Quick Summary

- Having a strong financial foundation is crucial for surviving economic downturns.

- Retaining customers is more cost-effective than acquiring new ones, especially during a recession.

- Having a diverse customer base can help stabilize your revenue.

- It’s important to adapt your products or services to meet the changing needs of the market.

- Investing in technology and improving your processes can lead to significant cost savings.

The Importance of Financial Resilience in Difficult Times

When the economy takes a downturn, businesses that are financially stable are the ones that can weather the storm. Think about it like a game of musical chairs – you don’t want to be the one left standing when the music stops. That’s what a recession can feel like. It can come on suddenly and without warning. That’s why having a safety net and no debt can mean the difference between having to close your business and being able to keep it open.

Comprehending the Economic Cycle

The economy can be compared to a large wheel that never stops spinning. At times it’s climbing, and at other times it’s descending. These periods of descent, or recessions, can be frightening, but they’re a typical part of the cycle. By recognizing that what falls must rise, you can ready and safeguard your business from the effects of these unavoidable downturns.

How Recessions Affect Small Businesses

Small businesses are typically hit hardest during a recession. Consumers may reduce their spending, resulting in a decrease in sales. However, it’s not all bad news. If they adopt the right strategies, small businesses can not only weather the storm but emerge stronger. The key is to be prepared and flexible.

Fortify Your Foundation: Financial Basics

Evaluating Your Cash Flow

Let’s discuss cash flow. It’s the heartbeat of your business. It’s essential to know exactly what’s coming in and going out. In prosperous times, positive cash flow signifies that you’re flourishing. But in difficult times, it can save your business. So, monitor it closely, and always seek opportunities to enhance your cash flow.

Creating a Financial Safety Net

Have you ever heard the phrase “put something aside for a rainy day”? For businesses, that rainy day could be an economic recession. A financial safety net acts like a shield, protecting your business when the storm hits. Try to save enough to cover at least three to six months of operating costs. It’s a cushion that can provide you with a sense of security and time to modify your plan if things become difficult.

Strategies for Managing Debt

Debt is a burden that can weigh you down, especially during a recession. It’s like trying to swim with a backpack full of rocks. Make your load lighter by paying off your debt before a downturn hits. Think about consolidating your loans or negotiating better terms. The less debt you have, the more agile you can be in responding to changes in the market.

Putting Customers First: Your Business Lifeline

The Art of Keeping Your Customers

Customer satisfaction is always important, but during a recession, it’s your lifeline. It costs less to keep a customer than to find a new one. So, focus on delivering great service and building relationships. Remember, loyal customers are more likely to stick with you when times are tough.

Consider a local coffee shop owner who initiates a loyalty program that offers a free coffee after a certain number of purchases. This is a straightforward way to show appreciation for customers’ loyalty and to promote repeat business.

Investigating New Customer Segments

Avoid putting all your eggs in one basket. If you only have one type of customer, you’re more susceptible if that group ceases spending. Seek out new markets to penetrate. Perhaps your products could attract a different age group or industry. Diversifying your customer base can help stabilize your income when one segment begins to decline.

Being flexible in difficult times is not just a nice saying; it’s a survival strategy for small businesses during a recession. When times get tough, you have to be ready to change and adapt what you offer. This could mean adjusting your products or services to meet your customers’ changing needs or finding completely new sources of income.

Recognizing Market Demands in Economic Downturns

In a recession, people’s needs shift. They may begin to seek less expensive options or products that provide greater benefits. This is your signal to think outside the box. Reevaluate what you’re offering and determine if it’s still viable in a difficult economy. Can you provide a more cost-effective option? Can you enhance your current products or services in some way? For more insights, explore our small business growth strategy blueprint for tips on adapting to market changes.

Reinventing Products and Services for Durability

It’s time to get creative. Consider how you can address your customers’ emerging needs or simplify their lives in a recession. This might be as basic as providing installment plans or as intricate as launching a new range of products. The goal is to remain pertinent and beneficial to your customers, regardless of the state of the economy.

