Main Points

- The Employee Retention Credit (ERC) is a tax credit that can be refunded. It was created to encourage businesses to keep their employees during the COVID-19 pandemic.

- Whether or not a business is eligible for ERC depends on things like if the business had to suspend operations or if it saw a significant decrease in revenue.

- Keeping accurate records of business operations and how much employees are paid is very important for making sure a business is in compliance.

- Filing on time and knowing when deadlines are can help a business get the most money back.

- Getting help from a tax professional can make it easier to understand the complex parts of ERC and be ready for possible audits.

Basics of ERC Refund Compliance

Many businesses find the Employee Retention Credit (ERC) hard to understand because there are many rules they need to follow. The ERC is a credit that was created by the CARES Act to help employers keep their employees on the payroll during the difficult time of the COVID-19 pandemic. It is very important for businesses to understand the basics of ERC so they can get the most benefit from it without breaking any rules.

What is ERC and Why Does It Exist?

The ERC is basically a saving grace for businesses trying to keep their employees on payroll during the pandemic. It’s a refundable tax credit, which means it can lower the taxes you owe or even result in a refund. The reason the ERC exists is to provide financial help to businesses that have had to fully or partially shut down due to government orders or have seen a significant drop in gross receipts.

For example, if your business had to temporarily shut down due to a government order, or if you noticed a significant decrease in your revenue compared to the same quarter of the previous year, you may be eligible for this credit. The aim is to assist you in maintaining your employees on the payroll, even in difficult times.

Who is Eligible?

It’s important to know if your business is eligible for the ERC. The two main factors that determine eligibility are government orders and a decrease in revenue. Let’s look at these in more detail.

First, if your business was fully or partially closed due to government orders related to COVID-19, you might be eligible. This includes any restrictions on commerce, travel, or group meetings. Second, if your business had a significant decline in gross receipts, you could qualify. For the 2020 tax year, a decline is considered significant if your gross receipts for a quarter were less than 50% of the same quarter in 2019. For 2021, the threshold is a 20% decline.

The Significance of Adhering to IRS Rules

When applying for the ERC, it is mandatory to follow the IRS rules. Filing incorrect claims can result in audits, penalties, and the necessity to amend tax returns. As a result, it is critical to comprehend the rules and verify the accuracy of your claims. The IRS has established specific rules for calculating the credit, determining which wages are eligible, and filing for the credit. Overlooking these rules can lead to expensive errors.

First and foremost, you need to keep comprehensive records and documentation. This means you should document any government orders that impacted your business, keep track of any decrease in revenue, and record all wages paid to employees during the eligible periods. This documentation is not only necessary for your claim but also prepares you for a potential audit.

How to Make Sure Your ERC Claims are Correct

There are several important steps you need to take to make sure your ERC claims are correct. These range from documenting the status of your business operations during the pandemic to figuring out which employee wages are eligible. For detailed guidance, refer to this ERTC tax credit compliance guide. Each step needs to be done with a high level of care and precision.

Keeping Track of Business Activities During the Pandemic

The first step to ensuring that you are compliant is to keep track of how the pandemic has affected your business operations. This means that you should be documenting any government orders that led to a full or partial suspension of your operations, as well as any steps that you took in response to these orders.

- Retain duplicates of any government orders that had an impact on your business.

- Make a note of the dates and length of any business shutdowns or limitations.

- Keep track of how these orders affected your business operations and income.

In addition to that, it’s crucial to remember any changes your business implemented, such as transitioning to work from home or altering services. These documents can validate your claim and provide transparency if any issues come up. For more detailed guidance, consider reviewing our ERC application deadline and compliance tips.

How to Determine Qualified Employee Wages

One of the most important steps in the ERC process is determining the wages that qualify for the credit. The credit is based on the qualified wages you pay your employees during the eligible periods. In 2020, the credit was 50% of qualified wages, with a maximum of $10,000 per employee per year. In 2021, the credit was increased to 70% of qualified wages, with a maximum of $10,000 per employee per quarter.

It’s important to know the difference between full-time and part-time employees, and to include any health plan expenses in the wages. This will allow you to get the most out of your refund and stay compliant.

