- The Employee Retention Tax Credit (ERTC) is a crucial financial lifeline for nonprofits impacted by COVID-19.

- Nonprofits must have seen a decrease in gross receipts or have been subjected to shutdowns to qualify for ERTC.

- ERTC can offer up to $26,000 per employee in tax credits, contributing to nonprofit viability.

- Accurate tracking and documentation are vital for a successful ERTC claim.

- The process of applying for ERTC may be complicated, but it’s crucial for nonprofit leaders to understand it.

Nonprofits have always served as the pillars of our communities, delivering vital services and support where it’s most needed. But during the challenging times of the COVID-19 pandemic, many nonprofits have faced financial hardships that threatened their ability to operate and serve. That’s where the Employee Retention Tax Credit (ERTC) steps in—offering a lifeline to organizations working hard to keep their missions alive.

Getting Started

This guide will help you understand what the ERTC is, why it’s crucial for nonprofits, and how to make sure your organization is maximizing this benefit. Now, let’s get started and equip your nonprofit to keep making an impact.

What is the Employee Retention Tax Credit (ERTC)?

The ERTC is a form of financial aid provided to organizations during the pandemic. It’s a refundable tax credit that benefits nonprofits for retaining their employees. It can be viewed as a ‘thank you’ from the government for contributing to the economy and maintaining employment during difficult times.

Why ERTC Matters to Nonprofits

What’s the big deal about the ERTC? It’s not just a tax credit—it’s a financial safety net. For many nonprofits, it has been the lifeline that has kept them afloat. And most importantly, it means you can keep doing what you do best, serving those who need you, without having to cut corners or limit your services.

At a Glance: How ERTC Impacts Nonprofit Sustainability

Let’s be real, you don’t want to have to cut programs or lay off staff. The ERTC can help prevent that. With up to $26,000 available per employee, this credit can greatly lighten the financial load and help maintain the stability and sustainability of your organization.

Steps to Prepare and File

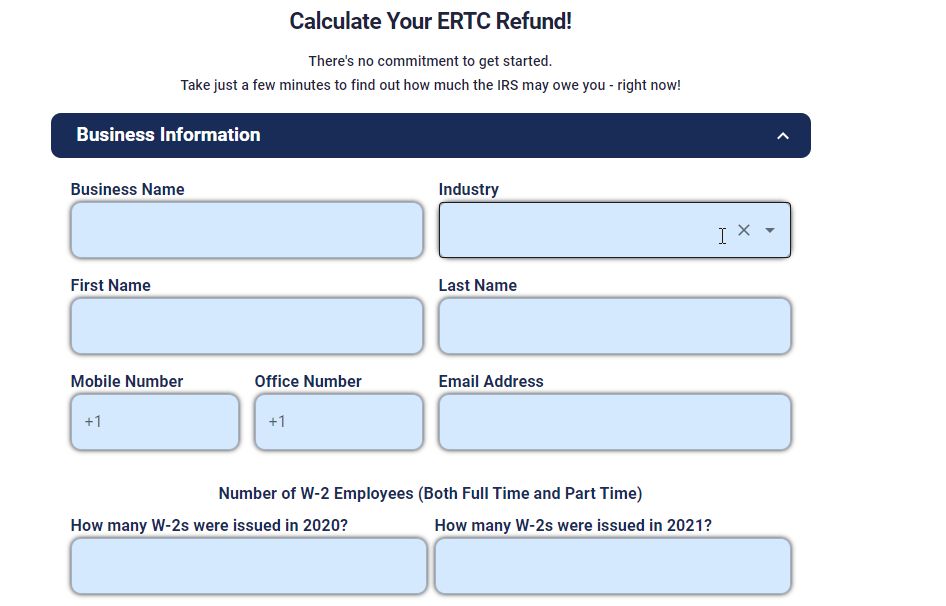

You might be wondering, “This sounds good, but how do I begin?” Don’t stress, we have a step-by-step guide to help you prepare and file for the ERTC.

Checking if your Nonprofit is Eligible for ERTC

- During any quarter of 2020 or 2021, did your nonprofit see a significant decrease in gross receipts compared to the same quarter in 2019?

- Due to government orders related to COVID-19, was your organization fully or partially suspended?

If you answered ‘yes’ to either of these questions, you’re on the right track. The next step is to gather detailed records of your organization’s financial activities during those periods.

Getting the Timing Right for ERTC Claims

It’s all about timing, and with ERTC, there’s a window of opportunity. The important thing is to make your claim within the designated timeframe. For the majority of nonprofits, this involves taking into account the 2020 and 2021 fiscal years. In particular, you should examine each quarter and compare it to the equivalent quarter in 2019. This will enable you to determine when your organization may have seen a decrease in gross receipts or was subject to a government-imposed shutdown. For more detailed information, refer to our ERTC eligibility checklist for nonprofits.

