Hello, soon-to-be entrepreneur! Starting a small business can seem like a daunting task with so many factors to consider. Fear not, I’m here to guide you through one of the most crucial choices you’ll have to make: selecting the best business structure. It’s more than just filling out forms—it’s about molding the future of your passion.

Key Points

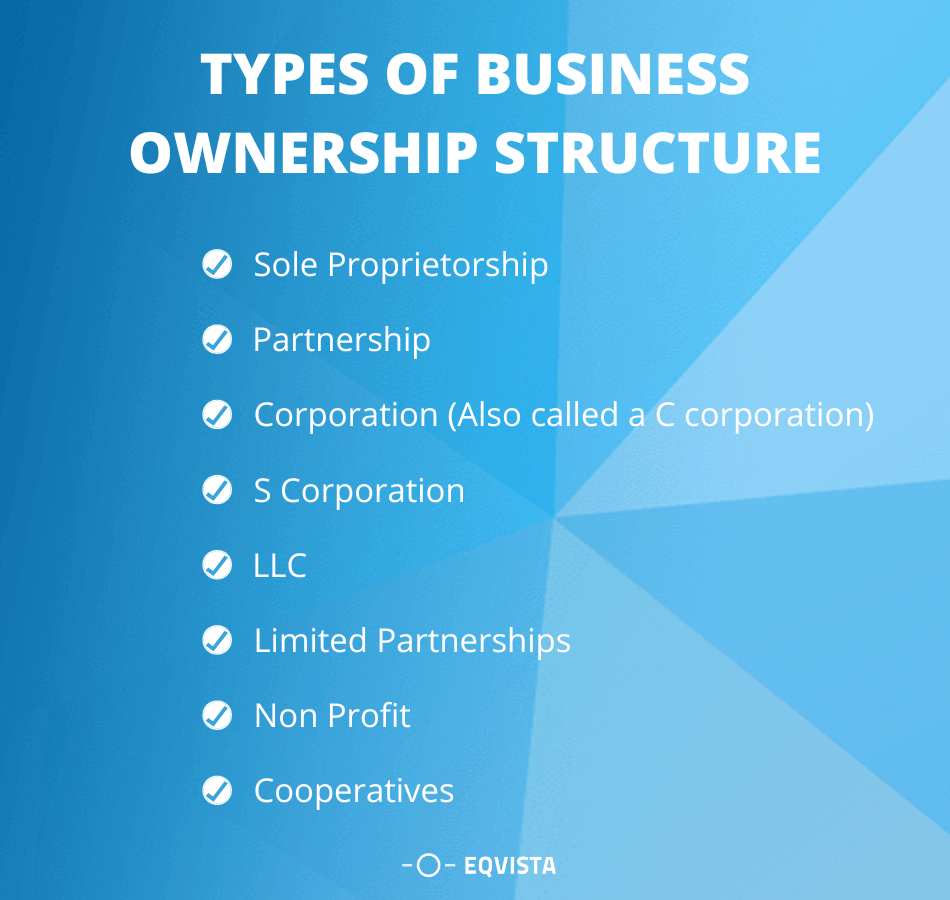

- Knowing the four main types of business structures is essential for making decisions about taxes, liability, and management.

- A sole proprietorship is simple to establish but doesn’t offer any personal liability protection.

- Partnerships are excellent for shared control, but keep in mind that you’re also sharing the responsibilities and risks.

- Corporations provide liability protection but can be complicated and expensive to maintain.

- LLCs offer a combination of simplicity and protection, making them a popular choice for many small businesses.

The Importance of Business Structure

Choosing a business structure isn’t just about the here and now—it’s about laying the groundwork for your business’s future. It affects how much you pay in taxes, your ability to raise funds, the paperwork you need to file, and how much your personal assets are at risk. It’s a decision that requires careful consideration and often, some guidance.

Considerations for Taxes and Personal Liability

Choosing a business structure involves considering taxes and personal assets. Some structures, such as sole proprietorships, are straightforward but mix your business and personal liabilities. This means that if your business is sued, your personal assets could be in danger. Others, like corporations, separate your business and personal finances, providing more protection but also more complexity in terms of taxes.

Considering the Future of Your Business

Another thing to think about is where you see your business in the future. Do you want to keep it small and local, or are you hoping to expand? The structure you choose for your business can either help or hinder your growth, so it’s important to choose carefully with your future goals in mind.

Selecting the Best Business Structure

Now, let’s get into the specifics of each structure, so you can choose the one that suits your business best. For a more comprehensive understanding, consider exploring this small business tax credits guide as it can influence your decision on the most advantageous structure for tax purposes.

Introduction to Sole Proprietorships

If you’re starting a business by yourself, a sole proprietorship could be the simplest and fastest way to get it up and running. You and your business are one and the same, which means less paperwork and simpler tax returns. But be aware, simplicity also means you’re solely responsible for any debts or legal problems.

Understanding Partnership Models

When you’re working with someone else, a partnership is a great option. It lets you split the work and the profits. But, just like in a marriage, you need good communication and compatibility because you’ll also share the risks. There are different types of partnerships, such as general and limited, so you can find the right balance for both of you.

