Bookkeepers are essential for tax planning. They keep financial records in order, which helps businesses make smart decisions and follow tax laws. Knowing what they do and how they can help your business is crucial for financial success.

Main Points

- Bookkeepers maintain financial records to ensure accurate tax calculations.

- They work with tax professionals to make tax preparation more efficient.

- Effective tax planning by bookkeepers can maximize tax deductions.

- Bookkeepers play a crucial role in enhancing cash flow management.

- Good bookkeeping helps avoid penalties and ensures compliance.

The Importance of Tax Planning for Bookkeepers

Tax planning is not just about numbers; it’s about strategy. Bookkeepers are the behind-the-scenes stars of this process. They manage the financial groundwork, making sure everything is ready before tax time. This is important because it directly affects a business’s bottom line.

The Role of a Bookkeeper in Business Success

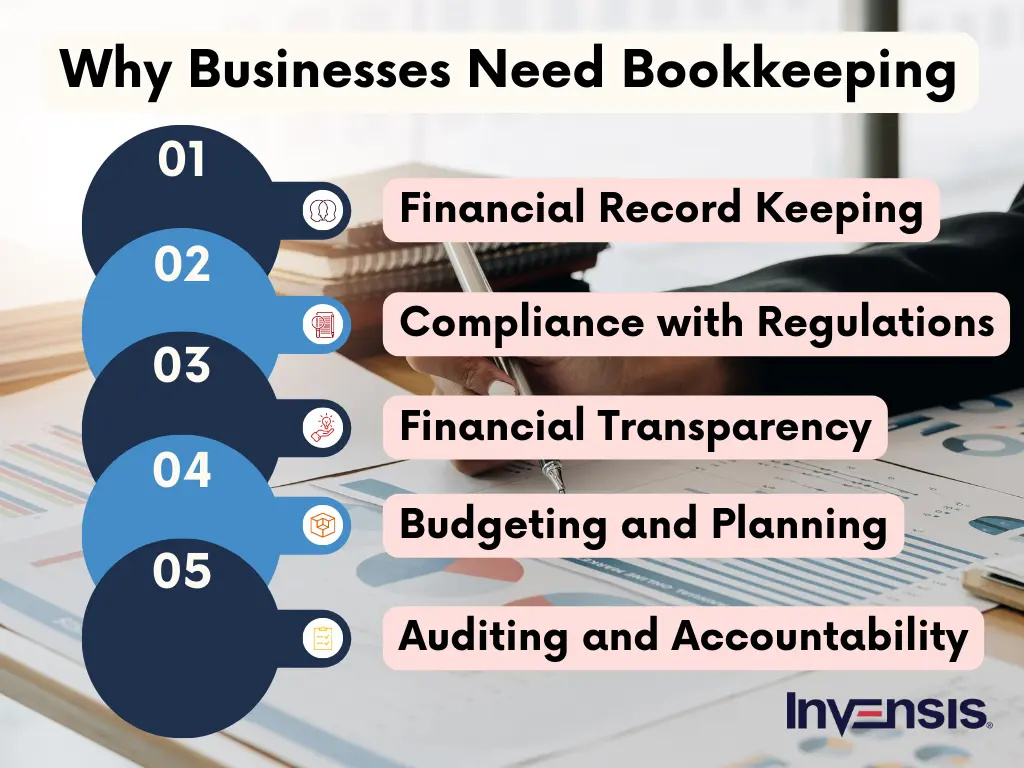

A bookkeeper’s role is pivotal in the success of a business. They are responsible for providing an accurate representation of the business’s financial status, which is crucial in making informed business decisions. By keeping and organizing financial records, bookkeepers allow businesses to keep track of their income and expenses with precision. This data is crucial for strategic planning and growth.

Staying on the Right Side of the Law

Tax laws are complicated and constantly changing. Bookkeepers are responsible for keeping up with the latest regulations and making sure all financial records are in compliance. They also keep track of deadlines and make sure everything is submitted on time to avoid costly penalties and audits.

For instance, a small retail store could be penalized for not reporting sales tax correctly. A proficient bookkeeper would make sure all sales records are current and comply with state rules, therefore preventing any legal issues.

Smoothing Out the Financial Workings

Bookkeepers do more than just tally numbers; they smooth out the workings. They organize the financial data, making it easier for accountants and tax professionals to do their work. This teamwork is vital for effective tax preparation and filing.

Imagine trying to cook a meal without having all your ingredients prepped and ready. It’s chaotic and inefficient. The same goes for taxes. Bookkeepers prepare the financial “ingredients,” making the tax filing process smooth and efficient.

