Getting to grips with tax credits can be a real game-changer for businesses, particularly the Work Opportunity Tax Credit (WOTC). This is a federal tax credit that incentivizes employers to hire individuals from certain groups who have had a hard time finding work. This not only promotes a more inclusive workforce but it can also provide significant financial benefits for businesses.

Summary

- WOTC provides a tax credit of up to $2,400 for each eligible new hire.

- Eligible groups include veterans, long-term unemployed, and individuals on public assistance.

- Employers must get certification from a state workforce agency to claim the credit.

- WOTC can significantly reduce a company’s federal income tax liability.

- Integrating WOTC into hiring practices can improve workforce diversity and lower hiring costs.

How to Utilize the Work Opportunity Tax Credit (WOTC) to Your Advantage

The Work Opportunity Tax Credit is more than just a tax break; it’s a strategic tool that can align your business goals with social responsibility. By taking advantage of WOTC, you can help individuals who have had difficulty finding employment and, at the same time, improve your bottom line. Let’s take a look at how this credit works and how you can maximize it.

Understanding the Purpose and Overview of WOTC

The WOTC is designed to encourage employers to hire individuals from specific targeted groups, including veterans, ex-felons, and individuals receiving government assistance. The program’s ultimate goal is to help these individuals find jobs and achieve financial independence. This program is beneficial for employers because they receive a tax credit for each eligible hire, leading to significant savings.

In essence, WOTC is a tool to promote diversity and inclusion in the workplace. It’s a win-win program that benefits both employers and workers, providing opportunities for those who might otherwise be ignored. In addition, it’s a clever financial strategy for companies aiming to lower their tax burdens.

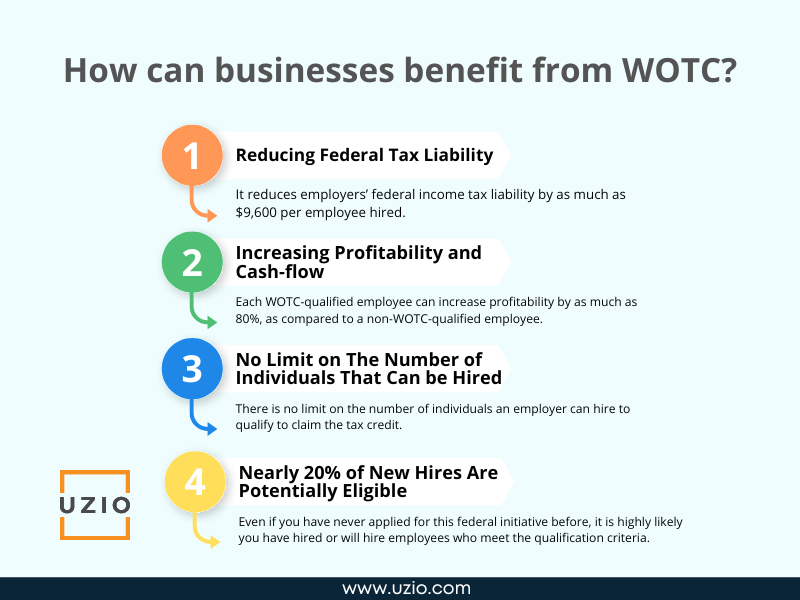

Effects on Business Tax Responsibilities

The potential decrease in tax responsibilities is a compelling reason to take part in the WOTC program. Businesses can earn a tax credit that lowers their federal income tax liability by hiring individuals from the targeted groups. This credit can go up to $9,600 per eligible employee, depending on the targeted group and the number of hours worked.

Support for Diverse Hiring Strategies

Implementing WOTC as part of your hiring process not only offers financial incentives but also encourages a more diverse workplace. By actively recruiting and employing people from a variety of backgrounds, businesses can foster a more vibrant and innovative workplace. Furthermore, this strategy can improve a company’s image as an employer that is socially responsible. For insights on how innovation plays a role in building resilient business strategies, check out this article on innovation’s role.