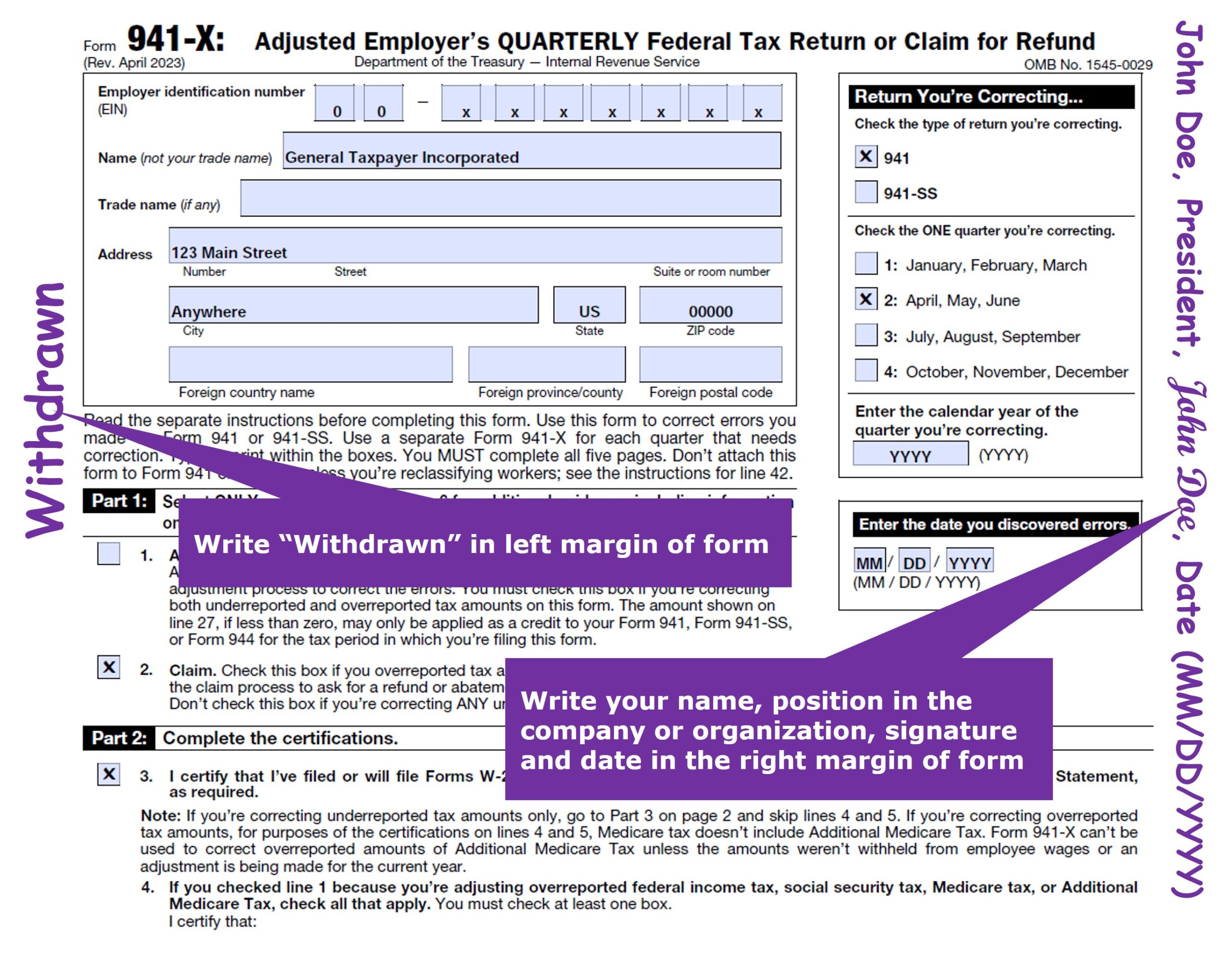

How to Amend Filings Using Form 941-X

| Step | Description |

|---|---|

| Find Mistakes | Look over previous filings for any errors in reported wages or credits. |

| Fill Out Form 941-X | Use this form to fix any errors in your quarterly payroll tax returns. |

| File On Time | Make sure the form is filed within the three-year statute of limitations. |

By taking these steps, you can fix any errors and make sure your ERC claim is accurate and compliant.

Maximizing Your Refund: Key Tactics

- Examine all employee wages and include only those that qualify.