Understanding Corporations

Corporations are considered the major leagues of business structures. They provide robust protection for your personal assets and can simplify the process of raising capital. However, they also come with a set of rules and formalities. If you have big dreams and are planning to build an empire, this might be the right choice for you.

Limited Liability Companies (LLCs)

If you’re looking for the liability protection of a corporation combined with the tax benefits of a sole proprietorship or partnership, an LLC might be the perfect fit for you. It’s a flexible choice that has become increasingly popular among small business owners who want the best of both worlds.

Cooperatives as a Business Format

Cooperatives are a different kind of animal. They are owned and run by a group of individuals for their mutual advantage. If your business is centered around community and shared decision-making, this might be the one. Consider local food co-ops or credit unions—businesses that are operated by the people, for the people.

Every structure has its own advantages and disadvantages, so it’s vital to match your decision with the requirements of your business and your personal risk tolerance. The most crucial thing to remember is that this isn’t a one-size-fits-all scenario. What’s effective for one company may not be effective for another, so customise your selection to your unique vision.

Keep in mind, you’re not just launching a business; you’re building a foundation for your future. So take a moment, consider what you want, and let’s create something amazing together. And when you’re prepared to protect your financial gains as a small business owner, you’ll want to look into ERTC Express to optimize your tax credits. But we’ll get there soon. Stay with us!

Understanding the Size of Your Business

Before you decide on a structure, understand your business. Are you the only one, or do you have a team? Will you operate in your local area, or are you planning to go global? The size of your business will greatly affect which structure is best for you. A sole proprietorship or partnership may be perfect for small businesses, while larger plans may require an LLC or a corporation.

Fundraising: The Basics

Fundraising is like putting gas in your business’s tank, and your business structure influences how you go about it. Sole proprietorships and partnerships might depend on personal savings or small loans. Corporations have the option to sell stock, and LLCs provide flexibility—members can invest in exchange for a portion of the business. Select a structure that is in line with your financial plan.

Grasping the Concept of Regulatory Compliance

Every type of business structure has its own set of rules. For example, corporations need to keep meticulous records, hold frequent meetings, and report to their shareholders. LLCs have fewer formal requirements but still need to keep specific records. Grasping the regulatory requirements of each type of business structure is key to avoiding legal problems in the future.

Imagine your business structure is like the framework of a car. It’s what holds everything together. If you mess up here, you could be in for a rough journey. So, make sure you know what each structure requires in terms of compliance.

Just remember, laws differ from state to state, so what’s effective in one state may not be in another. It’s always wise to consult with a legal professional or a business counselor to ensure you’re on the right path.

Take, for instance, a friend of mine who opened a bakery as a sole proprietorship. Everything was going great until she decided to expand. Suddenly, she was managing more orders, more employees, and more risk than she was comfortable with. After speaking with a consultant, she changed to an LLC, which gave her the protection she needed without the bureaucracy of a corporation.

Changing Business Structures

Business is fluid, and sometimes, the structure you start with isn’t the one you end up with. Changing your business structure can be a strategic decision to accommodate growth, decrease tax liabilities, or draw in investors.

Switching to a new business structure isn’t as intimidating as it seems. With the right guidance and a clear understanding of the benefits, you can make the transition smoothly. Whether you’re growing from a sole proprietorship to an LLC or changing from an LLC to a corporation, the key is to make sure the change aligns with your business goals.

Transitioning to a New Business Structure: A Step-by-Step Guide

When the time comes to transition your business to a new structure, it’s crucial to have a plan in place. This will likely involve filing paperwork with your state, such as articles of incorporation if you’re forming a corporation or articles of organization for an LLC. You may also need to obtain a new tax ID and update any business licenses or permits you have.

First and foremost, make sure you keep your team and stakeholders in the loop. They should be aware of why the transition is happening and how it’s going to happen. Clear communication makes sure everyone is on the same page and can help the process go more smoothly.

Overcoming Legal Obstacles and Expenses

Altering your business structure may require you to navigate through legal intricacies and expenses. You might have to create new operational agreements, move assets, or possibly terminate your existing entity. There are also registration fees and potential tax consequences. However, don’t let this discourage you—the long-term advantages can far surpass the initial inconvenience and cost.

Important Factors for Small Business Owners

As the owner of a small business, you have particular benefits and obstacles to consider when it comes to your business structure. The structure you choose can influence everything from your day-to-day operations to how well you can handle financial difficulties.

Advantages of Different Small Business Structures

Each structure has its own unique advantages. Sole proprietorships are straightforward, partnerships allow for shared management, LLCs are flexible, and corporations set the stage for expansion. When deciding, think about what your business requires, how comfortable you are with personal liability, and what you envision for the future.

Maximizing Employee Retention Tax Credits

Did you know that certain business structures can help you maximize tax credits like the Employee Retention Tax Credit (ERTC)? This credit can help businesses that have kept employees on payroll during challenging times. It’s worth taking a look at whether your business can benefit from this and other tax incentives.

Preparing for Potential Growth or Sale

The structure of your business can affect your potential for growth or sale. If you structure your business as an LLC or corporation, it may be easier to add new partners or investors. On the other hand, a sole proprietorship may limit your possibilities. Consider your future business goals and choose a structure that will help you achieve them.

