Being a small business owner is like being a ship captain navigating through a sea of financial obligations. One of the most intimidating of these is tax planning. But don’t worry, because understanding your taxes is not just about compliance—it’s a strategic way to increase your business’s net income. So let’s embark on this voyage to tax savvy success.

Main Points

- Key financial tools for small businesses include accounting software such as QuickBooks, payroll systems like Gusto, and tax preparation software like TurboTax.

- Remembering critical tax dates, like quarterly payments and filing deadlines, is key to avoiding penalties.

- Taking full advantage of tax deductions, like home office expenses and vehicle use, can greatly lower your tax bill.

- Planning tactics, including timing income and deductions, can improve your tax results.

- The Employee Retention Tax Credit (ERTC) can provide significant advantages for qualifying small businesses.

Tax Intelligence: Strengthening Your Small Business

Most importantly, smart tax planning is about making your money work harder for you. It’s about using every legal method to decrease what you owe, allowing you to put those savings back into your business. And it’s not just for the big guys—small businesses have much to gain from becoming tax intelligent.

Best Tools to Simplify Your Finances

The first step is to get the right tools. The right software can make all the difference when it comes to managing your finances and staying on top of your taxes. Think of it as giving your ship the best navigation system—it helps you avoid danger and find the best path to your destination.

Important Dates and Deadlines

Timing is crucial, so make sure to mark your calendar with all the key tax dates. If you miss a deadline, you could face penalties, which means less money in your pocket. You can’t afford to forget dates like quarterly estimated tax payments, yearly filing deadlines, and the dates for sending out W-2s and 1099s to your employees and contractors.

Important Tax Deductions to Take Advantage Of

Next, we have the gold mine of tax deductions. These are costs that the IRS permits you to deduct from your earnings before figuring out how much tax you need to pay. From office materials to business trips, ensure you’re not leaving any cash unclaimed.

Easy Ways to Get Ready for Tax Season

So, the best approach to tax season is to be ready. Keep your documents in order, maintain accurate records all year, and know what deductions and credits you can claim. This could mean the difference between a breeze and a storm at tax time.

Selecting the Appropriate Financial Analysis Instruments

Choosing the correct financial tools is crucial for any small business owner. It’s like picking the right equipment before going on a hike; without it, you’re likely to lose your way or encounter difficulties. Let’s take a look at some of the best tools that can assist you in managing your business’s finances.

Financial Tools: QuickBooks, Xero, Sage

Financial tools such as QuickBooks, Xero, and Sage act as the guiding light for your business finances. They allow you to monitor your revenue and expenses, create reports, and get ready for tax season. Each tool offers a variety of features to accommodate businesses of all sizes and requirements, so it’s important to choose the one that best fits your business model.

Payroll Systems: A Comparison of Gusto and ADP

Now, let’s talk about payroll systems. Gusto and ADP are two well-known options that can assist you in managing employee payments, tax withholdings, and end-of-year tax forms. Consider them your right-hand man when it comes to managing your team’s pay. They make sure everyone is paid accurately and that all relevant taxes are taken care of.

Smart Budgeting: The Importance of Budgeting Tools

Moreover, budgeting tools such as Mint or You Need a Budget (YNAB) can assist you in monitoring your business’s expenditure. These tools can provide you with an understanding of where your money is being spent, enabling you to reduce expenses and save for future investments.

Benefits of Integrated Invoicing Software

Effective invoicing is key to maintaining a steady cash flow. Invoicing software such as FreshBooks or Invoice2go can make it easier to issue bills and monitor payments. In addition, many of these tools can be integrated with other financial software, ensuring that your financial data is always up to date.

Why TurboTax and H&R Block Are Great for Tax Filing

For tax filing, TurboTax and H&R Block are two titans that shine. They make the process easier, guarantee precision, and assist you in taking advantage of deductions and credits. It’s akin to having an experienced guide with you as you navigate the complex labyrinth of tax legislation.

