portion of your rent, utilities, and other costs. It’s like getting a discount on your bills just for putting in a good day’s work at home.

What Happens If I Don’t Report My Business Taxes Correctly?

Messing up your taxes can be as painful as stepping on a Lego in the dark. You could end up facing penalties, interest on what you owe, and even an audit. And let me tell you, audits are about as fun as a root canal. To avoid this, be meticulous with your records and when in doubt, seek professional help. It’s better to be safe than sorry.

Don’t forget, a service like ERTC Filing Pros can help make sure your taxes are properly filed. They specialize in maximizing your tax credits, and they can help you steer clear of the hazards of incorrect reporting. So don’t be shy to get in touch and Apply Now for their help.

What Tax Credits Should I Be Aware of as a New Business Owner?

Absolutely! There are numerous tax credits available for new business owners. For instance, the Work Opportunity Tax Credit is available for hiring from specific groups, such as veterans or long-term unemployed individuals. Additionally, the Employee Retention Tax Credit can be significant if you have maintained employees on the payroll during difficult times. Credits like these can provide a financial boost to your business, so don’t miss out on this money.

How Do I Make Tax Planning an Ongoing Task?

Imagine tax planning as if it were your car’s upkeep. You wouldn’t wait for a breakdown to check the oil, would you? Therefore, establish a system to monitor expenses as they occur. Utilize accounting software, maintain a mileage log for business trips, and schedule quarterly meetings with your tax advisor. By doing a little bit throughout the year, you’ll save yourself a heap of stress when tax season arrives.

Where Can I Find Professional Help for My Business Taxes?

If you’re prepared to get professional help for your taxes (and finally relax), look no further than the experts at ERTC Filing Pros. They specialize in Employee Retention Tax Credits and can help ensure you’re getting every credit you’re eligible for. The best part? It only takes 15 minutes to get started. So why wait? Apply Now and take the first step towards stress-free tax filing.

In conclusion, having a good understanding of the business tax code is like having a GPS for your financial travels. With the right knowledge and tools, you can confidently navigate the winding roads of tax season. Keep in mind, it’s not just about paying what you owe—it’s about understanding how to use the tax laws to benefit you and your business. So take this knowledge, apply it, and watch your business prosper.