Key Points to Remember

- ERTC provides tax relief for businesses impacted by the pandemic; find out if you qualify.

- WOTC offers incentives for employing individuals who face employment obstacles.

- Learn how to maximize tax savings by combining ERTC and WOTC.

- Find out the step-by-step procedure for applying for these tax credits.

- Get clarification on common misconceptions and questions about ERTC and WOTC.

“Urgent Deadline Alert: ERTC Claim …” from www.marcumllp.com and used with no modifications.

ERTC Eligibility and Benefits

Let’s start with the Employee Retention Tax Credit (ERTC) – it’s a saving grace for businesses affected by the pandemic. If your business retained employees during COVID-19, you may be eligible for substantial tax relief. The ERTC is designed to assist businesses that were either fully or partially closed due to government orders or that saw a significant drop in gross receipts.

Here’s the scoop:

- Businesses with 500 employees or less can claim up to 70% of each employee’s wages, up to $10,000 per employee per quarter, for wages paid between January 1 and September 30, 2021.

- In 2020, businesses with 100 or less full-time employees can claim 50% of wages up to $10,000 per employee for the entire year.

However, double-dipping is not allowed. If a Paycheck Protection Program (PPP) loan has been taken, ERTC can’t be claimed for the same wages covered by the loan. Also, if the ERTC is going to be claimed, those same wages should not be used for other credits like the Family and Medical Leave Credit.

How to Find Employees Eligible for the Work Opportunity Tax Credit

Moving on, we will discuss the Work Opportunity Tax Credit (WOTC) – a hidden treasure that motivates you to employ individuals from certain groups that have struggled with finding employment. These groups consist of veterans, long-term recipients of unemployment benefits, and others. For each new hire that is eligible, you can claim a tax credit that ranges from $2,400 to $9,600, depending on the category of the employee and how many hours they work.

First and foremost, you must secure confirmation from your state’s employment agency that the worker is indeed part of a targeted group. You are required to submit Form 8850, “Pre-Screening Notice and Certification Request for the Work Opportunity Credit,” within 28 days of the eligible worker starting their job.

Since the WOTC is a non-refundable credit, it can only be applied to your company’s tax liability. But, if the credit is more than your liability, you can carry it back a year or carry it forward up to 20 years, making sure you take full advantage of this beneficial incentive.

“Time countdown for tax deadline concept …” from www.flickr.com and used with no modifications.

Maximize Your Tax Savings

Once you understand the ERTC and WOTC programs, you can strategize to get the most out of your tax savings. These credits can work together to help you save, but you can’t claim both credits for the same wages. You can, however, strategize to use both programs effectively. For example, you can use the ERTC for wages not covered by the PPP and then use the WOTC for new hires who are eligible.

It is important to keep thorough payroll records and work with a tax professional who can guide you through the intricacies of these credits, such as the Work Opportunity Tax Credit. They can help you figure out the best way to maximize your benefits across various tax incentives.

How to Calculate Your Potential ERTC

Before you can calculate your potential ERTC, you must first determine if you are eligible. Did your business see a significant decrease in gross receipts? Was your business fully or partially shut down due to government orders? If you answered ‘yes’ to either of these questions, you are on the right track.

Let’s break it down: understanding the complexities of tax incentives like the Work Opportunity Tax Credit can significantly benefit your business.

- In 2021, you’ll need to compute 70% of the eligible wages you paid each employee for each quarter, up to a maximum of $10,000 in wages per quarter. This could result in a credit of up to $7,000 per employee per quarter.

- In 2020, the amount is 50% of eligible wages up to $10,000 for the entire year, which could result in a $5,000 credit per employee.

Keep in mind to deduct any PPP loan amounts that have been forgiven and wages used for other credits from your eligible wages. The calculations can get complicated, so it’s helpful to have a tax expert’s advice. For more detailed guidance, consider the Employee Retention Credit services provided by experts.

Let’s look at an example. Imagine you have 10 employees and you paid them $10,000 each per quarter in 2021. If all other criteria are met, your ERTC would be 70% of $10,000 or $7,000 per employee. That’s a $70,000 credit per quarter for 10 employees!

