If you are looking to set up payroll for your LLC, it may seem like a daunting task. However, it is a critical step in managing your business. In this guide, I will break down the process into simple steps to help you get started with confidence.

Main Points

- The first step in setting up payroll for your LLC is to get an Employer Identification Number (EIN).

- Choosing the right payroll system can save you time and prevent mistakes.

- Correctly classifying workers as employees or contractors is crucial for compliance.

- Keeping accurate employee records ensures smooth payroll processing.

- Knowing your payroll tax obligations helps you avoid penalties.

Setting up payroll is one of the most important tasks when you start an LLC. This process has several steps, but it’s much more manageable once you understand them. The key is to tackle it one step at a time.

How to Set Up Payroll for an LLC

When it comes to setting up payroll for your LLC, it’s not just about paying your employees. It’s about making sure your business is following federal, state, and local tax laws. Even more important, it’s about building a smooth-running operation that helps your business grow.

Why Payroll Management Matters

Payroll management is crucial for any business. It guarantees that employees receive their paychecks correctly and punctually, which can increase morale and productivity. Additionally, it assists your LLC in adhering to tax laws, preventing expensive fines and penalties. Payroll is more than just writing checks; it’s about preserving the financial wellbeing of your business.

Getting to Know LLC Characteristics and Payroll Requirements

When you form an LLC, or Limited Liability Company, you’re getting a business structure that offers management flexibility and a variety of tax options. One of the key features of an LLC is that it allows you to choose your tax structure, which will impact how you set up your payroll. Most LLCs have the option to be taxed as a sole proprietorship, a partnership, or a corporation. Each of these choices will have different payroll requirements, so it’s important to understand what each one entails.

The Impact of Payroll on Your Business

How you manage your payroll can make or break your business. Doing it right means you’re following the law and avoiding fines. For guidance on maintaining compliance, consider this payroll taxes compliance guide. Plus, it makes your employees happy. When they get paid the right amount at the right time, they’re more likely to enjoy their job. That can make them work harder and stay with your company longer.

Consider this: A small tech company was having trouble keeping employees because of inconsistent payroll. But once they got their payroll process under control, their employees were happier, and they had a lot fewer people leaving the company.

How to Set Up Payroll for LLCs

There are several important steps to setting up payroll. If you follow these steps, you can make sure your payroll system is effective and follows the rules.

Get Your Employer Identification Number (EIN)

When you’re ready to start setting up payroll for your LLC, the first thing you’ll need to do is get an Employer Identification Number (EIN) from the IRS. This number is crucial for filing taxes and other IRS documents. It’s easy to apply for an EIN online, and the process is typically quick and painless.

Pick the Right Payroll System

It’s critical to select the right payroll system to manage your payroll effectively. You have the option of using a manual system, software, or a payroll service provider. Each choice has its own set of advantages and disadvantages. For example, payroll software can automate calculations and tax filings, while a service provider can take care of everything for you, giving you more time.

Classify Your Employees Correctly

Make sure to classify your workers correctly as either employees or independent contractors. If you misclassify them, you could face legal issues and fines. Employees have payroll taxes, while independent contractors take care of their own taxes. It’s important to understand these differences to stay compliant.

After you’ve determined your worker classifications, you’ll be able to establish employee records, figure out payroll, and make sure you’re following all the rules for payroll taxes and reporting. It’s important to take these steps to keep your payroll system running smoothly.

Establish Employee Files

Correct employee files are vital for payroll processing. You must gather information like Social Security numbers, tax withholding forms, and bank details for direct deposits. Maintaining these files current guarantees that your payroll runs efficiently and precisely.

How to Calculate and Process Payroll

When it comes to payroll, you need to calculate each employee’s gross pay, deductions, and net pay. Deductions might include taxes, health insurance, and retirement contributions. It’s essential to get these calculations right to prevent mistakes and keep your employees’ trust.

Adhering to Payroll Taxes and Reporting

It is a legal requirement to adhere to payroll taxes. This encompasses withholding federal, state, and local taxes from employee wages and submitting them to the correct agencies. In addition, various employment tax forms need to be completed throughout the year. Keeping on top of these requirements helps to avoid expensive penalties.

By learning and applying these steps, you can establish a payroll system that helps your LLC thrive and succeed.

