Main Points

- PPP (Paycheck Protection Program) and ERTC (Employee Retention Tax Credit) are two separate financial aids that can help small businesses.

- QuickBooks can be used to track and manage both PPP loans and ERTC claims, ensuring accuracy and compliance.

- It’s important to understand the changes in 2021 for ERTC to maximize your tax credits.

- Accurate data entry and proper setup in QuickBooks are important for tracking PPP loan forgiveness and ERTC eligibility.

- Applying for ERTC can now be done retroactively, even if you’ve received PPP funds, but specific rules must be followed to avoid ‘double-dipping’.

What Are PPP and ERTC?

If you’re running a small business, there’s a good chance you’ve heard of the PPP and ERTC. But what exactly are they? Let’s break it down. The PPP, or Paycheck Protection Program, was designed to help businesses keep their workforce employed during the COVID-19 crisis. It provides loans that can be forgiven if certain conditions are met, primarily around maintaining payroll.

Conversely, the ERTC is a tax credit designed to incentivize businesses to keep their employees. It enables you to claim a portion of the wages you pay to your employees, which can considerably reduce your tax liability. And the cherry on top? It’s a credit, not a loan, so there’s no need to worry about repayment.

Grasping the Intersection of PPP and ERTC

This is where things can get a little complicated. At first, businesses couldn’t take advantage of both PPP and ERTC – they had to choose one or the other. But wait, there’s a silver lining! Recent legislative changes now allow you to reap the benefits of both programs. However, you must tread carefully through the rules to make sure you’re not claiming the same expenses for both. This is where QuickBooks can be a lifesaver.

“Employee Retention Tax Credit Update …” from www.youtube.com and used with no modifications.

Significant ERTC Changes in 2021

There were many changes to the ERTC in 2021 that you should know. The most significant change was the increase in the credit amount. You can now claim up to 70% of qualifying wages, which is a big jump from the previous 50%. Additionally, the per-employee wage cap was increased to $10,000 per quarter instead of per year. This means you could potentially earn more money if you take advantage of these changes.

To illustrate, if you paid an employee $10,000 in wages in the first quarter of 2021, you could potentially claim a $7,000 credit for that quarter alone. Multiply that by the number of eligible employees and you can see how quickly this can accumulate.

How to Set Up QuickBooks for PPP and ERTC Tracking

Now, let’s get into the details of how to use QuickBooks to manage your PPP and ERTC funds. Setting it up correctly is crucial. You want to ensure every dollar is accounted for accurately. After all, errors can lead to issues with loan forgiveness or tax credits in the future.

How to Set Up QuickBooks for PPP

To start, you should create a unique account in QuickBooks for your PPP loan. This will help you keep everything organized and clear. After that, you should establish distinct expense categories for payroll expenses, rent, utilities, and other qualifying expenses. This is important because these are the expenses that can be forgiven under PPP, so you will need to monitor them closely. For a detailed guide on managing these expenses, refer to how to calculate Employee Retention Credit (ERC) in QuickBooks.

- Open the Chart of Accounts and create a new account for your PPP loan.

- Designate expense categories for costs that are eligible for PPP.

- Consistently monitor and update these accounts to maintain accuracy.

How to Enter PPP Loan Data Correctly

Once you’ve received your PPP loan, enter it as a liability in QuickBooks. When you spend the funds on eligible expenses, be sure to offset these expenses against this liability. Doing so will provide a clear and accurate view of how much of the loan you’ve used and how much could be forgiven. For a detailed breakdown, refer to our ERC eligibility guide which can help you understand the new legislative changes.

Monitoring Payroll Expenses for PPP Forgiveness

Payroll expenses play a crucial role in PPP forgiveness, so it’s important to keep a close eye on them. With QuickBooks, you can use the payroll feature to generate reports that display your total payroll expenses. You’ll need to show that you’ve kept your payroll consistent to be eligible for forgiveness, so these reports are invaluable.

Take, for example, a situation where your company got a $50,000 PPP loan and you used $40,000 of that on payroll within the required timeframe. QuickBooks can provide evidence that those expenses were truly for payroll, which may mean they can be forgiven.

Don’t forget, proper accounting is your friend when it comes to getting the most out of financial aid benefits. If you set up QuickBooks the right way and keep good records, you’re setting yourself up for an easier financial journey during these difficult times.

How to Calculate the Credit Amount

Imagine your business has an eligible employee who earned $10,000 in Q1 2021. Under the new ERTC regulations, you could claim a 70% credit, which would equal a $7,000 tax credit for that quarter for just this employee.

This is where the calculation of the ERTC credit amount starts to get interesting. You’re basically looking at 70% of qualifying wages paid up to $10,000 per employee per quarter. That’s a significant amount, but you have to do the math correctly. QuickBooks can help automate some of this, but you still need to understand the formula and make sure you’re entering the right data.