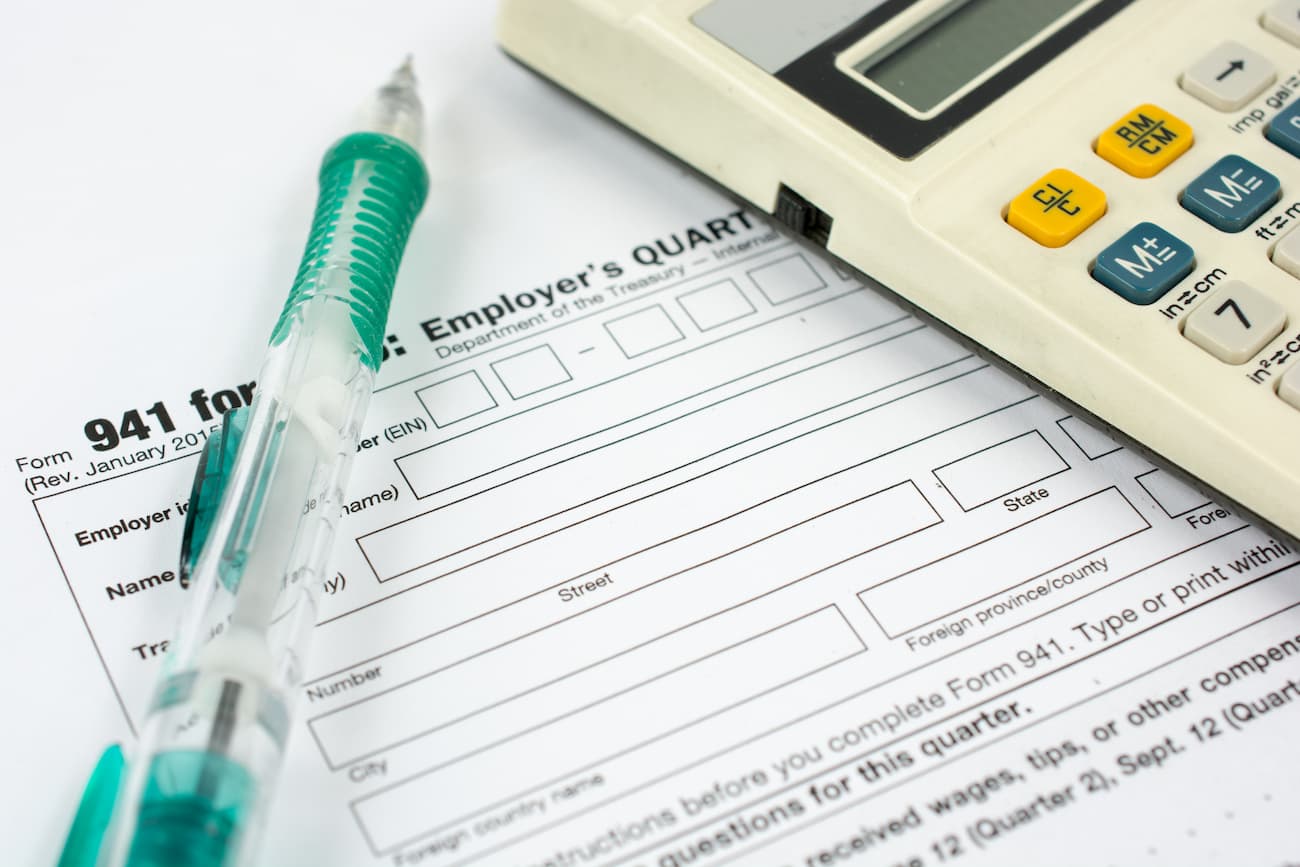

How to Apply for the ERTC

Applying for the ERTC may seem overwhelming, but it’s actually easier than it seems. The first thing you need to do is determine whether you’re eligible. This depends on how your business operated during the pandemic and your gross receipts. After determining that you’re eligible, you’ll need to calculate the credit based on your payroll data.

If you’re interested in claiming the ERTC, the credit should be included in your quarterly employment tax returns. This is typically done on Form 941, which is titled “Employer’s Quarterly Federal Tax Return.” If you’ve already submitted your returns and didn’t claim the credit, don’t stress. You can still amend the returns. You would do this using Form 941-X, which is titled “Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.”

If you’re in need of immediate cash flow, the IRS permits you to request an advance of the ERTC by submitting Form 7200, titled “Advance Payment of Employer Credits Due to COVID-19.” This could be a saving grace for businesses in need of upfront assistance.

“Quarterly Tax Forms 941 and 1040-ES …” from blog.bernieportal.com and used with no modifications.

Successfully Obtaining Work Opportunity Tax Credits

The key to the WOTC is timing. You have to fill out the IRS Form 8850 within 28 days of the eligible employee’s start date. Then, you send the form to your state’s workforce agency, which will confirm the employee’s eligibility for the credit.

- During the hiring process, identify potential employees from targeted groups.

- Complete pre-screening using IRS Form 8850 as soon as possible.

- Submit the form to your state workforce agency for certification.

Once you receive certification, you can claim the WOTC on your federal tax return using IRS Form 5884, “Work Opportunity Credit.” If you’re a tax-exempt organization, you’ll use Form 5884-C, “Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans.” As with ERTC, detailed record-keeping will ensure you have the necessary documentation to support your claim.

Debunking Common Misconceptions

There are many myths about WOTC and ERTC that can discourage business owners from utilizing these credits. Let’s set the record straight.

Eligibility Criteria for ERTC Explained

There’s a common misunderstanding that only small businesses are eligible for the ERTC. However, businesses of any size can qualify as long as they meet the criteria related to government orders or declines in gross receipts. Another widespread belief is that if a business received a PPP loan, they’re automatically ineligible for ERTC – this is incorrect. While you can’t claim the same wages for both, you can still claim ERTC on wages not paid with forgiven PPP loan funds.

What is the Work Opportunity Tax Credit?

