Main Points

- Special government contracts are available to veteran-owned businesses through incentive programs.

- The Service-Disabled Veteran-Owned Small Business Program provides exclusive opportunities for disabled veterans.

- Boots to Business offers training and support for veterans who are starting a business.

- SBA loans are designed for veterans, with unique benefits and application procedures.

- Resources and support are provided for military families and spouses to encourage entrepreneurship.

Incentive Programs & Options for Small Veteran Businesses

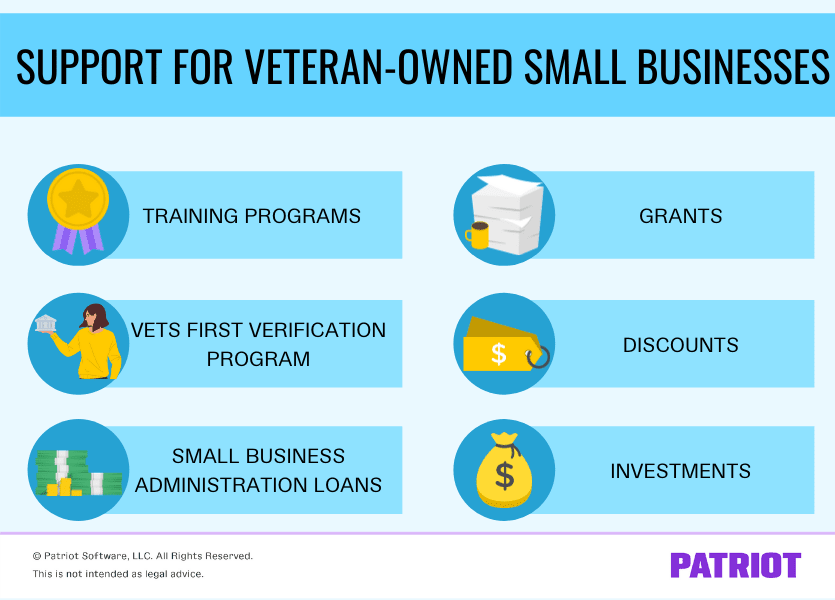

Veterans have bravely and dedicatedly served our country. Many of them find that starting a small business is an excellent way to use their skills and experience when they return to civilian life. Thankfully, there are many incentive programs specifically designed to help veteran entrepreneurs. These programs offer a variety of benefits, from financial assistance to training and networking opportunities.

The Importance of Small Veteran Businesses

Small veteran businesses are a vital part of our economy. They create jobs and provide unique perspectives and leadership styles that are shaped by their military experience. Supporting these businesses is more than just a boost to the economy, it’s a way to honor the service of our veterans and help them succeed in their new ventures.

When veterans transition from military to civilian life, they often encounter unique hurdles when trying to start a business. This can include navigating the complex world of business. That’s why programs specifically designed for veterans are so important. They offer resources that are designed to address these specific challenges, making it easier for veterans to start and grow their own businesses.

Introduction to Incentive Programs for Veteran Businesses

There are a variety of programs available to veterans who are also entrepreneurs. Each program has its own set of benefits and focuses on different areas of business development. The first step to taking advantage of these programs is to understand what each one offers.

There are several key programs such as the Service-Disabled Veteran-Owned Small Business Program, Boots to Business, and a range of SBA loan programs. We will delve into the specifics of the eligibility requirements, benefits, and application procedures for each of these programs. For those looking to expand their ventures, consider these veteran-owned business expansion tips to explore new markets effectively.

Small Business Program for Service-Disabled Veterans

The Small Business Program for Service-Disabled Veterans (SDVOSB) is an essential tool for veterans who were injured while serving their country. This program offers access to special government contracts that are reserved solely for service-disabled veterans.

Who Can Apply

There are certain requirements that veterans must meet to be eligible for the SDVOSB Program. The veteran must have a disability connected to their service, as determined by either the Department of Veterans Affairs or the Department of Defense. The business must also be owned and controlled by one or more service-disabled veterans by at least 51%.

When applying for this program, it is crucial to make sure that all of your documents are correct and current. This includes the confirmation of the service-related disability and evidence of owning and managing the business.

Triumphs of Bootcamp Alumni

Countless veterans have seamlessly moved from the military to being business owners with the help of the Boots to Business program. This program prepares veterans with the skills and knowledge they need to start their own businesses, providing instruction on everything from business planning to managing finances.

Let’s look at John’s story. He’s an ex-Marine who took part in a Boots to Business workshop. John had always wanted to open his own fitness center, merging his love for health with the discipline he learned in the military. With the program’s assistance, John was able to learn how to make a business plan, secure the necessary funds, and market his services effectively. His fitness center is now flourishing, and he attributes his success to the tools the program provided him.