Handling Payroll Taxes and Adhering to Compliance

Payroll taxes are a large portion of handling payroll for your LLC. It’s crucial to know what you need to do to avoid fines and make sure you’re following the rules.

Next, we’ll delve into the specifics of payroll taxes, the difficulties of compliance, and the typical errors to steer clear of.

What You Need to Know About Federal Payroll Taxes

If you’re running an LLC, you’re required to take out federal payroll taxes from the wages of your employees. These are your Social Security and Medicare taxes, which are often called FICA taxes. It’s your job to withhold these taxes from the paychecks of your employees and match a part of them. You also have to pay the federal unemployment tax, or FUTA, which helps fund unemployment compensation programs. It’s important to understand these responsibilities to stay in line with federal rules.

State and Local Payroll Tax Requirements

In addition to federal taxes, your LLC is also obligated to meet state and local payroll tax requirements. These can differ greatly based on where your business is located. Most states enforce state income taxes, which must be withheld from employee wages. Some states and localities also mandate additional taxes, such as disability insurance or local income taxes. Keeping track of these varying requirements is crucial for accurate LLC payroll processing.

Let’s say you run an LLC in California. You’ll need to withhold state income tax and state disability insurance, and contribute to the Employment Training Tax. But if your LLC is in Texas, you may only need to worry about federal taxes, because Texas doesn’t have a state income tax.

Submitting Employment Tax Forms

LLCs are required to submit several employment tax forms to remain compliant with payroll taxes. These forms include Form 941, which is a quarterly report of federal income and FICA taxes, and Form 940, which is an annual report of FUTA taxes. Additionally, employees must receive Form W-2, which provides a summary of their annual earnings and tax withholdings. It is crucial to submit these forms accurately and in a timely manner to prevent penalties and to stay in good standing with tax authorities.

Each form has its own specific deadlines. You can keep a calendar or use payroll software that will remind you of these due dates to avoid missing filings. Regular filing habits will help your LLC stay compliant and avoid unnecessary fines.

Typical Payroll Errors for LLCs to Evade

Establishing payroll for an LLC has many components, and errors can occur. Nevertheless, knowing the usual errors can help you evade them and keep your payroll process running smoothly. For more detailed guidance, you can refer to this payroll taxes compliance guide.

Incorrect Worker Classification

A common error is incorrectly classifying workers as independent contractors rather than employees. This can have significant tax consequences, as employees are subject to payroll taxes, while contractors are not. Incorrect classification can lead to back taxes, fines, and interest. Always make sure you correctly classify your workers based on their job responsibilities and your relationship with them.

Overlooking Payroll Tax Deposits

Another common mistake is not depositing payroll taxes on time. The IRS insists on timely deposits of withheld taxes, and not meeting these deadlines can result in substantial penalties. It’s essential to establish a dependable system for monitoring and depositing these taxes. Regardless of whether you utilize payroll software or engage a professional, making timely deposits will safeguard your LLC from financial penalties.

Missing Deadlines

There are a lot of deadlines to keep in mind when it comes to payroll, including tax deposits and form filings. If you miss these deadlines, you could be hit with penalties and interest charges. To avoid this, make a detailed schedule that includes all payroll-related deadlines. Use reminders and alerts to keep track of these important dates, making sure you meet your obligations on time.

Selecting the Appropriate Tools for LLC Payroll

Selecting the appropriate tools can make payroll management for your LLC much simpler. By having the appropriate systems in place, you can automate many processes, reduce errors, and save a lot of time. Additionally, utilizing fast online business funding can provide the financial flexibility needed to invest in the right payroll tools.