Many employers may feel that the WOTC is too complex and not worth the effort. However, with the right planning and support, the process can be simplified. Another common misconception is that the WOTC is only for large corporations. In fact, businesses of all sizes can take advantage of the WOTC by hiring eligible employees.

“Creative Commons Keyboard …” from www.picpedia.org and used with no modifications.

Practical Tips for Immediate Application

Begin by examining your payroll and recruitment procedures to maximize these tax credits. Consider the possibility of claiming ERTC and how employing from specific groups could increase your WOTC claims. Collaborate with your HR and accounting departments to ensure both programs’ requirements are met.

Harmonizing ERTC and WOTC for Maximum Advantages

Although it’s not possible to use the same payroll to claim both WOTC and ERTC, you can plan your payroll in a way that allows you to benefit from both. For example, use ERTC for current employees and focus on WOTC for new hires. This method allows you to maximize your tax credits and bolster your business’s financial wellbeing.

Get Started: Your First Move Towards Optimizing Your Tax Credits

Don’t miss out on extra cash. If you’ve been affected by the pandemic or you’re planning to grow your team, these tax credits can provide significant financial aid. Start by checking your eligibility and collecting the required documents. Then, Get Started to claim your ERTC and WOTC benefits. These credits can support your business’s recovery and expansion, turning tough times into opportunities.

Don’t miss out on financial relief. If your business has been affected by the pandemic or you’re planning to grow your team, these tax credits can provide significant financial benefits. Begin by checking your eligibility and collecting the required documents. Then, apply for the Work Opportunity Tax Credit to claim your ERTC and WOTC benefits. These credits can help strengthen your business’s recovery and growth, turning difficult times into opportunities.

Debunking Popular Myths

There are many misconceptions about ERTC and WOTC that may prevent businesses from utilizing these credits. Let’s set the record straight.

Understanding Who Qualifies for the ERTC

There’s a myth that only small businesses can claim the ERTC. Actually, businesses of any size can qualify, as long as they meet the criteria about government orders or declines in gross receipts. Also, some people think that if they got a PPP loan, they can’t get the ERTC. That’s not true. You can’t claim the same wages for both, but you can still claim the ERTC on wages that weren’t paid with forgiven PPP loan funds.

Decoding the Work Opportunity Tax Credit

Many employers are under the impression that the WOTC is too complex to make it worth their while. However, with the right planning and support, the process can be much smoother. Another common misunderstanding is that the WOTC is only for big corporations. But the fact is that businesses of all sizes can take advantage of the WOTC by hiring qualified employees.

“Apply | Apply – Stock Photo This image …” from www.flickr.com and used with no modifications.

Practical Tips for Quick Application

Maximize these tax credits by first examining your payroll and recruitment procedures. Search for chances to claim ERTC and think about how recruiting from specific groups could increase your WOTC claims. Collaborate with your HR and accounting departments to guarantee adherence to the rules of both schemes.

How to Best Utilize ERTC and WOTC

Even though you cannot use the same wages to claim both ERTC and WOTC, you can strategically plan your payroll to benefit from both. For example, use ERTC for existing employees and target WOTC for new hires. This strategy maximizes your tax credits and supports your business’s financial health.

Apply Now: Make the Most of Your Tax Credits

Don’t miss out on potential savings. If your business has been affected by the pandemic or you’re planning to hire more staff, these tax credits can offer significant financial benefits. Start by checking your eligibility and collecting the required paperwork. Then, Apply Now to claim your ERTC and WOTC credits. These credits can support your business’s recovery and expansion, transforming difficulties into opportunities.

Commonly Asked Questions

How can I tell if my business is eligible for the ERTC?

If you’re unsure whether your business is eligible for the ERTC, consider whether you’ve seen a substantial drop in gross receipts or if you’ve had to partially or completely halt operations due to government orders related to COVID-19. If either of these situations is true, you probably qualify for the credit.

Who is eligible for the Work Opportunity Tax Credit?

The Work Opportunity Tax Credit (WOTC) is available to employers who hire veterans, those who receive specific types of public assistance, ex-felons, and people who have been unemployed for a long time. If your company hires someone from these groups, you may be eligible for the credit.

Is it possible to claim ERTC and WOTC for the same employee?

Unfortunately, you cannot claim both ERTC and WOTC for the same employee’s wages. But, you can plan to make sure you’re getting the most out of both credits separately.

- Use ERTC to cover the wages of current employees that are not covered by other credits or PPP loans.

- Use WOTC for new hires who are eligible and not covered by ERTC.

What paperwork do I need to apply for ERTC and WOTC?

For ERTC, you’ll need your business’s tax identification number, relevant payroll records, and any records related to government orders affecting your business. For WOTC, you need the IRS Form 8850 completed by the new hire, and the certification from the state workforce agency.

Keep all your paperwork organized and easily accessible to make the application process for both credits easier.

How can these tax credits affect my overall business financial strategy?

ERTC and WOTC can have a substantial impact on your business’s financial strategy by reducing your total tax liability. This can free up money for other business investments, help you keep employees during hard times, and encourage the hiring of individuals who may bring diverse perspectives and skills to your workforce.