Get the Most Out of Your Deductions: A Guide for Small Businesses

One of the best strategies to lower your tax bill is to take full advantage of your deductions. This involves knowing which business costs you can deduct and how to correctly record them. Here are some of the main deductions you should keep in mind. For more detailed strategies, consider exploring tax planning strategies for your small business.

How to Properly Deduct Home Office Expenses

When you work from home, the home office deduction can be a huge benefit. The trick is to use your home office exclusively and frequently for business. Measure your workspace, calculate what percentage of your home it takes up, and apply that to your home-related expenses.

Car Use: Record Mileage for Tax Advantages

Do you use your car for work? Keep a record of your work-related mileage. You can choose between the standard mileage rate or actual car expenses for deductions. Just remember, commuting doesn’t count, so be sure to record only the miles that are work-related.

Depreciation: A Basic Overview

Depreciation can be somewhat complicated. It enables you to distribute the expense of a significant purchase, such as machinery or a car, over the item’s useful lifespan. As a result, you can deduct a part of the cost annually, potentially lowering your taxable income.

Retirement Plans: Contributions that Can Decrease Your Tax Bill

Adding to a retirement plan is beneficial not only for your future but also for your current tax situation. Contributions to plans such as a SEP IRA or a Solo 401(k) can decrease your taxable income now, while ensuring your financial future.

Retirement Plans: Contribute to Lower Your Taxes

Planning for your future is a win-win situation. You’re not just preparing for a comfortable retirement, but you’re also able to reduce your current tax liability. Smartly contributing to retirement plans such as a SEP IRA or a Solo 401(k) can lower your taxable income. It’s like planting seeds that grow tax-free until you’re ready to reap the benefits during retirement.

For example, if you put $5,000 into an eligible retirement scheme, the IRS will not tax that $5,000 of your income this year. These savings can add up over time. Additionally, your contributions will grow tax-deferred, so you will not pay taxes on the earnings until you withdraw them when you retire.

However, keep in mind that there are annual limits to how much you can contribute, and these may vary from year to year, so it’s crucial to stay updated. A financial advisor or tax professional can assist you in taking full advantage of these opportunities.

Important Tax Planning Tips for Small Businesses

When it comes to small business tax planning, there are tactics that can significantly affect your financial stability. Important tax planning involves timing, awareness, and action. It’s about knowing the ups and downs of your business cycle and using it to benefit you.

Optimizing Income and Expenses Timing for Better Tax Results

One of the most effective strategies you can use is optimizing the timing of your income and expenses. By speeding up or delaying income and expenses, you can affect your tax bracket and potentially lessen your tax load. For instance, if you anticipate being in a higher tax bracket next year, it might be beneficial to speed up income into the current year.

On the other hand, if you expect to earn less next year, it might be a good idea to postpone some expenses to the next year to balance that lower income. This kind of tactical planning needs a solid grasp of your company’s financial future and the tax laws that are relevant to it.

Imagine that the tax year is coming to a close and you’re anticipating a hefty invoice to be settled. If it’s beneficial for your tax circumstances, you could postpone invoicing until the following year to defer the revenue. On the other hand, if you have impending costs that you can cover now, you could decrease your taxable income by making those payments before the end of the year. For more detailed strategies, consider reading our small business tax credits guide.

However, these decisions should not be made in a vacuum. Instead, they should be part of a comprehensive tax strategy that considers your business’s unique situation and objectives.

- Examine your financial projections and cash flow to decide when to schedule income and expenses.

- Speak with a tax expert to learn about the effects of speeding up or postponing income and expenses.

- Stay informed about tax law changes that could influence your plan.

Investing in Retirement Plans and Health Savings Accounts

Health Savings Accounts (HSAs) are another tax-friendly tool for small business owners, in addition to retirement plans. If you have a high-deductible health plan, you can invest in an HSA and reduce your taxable income. HSA funds grow tax-free and can be withdrawn tax-free for eligible medical costs.