Work Smarter, Not Harder: Operational Efficiency

Cutting Costs by Streamlining Processes

In times of economic hardship, every dollar matters. Take a close look at your business operations and identify areas where you could be more efficient. Consider automating tasks to save both time and money. Or, look for less expensive suppliers that still offer high-quality products or services. Even small changes can lead to significant savings in the long run.

Strategic Investment in Technology and People

Putting your money into the right technology and people can end up saving you more in the long run. For instance, a high-quality customer relationship management (CRM) system can help you keep tabs on your customers and sales, which can result in improved customer service and more repeat business. Also, employing the right individuals – those who are flexible and can handle multiple roles – can make a significant difference during challenging times.

Utilizing Connections: Networking and Partnerships

There’s a saying that no man is an island, and this is also true for businesses. Establishing robust relationships with other businesses can pave the way for new opportunities and assist you in weathering a recession. You may be able to join forces on marketing initiatives, share resources, or even develop new products or services together.

Team Up with Other Businesses for Mutual Advantages

Try to find businesses that match well with yours and find out ways you can assist each other. Perhaps there’s a local shop that could carry your products, or a service provider who could benefit from your services. By collaborating, you can attract new clients and keep your businesses robust.

Fortifying Connections with Suppliers and Distributors

Building strong relationships with your suppliers and distributors is crucial for your business’s success, particularly during a recession. It’s important to nurture these relationships. You may need to discuss improved terms or explore more economical methods of delivering your products to the market. Having a solid relationship can make these discussions smoother and more fruitful.

- Discuss payment terms with suppliers to postpone cash outflows.

- Collaborate with similar businesses to provide combined services or products.

- Participate in shared marketing campaigns to divide expenses and broaden your reach.

Communication is always vital, but during a recession, it becomes absolutely crucial. You need to ensure that your customers understand why they should spend their scarce money on your business. This means you must understand your value proposition and ensure it is conveyed in all your activities.

Conveying the Worth: Messaging and Market Positioning

To illustrate, a neighborhood bakery might begin advertising their bread as not just tasty but also a budget-friendly way to feed a family. By emphasizing the worth, they can draw in customers who are trying to make their grocery budget go further.

Polishing Your Brand Message

Your brand message is what distinguishes you from the competition. It’s what makes customers pick you over someone else. So, take a hard look at your message and ensure it’s striking the right chords. Is it straightforward? Is it persuasive? Does it address the current needs of your customers?

First and foremost, it’s crucial that your brand message is uniform across all platforms, whether it’s your website, your social media, or your in-store signs. Being consistent helps build trust, and trust fosters loyalty, which is incredibly valuable during an economic downturn.

- Put an emphasis on the long-lasting nature and robustness of your products to show their worth over a long period.

- Highlight the excellence of your customer service to build a sense of trust and loyalty.

- Use social proof, such as testimonials and reviews, to underline the quality and dependability of your products or services.

