Quick Overview

- Choosing the right business structure can save you significant tax dollars.

- Understanding available tax deductions and credits can reduce your taxable income.

- Compliance with tax regulations is crucial to avoid penalties and fines.

- Strategic tax planning empowers women entrepreneurs towards financial independence.

- Proactive tax planning can unlock opportunities for business growth and reinvestment.

Importance of Tax Planning for Women-Owned Businesses

Tax planning is not just a task on a checklist; it’s a vital part of running a successful business. For women-owned businesses, strategic tax planning can be a game-changer. It allows you to retain more of your hard-earned money and reinvest it into your business. This isn’t just about numbers; it’s about empowerment.

Advantages of Thoughtful Tax Planning

Thoughtful tax planning not only reduces your tax burden but also paves the way for the long-term success of your business. It gives you a better understanding of where your money is going and how you can better utilize it. Thoughtful tax planning provides a clear view of your financial health, allowing you to make educated decisions.

Boosting Financial Autonomy

Many women business owners strive for financial autonomy. Tax planning strategies can bring you one step closer to this goal. By learning to handle your taxes, you can gain a sense of financial confidence and control.

Take Jane, for example. Jane owns a small bakery. After consulting with a tax professional, she found out that she could save on taxes by changing her business structure from a sole proprietorship to an LLC. This change not only reduced her tax burden, but it also gave her more flexibility in managing her income.

Chances for Expansion and Reinvestment

When you plan your taxes effectively, you can create chances for expansion. The money you save can be used to buy new equipment, hire more employees, or broaden your range of products. Here are some ways in which strategic tax planning can be beneficial for your business:

- Boost your cash flow by minimizing your tax obligations.

- Put money into initiatives that will help your business grow.

- Bolster your financial stability and resilience.

When you reinvest the money you save on taxes back into your business, you create a cycle of growth and improvement that can help ensure your business’s long-term success.

Understanding the Legal Side of Tax Planning

Grasping the legal components of tax planning is essential for all business owners. For businesses owned by women, this understanding is empowering and can help avoid expensive errors.

Selecting the Appropriate Business Model

The model of your business plays a crucial role in your taxes. Operating as a sole proprietorship, partnership, LLC, or corporation each come with their own tax consequences. Selecting the correct model can save you money and provide legal protection.

For instance, an LLC provides tax flexibility and can assist in separating personal and business liabilities. In contrast, a corporation may offer advantages such as lower tax rates on retained earnings. It’s crucial to assess your business requirements and seek advice from a tax expert to make the most informed decision.

Tips for Effective Tax Planning

Effective tax planning is all about employing clever tactics to lessen your tax load while increasing your business’s potential. By being proactive and strategic, you can transform tax planning into a potent tool for growth. Let’s explore some effective tactics that can aid women-owned businesses to prosper financially.

Here are some tips to help you manage your taxes:

- Maintain accurate records of all your business expenses.

- Continually evaluate your financial statements and modify your strategies as necessary.

- Stay up-to-date with the latest tax credits and deductions available for small businesses.

- Consider seeking advice from a tax professional to uncover more ways to save on taxes.

Applying these strategies will not only help you reduce your tax liabilities, but it will also improve your overall financial management. Having a clear understanding of your financial position makes it easier to make decisions that will benefit your business in the long run. For more insights, you can explore tax audit defense strategies for small businesses.

First and foremost, bear in mind that tax planning isn’t a one-off job. It demands frequent updates and modifications in line with your business’s expansion and alterations in tax legislation. By being proactive, you can guarantee that your business stays financially robust and competitive.

Taking Advantage of Tax-Deferred Retirement Accounts

A great strategy to lower your taxable income is to contribute to tax-deferred retirement accounts. If you’re self-employed or own a small business, options such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k) are ideal. These accounts not only help you save for your retirement, but also offer tax benefits in the present.

Maximizing Your Business Expenses and Deductions

Maximizing your business expenses and deductions is all about keeping detailed records. Essentially, every dollar you spend on your business could be a dollar off your taxable income. This includes common expenses like office supplies, travel expenses, and marketing costs.

Let’s look at a case study: Sarah is the owner of a small graphic design business. She is diligent about keeping track of her home office expenses, including internet and utilities. She can deduct a portion of these expenses from her taxes, which not only reduces her taxable income but also gives her a more accurate understanding of her business’s profitability. For more insights on tax strategies, check out these tax audit defense strategies for small businesses.

“Small business owners can greatly reduce their tax liability by diligently recording and categorizing their expenses in order to take advantage of a wide range of tax deductions.”