Choosing the Ideal Legal Structure for Tax Benefits

The legal structure of your business plays a major role in the way you are taxed. Depending on whether you run your business as a sole proprietorship, partnership, LLC, or corporation, you will face different tax implications. For example, corporations are subjected to double taxation on dividends, while LLCs have the option to choose their taxation method, which can be advantageous depending on your circumstances.

How to Claim Your Employee Retention Credits

The Employee Retention Tax Credit (ERTC) is a significant tax break for small businesses that have continued to pay their employees throughout the pandemic. If your business qualifies, you can claim a sizable credit for a portion of the wages you’ve paid to your employees. This isn’t just a deduction; it’s a credit, which means it directly reduces your tax bill.

Understanding whether you’re eligible can be tricky, but it’s definitely worth the time. You must have seen a substantial drop in gross receipts or have had your business operations fully or partially suspended due to governmental orders. If you believe you might qualify, don’t pass up this opportunity.

Let’s say you own a small restaurant and you’ve seen your gross receipts cut in half compared to the same quarter last year. You might be eligible for the ERTC, which could cover as much as 70% of qualified wages. That’s a significant financial help.

Case Studies: Successful Tax Planning

Case studies are a great way to see the impact of effective tax planning. Let’s explore how two businesses successfully worked their way through the tax system.

Case Study: Retail Business Maximizes Deductions

A small boutique clothing store in a busy city took advantage of several tax deductions to reduce its taxable income. By meticulously monitoring inventory costs, employee wages, and utility bills, the store was able to maximize deductions and save thousands of dollars at tax time.

Case Study: How a Tech Startup Benefitted from R&D Tax Credits

A tech startup that was committed to creating groundbreaking software made use of the Research and Development (R&D) tax credit. By keeping a record of their development procedures and costs, they managed to claim a significant credit. This not only reduced their tax obligation but also encouraged more innovation.

Keeping it Legal: Getting to Grips with IRS Rules and Audits

Following IRS rules isn’t a choice—it’s a must. Getting to grips with these rules and sticking to them can save you from expensive fines and nerve-wracking audits.