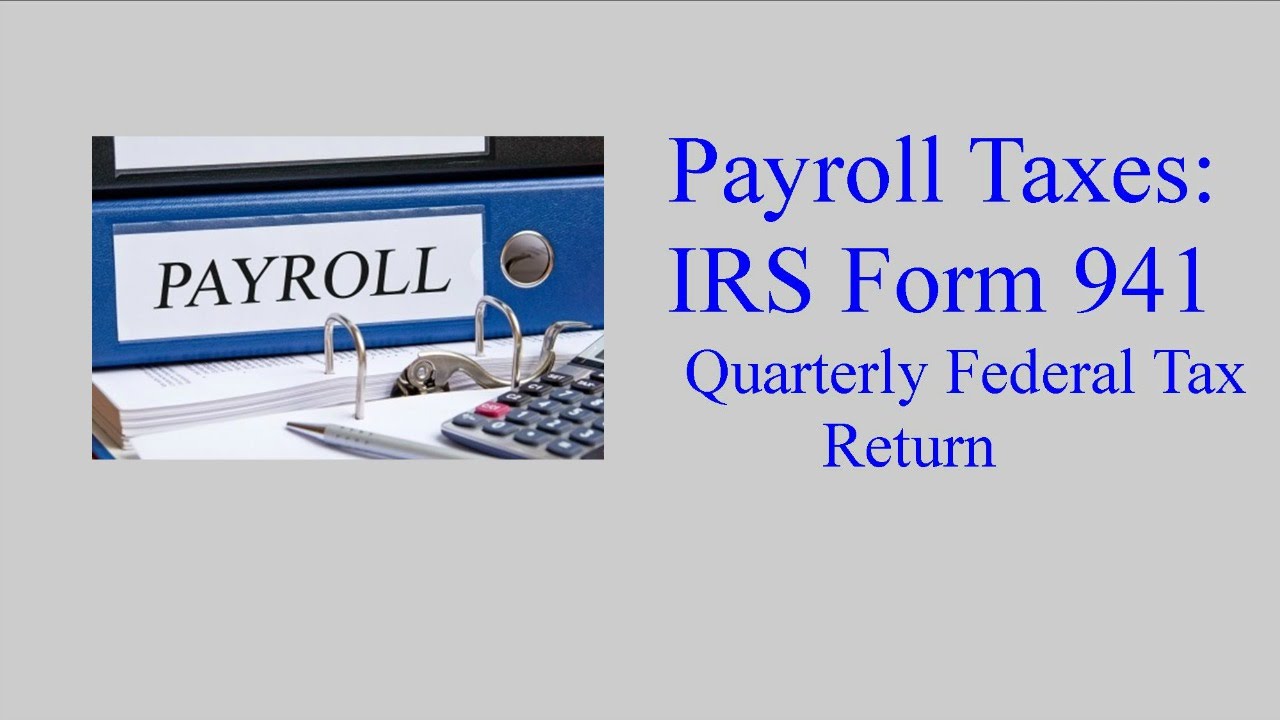

Forms Needed to Apply for ERTC

When applying for your ERTC, you’ll need to complete the appropriate forms. This is the nitty-gritty part of the process. The main form you’ll need is the IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return. Don’t be intimidated by the paperwork. All you have to do is report your total qualified wages and any related health insurance costs for each quarter you’re claiming the credit for.

But that’s not all. If you’ve already filed your 941 and later found out that you were eligible for ERTC, you’ll need to submit Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form is your key to correcting past quarters and claiming the credit you deserve.

Don’t forget, the IRS is detail-oriented, so ensure that you’re completing every section with precision. A minor error could postpone your credit or even lead to a rejection, which is something you want to avoid.

How to File for ERTC: A Step-by-Step Guide

Start by collecting your financial statements and payroll records. You’ll need them for the process. Then, check if you’re eligible for each quarter. After confirming your eligibility, calculate the total qualified wages for your claim. Finally, fill out Form 941 with these numbers. If you’re making adjustments to previously filed returns, use Form 941-X instead.

Now we get to the nitty-gritty: sending your forms to the IRS. Then, the waiting game starts. But don’t just twiddle your thumbs—keep a copy of everything you’ve submitted. If the IRS has questions later on, documentation is your best friend.

Avoid These Common Filing Errors

Let’s take a moment to discuss the common pitfalls you’ll want to avoid. One of the most common errors is failing to thoroughly review your forms before you submit them. Believe me, a second review can save you a lot of trouble down the road. Another common error is failing to claim the maximum credit amount because you didn’t include all eligible wages. And, for the love of all that is holy, please remember to keep a detailed record of your claim process. This is your evidence in case any questions arise.

Avoid delaying your filing for too long. Deadlines are there for a reason and the IRS won’t wait for you. So, make sure everything is in order and file as soon as you can.

