Author: Mike Sweeney

Effective time management is crucial for small business success. Learn strategies to overcome common challenges like juggling multiple roles, frequent distractions, and unclear task importance. Discover how tools, delegation, and efficient workflows can boost productivity and drive growth for your business…

Read More

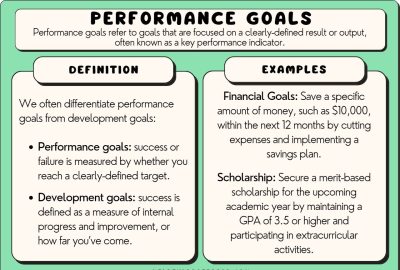

Performance management ensures that employees are aligned with company goals and receive regular feedback. This is crucial for boosting engagement and productivity, making educated decisions on promotions and training, and ultimately driving small business success…

Read More

In today’s digital age, having a strong online presence is not just an option; it’s a necessity. Small businesses need to be visible online to attract new customers, build brand awareness, and compete with larger companies. Discover key strategies to enhance your online visibility and drive success…

Read More

Small businesses need to adapt quickly when the business environment changes. Pivoting is crucial for survival, whether facing economic downturns or shifts in customer tastes. Successful adaptations involve careful planning and the use of technology…

Read More

Getting to know your target audience is key to successful marketing. Avoid errors like making assumptions or being too broad in targeting. Look at your existing customer data for insights and use social media listening and competitor analysis…

Read More

Discover top small business ideas to support local communities, from cozy coffee shops to pet grooming services. Create local hubs and address unique market needs with these creative ventures…

Read More

Setbacks are essential for growth. They compel teams to innovate and improve, transforming challenges into opportunities. Learn how to see obstacles as chances to grow, and leverage resources like ERTC to overcome difficulties and invest in the future…

Read More

Discover how small business collaboration can boost market reach, reduce costs, and drive innovation. Learn the importance of transparent communication and finding complementary partners to maximize success…

Read More

Quickly respond to customer complaints to make them feel valued. Use empathetic listening to understand root causes. Check in to ensure satisfaction. Staff training can enhance satisfaction…

Read More

SOPs are essential for maintaining consistency and efficiency in small businesses. These procedures serve as a roadmap, instructing teams on how to carry out tasks effectively. From reducing mistakes to enhancing productivity, SOPs play a pivotal role in seamless operations…

Read More