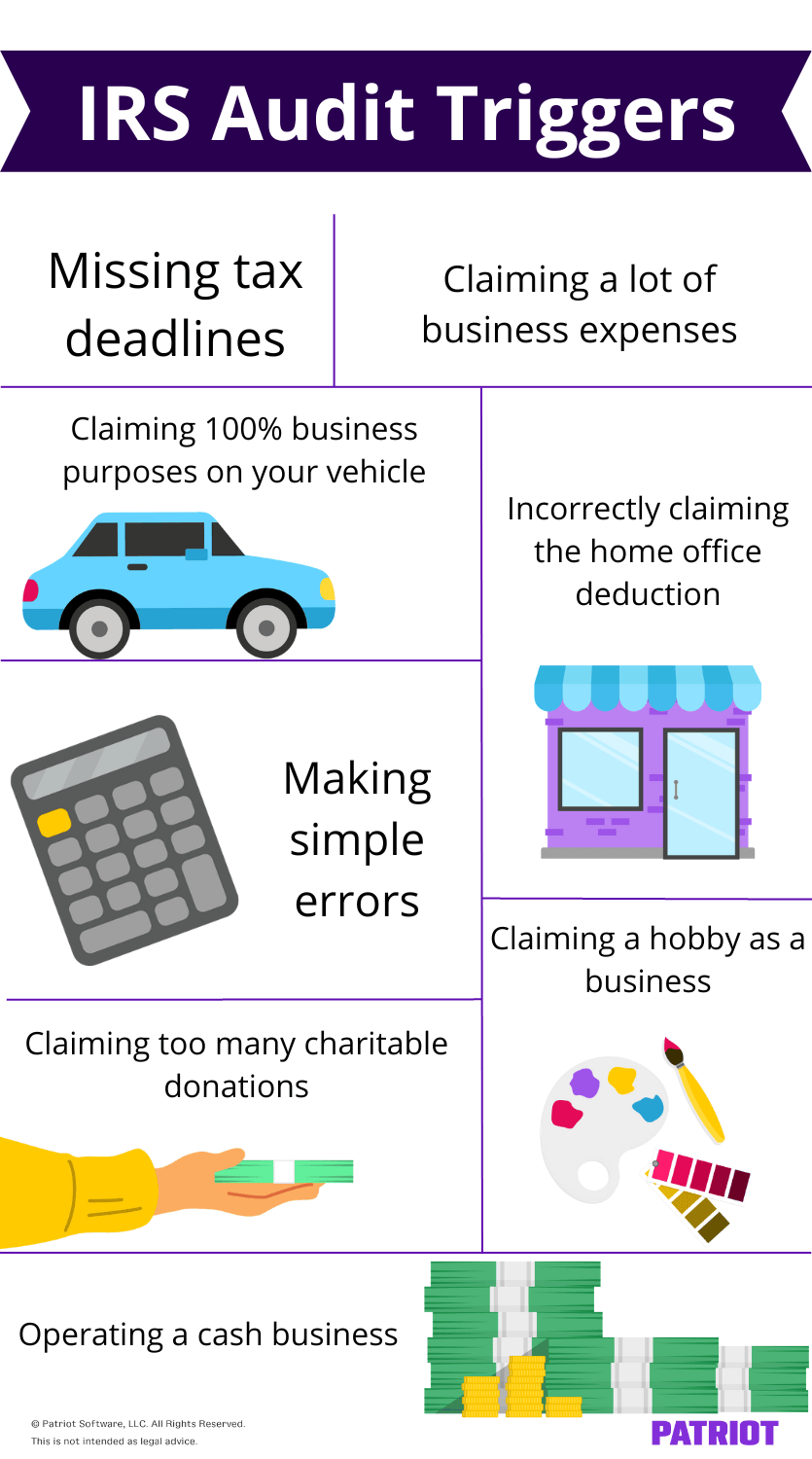

There are a few red flags that could trigger an audit, such as claiming big deductions in comparison to your income, reporting too many expenses for things like travel and entertainment, and making mistakes on your tax forms. The best way to avoid these traps is to make sure that all of your deductions and expenses are valid and that you have the paperwork to back them up.

For instance, if you’re claiming a home office deduction, it’s important to have a specific area that’s only used for business. The IRS may ask for evidence, so it’s a good idea to keep pictures and documentation of your home office arrangement.

Another piece of advice is to tread carefully with mileage deductions. If you’re claiming a large number of miles for business travel, be ready to provide a comprehensive mileage log to back up your deduction.

Keep in mind, the secret to getting through an audit is maintaining meticulous records. Every cost should be recorded with a matching receipt or paper.

Now, we’ll examine some top tips for maintaining flawless records.

Maintaining Flawless Records: Top Tips

Effective record-keeping is the foundation of every successful tax plan. It’s not just about saving receipts; it’s about creating a system that lets you monitor and classify every transaction. Here are some suggestions:

- Log all your business transactions using accounting software.

- Keep your receipts in order by category and date.

- Ensure your records are accurate and complete by reviewing them regularly.

Choosing Your Tax Preparer: Credentials are Important

In conclusion, the person you select to prepare your taxes can make a big difference. You need someone who is not only competent, but also understands your business and its specific needs. Look for credentials such as Certified Public Accountant (CPA) or Enrolled Agent (EA), and inquire about their experience with small businesses in your sector.

Never Stop Learning: Boost Your Tax IQ

Taxes are ever-evolving, and staying up-to-date can be tough. But, continuous learning is key to staying on top of things. Go to workshops, webinars, and read publications that center on small business tax matters. And don’t forget, knowledge is power, particularly when it comes to taxes.

If you’re interested in exploring tax benefits such as the ERTC in more detail, you might want to check out ERTC Filing Pros. They specialize in helping you get the most out of your refundable claims for the Employee Retention Tax Credit, and they make it easy with a process that doesn’t take much time.