Veteran-Focused SBA Loan Programs

For many veterans, the biggest obstacle to starting their own business is securing the necessary funding. That’s where SBA loan programs come in. They are specifically designed to help veterans get the money they need to start or expand their businesses. These loans come with terms and conditions that are very favorable to veterans, making them a great option. For additional insights, consider exploring veteran-owned business tax considerations to optimize your financial strategy.

Overview of SBA 7(a) Loans

The SBA 7(a) Loan Program is a top choice for many veterans. It provides loans of up to $5 million that can be used for several purposes, such as buying equipment, purchasing real estate, or offering working capital. The loans have competitive interest rates and flexible repayment terms, which makes them a viable option for numerous veterans.

The 7(a) Loan Program offers a key advantage: its guarantee. The SBA promises to cover part of the loan, lessening the risk for lenders and making them more open to working with veteran business owners. This guarantee can be especially beneficial for veterans who may lack a long credit history or collateral.

Additionally, the application process for 7(a) loans is simplified, with numerous resources available to assist veterans in understanding the requirements. This makes it more accessible for veterans to obtain the funds they need to make their business ideas a reality.

How Veterans Can Apply

While applying for an SBA loan may seem intimidating, it’s not as difficult as it seems. Here’s a simple guide to walk veterans through the application process:

- First, you need to gather all the necessary documents. This includes your business plan, financial statements, and proof that you are a veteran.

- Next, visit the SBA website or go to a local SBA office. This will help you learn more about the different loan options that are available. You can then choose the one that best fits your needs.

- Fill out the loan application. Make sure all the information is correct and complete. This is very important because it can help prevent delays in the approval process.

- Send your application to a lender that is approved by the SBA. You can find a list of these lenders on the SBA website.

- Finally, work closely with your lender. This will help you address any questions or concerns that may come up during the review process.

What Documents Do You Need for Loan Applications?

If you are applying for an SBA loan, it is very important to have the right documents. This includes your business plan, financial statements, and proof that you are a veteran. For additional guidance, you might want to explore veteran-owned business expansion tips to ensure you have everything in order.

- A detailed business plan that includes your business objectives, tactics, and financial forecasts.

- Financial statements for both you and your business, such as tax returns and income statements.

- Evidence of your veteran status, like a DD214 form or a letter from the Veterans Affairs Department.

- Information about the amount of the loan you’re asking for and what you’ll use the money for.

Ensuring that all documents are complete and correct will speed up the application process and improve your chances of being approved.

Support for Military Families and Spouses

Veterans aren’t the only ones who can take advantage of business incentive programs. There are also many resources available for military families and spouses, acknowledging the unique obstacles they encounter when pursuing entrepreneurship.

Entrepreneurship Training Programs on Offer

Training programs tailored to the unique needs of military spouses and family members abound. These programs equip them with the necessary skills and knowledge to not only start but also successfully grow their businesses. They cover a vast array of subjects, including business planning, marketing, and financial management.

Support Programs for Female Veterans

Female veterans often encounter more obstacles in the business world. To tackle these issues, a number of programs are geared towards empowering female veterans through education, mentorship, and networking opportunities. Programs such as the Veteran Women Igniting the Spirit of Entrepreneurship (V-WISE) provide specialized support, assisting female veterans in bringing their business ideas to life.

Opportunities for Military Spouses

Due to the nature of military life, spouses often have to move around a lot, which can make traditional employment difficult. Running their own businesses offers them the flexibility they need, as they can take their businesses with them wherever they go. The Military Spouse Entrepreneur Program is one of many that offer the resources and support military spouses need to start and maintain successful businesses, no matter where they are stationed.

By utilizing these resources, military spouses can gain financial freedom and contribute to their family’s economic well-being.

Community and Extra Help

Creating a prosperous business involves more than just money and education. Building relationships and community backing are vital parts of being successful. Luckily, there are countless resources that can assist veteran business owners in meeting others and finding more help.

For veterans just starting out in business, Veterans Business Outreach Centers (VBOCs) are a great place to begin. These centers offer workshops, training, and counseling to veteran business owners, helping them overcome the obstacles of entrepreneurship.

- The Office of Small & Disadvantaged Business Utilization (OSDBU) provides resources and support for veteran entrepreneurs, including webinars and training sessions.

- Networking events and community support groups offer veterans the chance to connect with other entrepreneurs and share experiences and advice.

- Online forums and social media groups provide a platform for veterans to ask questions, share resources, and find support from others who understand their unique challenges.

Veterans Business Outreach Centers

VBOCs are instrumental in supporting veteran entrepreneurs. They provide a wide range of services, including business training, counseling, and mentoring. These centers are staffed by experienced professionals who understand the unique challenges faced by veterans and can provide tailored support and guidance.

