Author: Mike Sweeney

Small Business Legal Dispute Handling Guide & Tips

- Aug 14, 2024

Knowing how to resolve disputes is key to saving time and money for small businesses. Handling disputes quickly can spare stress and maintain relationships. Common disputes include partnership issues, breaches of contract, and employee disagreements. Proactive steps and early resolution methods can often avoid costly litigation…

Read More

Small Business Budget Tips, Best Practices & Guides

- Aug 13, 2024

Developing a budget provides clarity on your financial situation and spending habits. Recognize all income streams for precise financial preparation. Keep a record of fixed and variable costs to monitor your spending. Establish explicit financial objectives to direct your business expansion…

Read More

The Employee Retention Credit (ERC) is a significant tax relief tool for businesses impacted by COVID-19. Discover insights on eligibility, compliance, and application processes, and learn how the right advisor can maximize your benefits…

Read More

The ERC moratorium will stay in place until at least September 2023. The IRS is concentrating on reviewing and processing current ERC claims during this period. Businesses can still seek advice from tax professionals to determine their ERC eligibility…

Read More

ERC compliance is crucial for businesses to ensure they are adhering to regulations and avoiding potential penalties. Proper documentation and adherence to guidelines can prevent legal issues and promote a smooth operation. Getting professional help can make the process easier and more accurate…

Read More

The IRS has halted new ERC claims processing as of September 14, 2023, to manage current volumes and ensure compliance. This guide explains what it means for businesses, how to ensure compliance, and the importance of working with a tax professional…

Read More

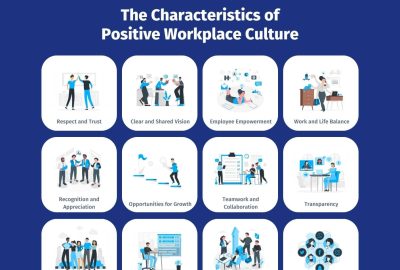

For any small business to be successful, creating a positive company culture is crucial. It’s about creating an environment where employees feel valued and motivated. This leads to higher productivity and better job satisfaction. Consider this. When your team members are satisfied and engaged, they are more likely to…

Read More

Resilience is vital for small business success, aiding owners in overcoming obstacles and setbacks. In this article, I’ll share motivational stories of small business resilience and offer practical advice to help you build a resilient business…

Read More

Cause marketing is a powerful strategy that benefits both businesses and society. By aligning your brand with a social cause, you can make a positive impact while also growing your business. This approach helps connect with customers on a deeper level and build a devoted customer base…

Read More

In today’s competitive business world, understanding your customers is crucial. Customer data provides insights that help improve small business operations, driving growth and satisfaction. Discover the importance of customer data, how to gather it, and strategies to leverage it for success…

Read More