Key Points to Remember

- Legal advice can help minimize tax liabilities and prevent expensive errors.

- Starting a new business requires knowledge of the tax implications of various business structures.

- Expanding or moving a business can result in new tax responsibilities.

- An IRS audit or tax dispute is a crucial time to get legal advice.

- Legal professionals can help maximize tax deductions and credits.

Why Legal Advice is Necessary for Business Taxes

Every business owner is aware that taxes are a significant aspect of operating a business. However, comprehending the complexities of tax laws can be daunting. This is when legal advice becomes crucial. A tax attorney can provide clarity and guidance, ensuring that you are not only compliant but also making sound financial decisions.

First and foremost, tax laws are intricate and ever-evolving. What was effective last year may not be valid this year. As a result, it’s crucial for your business’s financial well-being to stay current. Getting legal advice allows you to keep up with these changes without being distracted from your primary business operations.

“No matter the size of the taxpayer, a tax attorney can be a great help. It could be a simple collection case that is a missed posting of a payment amount, a lost payment, or a refund claim.”

The Importance of Tax Decisions in Business Success

Tax decisions can make a big difference in your business’s bottom line. Everything from the way you structure your business to the deductions you claim to how you handle tax audits can affect your overall financial success. Legal advice ensures that these decisions are made strategically and with a full understanding of the potential consequences.

Typical Situations That Need Legal Advice

Legal advice is not only helpful but also essential in a number of situations. For example, if you are starting a new business, you need to choose the correct business structure. This choice will have an impact on your taxes, liability, and even your business’s potential for growth in the future.

Also, if you’re growing your business or moving it to a new location, you should know that each state has different tax laws. The expansion or relocation of your business may lead to new tax obligations. By seeking legal advice, you can better understand these changes and plan accordingly. For additional guidance, consider these startup business tax strategies to help navigate through tax complexities.

When Should You Seek Legal Advice for Business Taxes?

Understanding when to seek legal advice can protect you from possible issues and improve your business’s financial well-being. Let’s explore a few scenarios where legal advice is crucial.

Key Tax Considerations When Launching a New Business

Choosing the right business structure is critical when starting a new business. The tax implications of a sole proprietorship, partnership, LLC, or corporation can significantly impact your bottom line. A tax attorney can help you navigate these complexities and choose the structure that best aligns with your financial objectives.

Growing or Moving Your Company

When your business grows, it often means new possibilities and hurdles. One of those hurdles is understanding new tax rules. Whether you’re opening a new shop in a different state or relocating your whole company, it’s essential to get legal advice.

- Investigate what taxes your state and city require.

- Learn how your current tax status will be affected.

- Prepare for any possible tax credits or incentives.

In addition, a tax lawyer can help you navigate the paperwork and make sure you’re following all the rules.

Lowering Tax Obligations

The main reason to get legal advice is to lower your tax obligations. Tax attorneys are experts at finding ways to decrease the tax your business has to pay. They can help you navigate tax credits, deductions, and incentives that you might not know about, making sure you use every chance to reduce your tax payment.

Steering Clear of Legal Trouble and Fines

Slipping up on your taxes can result in grave legal problems and monetary fines. A tax attorney can assist you in steering clear of these troubles by making certain that your tax submissions are precise and adhere to the law. They are knowledgeable in the intricacies of tax codes and can offer priceless counsel on how to manage different tax-related scenarios.

For example, if you’re going through an IRS audit, having a tax attorney with you can make a world of difference. They will defend your interests, help you know your rights, and guide you through the audit process to reduce any potential penalties.

Getting the Most Out of Your Tax Deductions and Credits

While tax deductions and credits can significantly decrease the amount of tax you have to pay, they can also be confusing. A tax attorney can assist you in identifying all the deductions and credits your business is eligible for, so you don’t miss out on any potential savings. Whether you’re claiming deductions for business expenses or figuring out tax credits for hiring new staff, legal counsel can help you get the most out of your tax benefits.

Finding the Best Legal Counsel

Finding the best legal counsel for your business taxes is of utmost importance. You need someone who not only knows the law but also knows the specific needs of your business. Find a tax attorney who has experience in your field and has a history of successfully dealing with cases like yours.

Another crucial factor to consider is the attorney’s communication style and availability. You need someone who is not only responsive but can also break down complex tax issues in a way that you can understand. Clear communication is, after all, the foundation of a successful working relationship. For specialized assistance, consider exploring small business tax credit services that can offer tailored advice.

“Tax lawyers are experts in the intricate and technical area of tax law. They are the ideal choice for dealing with legal matters, audits, and disagreements with tax agencies.”

In addition to experience and communication, the cost of employing a tax attorney should be considered. Make sure you comprehend their pricing structure and what services are included. While legal counsel may be costly, the potential tax savings and penalty avoidance can make it a sound investment.