Who Can Claim the WOTC?

Before you can claim the WOTC, you need to know who qualifies for this tax credit. Eligibility is based on the new hire being a member of one of the targeted groups. These groups are defined by the IRS and can change, so it’s important to stay up-to-date on any changes.

Overview of Targeted Groups

The targeted groups for WOTC include a variety of individuals who face employment challenges. Some of the primary groups are:

- Veterans, particularly those with disabilities related to their service.

- Individuals receiving Temporary Assistance for Needy Families (TANF).

- Formerly incarcerated individuals who have been released from prison.

- People who have been unemployed for a long period of time.

- Residents of designated communities, including those living in Empowerment Zones.

Hiring from these groups allows businesses to both contribute to societal progress and tap into a wider pool of talent.

Eligibility Criteria

Employers need to get a certification to claim the WOTC, which confirms that their new employee is part of one of the designated groups. This certification is given by a state workforce agency. It’s crucial to remember that the certification process must start on or before the day the employee starts working. As a result, careful planning and quick action are essential.

First and foremost, employers must fill out IRS Form 8850, “Pre-Screening Notice and Certification Request for the Work Opportunity Credit,” and send it to their state workforce agency within 28 days of the employee’s start date. This confirms that the business is qualified to receive the tax credit.

Submitting the Necessary Paperwork

In order to properly claim the Work Opportunity Tax Credit, it’s important to submit the right paperwork. The primary document you’ll need is IRS Form 8850. This form is known as the “Pre-Screening Notice and Certification Request for the Work Opportunity Credit.” Both the employer and the new hire must fill out this form, confirming that the employee is part of one of the eligible targeted groups. For more insights on tax credit claims, explore the role of automated calculators in streamlining the process.

In addition to Form 8850, you must also submit the Department of Labor’s ETA Form 9061 or 9062. Form 9061 is known as the “Individual Characteristics Form,” while Form 9062 is used if the employee has already been conditionally certified as part of a targeted group. These forms provide comprehensive information about the new hire’s eligibility and must be included with Form 8850 when it’s submitted to the state workforce agency.

- Fill out IRS Form 8850 with your new employee.

- Turn in ETA Form 9061 or 9062, whichever is relevant.

- Mail these forms to your state workforce agency within 28 days of the new employee’s first day.

After you’ve turned in these forms, the state workforce agency will look over the information and give a certification if the employee qualifies. You need this certification to claim the tax credit on your business tax return.

Having copies of all the forms you’ve submitted and any correspondence with the state agency is crucial. This documentation will serve as your proof of eligibility if you’re audited or if there are any inquiries. For more information on how technology can assist in these processes, explore the role of automated calculators in streamlining tax rebate claims.

Important Dates and Deadlines

When dealing with the Work Opportunity Tax Credit, it is crucial to be prompt. Employers need to make sure they meet all deadlines so they can claim the credit. The most crucial deadline is the 28-day window from when the employee starts to when you need to submit Form 8850 and the accompanying forms to the state workforce agency. If you miss this deadline, you may not be eligible for the credit. To streamline your process, consider using automated calculators for tax rebate claims to ensure accuracy and timeliness.

Monetary Advantages of WOTC

Companies can experience significant monetary advantages from the Work Opportunity Tax Credit. By employing eligible people, businesses can lower their federal tax obligations and strengthen their financial position. The credit amount fluctuates depending on the targeted group and the employee’s work hours. For businesses seeking additional financial support, exploring government business grants can be a beneficial option.

Figuring Out Your Potential Tax Savings

When figuring out your potential tax savings, you need to take into account how many eligible employees you’ve hired and the specific credit amount for each targeted group. For instance, if you hire a veteran with a service-connected disability, you could get a credit of up to $9,600. If you hire a long-term unemployed person, you could get a credit of up to $2,400. To further streamline your rebate claims, consider the role of automated calculators in managing these processes efficiently.

