Author: Mike Sweeney

ERTC Express provides essential tools for human services non-profits to claim the Employee Retention Credit (ERC). These tools ensure compliance, offer personalized support, and handle all paperwork, empowering non-profits to focus on their mission. With no upfront costs, it offers a hassle-free path to financial relief…

Read More

Customer service is the lifeblood of small businesses, crucial for building trust and loyalty. By fostering personalized interactions and addressing issues promptly, businesses differentiate themselves, turning customers into advocates and driving success through repeat transactions and referrals, ultimately enhancing reputation and market presence…

Read More

California offers numerous grants and funding opportunities for small businesses. From state-funded options like the California Competes Tax Credit to federal programs such as the SBIR, there’s support for every enterprise. Understanding eligibility and leveraging these resources can help your business thrive in the Golden State…

Read More

ERTC Express Submission Simplification, Paychex Solutions for Social Justice Non-Profits

- Mar 11, 2025

The ERTC offers nonprofits vital financial aid during the pandemic, ensuring they can retain staff and continue their essential work. Paychex simplifies ERTC submissions for these organizations, allowing them to focus on their missions while maximizing potential savings and reducing submission errors…

Read More

The Employee Retention Tax Credit (ERTC) is a vital financial relief for non-profits impacted by COVID-19. With the 2025 deadline approaching, it’s crucial to understand key terms to maximize benefits. Ensure eligibility, particularly through the Gross Receipts Test, before submitting claims by April 15, 2025…

Read More

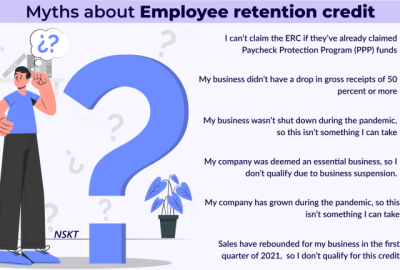

Animal shelters are vital community resources, but financial challenges can hinder their operations. The Employee Retention Tax Credit (ERTC) offers crucial support, allowing shelters to continue their mission during tough times. Understanding eligibility and dispelling myths is key to accessing this financial lifeline for non-profits…

Read More

Learn how historical societies can utilize the Employee Retention Tax Credit (ERTC) to support their mission during financial hardships. Discover eligibility requirements, tips for combining with other relief programs like PPP, and the importance of working with tax professionals to navigate the complexities of this lifeline…

Read More

Non-profits can maximize financial aid by leveraging the ERTC and federal grants. Understanding ERTC eligibility and effective financial management is vital. To optimize benefits, strategically stagger applications and balance resources for long-term success. Explore best practices for non-profits managing ERTC and federal funding opportunities…

Read More

ERTC Claim Guide for Educational Non-Profits & Tips

- Mar 01, 2025

Educational non-profits can benefit from the Employee Retention Tax Credit (ERTC) to support payroll expenses. By understanding eligibility criteria and utilizing IRS resources, these organizations can focus on their educational missions. Learn how to successfully claim and maximize this financial relief opportunity for your non-profit…

Read More

The Employee Retention Tax Credit (ERTC), a COVID-19 relief measure, offers a refundable tax credit to businesses maintaining staff. With an April 15, 2025 filing deadline for 2021 claims, prompt action is vital. Documentation and professional guidance can maximize benefits…

Read More