- Employ a trustworthy tax professional to verify calculations.

- Document all business disruptions and revenue declines accurately.

To maximize your ERC refund, it’s not enough to just meet the eligibility requirements. You need to strategically approach the process to claim as much as possible. One such strategy is to thoroughly examine all employee wages. Ensure that only wages that qualify are included in your calculations. This means wages already used for other credits, like the Paycheck Protection Program (PPP), should be excluded.

Another way to ensure you’re on the right track is to hire a tax professional. They can help you double-check your numbers and make sure you’re not missing anything. Plus, they can provide insights into how to maximize your refund while still staying within IRS rules.

Lastly, it’s vital to have proper documentation. Make sure you keep detailed records of all business interruptions and drops in revenue. This documentation will not only back up your claim but will also assist in correctly figuring out your refund amount.

Why You Shouldn’t Miss Filing Deadlines

It’s crucial to meet the deadlines for filing to get your ERC refund. If you miss a deadline, you might lose your chance to get financial help. The IRS has set deadlines for when you should file your ERC claims. You should know these dates.

The final date to submit your 2020 claims is April 15, 2024, and for 2021 claims, it’s April 15, 2025. Make sure to note these important dates and set reminders so you don’t forget to file on time. By filing early, you’re not only guaranteeing your refund, but you’re also decreasing the chance of making mistakes due to rushing at the last minute. For more information on deadlines and compliance, you can check the ERC application deadline guide.

Avoid These Frequent Claim Mistakes

Minor mistakes in your ERC claim can create major issues. Frequent errors include incorrectly calculating eligible wages, neglecting to provide the correct documentation, and misinterpreting government orders.

Steer clear of these mistakes by taking the time to double-check your calculations and to ensure that you have the necessary documentation to support your claim. If you’re not confident about any part of the process, get professional advice. It could save you time and avoid expensive errors.

Defending Against Audits and Staying Compliant

It’s a smart move to be ready for a possible IRS audit when you’re claiming the ERC. Even though audits aren’t a certainty, being ready for one can save you a lot of worry and resources down the line. This means keeping thorough records and knowing what an audit entails.

The first step in audit defense is to make sure your records are complete and well-organized. This includes documentation of all government orders that have affected your business, revenue records, and wage calculations. Having these records at your fingertips can make the audit process go more smoothly and efficiently.

Getting Ready for a Possible IRS Audit

Getting ready for an IRS audit means knowing what the IRS might want to see. They’ll probably go over your records of business interruptions, employee wages, and eligibility requirements. Having this information neatly arranged and easily accessible can make the audit process less intimidating.

Keeping Thorough Records

Thorough record keeping is your best protection against an audit. This includes maintaining detailed records of all transactions, government orders, and communications related to the ERC. Keeping these records up to date ensures you’re ready for any questions from the IRS.

Why Hire a Professional Tax Advisor?

When it comes to ERC compliance, hiring a professional tax advisor can be a huge help. They can guide you through the complicated world of tax laws and make sure your claims are both accurate and compliant.

Professional help not only provides peace of mind, but it also maximizes your refund. Tax professionals are experts at finding extra savings opportunities and making sure all eligible expenses are included.

Should you be audited, having a professional in your corner can make a world of difference. They can advocate for you and offer expert advice throughout the process, ensuring a just and efficient resolution.

Planning for the Future: Ensuring Future ERC Benefits

Ensuring future ERC benefits means keeping up to date with legislative changes and being aware of submission deadlines. As the ERC landscape changes, businesses need to keep up with new regulations and opportunities.

Staying up-to-date with changes allows your business to continue reaping the benefits of available credits and incentives. This forward-thinking strategy can offer financial stability and aid your long-term growth plan.

Getting to Know the ERC Submission Deadlines

It’s important to understand when the ERC submission deadlines are to make sure you get your refund. As we’ve mentioned before, the deadlines for 2020 and 2021 claims are April 15, 2024, and April 15, 2025, respectively. If you miss these deadlines, you could miss out on money.

Make sure you submit on time by setting reminders and setting aside time for careful preparation. This includes collecting the necessary paperwork, reviewing the eligibility requirements, and speaking with tax professionals.