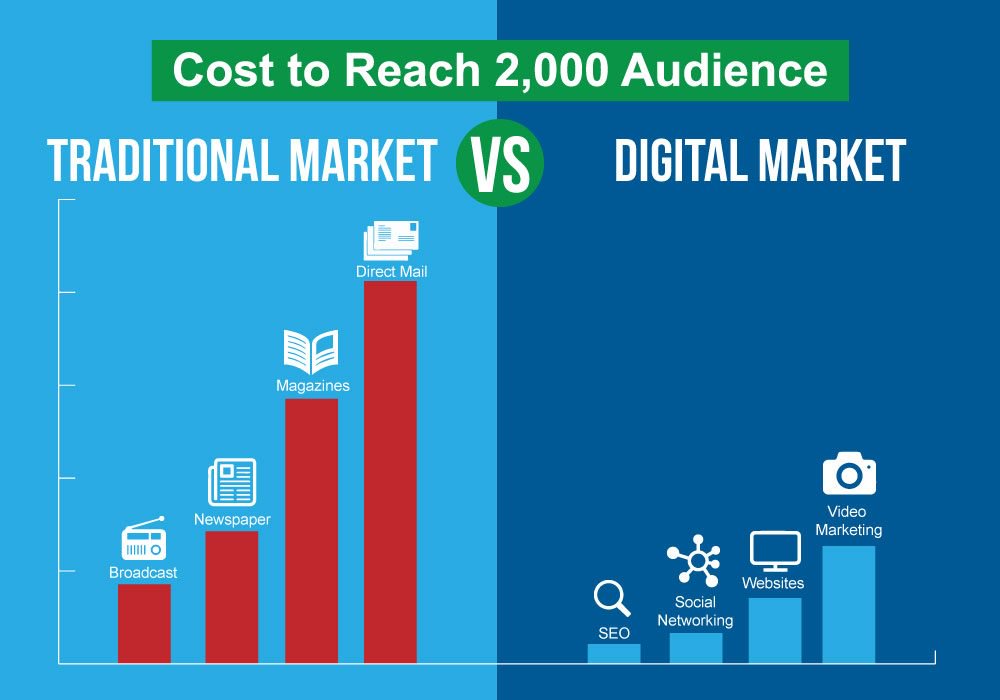

Cost-Effective Marketing Strategies

Marketing during a recession doesn’t necessarily mean you have to spend large amounts of money. It’s about being clever with your budget and finding ways to connect with your customers that don’t cost a fortune. Social media, email marketing, and content marketing are all affordable ways to keep your business in the forefront of your customers’ minds.

- Use social media to interact with customers and share promotions.

- Produce useful content that addresses your customers’ issues and demonstrates your knowledge.

- Utilize email marketing to maintain contact with customers and promote repeat purchases.

It’s important to plan ahead, especially when the future is unpredictable. By foreseeing potential difficulties and preparing strategies to tackle them, you can shield your business from the most severe impacts of a recession.

Preparing for What’s Next: Foreseeing Future Obstacles

Imagine a small tech company that decides to invest in cloud storage solutions before a recession hits. They predict the increased need for remote work solutions and position themselves as a leader in the space. When the recession does hit, they’re ready to meet the demand and their business flourishes.

Adaptive business planning means being ready to change your plans as the situation evolves. It’s about staying flexible and being prepared to pivot when necessary. And don’t forget about insurance. It’s not the most exciting topic, but it can be a lifesaver when things go wrong. Make sure you’re covered for the risks that are most likely to impact your business.

Securing your business with the appropriate insurance can provide you with a sense of security and financial safeguard. Consider business interruption insurance, liability insurance, and property insurance to ensure you’re protected from all sides.

Recessions can be challenging, but they don’t have to spell doom for your business. With the right tactics and a dash of determination, you can emerge on the other side stronger and more robust. So, take a moment, roll up your sleeves, and get set to make your business recession-resistant.

During economic downturns, businesses with a strong financial base are the ones that remain resilient. Consider it like this: You don’t want to be the last one standing when the music stops in a game of musical chairs. That’s the feeling a recession can give – abrupt and unforeseen. Therefore, having a safety net to rely on, and no debt can mean the difference between going out of business and surviving.

During a recession, small businesses can often find themselves in a tight spot. Consumers may start to reduce their spending, which can lead to a decrease in sales. However, it’s not all bad news. If they use the right tactics, small businesses can not only make it through but also emerge stronger than before. The key is to be ready and flexible.

Shielding Your Business with Appropriate Insurance

Protection is key. Insurance might not be the most exciting topic, but it acts as a safeguard for your business. Consider the potential pitfalls during a recession – a fire, a lawsuit, or even a disruption in your operations. Having the right insurance in place means you can weather those storms and continue moving forward. It’s about taking the initiative, not just responding to events.

Think about the kinds of insurance that are suitable for your business. General liability, property insurance, and business interruption insurance are just some of the types that can offer that crucial cushion. And keep in mind, the aim here is to reduce risk, so don’t cut corners on coverage to save a few dollars now—it could end up costing you everything later.