Main Duties in Tax Planning

Bookkeepers have a few important duties in the area of tax planning. They are instrumental in making sure that businesses are prepared for tax season.

Keeping and Handling Financial Documents

A bookkeeper’s main job is to keep and handle financial documents. This covers everything from profit and loss statements to expense receipts. Bookkeepers keep thorough records to make sure all financial transactions are accurately documented. For more insights on organizing these crucial documents, you can explore small business tax documentation tips.

For example, a bookkeeper working for a small-town bakery would keep track of daily sales, ingredient costs, and payroll. This level of detail guarantees that the bakery’s financial health is always transparent and prepared for tax season.

Working with Tax Experts

Bookkeepers frequently work hand-in-hand with tax experts like CPAs or tax advisors. This partnership is vital for successful tax planning. By delivering structured financial information, bookkeepers simplify the process for tax experts to evaluate a company’s tax obligations and find possible deductions.

It’s a match made in heaven. Bookkeepers deliver the data, and tax experts use it to plan and maximize tax results. Together, they guarantee that businesses follow the rules and take full advantage of any tax benefits.

Creating Precise Financial Reports

Financial reports are the foundation of tax planning. Bookkeepers create these reports with care, making sure that all figures are correct and represent the company’s real financial situation. Tax experts then use these reports to figure out how much tax is due and to find possible savings.

It’s crucial to be precise. A minor mistake in financial reports can result in serious tax problems. This is why bookkeepers are so meticulous in their preparation of these records, making sure to check and double-check for any inaccuracies or errors.

Advantages of Efficient Tax Planning

Efficient tax planning can transform a business. When bookkeepers perform their role effectively, the results are significant. The benefits range from lowering tax obligations to enhancing financial wellness, making the benefits both obvious and powerful.

Having a solid tax plan in place is a huge relief. It allows you to have confidence in the accuracy and compliance of your financial records, freeing you to concentrate on expanding your business instead of fretting about tax time.

Maximizing Tax Deductions and Credits

Bookkeepers are instrumental in helping businesses reduce their tax liabilities by identifying tax deductions and credits. They meticulously track all financial transactions to ensure that no potential deduction is missed.

Take for instance a bookkeeper who observes that a business has made multiple donations to charity over the course of a year. These contributions could be classified as tax-deductible expenses, thereby reducing the company’s overall tax burden.

Moreover, bookkeepers assist in monitoring business costs that can be deducted, like office materials, travel expenses, and some food costs. They make sure these expenses are properly categorized to take full advantage of possible deductions. For more tips, check out these small business tax documentation organization tips.

“A well-organized bookkeeper can uncover thousands of dollars in tax savings by simply ensuring all deductions and credits are accounted for.”

Improving Cash Flow Management

Cash flow is the lifeblood of any business. Effective tax planning by bookkeepers can enhance cash flow management by forecasting tax liabilities and ensuring that funds are available when taxes are due. This proactive approach prevents cash shortages and allows businesses to plan for future expenses.

Boosting Financial Stability and Security

For a business to succeed in the long run, financial stability is crucial. Bookkeepers play a key role in ensuring this stability by keeping financial records up to date and accurate and making sure the business is in compliance with tax laws. This accuracy helps to mitigate the risk of audits and penalties and provides a solid financial base for the business.

Furthermore, regular and precise bookkeeping helps companies establish trust with stakeholders, such as investors and lenders. When financial reports are dependable and clear, it becomes simpler to obtain financing and investment opportunities.

Case Studies and Real-World Examples

Looking at real-world examples can give us a better understanding of the crucial role bookkeepers play in tax planning. In this section, we’ll look at some success stories and learn from common tax errors.

Success Stories from Small Businesses

Consider a small tech startup that hired a committed bookkeeper from the get-go. The bookkeeper kept detailed financial records and was able to find several R&D tax credits that the company was eligible for. These credits greatly reduced their tax burden, giving them the opportunity to reinvest in product development.

A family-owned restaurant was also having a hard time with cash flow problems. But with the aid of a bookkeeper, they were able to put a tax planning strategy in place that projected their quarterly tax payments. This strategy helped them manage their cash flow better and made sure they always had the funds to meet their tax obligations.

What We Can Learn from Typical Tax Errors

Conversely, we can learn from businesses that didn’t put effective bookkeeping first. One retail business was slapped with a large tax penalty due to incorrect record-keeping. They didn’t keep track of sales tax properly, leading to an underpayment that brought about fines and interest charges.