In order to figure out the credit, you need to tally up all eligible wages, health insurance costs, and certain other expenses associated with keeping employees during the quarter. You then multiply this total by 70% to determine your credit amount. Keep in mind, you can only count wages up to $10,000 per employee for each quarter.

Remember, there are limits! The credit has a maximum of $7,000 per employee for each quarter of 2021. So, even if an employee makes more than $10,000 in a quarter, the most you can claim for them is still $7,000.

Claiming ERTC Retroactively

You may be worried that you’ve missed your chance to apply for ERTC. However, there’s no need to panic. You can still claim ERTC retroactively! If you qualify for the credit in previous quarters, you can still make a claim. You can do this by amending your previous quarter’s payroll tax returns using Form 941-X.

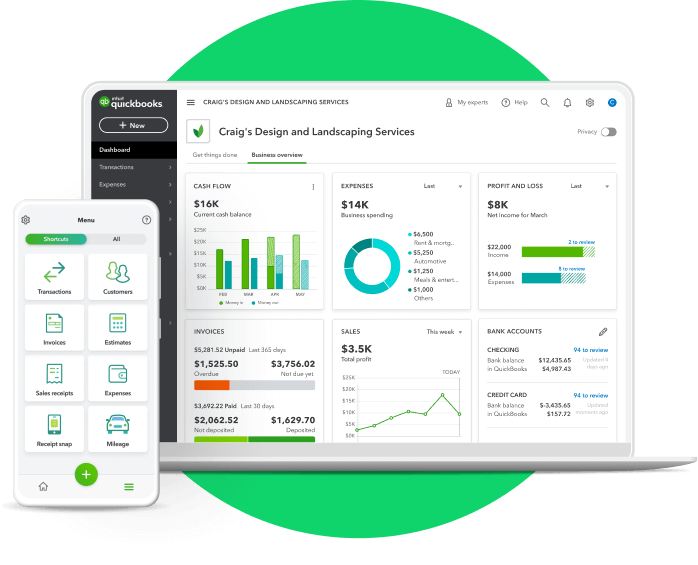

“Accounting Software & Solutions …” from quickbooks.intuit.com and used with no modifications.

QuickBooks Reports for Bulletproof Claims

Now, we’re going to look at how to make your claims bulletproof. The secret is to generate accurate QuickBooks reports. These reports are what you’ll use to back up your claim if the IRS comes calling. They’ll want to see that your figures are accurate and that you’ve followed the rules to the letter.

It’s important to generate payroll reports that distinctly outline each employee’s wages and their respective payment dates. This is crucial because the timing of wage disbursements may impact your qualification for the ERTC.

Producing Necessary Reports for ERTC Claims

When you’re using QuickBooks, you’ll need to create several reports. The Payroll Summary report will be the most useful for you. It’ll display all the wages you’ve paid, as well as taxes and adjustments. This is the report that provides the figures you need for your ERTC calculations.

It’s also a good idea to run a Payroll Detail report. This one really gets into the weeds, showing individual paychecks. If the IRS wants to see the specific breakdown of wages, this is where you’ll find it.

Grasping Report Data for Precise Claims

Grasping the data in these reports is vital. You need to be aware of what is eligible and what isn’t. For instance, wages utilized for PPP forgiveness can’t be claimed for ERTC. QuickBooks will display all the wages, but it’s your responsibility to apply the rules and determine which ones are eligible for the credit.

It’s not just about the numbers, though. You have to understand the context. Was your business affected by government orders? Did you have a substantial decrease in revenue? These factors affect your eligibility and the amount you can claim.

Preparing for Potential Audits

In the event that the IRS chooses to audit your ERTC claim, you must be able to present documentation that verifies your claim. This involves having all your payroll records organized and demonstrating the calculations you utilized to establish the credit amount.

QuickBooks allows you to consolidate all your payroll documentation and reports. It’s crucial to maintain comprehensive records of how you established eligibility and determined the credit sum. If your calculations are transparent and easy to follow, you’ll be more prepared for an audit.

Keep in mind, the ultimate objective is to create a collection of records that narrates a straightforward tale: “This is the amount we compensated our workers, this is how the pandemic impacted us, and this is how we computed the tax credit we’re requesting.” If you can achieve this, you’re on the right track.

Avoiding Common Mistakes

For example, a common mistake is claiming ERTC for wages that were already covered by a PPP loan. This is not allowed. You need to make sure that the wages you’re claiming for the ERTC have not been used to get PPP loan forgiveness.

When working with the PPP and ERTC, there are some common mistakes that can cause problems. Let’s discuss how to avoid them.

First off, don’t ‘double-dip’. You’re not allowed to claim ERTC for wages that you’ve already claimed for PPP forgiveness. It’s crucial that you keep a close eye on which wages are being used for PPP so you don’t accidentally claim them for ERTC.