Remember that deductions for business-related meals, travel, and even professional development courses can be a gold mine. These expenses can accumulate and provide substantial tax relief when properly documented and claimed.

Maximizing Tax Efficiency Through Employee Benefits

Providing employee benefits such as health insurance or retirement plans can be a beneficial move for both parties involved. These benefits can be an effective tool for attracting and retaining high-quality employees, and they can also offer tax benefits for your business. Contributions to employee benefits are often tax-deductible, which can help to reduce your overall tax liability.

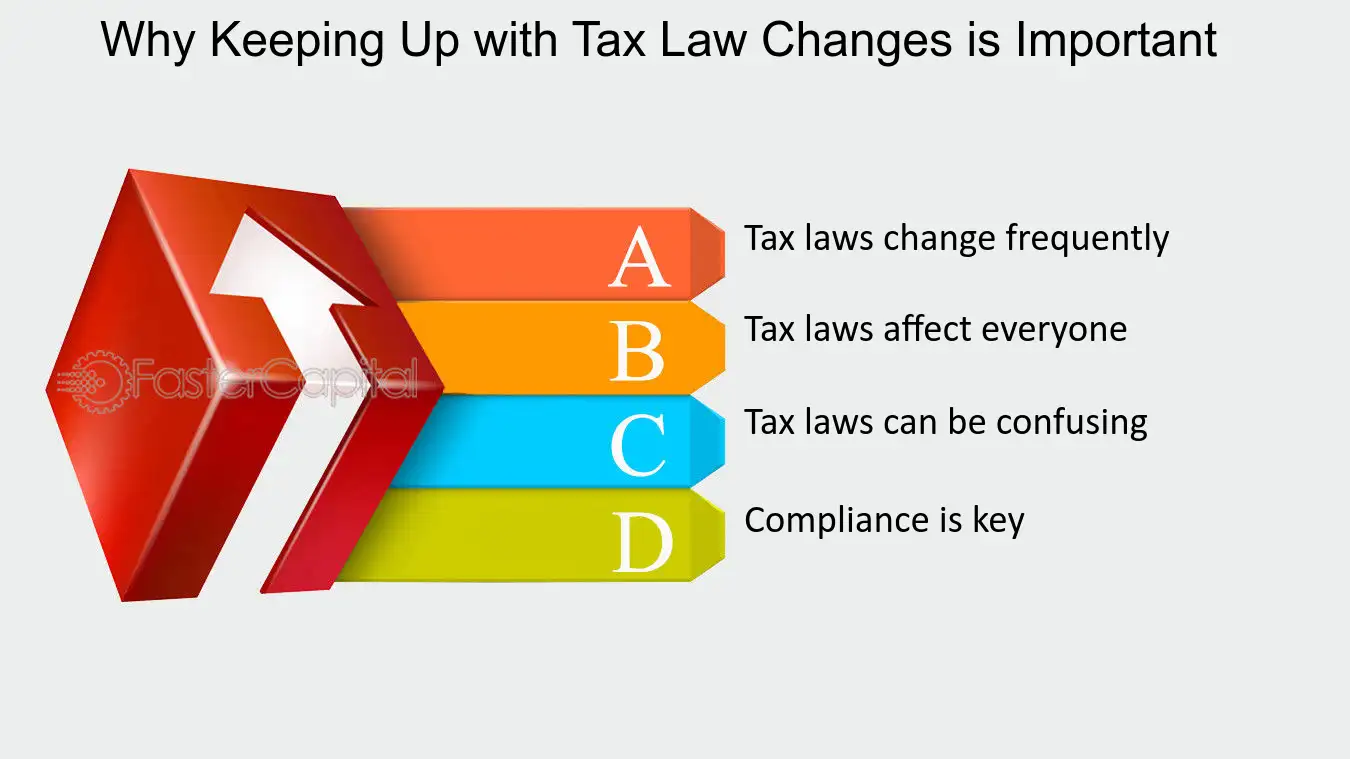

Getting Ready for Future Tax Laws

It’s important to keep up to date with ever-changing tax laws for successful tax planning. By predicting future tax laws, you can change your plans and avoid possible problems. Being proactive in this way helps to keep your business in good standing and financially safe.

In addition to that, being aware of possible changes in tax law can help you spot new opportunities to save on taxes. Whether it’s a new deduction or credit, being ready allows you to fully leverage these benefits as soon as they’re available. For more information on tax credits, check out this guide on minority business tax credits.

By subscribing to tax newsletters or becoming a member of business associations that offer updates on tax regulations, you can stay up-to-date. These resources can be crucial in keeping you one step ahead and making sure your tax strategies continue to work.