This example underscores the necessity of precise and systematic financial documentation. A proficient bookkeeper could have averted these problems by making sure all transactions were logged accurately and regulatory compliance was upheld.

Wrapping Up Bookkeeper Tax Planning

To sum up, bookkeepers are essential to the tax planning process. They are skilled at managing financial records and working with tax experts to ensure that businesses stay compliant and financially sound. They help businesses succeed and stay stable by maximizing tax deductions and managing cash flow.

Important Points to Improve Financial Management

Here are some important points to remember to improve your business’s financial literacy and tax planning capabilities:

- Make sure your bookkeeper keeps your financial records accurate and organized.

- Work together with tax experts to get the most out of deductions and credits.

- Put a proactive tax planning strategy in place to better manage cash flow.

- Check your financial statements regularly for accuracy and compliance.

- Learn from real-world examples to steer clear of common tax errors.

Sticking to these rules will help improve your business’s financial health and make the tax planning process go more smoothly.

Commonly Asked Questions

Many business owners have questions about tax planning and how bookkeepers can help. Here are some of the most frequently asked questions and their detailed answers.

What Role Do Bookkeepers Play in Tax Preparation?

Bookkeepers are crucial to tax preparation because they organize and maintain financial records. They make sure all income, expenses, and deductions are correctly recorded, which provides a strong basis for tax calculations. This thorough record-keeping allows tax professionals to prepare and file tax returns efficiently.

Additionally, bookkeepers can pinpoint possible tax deductions and credits by examining financial data. Their meticulousness boosts tax savings and guarantees adherence to tax rules.

What Kind of Records do Bookkeepers Need to Keep for Taxes?

Bookkeepers need to keep a wide range of financial records to aid in tax preparation. This includes things like income statements, balance sheets, expense receipts, payroll records, and bank statements. It’s important that these documents are kept organized and current for accurate tax reporting. For more guidance, check out these small business tax documentation organization tips.

Can Bookkeepers File Taxes?

Bookkeepers can help prepare financial documents for tax filing, but they usually don’t file the taxes themselves. This is usually the job of certified tax professionals like CPAs or tax advisors. However, bookkeepers can provide the necessary paperwork and support to make the tax filing process easier.

Keep in mind that some bookkeepers may also offer tax preparation services if they have the right qualifications and certifications. Always make sure to check a bookkeeper’s credentials before hiring them for tax filing services.

There are instances where companies may opt to have their bookkeepers collaborate with their tax experts to simplify the tax submission procedure and guarantee that all financial information is correct and comprehensive.

What Is the Frequency for a Business to Review Its Tax Strategies?

Every year, at least once, and usually before the fiscal year ends, businesses should review their tax strategies. This enables them to pinpoint any changes in tax laws that could impact their tax obligations and to look for possible deductions and credits.

What Kind of Tools Do Bookkeepers Use for Tax Planning?

Bookkeepers typically use accounting software and financial management tools to make tax planning easier. They often use popular software like QuickBooks, Xero, and Sage, which automate record-keeping and generate financial reports. These tools make managing financial data more accurate and efficient.

Do Bookkeepers Assist in Tax Audits?

Absolutely, bookkeepers are essential when it comes to preparing for tax audits. They make sure that all financial records are correct and well-arranged, which makes answering audit inquiries a breeze. Their attention to detail in record-keeping lowers the chances of mistakes and inconsistencies that could lead to an audit.

When an audit occurs, bookkeepers collaborate with tax experts to supply the required paperwork and assistance. Their skill in managing financial records gives businesses the assurance they need to handle the audit process.

Take a sales tax audit for instance, a bookkeeper would be the one to make sure that all sales records and tax filings are accurate and ready to be reviewed. This preparation minimizes disruptions to the business and ensures a smooth audit process.

“A business’s best defense against tax audits is a well-prepared bookkeeper, who ensures that all records are in order and compliant with regulations.”

How Do Bookkeepers and CPAs Differ?

While both bookkeepers and CPAs are vital to managing a business’s finances, they have distinct responsibilities. Bookkeepers are responsible for recording and organizing financial transactions, ensuring that all records are accurate and up-to-date. They take care of daily financial tasks, such as invoicing, payroll, and expense tracking.

Certified Public Accountants (CPAs) are certified experts in the field of accounting and tax services. They offer strategic financial guidance, handle tax return preparation, and represent businesses in tax audits. CPAs usually have a more comprehensive knowledge of tax laws and financial regulations.