Initiating the Process

Are you prepared to begin? The initial move is to choose a business name and make it official. This includes checking for name availability, registering your name, and potentially trademarking it to safeguard your brand.

Afterward, it’s time to secure all required licenses and permits. These will differ greatly based on the nature of your business, its location, and the industry it falls under, so make sure you do the necessary research to ensure you’re in full compliance.

Picking and Registering Your Business Name

Imagine you’re starting a coffee shop. You’ll need a name that’s catchy, memorable, and gives a hint of what your business is about. Once you’ve decided on “Bean Dream,” you’ll check to make sure the name isn’t already taken, then register it with your state and secure the domain name online.

After you’ve registered your business name, you’ll file the necessary paperwork to establish your business structure. For an LLC, that means articles of organization. For a corporation, it’s articles of incorporation. And don’t forget about setting up your tax ID and opening a business bank account.

Now that your business is officially up and running, it’s time to start thinking about the day-to-day operations. This includes setting up your accounting system, defining your brand, and starting to market your business. But there’s one more thing to consider: employee considerations and the ERTC.

Securing Required Licenses and Permits

Your business may require a general business license, a sales tax permit, health department permits, or professional licenses. It is crucial to investigate and apply for all required permissions before you start your business. This will ensure that your business is legal and operational from the first day. For more detailed information, refer to our comprehensive small business tax credits guide.

Remember, starting a business is a journey, not a race. It’s about making smart decisions that set you up for success. So take your time, do your research, and when you’re ready to take advantage of financial benefits like the ERTC, head over to ERTC Express to begin your claim. They’re dedicated to maximizing refundable claims for small businesses, and the process is so easy it takes less than 15 minutes of your time.

When it comes to choosing your business structure, employee considerations are a significant factor. If you have employees, you must consider payroll taxes, benefits, and even tax credits. The Employee Retention Tax Credit (ERTC) is a beneficial incentive for businesses that have managed to keep their employees during the pandemic. It’s a way to gain some financial relief and recognition for your resilience.

Get Your Employee Retention Tax Credit with ERTC Express

Let’s dive into the ERTC. It’s a lifeline for small businesses, providing a refundable tax credit for wages paid to employees. This isn’t just a deduction; it’s a credit that can reduce your tax bill dollar-for-dollar. And if the credit is more than what you owe, you’ll get the difference back in cash. That’s money you can reinvest in your business.

What is the Employee Retention Tax Credit (ERTC)?

The ERTC is a provision of the CARES Act that was created to motivate businesses to retain their employees during the COVID-19 pandemic. If your business has seen a decrease in gross receipts or was partially or fully shut down due to government mandates, you may qualify for this credit.

Why ERTC Express is the Best Choice for Your Small Business

If you’re looking to claim your ERTC, you want the process to be hassle-free and the claim to be as large as possible. That’s where ERTC Express comes in. They are experts in assisting small business owners like you through the intricacies of the ERTC. With their knowledge, you can be confident that you’re receiving every penny you deserve.

Start Your ERTC Claim at ERTC Express

Are you ready to claim your ERTC? Don’t delay. Visit ERTC Express and begin the process. Their team of professionals will walk you through each step, ensuring you receive the maximum benefit with the least amount of time invested. It’s a straightforward, risk-free process that’s completely dependent on your refund. Additionally, they offer audit-proof documentation, which is essential in case the IRS comes calling.

Common Questions

There are many questions that come up when discussing business structures and the ERTC. Let’s address some of the most common ones.

Is it possible to change the structure of my business later on?

Definitely. As your business grows and changes, so might your requirements. You can transition from a sole proprietorship to an LLC or from an LLC to a corporation. However, keep in mind that each change necessitates paperwork, potential fees, and a comprehensive understanding of the implications of the new structure.

How is my business structure related to my taxes?

The structure of your business dictates your tax situation. Sole proprietorships and partnerships pay taxes through personal tax returns, while corporations are taxed separately. Limited liability companies provide flexibility—you get to decide your tax status. Make a smart choice, as it will affect your profit margin.

What’s the easiest business structure for first-time entrepreneurs?

If you’re new to the world of entrepreneurship, a sole proprietorship is usually the easiest route. It involves less paperwork, and you can hit the ground running. Just remember that this structure involves personal liability.

Is it necessary for all business structures to be registered and licensed?

The majority of businesses will need to be registered and licensed in some way, but the details can change based on where you are and what industry you’re in. It’s always a good idea to check the local laws to make sure you’re following them right from the start.

Why would a small business owner prefer an LLC to a sole proprietorship?

Choosing an LLC provides personal liability protection, which is not available with a sole proprietorship. This implies that your personal assets will be more secure if your business encounters any issues. In addition, LLCs offer tax advantages and can help your business appear more professional.

How does ERTC Express make it easier to claim tax credits?

ERTC Express handles the entire process for you, making it easier. They assess your eligibility, calculate the credit, and prepare the documentation. You only need to spend less than 15 minutes to get started, and they operate on a contingency basis—no upfront fees.