Common Questions

It’s natural to have questions when you’re trying to make your business recession-proof. In fact, it’s a good thing. Asking questions means you’re planning for the future. So let’s address some of the most frequently asked questions that small business owners have about navigating economic downturns successfully.

What financial preparations can businesses make for a recession?

Preparing financially for a recession is similar to assembling an emergency kit before a disaster. You hope you won’t need it, but you’ll be grateful it’s there if you do. Begin with a robust budget that eliminates superfluous costs and concentrates on necessities. Accumulate that emergency fund, ideally sufficient to cover several months of expenditures. And diversify your revenue streams—don’t depend solely on one product or service to generate income.

For instance, a landscaping company might also provide snow removal services during the winter. This ensures a consistent income stream throughout the year, regardless of the season.

Why is it so important to retain customers during economic downturns?

In difficult economic times, every customer is essential. That’s why it’s so important to focus on retaining the ones you already have. It’s more costly to acquire new customers than it is to retain existing ones, and loyal customers are more likely to stick with you when money is tight. They’re also your best source of free advertising—satisfied customers will tell their friends.

- Provide top-notch customer service that makes clients feel appreciated.

- Develop loyalty programs that incentivize repeat customers.

- Maintain regular contact with customers via email newsletters and social media posts.

How can small businesses broaden their sources of income?

Expanding your sources of income is like casting multiple fishing lines—you’re more likely to catch something. For a small business, this might mean introducing new products or services that attract a different customer base or breaking into new markets. It could also mean discovering new ways to profit from your existing resources or expertise.

For example, a restaurant might consider offering cooking classes as an additional service. Similarly, a physical store could establish an online presence to attract customers from beyond their immediate locality. Diversification ensures that you don’t have all your eggs in one basket, and you are better prepared to weather a downturn in any one aspect of your business.

How to maximize operational efficiency with limited resources?

Operational efficiency is about using what you have to its fullest potential. It involves finding ways to make your processes more streamlined, reducing waste, and increasing productivity. This could involve automating tasks that are repetitive, outsourcing activities that are not at the core of your business, or even reorganizing your workspace to improve workflow. The goal is to do more with less, allowing you to maintain the quality and service you provide without going over your budget.

How can technology help your business survive a recession?

Technology can be a powerful tool for helping your business weather a recession. It can automate tasks, expand your customer base, and even enable you to offer new products or services. For instance, an e-commerce platform can give you a new way to sell your products, and social media can be an affordable way to advertise your business. If you invest in the right technology, it can give you an edge over your competition, even in a challenging economy.

Is it beneficial to collaborate with other businesses during a recession?

Definitely. Joining forces with other businesses can create new opportunities that may not be available to you on your own. For instance, a local bookstore could team up with a coffee shop to form a unique book club, offering discounts on books and coffee. This type of collaboration can draw in new customers and give both businesses a boost.

Cooperating can also help you save money. Combined marketing campaigns, shared distribution channels, or group purchasing can lower costs for everyone involved. Plus, you’ll be forging relationships that can bolster your business long after the recession has passed.

Why is marketing during a recession important?

It may seem like marketing during a recession is a bad idea. After all, you’re trying to save money, right? But reducing your marketing efforts is like turning off your headlights to save battery while driving at night. You need to be seen to stay in the game. Intelligent, targeted marketing can help you attract new customers and keep your brand in the forefront of people’s minds, even when wallets are tightening. Discover more about small business content marketing strategies to boost your success during these challenging times.

How can business insurance help recession-proof your business?

Business insurance is your safety net when the unexpected happens. It can protect you from losses due to theft, damage, liability claims, and even business interruptions. Think of it as a small investment now that can prevent a huge financial loss later. Make sure you understand your risks and get coverage that’s tailored to your business. It’s not just about peace of mind—it’s about financial survival.

Recession-Proof Small Business Tactics & Survival Strategies for Economic Downturns can be essential for navigating through tough economic times. Implementing strategies to recession-proof your business can help ensure stability and growth even when the market is volatile. By focusing on these strategies, small business owners can protect their operations and lay the groundwork for future success.