What to Look For in a Tax Lawyer

When you’re deciding on a tax lawyer, you’ll want to find someone who is analytical and has a strong attention to detail. Tax law is complicated, and being able to get into the nitty-gritty can be a game changer. You’ll also want a tax lawyer who is proactive and can provide advice on how to prevent issues from occurring.

Trustworthiness is another critical quality. You need to feel assured that your lawyer is working in your best interests and offering truthful, impartial advice. Establishing a robust relationship with your lawyer can result in better outcomes for your business.

Lastly, think about their ability to solve problems. Tax matters can get complex, and a lawyer who can think out of the box and strategically will be a valuable addition to your business.

Evaluating Different Lawyers

It’s a smart move to evaluate a number of lawyers before deciding on one. Look at their level of experience, their reputation, and what their clients have to say about them. Ask them for references and talk to other business owners about their own experiences. Doing this research will help you find the best match for what your business needs, especially when considering essential services for small business tax planning.

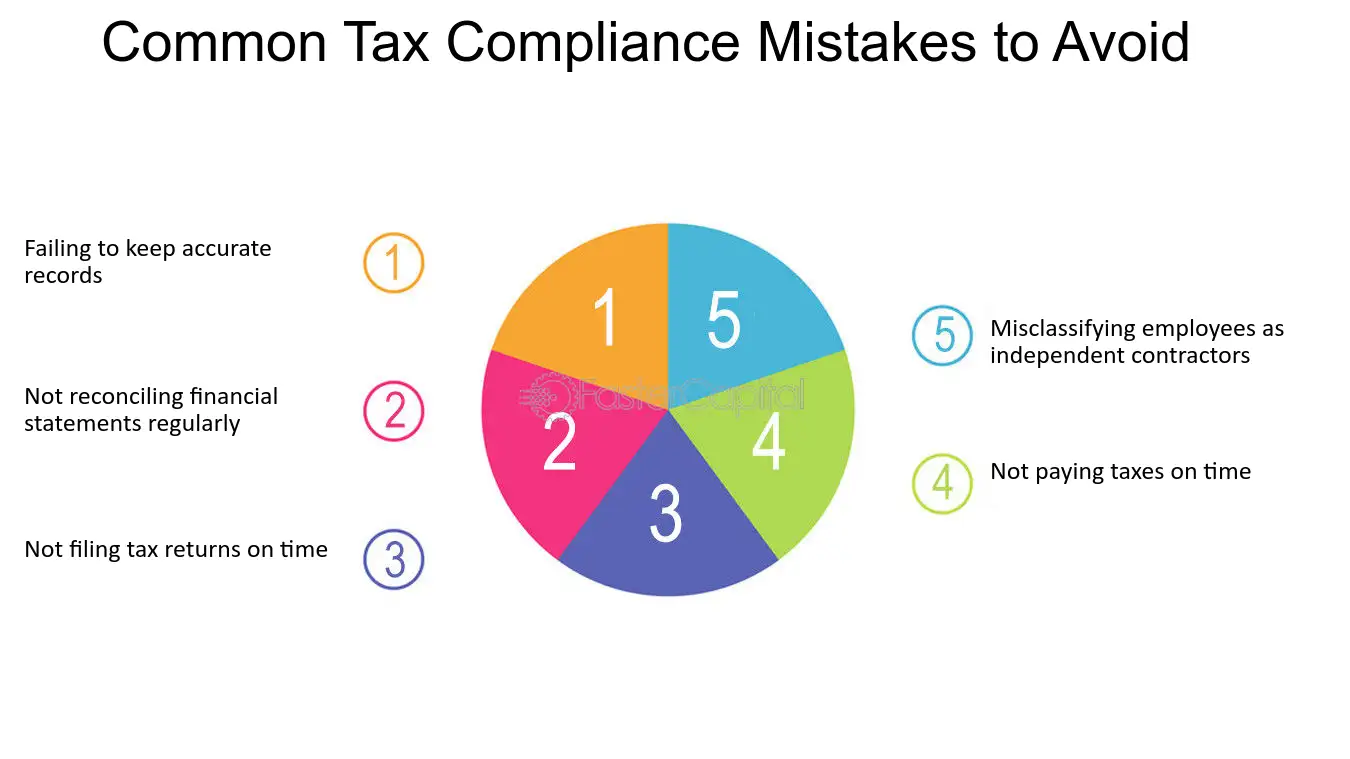

Typical Errors in Managing Business Taxes

Dealing with business taxes can be difficult, and even minor errors can result in major issues. Here are some typical errors to steer clear of:

Grasping Your Tax Responsibilities

It’s common for business owners to not fully grasp their tax responsibilities. This misunderstanding can result in either underpaying or overpaying taxes, both of which can lead to adverse effects. A tax attorney can aid you in comprehending your responsibilities and making certain you’re fulfilling them.