By keeping yourself updated and taking the initiative in your tax planning, you can transform what usually feels like a burden into a chance for growth. Take charge of your taxes and see your business flourish.

Effective documentation is the foundation of all successful tax planning. It’s not just about saving receipts; it’s about creating a method that lets you monitor and categorize every transaction. Here are some suggestions:

- Utilize accounting software to document all business transactions.

- Organize receipts by type and date.

- Review your records frequently to ensure they are accurate and complete.

Assessing Your Tax Preparer: Qualifications are Important

In conclusion, the individual you select to prepare your taxes can have a significant impact. You want someone who is not only competent but also familiar with your business and its specific challenges. Look for qualifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA), and inquire about their experience with small businesses in your sector.

Never Stop Learning: Boost Your Tax Expertise

Taxes are always evolving, and staying on top of changes can be tough. But, it’s crucial to keep learning to stay ahead. Take part in workshops, webinars, and read materials that concentrate on small business tax matters. And always remember, knowledge is power, particularly when it’s about taxes.

Discover Your ERTC Opportunities

If you’re interested in exploring particular tax benefits such as the ERTC, you might want to check out ERTC Filing Pros. They have a unique skill set that allows them to maximize refundable claims for the Employee Retention Tax Credit, offering a straightforward process that doesn’t take up much of your time.

Transforming what often feels like a burden into an opportunity is possible when you remain informed and proactive about your tax planning. By taking control of your taxes, you can empower yourself and your business and watch it flourish.

Future Tax Workshops and Webinars

Don’t miss the chance to attend future tax workshops and webinars to keep you up to date on the latest tax changes and strategies. These events are a great chance to ask questions, meet other small business owners, and get advice from tax professionals.

Important Reading and Tools for Comprehensive Knowledge

There are many readings and tools that can give you a comprehensive knowledge of small business tax planning. From IRS guides to industry journals, ensure that you’re using credible sources to guide your tax decisions.

Common Questions

Have some questions? Don’t worry, you’re not the only one. Here are some common questions about small business tax planning:

Which Accounting Software Should I Use for My Small Business?

The accounting software that’s best for your small business depends on what you need it to do. QuickBooks is a popular choice because it can do so many things, but Xero and Sage are also good. Look at what each one offers and how much it costs to decide which one is the best for your business.

What Can I Do to Get the Most Out of My Tax Deductions?

If you want to get the most out of your tax deductions, you should keep thorough records of all your business expenses, stay informed about the most recent tax laws, and think about getting advice from a tax expert. Deductions can include everything from home office costs to travel expenses, so you should claim everything you have a right to.

What Are the Essential Documents to Keep for Small Business Taxes?

Essential documents include expense receipts, bank and credit card statements, invoices, payroll records, and prior tax returns. Keep these documents in an organized manner to make your tax preparation easier and to substantiate your deductions.

Is it Possible for Small Business Owners to Deduct Home Office Expenses?

Yes, if you use a part of your home regularly and exclusively for business purposes, you may be able to deduct home office expenses. This can include a portion of your rent or mortgage, utilities, and insurance.

How Can You Stay Informed about Tax Law Changes?

Stay informed about tax law changes by subscribing to IRS updates, following credible tax blogs, and attending tax planning seminars. Keeping up-to-date will allow you to adjust your tax strategy and leverage new tax benefits.

What Sets Apart a Tax Credit from a Tax Deduction?

A tax credit directly lessens your tax bill by a certain amount, while a tax deduction reduces the amount of your income that is taxable. Both can decrease your total tax liability, but they do so differently.

What is the advantage of the Employee Retention Tax Credit for small businesses?

Small businesses can take advantage of the Employee Retention Tax Credit by claiming a tax credit for a portion of the wages paid to employees during eligible periods. This can greatly decrease the amount of taxes owed and provide financial relief.