Keeping Up with Changes in Tax Laws

As a business owner, it’s crucial to keep an eye on changes in tax laws. These changes can greatly affect your business’s finances, so it’s important to stay informed. You can use resources such as the IRS website or professional tax advisors to keep up with any changes.

Also, taking part in tax planning seminars or workshops can offer useful knowledge and assist you in understanding how tax law changes could impact your business. Being ahead of the game in this area can stop expensive errors and make sure your business stays within the law.

Adjusting Business Plans to Tax Changes

As tax laws evolve, it’s critical to modify your business plans to suit. This could mean reshaping your business, altering your pricing structures, or seeking out new markets. By being adaptable and responsive to these shifts, you can transform possible obstacles into chances for expansion.

Collaborating with Tax Experts for Advice

In conclusion, never undervalue the importance of collaborating with seasoned tax experts. They can offer customized guidance that is in line with your business objectives and aids you in maneuvering through the intricacies of tax planning. A tax expert can also help in pinpointing more tax-saving chances that you may have missed.

Working with a tax professional can help you ensure that your tax strategies are not only effective, but also meet current legal requirements. This can be a key part of achieving financial success and setting your business up for the future.

Wrapping Up Tax Strategies for Empowerment

For women entrepreneurs, tax planning can be a game-changer. Understanding and using effective tax strategies can help you take control of your business’s financial health. It’s not just about saving money, it’s about empowering yourself to make informed decisions that can help your business grow and be sustainable.

Creating a Strong Financial Foundation

Creating a strong financial foundation begins with effective tax planning. By actively managing your taxes, you can make sure your business is ready for any economic challenges that may come its way. This strength is key to long-term success and stability.

Furthermore, a well-thought-out tax plan can enable you to put money back into your business, whether it’s by developing new products, updating your tech, or bringing on more employees. These investments can result in higher profits and a better standing in the market. For those considering expansion, here are some expansion tips for new markets that can further enhance your business strategy.

Keep in mind that tax planning isn’t a one-time deal. It’s a continuous process. Regularly reviewing and adjusting your strategies will help your business stay nimble and adaptable to changes in the economy.

Empowering Women Entrepreneurs Through Economic Opportunities

With proper tax planning, women entrepreneurs can unlock a wealth of economic opportunities. By lowering your tax liabilities, you can free up more capital to fund groundbreaking projects, penetrate new markets, and sharpen your competitive edge. This not only boosts your business but also helps stimulate the wider economy through job creation and innovation. For more insights, explore women-owned business finance & tax tips.

Moreover, the success of more women-owned businesses serves as a motivation for others to venture into entrepreneurship, leading to a domino effect that strengthens both the community and the economy. Through the sharing of knowledge and resources, women entrepreneurs can help each other achieve financial success.

Common Questions

Tax planning can be complicated. Here are some questions that women business owners frequently ask, along with simple answers to help you understand.

What advantages does women-owned business certification offer?

Being certified as a women-owned business can lead to opportunities for government contracts, grants, and funding that are specifically targeted at women in business. It can also boost your reputation and presence in the market, leading to potential new partnerships and networks.

How do I choose the best business structure for my taxes?

There are many factors to consider when deciding on a business structure. These include your business goals, liability concerns, and tax implications. The most common structures are sole proprietorship, partnership, LLC, and corporation. You should consult with a tax professional to understand the advantages and disadvantages of each option and choose the one that best fits your business.

For example, an LLC might provide flexibility and protection from personal liability, while a corporation could be a good choice if you intend to reinvest earnings back into the company. Grasping these subtle differences is key to making a knowledgeable choice.

What tax deductions are typically available to women-owned businesses?

Women-owned businesses have access to a range of deductions that can lower their taxable income. These often include expenses related to office supplies, travel, marketing, and employee benefits. Furthermore, your business may qualify for specific tax credits like the research and development tax credit, which can further reduce your tax bill.

It’s crucial to keep meticulous records of all your business expenses to take full advantage of these deductions. Regularly examining your financial statements can also uncover more opportunities to save on taxes.

What should I do to remain in compliance with evolving tax laws and rules?

To remain compliant with tax laws, you must stay informed about any changes or updates. You can do this by subscribing to tax newsletters, attending workshops, and consulting with tax professionals. In addition, you should keep accurate records and file your taxes on time, as these are crucial aspects of compliance.

- Keep an eye on changes in tax laws and tweak your plans as necessary.

- Get a tax expert on board for tailored advice and support.

- Make the most of online tools and resources to make tax filing and record-keeping easier.

Being proactive and informed will help you handle the complexities of tax planning confidently and keep your business successful.