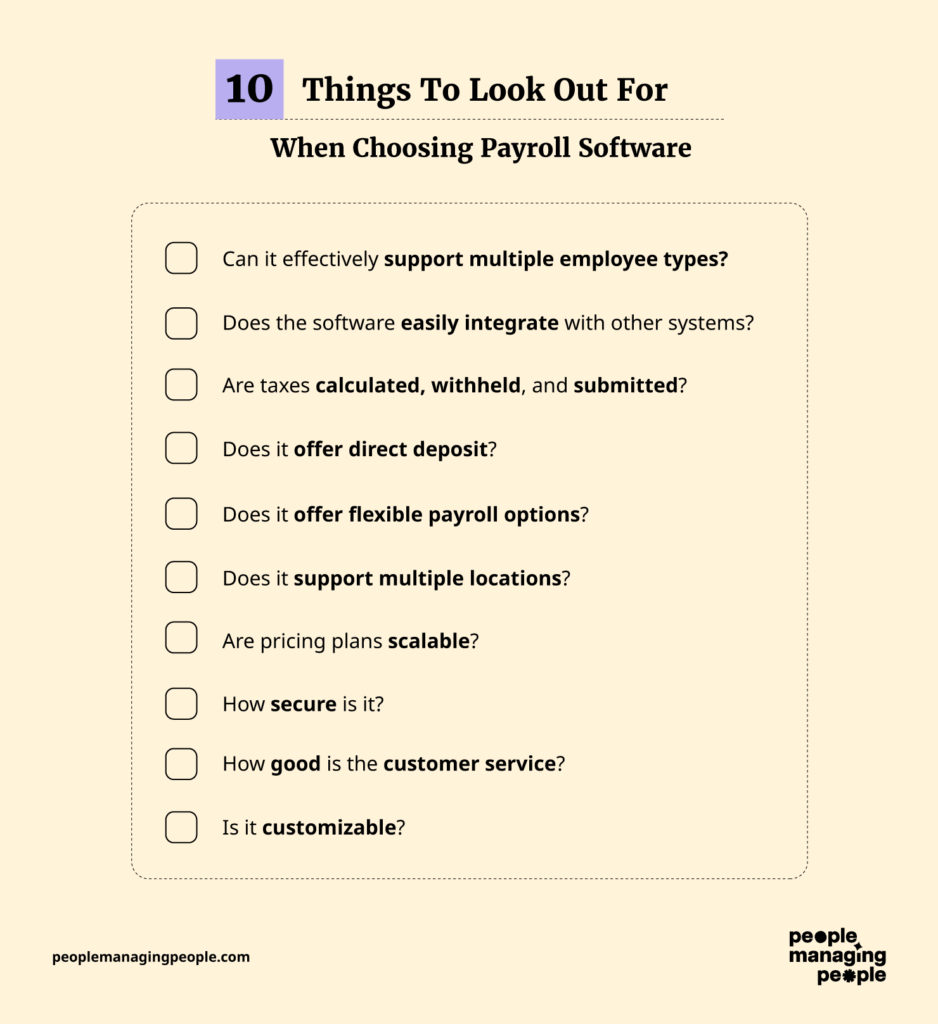

Choosing the Right Payroll Software

When it comes to picking the right payroll software, you should consider things like how user-friendly it is, how much it costs, and what features it offers. The best software will automatically calculate taxes, generate payroll reports, and remind you when it’s time to file. Some of the most popular choices are Gusto, QuickBooks Payroll, and ADP. You should evaluate these options based on what your LLC needs and how much you’re willing to spend.

The Perks of Delegating Payroll

For many LLCs, particularly those with fewer resources, delegating payroll can be a smart move. By bringing on a payroll service provider, you can hand over complex tasks, guaranteeing compliance and precision. These providers take care of everything from tax filings to employee paychecks, freeing up your time to concentrate on expanding your business. For more insights, explore tax relief programs and how they can benefit your company.

Outsourcing not only helps lessen the burden of work, but it also gives you a sense of security. Having professionals handle your payroll ensures your LLC stays in line with the constantly evolving tax laws and regulations.

- Time-saving: Gives you more time to concentrate on the main aspects of your business.

- Expertise: Provides access to payroll professionals who are knowledgeable about tax laws and regulations.

- Accuracy: Lowers the likelihood of mistakes and penalties.

Using Automation to Improve Payroll Efficiency

Automation is crucial for effective payroll management. By automating tasks like tax computations, direct deposits, and record-keeping, you can reduce errors and save time. Most payroll software includes automation features, which simplifies the process of streamlining your operations. As your LLC expands, automation becomes increasingly important, as it allows you to manage a larger workforce without adding to your administrative workload.

In the final section of this guide, we will delve into payroll management best practices and address common questions that LLC owners encounter.

Guaranteeing Precision in Payroll Computations

- Verify employee hours and wage rates prior to processing payroll.

- Employ software to automate computations and minimize human error.

- Frequently update tax tables to guarantee accurate withholdings.

Maintaining precision in payroll computations is vital to preserve trust and compliance. Errors in computing wages or taxes can result in employee discontent and possible legal problems. As such, it’s vital to establish a system that guarantees accuracy in every payroll cycle.