What You Need to File

Let’s get down to brass tacks. You have to prove to the IRS that you’re entitled to this credit. That means having your financials, proof of business operations, and employee payroll documents all lined up. It’s like making a case—you need evidence to support your argument.

Don’t just collect these documents, but make sure you understand them. You should know what each number means and how it factors into your eligibility. This isn’t just paperwork, it’s the basis for your ERTC claim.

Collecting Required Financial Documents

Firstly, gather your financial documents. They form the basis of your ERTC claim. They will demonstrate either a reduction in your gross revenue or the effects of a shutdown. Ensure that they are well-organized and simple to comprehend. The more organized your documents are, the easier the filing process will be.

Showing Your Nonprofit’s Functioning During Qualifying Timeframes

Following that, you must provide evidence that your nonprofit was active during the qualifying timeframes and explain how the pandemic impacted you. Did you have to cut back on your hours? Did you transition to providing services online? Regardless of the specifics, make sure to record it. This could take the form of official shutdown orders, internal memos outlining changes in operation, or financial reports that underscore the decline.

Accurate, current, and accessible financial records are a critical part of the ERTC application process. As a nonprofit leader, it’s your responsibility to make sure your financial records are in order. These records are important because they show your organization’s financial status during the specified periods and will be carefully reviewed by the IRS.

However, it’s not enough to just have these documents. You need to be able to explain the story they represent. Can you clearly illustrate how the pandemic has affected your nonprofit’s revenue? Doing so could be the deciding factor in whether your ERTC claim is successful.

“IRS Form 941 – Employers Quarterly …” from m.youtube.com and used with no modifications.

Collecting Essential Financial Documents

You’ll need to gather financial documents such as profit and loss statements, balance sheets, and quarterly gross receipts. You should compare these to the corresponding period in 2019 to show the necessary reduction in income or the effects of any shutdowns. Remember, the details are crucial, so keep everything neatly arranged and clearly marked.

Demonstrating Functionality During Qualifying Periods

For your nonprofit to qualify for the ERTC, it’s crucial to show that it was operational during the pandemic. You should be prepared to offer evidence of how your operations were impacted. This might entail providing copies of shutdown orders that affected your nonprofit, sharing communications with stakeholders regarding changes in operations, or presenting internal memos that talk about the change in service delivery.

For instance, if your nonprofit organization was forced to cancel fundraising events or shut down a thrift store due to government mandates, it’s important to keep those mandates and any financial reports that show the subsequent loss of income. These tangible proofs will back up your claim and show your necessity for the ERTC.

Keeping Track of Employee Payroll Documents

ERTC requires you to maintain thorough records of your employees’ payroll documents, just like your financial records. You must provide comprehensive payroll reports for each quarter in which you’re claiming the credit. These reports must include the total wages paid to each employee, and health insurance costs, if any.

Make sure your payroll records are correct and up-to-date. They will be used to determine how much credit you qualify for. Any errors or omissions could result in a reduced credit or, in the worst case, your claim being rejected.

Determining Eligible Wages for the ERTC

Figuring out eligible wages is a key part of the ERTC application process. It’s more than just adding up the numbers; it’s about knowing which wages are eligible and making sure you’re claiming the right amount. Eligible wages are those paid to employees during eligible quarters when your nonprofit was impacted by COVID-19 restrictions.

Remember that there are limits to the amount of wages you can claim per employee. In 2020, you can claim 50% of eligible wages up to $10,000 per employee for the whole year. For 2021, it’s even more beneficial—you can claim 70% of eligible wages up to $10,000 per employee per quarter. This equates to a potential $7,000 per employee, per quarter, in tax credits.

Keeping Records for Future Checks

Once you’ve filed your ERTC claim, the process isn’t finished. You need to keep all documents related to your claim for at least four years after the date the tax is due or paid, whichever is later. This includes all financial records, payroll reports, and proof of operations.

Why does this matter? It’s because the IRS might scrutinize your claim to make sure everything is legitimate. If they do, you’ll have to give them all the paperwork you used to make your claim. Your nonprofit has to show that you had a right to the ERTC, and having your records in order will make this a lot easier.

Wrapping up, the ERTC provides a substantial chance for nonprofit institutions to recover a portion of the financial setbacks they’ve experienced as a result of the COVID-19 outbreak. By familiarizing yourself with the eligibility criteria, assembling the required paperwork, and diligently monitoring your financials and payroll, you can get the most out of the benefits offered to your nonprofit. Keep in mind that the ultimate aim is to guarantee your organization’s longevity and prosperity, so if you’re eligible, don’t hesitate to take advantage of this tax credit.

Most importantly, if you’re ready to secure the financial aid your nonprofit deserves, don’t wait. Apply Now to start the ERTC filing process and bring much-needed relief to your organization. Together, we can help your nonprofit emerge stronger and more resilient from these challenging times