Employee Credit Cap

How much credit you can get per employee is determined by a variety of factors, such as the targeted group and the wages you pay to the employee. For most groups, the credit is 40% of the first $6,000 in wages paid, so the maximum credit is $2,400. However, for veterans with service-related disabilities, the maximum credit can be as high as $9,600.

Long-Term Economic Benefits

Aside from the immediate tax benefits, participating in the WOTC program can lead to long-term economic benefits. By lowering tax liabilities, businesses can put more resources into other areas, such as growing or innovating. Furthermore, a more diverse workforce can result in increased creativity and problem-solving, which can contribute to the success of a business.

In addition, the positive public relations that come from hiring from targeted groups can enhance a company’s reputation and brand image, attracting more customers and business opportunities. The WOTC is more than just a financial tool; it’s a strategic asset for long-term growth.

Wrapping up, the Work Opportunity Tax Credit offers substantial financial perks while encouraging diversity and inclusion at work. By knowing who’s eligible, filing the right paperwork, and meeting all deadlines, companies can get the most tax savings and make a positive impact on society.

Boosting Your Business Plan with WOTC

When you incorporate the Work Opportunity Tax Credit into your business plan, it can improve your company’s overall effectiveness. By coordinating your hiring process with WOTC, you can save money and also foster a more diverse and vibrant workplace. If you’re looking for additional financial support, consider exploring government grants for small businesses to further enhance your business strategy.

How to incorporate WOTC into your recruitment process

If you want to incorporate WOTC into your recruitment process, you should start by identifying potential candidates from the groups that are eligible for WOTC during the hiring process. It could be a good idea to collaborate with local employment agencies or community organizations that can help you find potential candidates. This way, you can make sure that your recruitment strategy meets the requirements of WOTC and allows you to maximize your tax credit potential. For more insights on building a resilient business strategy, consider exploring the role of innovations in achieving success.

Moreover, educating your HR team about the WOTC eligibility criteria and certification process can make it easier to incorporate this program into your hiring practices. Taking this initiative can result in a more streamlined hiring process and bigger tax savings.

Enhancing Diversity in the Workforce

Perhaps the greatest benefit of the WOTC is the opportunity it provides to enhance workforce diversity. By employing individuals from a variety of backgrounds, companies can foster a more inclusive, innovative work culture. The variety of perspectives and experiences that diverse teams bring can lead to improved problem-solving and decision-making.

Using Tax Savings to Expand Your Business

With the tax savings from the WOTC, businesses can reinvest in themselves and grow. By lowering their tax liabilities, companies can free up money to invest in other areas, like research and development, marketing, or training for their employees. This reinvestment can lead to a more competitive business and long-term success.

Furthermore, by advertising your involvement in the WOTC program, you can boost your company’s image as a socially conscious and inclusive employer. This positive reputation can draw in more customers, clients, and business opportunities, further contributing to your company’s growth.

Typical Problems and Their Answers

The Work Opportunity Tax Credit, while providing a plethora of advantages, may pose issues for businesses in terms of certification or record-keeping accuracy. Understanding these problems and how to solve them can help businesses get the most out of the WOTC program.

A common hurdle is the possible delay in getting certification from the state workforce agency. To overcome this problem, make sure that all forms are filled out correctly and submitted on time. Keeping open communication with the agency can also help speed up the process.

For instance, a small business in Texas had their WOTC certification delayed due to incomplete paperwork. After they double-checked their forms for accuracy and followed up with the state agency, they were able to resolve the issue and successfully claim the tax credit.

Another difficulty is maintaining precise records of all submitted forms and correspondence. A robust documentation system can assist in ensuring that all necessary paperwork is available for audits or inquiries.

By actively tackling these issues, companies can make the most of the WOTC program and improve their total tax strategy.

How to Beat Certification Delays

Employers seeking to reap the benefits of the Work Opportunity Tax Credit often find certification delays to be a significant obstacle. These delays are frequently due to paperwork that is incomplete or incorrect, which is submitted to state workforce agencies. To beat this, make sure to thoroughly complete all forms such as IRS Form 8850 and ETA Form 9061 or 9062 and submit them promptly. It can also be helpful to the certification process to maintain open communication with the agency. Additionally, keeping track of when you submit and regularly following up can help prevent any unnecessary delays. For more insights on streamlining your tax processes, consider exploring the role of automated calculators in tax rebate claims.