Begin by checking the number of hours worked and the rate of pay for each employee. Simple mistakes in these numbers can result in significant differences in paychecks. Using software to automate these calculations can significantly reduce the chance of human error.

Furthermore, always keep your tax tables up-to-date. Tax laws may change, and if you’re using outdated information, you could end up withholding the wrong amounts. By staying informed and regularly updating your systems, you can ensure accuracy and compliance. For more guidance, check out this quick guide to LLC payroll.

Keeping Accurate Employee Records

One of the keys to effective payroll management is maintaining detailed and accurate employee records. This includes personal information, tax withholding forms, and payment history. Having this information well-organized and easily accessible is important for both payroll processing and labor law compliance.

Continually Checking and Assessing Payroll Systems

It is crucial to perform regular audits of your payroll systems to spot and correct any errors or inefficiencies. By doing routine checks, you can make sure that your payroll procedures stay in line with current laws and fit the needs of your business.

Common Questions and Answers

As an LLC owner, you probably have a lot of questions about setting up and managing payroll. Here are some of the most frequently asked questions and detailed answers to help you navigate the process, including guidance on payroll taxes.

One of the initial steps to set up your LLC’s payroll is to get an EIN. This number serves as your business’s social security number, enabling you to handle taxes and payroll legally and effectively.

Getting an EIN is a simple process that can be done online via the IRS website. Once you have it, it will be the main identifier for all of your business dealings.

Keep in mind, an EIN isn’t solely for payroll purposes; it’s also necessary for several other business activities, like applying for licenses and opening bank accounts.

How can LLCs make payroll management easier?

LLCs can make payroll management easier by using technology and outsourcing some tasks. Automation tools and payroll software can efficiently handle calculations, tax filings, and direct deposits.

Payroll software can be a real time-saver, taking over a lot of the repetitive work involved in managing payroll. These tools often have features like automatic updates for tax rates and reminders for when you need to file, helping you stay compliant.

You can also choose to outsource payroll to a professional service. This way, experts can take care of the intricate details of payroll while you concentrate on expanding your business.

Moreover, continuous learning for your payroll team can assist them in staying informed about the latest rules and best practices, making the process even easier.

For instance, a small retail LLC chose to outsource their payroll, which gave them the opportunity to concentrate on growing their product line. Consequently, they experienced a 30% sales growth in the first quarter.

Which payroll taxes are LLCs liable for?

LLCs are liable for several payroll taxes, including federal income tax withholding, Social Security and Medicare taxes (FICA), and federal unemployment tax (FUTA). Depending on your location, state and local taxes may also apply.

You must be aware of these tax responsibilities to ensure that you are following the rules. If you fail to withhold or pay these taxes, you could be hit with fines and interest, which could harm the financial stability of your LLC.

What’s the big deal about employee classification?

It’s important to get it right when you’re deciding whether someone is an employee or an independent contractor. If you don’t, you could end up in hot water with legal and tax problems. Misclassifying someone could mean you have to pay fines, back taxes, and even deal with legal battles.

How regularly should you run payroll?

The frequency of payroll runs can differ based on your business and the laws of your state. Usual payroll schedules include weekly, bi-weekly, twice a month, and monthly. The best schedule for you will depend on your cash flow and what your employees prefer. To ensure compliance with tax regulations, you might find this payroll taxes compliance guide helpful.

Keeping a regular payroll schedule ensures that your employees get paid on time and helps you manage your business’s cash flow more effectively.

Why should you use payroll software?

There are several advantages to using payroll software. It automates tasks such as calculations, tax filings, and direct deposits. This decreases the likelihood of mistakes, saves time, and helps you stay compliant with tax laws.

Plus, payroll software usually offers in-depth reports, which assist you in examining labor expenses and making educated business choices.

Is it possible for an LLC owner to pay themselves a salary?

Absolutely, an LLC owner has the ability to pay themselves a salary, particularly if the LLC is taxed as a corporation. This process includes withholding payroll taxes and reporting the salary on a W-2 form.

What information should be kept in employee records?

Employee records should contain personal information, tax withholding forms, employment contracts, and payment history. Organizing these records will help with payroll processing and labor law compliance.

By keeping these records up-to-date and reviewing them regularly, you can avoid mistakes and ensure that your LLC continues to comply with regulations.