Author: Mike Sweeney

Best CRM And Accounting Software For Small Business

- Mar 30, 2025

Small businesses face challenges in multitasking with limited resources. CRM software aids in managing customer interactions while accounting software handles financial data. Choosing integrated solutions saves time and minimizes errors. Key features are usability, customization, and mobile access. Explore options like HubSpot and QuickBooks for efficiency…

Read More

For non-profits, efficiently managing financial data is crucial, especially when claiming the Employee Retention Tax Credit (ERTC). QuickBooks simplifies this process, ensuring accuracy and saving time. By automating and setting up QuickBooks correctly, non-profits can effectively navigate ERTC claims and focus on their core missions…

Read More

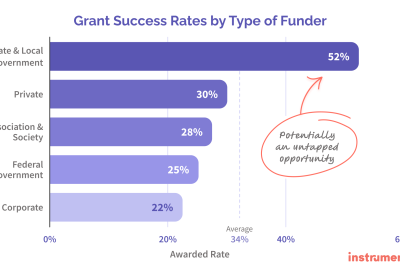

Minority Business Grant Success Statistics & Rates

- Mar 26, 2025

Minority business grants are pivotal in overcoming financial barriers. With varying success rates among different groups and industries, tailored support is crucial. A solid business plan and community networking enhance grant success, empowering minority entrepreneurs to realize their visions and drive business growth in underrepresented areas…

Read More

SETC Refund Process & Credit Details

- Mar 23, 2025

Navigate the SETC refund process with ease! Start by gathering your tax documents and ensure eligibility with a positive net income. Use the SETC Estimator Tool, submit an accurate application, and be ready for a few weeks’ processing time, minimizing errors to avoid hold-ups…

Read More

Choosing the right CRM is vital for small businesses and accounting firms to enhance client management and boost productivity. Top choices like Zoho CRM, HubSpot, and TaxDome offer tailored solutions. Consider budget, customization, and integration capabilities when selecting the ideal CRM for your needs…

Read More

Discover how educational non-profits can maximize ERTC benefits to support their missions. This financial relief offers up to $21,000 per employee, providing significant aid to those eligible. Learn the steps to determine qualification and navigate challenges to maximize this critical opportunity…

Read More

Employee Retention Tax Credit (ERTC) is crucial for non-profits, offering financial benefits to retain staff and sustain operations. ERTC Express aids organizations in compliance, maximizing their refund potential, and strategically using funds to expand initiatives while adhering to IRS guidelines…

Read More

Recent changes in the Employee Retention Tax Credit (ERTC) have caused financial challenges for non-profit clinics. These organizations must now return advanced payments for the fourth quarter, prompting a reevaluation of their financial strategies and an urgent search for alternative funding sources to sustain operations…

Read More

The Employee Retention Tax Credit (ERTC) is a crucial lifeline for 501(c)(3) organizations during financial challenges. By understanding eligibility requirements, such as declining gross receipts or government shutdowns, nonprofits can maximize this financial aid and ensure their sustainability in uncertain times…

Read More

The Employee Retention Tax Credit (ERTC) is a vital financial tool for nonprofits facing economic challenges. Charity leaders must understand its rules and benefits to navigate effectively. Keynote sessions reveal insights for nonprofits to leverage ERTC, enhancing financial health and sustainability in their operations…

Read More