One more mistake to avoid is not maintaining proper records. If you don’t have enough evidence to back up your claim, you might have to return the credit. Ensure that all your payroll records in QuickBooks are correct and current.

Preventing Double-Dipping: PPP and ERTC Regulations

In order to prevent double-dipping, it’s crucial to know which wages you’re utilizing for PPP forgiveness. After these have been allocated, you can then consider other wages for the ERTC. It’s somewhat akin to completing a puzzle – each piece must be correctly positioned.

How to Fix Incorrectly Categorized Expenses

One of the most common errors is misclassifying expenses. Make sure you’re putting your expenses in the correct categories in QuickBooks. If you’ve classified a payroll expense incorrectly, you can fix it by editing the transaction. It’s important to be detailed – accuracy is crucial.

Advice for Maintaining Records and Prompt Submissions

Maintaining flawless records is not just a good habit; it’s your saving grace in the event of an audit. Use QuickBooks to keep a transparent record of all transactions related to PPP and ERTC. Also, don’t procrastinate on submitting your claims. Being prompt is crucial as it demonstrates that you’re managing your finances well and it lessens the likelihood of mistakes.

In summary, QuickBooks can be a game-changer when it comes to handling PPP and ERTC claims. Make sure you set it up properly, maintain precise records, and familiarize yourself with the regulations. By doing so, you’ll be well-equipped to get the most out of your financial aid and keep your business flourishing.

As we conclude, we want to ensure that you’re prepared to manage your PPP and ERTC claims with assurance. Understanding the correct procedures and having QuickBooks properly configured will save you both time and worry. And we all know that time is money, particularly in the world of business.

Why ERTC Express is a Time-Saver

ERTC Express is a simplified system for maximizing your refundable claims on the Employee Retention Tax Credits. It’s designed to take less than 15 minutes of your time, making it ideal for local and small to medium-sized businesses to ensure they claim the maximum credits they’re entitled to. They offer a no upfront fee service, which is contingent on your refund, which means they’re just as invested in getting you your money as you are.

Empowering You to Apply Now

Many people hesitate to claim their eligible tax credits because they’re uncertain or intimidated by the process. However, with the right guidance and resources, you can tackle your ERTC claims like a professional. QuickBooks, in conjunction with services like ERTC Express, can simplify the process of claiming these tax credits.

Start Your ERTC Claim Today at Pandemic Tax Refund

Don’t let your money go to waste. If you’re eligible for ERTC and haven’t yet claimed it, or if you’re unsure about your eligibility, the time to act is now. The experts at Pandemic Tax Refund are focused solely on ensuring you receive the maximum refundable credits. It’s an opportunity for a substantial refund check from the IRS that you shouldn’t miss out on. For more details on eligibility, check out our comprehensive ERTC eligibility checklist to maximize your credits.

Frequently Asked Questions

What’s the Difference Between PPP and ERTC?

The PPP (Paycheck Protection Program) is a loan that provides a direct incentive for small businesses to keep their workers on the payroll. On the other hand, the ERTC (Employee Retention Tax Credit) is a refundable tax credit that rewards businesses for keeping employees on their payroll during the COVID-19 pandemic.

If I’ve Received PPP, Can I Claim ERTC?

Yes, you can claim ERTC even if you’ve received PPP funds. However, you cannot use the same wages for both PPP loan forgiveness and the ERTC. It’s crucial to track these expenses separately in QuickBooks to ensure you’re not double-dipping. For a detailed breakdown, refer to our ERTC eligibility checklist to maximize credits with or without PPP.

How Can I Document ERTC in QuickBooks?

If you want to document ERTC in QuickBooks, you have to manually adjust your payroll tax filings to account for the tax credit. This means you’ll need to decrease your payroll tax liability by the amount of ERTC you’re claiming. Make sure to maintain thorough records of the wages that are eligible for the credit to back up your claim.

What Papers Are Required for ERTC Claims?

You’ll need comprehensive payroll records, proof of eligible wages, health plan expenses, and any other pertinent financial documents that demonstrate your business’s eligibility for the ERTC. These documents are vital for accurately determining your credit and for potential IRS audits.

Are there cut-off dates for filing ERTC claims?

Yes, there are cut-off dates for filing ERTC claims. You need to submit a revised payroll tax return using Form 941-X for previous quarters where you are claiming the credit. It’s crucial to act quickly to avoid missing out on these beneficial tax credits.

To sum it up, PPP and ERTC are lifelines for businesses facing financial difficulties during these challenging times. By keeping meticulous records in QuickBooks and leveraging tools like ERTC Express, you can ensure you get the most out of these programs. So don’t delay, check your eligibility and start the process to claim what you deserve. The financial stability of your business might very well hinge on it.