Ensuring Paperwork is Correct

When you’re applying for the WOTC, it’s important to make sure your paperwork is accurate. If it’s not, you could experience delays or even be disqualified from getting the credit. To make sure your paperwork is accurate, you should create a strong system for collecting and checking information from new hires. This should include making sure all necessary forms are filled out completely and correctly before they’re submitted.

Continuous education for HR personnel on the most recent WOTC rules and paperwork protocols can also help avoid mistakes. By adopting these strategies, companies can guarantee that they meet all necessary conditions and increase their chances of receiving the tax credit.

Questions and Answers

The Work Opportunity Tax Credit can be a bit confusing, so we’ve compiled a list of common questions to help shed some light on the program’s specifics and advantages.

What is the Work Opportunity Tax Credit?

The Work Opportunity Tax Credit (WOTC) is a federal tax credit given to employers who hire individuals from certain targeted groups who have traditionally faced obstacles to employment. This tax credit is designed to promote diversity in the workplace and help those who have had difficulty finding employment.

When businesses participate in the WOTC program, they not only decrease their federal tax liability, but also support individuals who are in dire need of employment.

Who is eligible for WOTC?

The IRS identifies specific groups of individuals who are eligible for WOTC. These groups include veterans, long-term unemployed individuals, ex-felons, and recipients of government assistance such as TANF. Employers must get a certification from a state workforce agency to confirm that the new hire is part of one of these groups.

What financial benefits does the WOTC offer employers?

Employers benefit from the WOTC because it reduces their federal tax liability. The credit amount can vary depending on the targeted group and the employee’s wages. The maximum credit can be up to $9,600 per eligible employee. For more detailed information, you can visit the IRS Work Opportunity Tax Credit page. This decrease in tax obligations can lead to substantial savings for businesses.

Moreover, the WOTC promotes the inclusion of diverse hiring practices, which can result in a more varied and innovative team, offering long-term benefits to the company.

What are the prerequisites for obtaining WOTC certification?

Employers wishing to obtain WOTC certification must fill out and submit IRS Form 8850 and ETA Form 9061 or 9062 to their respective state workforce agency. These forms must be submitted within 28 days of the employee’s first day of work. The state agency will then review the information and issue a certification if the employee qualifies.

It’s crucial to submit these forms correctly and on time to guarantee eligibility for the tax credit.

How does WOTC encourage diversity in the workplace?

The WOTC encourages diversity by incentivizing employers to hire people from different backgrounds who face difficulties in finding employment. By offering incentives to hire from targeted groups, the program fosters a more inclusive workforce. This diversity can result in enhanced creativity, innovation, and problem-solving within the company.

What paperwork is needed to apply for WOTC?

If you want to apply for the Work Opportunity Tax Credit, you need to fill out IRS Form 8850, which is the “Pre-Screening Notice and Certification Request for the Work Opportunity Credit,” and either ETA Form 9061 or 9062. These forms confirm that the new hire is eligible. You have to submit them to the state workforce agency within 28 days of when the employee starts working.

It’s important to keep copies of all the forms you’ve submitted and any correspondence with the agency for your records and in case of audits.

What can I do to get the most out of my WOTC benefits?

If you want to get the most out of your WOTC benefits, make sure to incorporate the program into your hiring process by actively looking for candidates from the targeted groups. Work together with local workforce agencies and community organizations to find potential employees. Make sure to fill out all necessary forms correctly and turn them in on time to avoid any delays.

Furthermore, make sure your HR team is well-versed in WOTC requirements and documentation procedures to simplify the process and increase your chances of qualifying for the tax credit.

By taking these measures, you can make the most of the Work Opportunity Tax Credit, which not only benefits your business financially, but also promotes a diverse and inclusive workforce.