Whether you’re launching a new venture or looking to expand your current one, VBOCs can provide the resources and support you need to succeed. They offer a range of programs and services designed to help veteran entrepreneurs reach their business goals.

Office of Small & Disadvantaged Business Utilization

The Office of Small & Disadvantaged Business Utilization (OSDBU) is a crucial tool for veteran business owners. This office is committed to making sure that small and disadvantaged businesses have the resources they need to thrive. Through the OSDBU, veterans can access a variety of support services, such as webinars, training sessions, and networking opportunities.

The OSDBU is particularly beneficial for its commitment to assisting veteran-owned businesses in obtaining government contracts. These contracts can be a major source of income for small businesses, providing them with the financial stability they need to expand and succeed. Veteran entrepreneurs can use the resources provided by the OSDBU to position themselves for success in the competitive government contracting arena.

Resources for Networking and Community Support

For any entrepreneur, establishing a robust network is critical, and veterans are no different. Networking allows you to interact with other business owners, exchange experiences, and learn from each other. There are a plethora of resources available to veteran entrepreneurs for networking and community support, both online and in person.

Groups such as the Veterans Business Network and the American Veterans Chamber of Commerce provide networking events, workshops, and online forums where veterans can meet and work together. These platforms offer a supportive space where veterans can ask questions, share resources, and find mentorship opportunities.

Final Thoughts: Supporting Veteran Business Owners

Those who have served our country deserve our full support as they transition back into civilian life. The resources and programs available to veteran entrepreneurs are designed to help them succeed, providing the necessary tools and support they need to thrive in the business world.

According to the U.S. Small Business Administration, “Being certified by the SBA gives service-disabled veteran-owned small businesses (SDVOSBs) the chance to compete for federal sole-source and set-aside contracts throughout the federal government. Meanwhile, certified veteran-owned small businesses (VOSBs) have even more opportunities to expand and thrive.”

These resources are available to veteran entrepreneurs to help them overcome the unique challenges they face and achieve their business goals. Whether it’s securing funding, accessing training, or building a network, there is a wealth of support available to veteran entrepreneurs to help them succeed. For more information on funding options, check out this guide on funding options for veteran-owned businesses.

Looking at the Available Resources and Opportunities

Looking at the wide range of resources and opportunities that are available to veteran entrepreneurs, it’s clear that the support system in place is strong and successful. From special loan programs to targeted training initiatives, veterans have access to a wealth of resources that can help them succeed in the business world.

How Veteran Communities May Benefit

These programs could greatly benefit veteran communities. When we help veteran entrepreneurs succeed, we’re not just supporting them. We’re also helping the communities they’re part of grow and stabilize economically. Veteran-owned businesses create jobs, encourage innovation, and offer unique perspectives in the marketplace.

- Businesses owned by veterans can stimulate economic growth and create jobs.

- These businesses introduce a variety of viewpoints and innovative solutions to the market.

- Supporting entrepreneurs who are veterans is a way to recognize their service and contributions to our country.

By continuing to support entrepreneurs who are veterans, we can make sure they have the tools and resources they need to be successful, which ultimately benefits the broader economy and society as a whole.

Commonly Asked Questions

For veterans who are starting their own businesses, it’s important to have clear and concise information. Here are some commonly asked questions that may help you on your path.

Which program is the best for veteran entrepreneurs?

There are many great programs out there, but the Service-Disabled Veteran-Owned Small Business Program is especially good for veterans with service-connected disabilities. It gives them access to special government contracts and provides them with a lot of opportunities to grow their business.

What do I need to qualify for veteran-specific SBA loans?

In order to qualify for veteran-specific SBA loans, you must be able to provide documentation that verifies your veteran status. This could be a DD214 form. On top of that, you must meet the specific eligibility requirements for the loan program you’re applying for. This could include requirements related to the size of your business, the industry you’re in, and your financial history.

Do networking events exist that are specifically for veteran business owners?

Indeed, there are several networking events that are specifically created for veteran business owners. The Veterans Business Network and the American Veterans Chamber of Commerce are organizations that offer events and forums. These allow veterans to connect, share resources, and find opportunities for mentorship.

Are these business resources available to military spouses?

Yes, they are. Many of the resources and programs that are available to veterans are also available to military spouses. Programs such as the Military Spouse Entrepreneur Program offer tailored support to help spouses start and grow successful businesses, acknowledging the unique challenges they face. Additionally, military spouses can benefit from understanding veteran-owned business tax considerations to optimize their business strategies.

Military spouses can use these resources to reach financial independence and add to their family’s financial stability, no matter where they’re stationed.