Author: Mike Sweeney

Small Business Incentive Programs & ROI Strategies

- Dec 06, 2024

Small business incentive programs boost productivity and engagement by aligning rewards with business goals. Understanding employee preferences is key to choosing effective incentives. Budgeting smartly with a mix of cost-effective options ensures a significant return on investment, driving growth and fostering a motivated workforce…

Read More

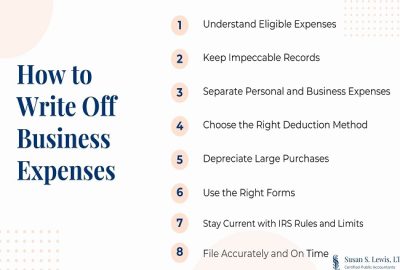

Lower your small business tax bill by identifying deductible expenses that reduce taxable income. Common deductible expenses include rent, utilities, and office supplies. Understanding these can save you money and help you avoid issues with the IRS. Ensure accurate tracking to maximize savings and compliance success…

Read More

Tax planning isn’t just for big corporations. For small businesses, every saved tax dollar is crucial. Effective planning uncovers deductions and credits, optimizes cash flow, and boosts profitability. Leverage financial tools and stay updated on tax laws to safeguard and grow your business…

Read More

Non-Profit Tax Planning Strategies & Tips

- Dec 03, 2024

Non-profits must comply with tax regulations to maintain their tax-exempt status. Strategies include understanding Form 990 and UBIT, leveraging tax consultants, implementing planned giving programs, and keeping accurate records. These steps are crucial for financial stability and mission success in the non-profit sector…

Read More

Essential Small Business Tax Planning Tips

- Dec 02, 2024

Effective tax planning is crucial for small businesses to minimize liabilities and maximize savings. By strategically planning throughout the year, you can reduce your tax liability and ensure compliance. Explore key tips to navigate the complexities of small business taxes and secure financial health for your enterprise…

Read More

ERTC Refundable Tax Credits Basics & Guide

- Nov 24, 2024

Navigating taxes can be complex, but the Employee Retention Tax Credit (ERTC) can be a significant financial aid. Learn about eligibility, claim periods, and documentation needed to maximize your benefit and support your business through challenging times with this comprehensive guide to ERTC refundable tax credits…

Read More

Discover how tax credits can significantly reduce your tax liability. Uncover hidden opportunities with R&D credits, energy efficiency incentives, and more. Maximize your benefits by engaging a professional tax advisor to ensure you claim what’s rightfully yours and unlock potential savings for your business…

Read More

Simplified business tax codes reduce errors and administrative burdens, enabling companies to focus on growth. Clear regulations save time and money. Understanding these principles helps businesses thrive. Consulting experts and using tax software are wise steps toward efficient tax management…

Read More

Small Business Owners Tax Credits Tips & Strategies

- Nov 18, 2024

Small business tax credits can significantly reduce your tax bill, making them crucial for financial relief. Unlike deductions, credits directly lower your liability, keeping more money in your business. This powerful tool can be the difference between survival and growth for small businesses, offering essential financial breathing room…

Read More

Minority-Owned and Women Owned Business Tax Benefits & Government Contracting Opportunities

- Nov 16, 2024

Minority and women-owned businesses benefit from tax incentives and government contracts. These supports are essential for growth, offering crucial capital and access to new opportunities. Understanding and utilizing these programs can drive innovation and resilience, leveling the competitive field for these businesses…

Read More