Filing on time is not only crucial for securing your refund, but it also minimizes the chances of making errors and facing potential penalties. If you stay organized and proactive, you can take full advantage of the benefits offered by the ERC.

| Year | Deadline |

|---|---|

| 2020 | April 15, 2024 |

| 2021 | April 15, 2025 |

Keeping an Eye on Legal Changes that Impact ERC

Keeping up-to-date with legislative changes is key to ensuring compliance and maximizing your ERC benefits. Any changes in tax laws and regulations can affect your eligibility and the amount you can claim.

Keep yourself updated by subscribing to industry newsletters, participating in webinars, and discussing with tax professionals. This proactive approach ensures you’re aware of any changes and can adjust your strategy accordingly.

Building Sustainable Compliance Plans

It’s crucial to develop sustainable compliance plans to ensure your company remains qualified for ERC benefits and other tax incentives. These plans include ongoing tax law surveillance, thorough record-keeping, and cultivating a compliance culture within your company.

Putting in place a routine review process for all tax-related paperwork and claims is a good approach. This will make sure your records are current and precise, lowering the chance of inaccuracies and non-compliance. In addition, think about putting money into compliance training for your team. This can enable employees to comprehend and comply with tax laws, decreasing the chance of errors.

Moreover, collaborating with a reliable tax consultant can offer continuous assistance and advice. These experts can aid you in understanding intricate tax regulations and pinpointing areas for savings, making sure your business stays in line with the rules and financially stable.

Common Questions

What if my ERC claim doesn’t meet compliance standards?

If your ERC claim doesn’t meet compliance standards, the IRS may ask you to revise your tax return and give back any credits you received. You might also have to pay penalties and interest on the amount you owe. To avoid these outcomes, it’s important to make sure your claims are correct and have the right documentation to back them up. For more information, you can refer to this ERC compliance guide.

How can I tell if my business is eligible for ERC?

Your business is eligible for ERC if it was fully or partially suspended due to government orders related to COVID-19, or if it experienced a substantial reduction in gross receipts. In 2020, a substantial reduction means a decline of more than 50% compared to the same quarter in 2019, and in 2021, it means a decline of more than 20%. For more detailed guidance, you can refer to our ERC compliance advisors.

Is it possible to claim ERC for part-time workers?

Indeed, it is possible to claim ERC for part-time workers. The credit is calculated based on the qualified wages paid to all eligible workers, irrespective of whether they work full-time or part-time. Make sure to correctly calculate the wages for each worker to get the most out of your credit.

What kind of paperwork do I need to file for ERC claims?

When you’re filing for ERC, you’re going to need paperwork that shows government orders that affected your business, records that show a decrease in revenue, and detailed wage records for all employees who are eligible. If you keep all of your records organized and thorough, it’ll make the claims process easier and help you out if you’re audited. For more detailed guidance, you can check out ERTC compliance CPA advisors for expert advice.

How long do I need to keep records for ERC claims?

You should keep records for ERC claims for at least three years from the date you filed the original return or two years from the date you paid the tax, whichever is later. This is to make sure you have the necessary documentation if the IRS decides to audit or inquire.

Is there a cap on the amount I can claim for each employee?

Indeed, there is a cap on the amount you can claim for each employee. In 2020, the maximum credit is 50% of qualified wages, capped at $10,000 per employee for the year. In 2021, the credit is 70% of qualified wages, capped at $10,000 per employee each quarter. For more details on compliance, you can refer to this ERC refund compliance guide.

For instance, if a staff member made $8,000 in eligible wages in the first quarter of 2021, you’re entitled to claim 70% of that sum, or $5,600, as a credit. To ensure compliance with the latest regulations, consider consulting ERTC Express Tax Credit Compliance Advisors.

Could mistakes in my application result in audits?

Indeed, mistakes in your ERC application can initiate an IRS audit. Frequent mistakes encompass wage miscalculations, not satisfying eligibility requirements, and not having adequate documentation. To lessen the possibility of an audit, make sure your applications are correct and backed up by comprehensive records.

Can new businesses established during the pandemic benefit from ERC?

Indeed, new businesses established during the pandemic may be eligible for ERC as a Recovery Startup Business. To qualify, your business must have been established on or after February 15, 2020, employ at least one W-2 employee, and not exceed $1 million in annualized revenue. If you meet these criteria, you can benefit from the ERC, even as a new business.