For instance, if you’re not familiar with specific taxes that apply to your industry, you could end up getting penalized for not complying. Legal advice can assist you in recognizing and meeting all of your tax obligations.

Ignoring State and Local Taxes

Even though federal taxes usually get the most attention, state and local taxes are just as important. Every state has its own tax laws, and if you ignore them, you could face penalties. A tax lawyer can help you understand these laws and make sure you’re following them at all levels.

Furthermore, if your business is running in various states, it’s critical to understand the tax implications for each location. Seeking legal advice can assist you in navigating these complexities and preventing expensive errors.

Wrapping Up on Legal Advice for Business Taxes

So, as you can see, seeking legal advice for business taxes isn’t just about staying on the right side of the law—it’s about making smart decisions that can significantly benefit your business’s bottom line. With the help of a skilled tax attorney, you can minimize your tax liabilities, steer clear of legal issues, and get the most out of your tax benefits.

Keep in mind, being proactive and making informed decisions are crucial for successful tax management. Don’t wait until you are being audited or facing a legal problem to seek advice. If you take proactive steps now, such as exploring startup business tax strategies, you can ensure your business will be successful in the long run.

Best Practice Overview

Getting legal advice for business taxes is a smart strategy that can save you money and prevent legal problems. It’s important to talk to a tax lawyer when you’re starting, growing, or moving your business. Knowing the tax consequences of your business choices can help you minimize liabilities and maximize deductions. Regular meetings with a tax lawyer help you stay compliant and give you peace of mind.

Being Proactive for Future Success

For future success, it is important to make regular legal consultations for tax planning a priority. Stay up-to-date on changes in tax laws and how they can impact your business. Take a proactive approach to tax management by setting up systems to accurately track expenses and income. This will not only help during tax season but also provide valuable insights into the financial health of your business. For more detailed guidance, consider following a quarterly tax filing guide to ensure you’re on the right track.

Make tax planning a part of your overall business strategy. Keep in mind the long-term effects of your tax decisions and ensure they align with your business objectives. Regularly revisit your tax strategy with a legal advisor and make necessary adjustments. This proactive method will help you avoid unexpected surprises and set your business up for continuous growth.

Common Questions

As a business owner, you probably have a lot of questions about how to handle taxes. Here are some of the most frequently asked questions and their answers to help you make informed decisions.

Knowing these answers will enable you to make knowledgeable decisions and seek legal advice when needed.

Keep in mind, every business is different, and speaking with a tax attorney can offer customized guidance for your particular circumstances.

- What tax issues do small businesses face most often?

- How can tax planning benefit from legal advice?

- Do I need to speak with a lawyer before a tax audit?

- How frequently should a business seek legal advice about taxes?

- Can a CPA handle all tax issues without needing a lawyer?

- What penalties might a business face for not complying with tax laws?

What tax issues do small businesses face most often?

Small businesses often run into problems like misclassifying workers, not filing taxes on time, and misunderstanding what they can deduct. These mistakes can result in penalties and higher tax bills. Legal advice can help clear up these issues and make sure the business is following all tax laws.

Why is legal advice beneficial for tax planning?

Legal advice offers a look into tax strategies that match your business objectives. A tax attorney can aid you in structuring your business for tax efficiency, find eligible deductions, and prepare for future tax obligations. This advice guarantees that you’re not just compliant but also maximizing your tax situation.

Should I hire a lawyer before a tax audit?

Yes, it’s a good idea to hire a lawyer before a tax audit. A tax lawyer can help you understand your rights, prepare the necessary paperwork, and represent you during the audit. Their knowledge and experience can greatly affect the outcome of the audit and help you avoid potential penalties.

When is the best time for a business to seek tax legal advice?

It is recommended that businesses seek tax legal advice at least annually, especially before tax season. However, during periods of significant business changes, such as expansion, restructuring, or entering new markets, more frequent consultations may be required. Regular advice can help your business stay compliant and make informed decisions.

Aside from yearly check-ins, you should think about seeking advice from a tax attorney when there are major shifts in tax laws or your business activities. This forward-thinking strategy will enable you to adjust to changes and keep your finances stable.

Is it possible for a CPA to manage all tax matters without the help of a lawyer?

Although CPAs are proficient in tax preparation and accounting, they may not be prepared to deal with complex legal matters or conflicts with tax authorities. A tax attorney offers specialized legal knowledge, particularly in areas related to tax law interpretation, audits, and legal disputes.

What could be the penalties for not complying with tax rules?

Not complying with tax rules could lead to penalties such as fines, interest on unpaid taxes, and legal action. In the worst cases, it could lead to criminal charges. These penalties could have a significant financial impact on your business. Seeking legal advice ensures you are compliant and helps you avoid these expensive consequences.